- >News

- >Bitcoin’s Liquid Supply Continues to Decline, Will Retail Investors Get Locked Out?

Bitcoin’s Liquid Supply Continues to Decline, Will Retail Investors Get Locked Out?

Bitcoin’s price has pulled back since hitting an all-time high of $41,940 on January 8, falling as low as $31,500 before stabilizing within the $34,000 to $38,000 range. This failure to continue its forward march towards new ATHs may have disappointed much of the cryptocurrency market, but there are plenty of indications that it’s ready to jump again as soon as demand reaches new levels.

Most notably, the latest data compiled by the likes of glassnode and other analysts indicate that the circulating supply of bitcoin is actually shrinking. So while retail investors are showing an rejuvenated and heightened interest in crypto, many holders are removing their bitcoin from exchanges, keeping their funds on hardware wallets and trading with decreasing frequency.

This is extremely bullish for bitcoin prices. However, retail investors need to be aware that much of this hoarding is coming from institutions, who are buying up bitcoin in increasing quantities and threatening to push smaller individual traders out of the market.

Glassnode Data Shows That 78% of Bitcoin Supply Is Not Liquid

If you look on CoinMarketCap, CoinGecko, or any other price-tracking website, you’ll see that bitcoin’s “circulating supply” is currently in the 18.6 million region. However, such a metric is false, since while 18.6 million bitcoins have indeed been mined, not all of them are actually being traded and circulated around exchanges or trading platforms.

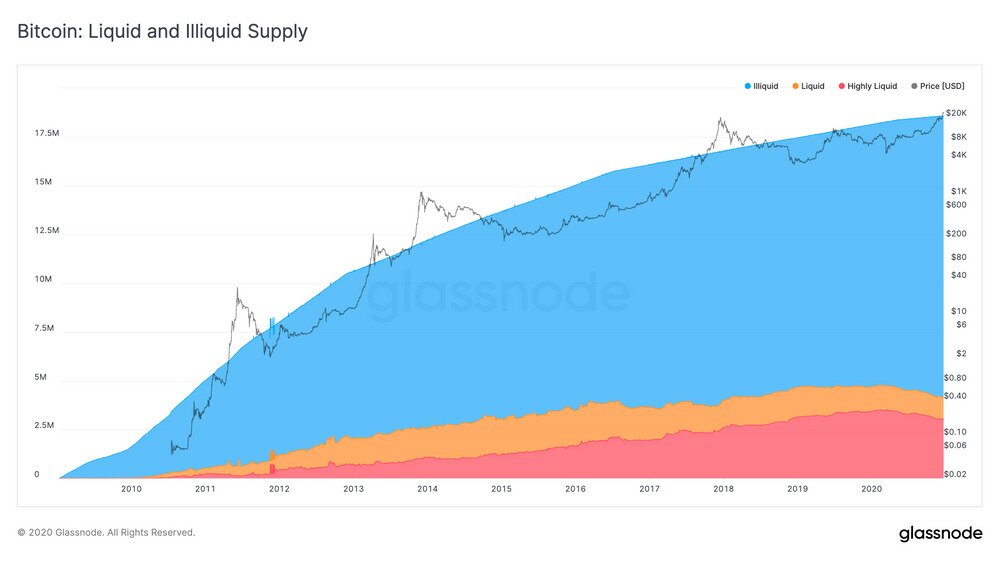

In fact, the latest data from Zug/Berlin-based researchers glassnode reveals that the vast majority of the 18.6 million bitcoins in existence are not circulating. And as the table below illustrates, the proportion and number of “illiquid” bitcoins is only increasing all the time.

Source: glassnode

According to glassnode calculations, 78% of bitcoin’s supply isn’t liquid. This means that around 14.5 million bitcoins are being hoarded off exchanges and trading platforms (i.e. on hardware wallets) “in anticipation of a long-term BTC price appreciation.”

These bitcoins are rarely if ever being moved or traded, something which exerts additional supply-side pressure on bitcoin’s price, helping it to creep upwards. What’s more, the chart above shows how growth in the supply of “illiquid” bitcoins is outpacing the growth in the supply of “liquid” and “highly liquid” bitcoins, meaning bitcoins held by entities which trade at least half of their supplies.

To be more precise, the supply of illiquid bitcoins has risen by roughly 3.6 million BTC since the beginning of 2016. By contrast, highly liquid bitcoins have risen from around 1.8 million to a peak of approx. 3.5 million at the beginning of 2020. Since the start of 2020, however, this supply has dwindled to around 3 million, making for an overall growth of 1.2 million since January 2016.

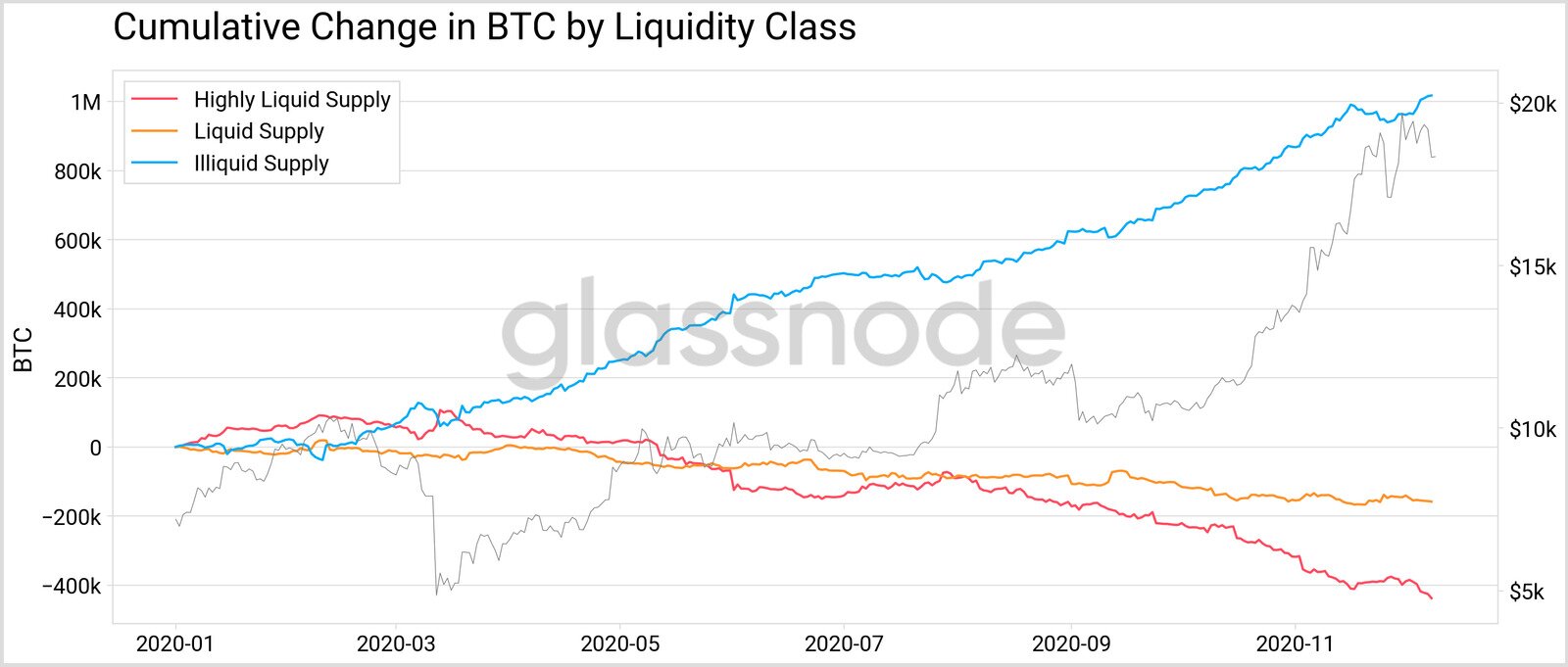

As glassnode themselves explain, the circulating supply of bitcoin shrunk considerably in 2020, with roughly one million bitcoin becoming illiquid over the course of the year. “This indicates that the present bull market is driven by the staggering amount of illiquidity,” as glassnode researchers Kilian Heeg and Rafael Schultze-Kraft write.

Source: glassnode

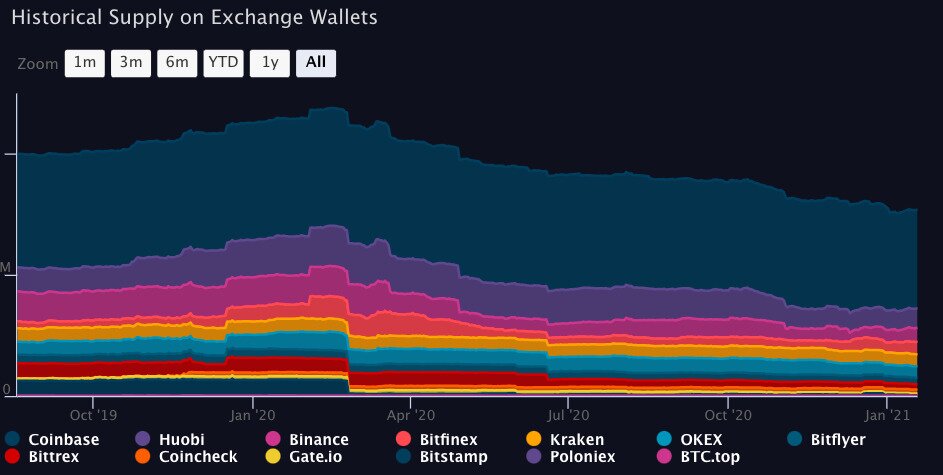

It’s also worth pointing out that other metrics support glassnode’s data, and conclusions. Exchange data collected by ViewBase shows that nearly one million bitcoin has left centralized exchanges over the past year, resulting in an overall supply of a little over 1.5 million bitcoins.

Source: ViewBase

This equates to about 7% of bitcoin’s overall supply of 18.6 million BTC. It’s certainly not much, and with the overarching trend being an increase in illiquid bitcoin, it’s patently clear that the percentage of bitcoin on exchanges will only decline over the long-term.

In other words, the hoarding behavior of much of the cryptocurrency market provides further strong evidence — along with Bitcoin’s fundamental supply cap — that the price of bitcoin can really only go up, assuming steady or growing demand.

Who’s Hoarding?

For those who are relatively new to Bitcoin, it should be said that the growth in illiquid bitcoin is largely the result of larger ‘whales,’ who are buying up BTC en masse, particularly during dips that let them acquire the cryptocurrency at a relative ‘discount.’

This view is supported by other glassnode data, particularly glassnode’s metric on the number of unique entities holding at least 1,000 BTC (which is now worth some $36.5 million). The number of such entities has risen substantially since the market crash of March 2020, jumping from 1,700 to 2,140 by the end of December, an increase of 25%.

The significance of this is that, with institutional and corporate investors buying up bitcoin at a steady rate, retail investors need to be aware of the risk that they could be increasingly priced out of the market. This is something more experienced investors are acutely aware of, as evidenced by the sheer number of warnings they’re posting online.

Source: Twitter

It’s therefore arguable that any small individual trader with an interest in buying bitcoin should act sooner rather than later, making their purchases when the price of bitcoin is relatively low, rather than when it’s pushing towards new heights.

More importantly, they should very much take a long-term view of bitcoin investment. As the above data highlights, the supply of liquid bitcoin is declining steadily over time, heightening the likelihood of significant price increases in the more distant future.

Yes, Bitcoin may still have one or two shocks in store in the near future (possibly coming from Tether), but this is exactly why holding onto it for longer periods of time is so important. With its circulating supply dwindling from one year to the next, any short-term dips or corrections will be cancelled out eventually.