- >News

- >Bitcoin Volatility Drops to 15-Month Low: Is A Bull Run Coming Soon?

Bitcoin Volatility Drops to 15-Month Low: Is A Bull Run Coming Soon?

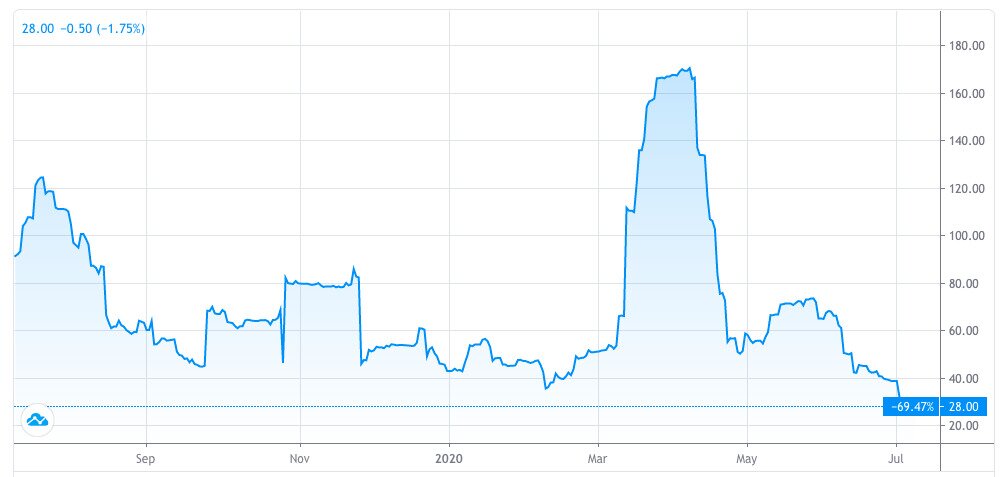

Bitcoin’s volatility has dropped to a 15-month low, as the cryptocurrency’s price hovers within a narrow range. According to data from TradingView, its volatility level sits at 28%, the lowest since late March 2019, when it hit 25%.

Its volatility has been steadily declining ever since June. Historically, this means either one of two things: either a bitcoin bull run is about to happen, or the market is going to see a big sell-off.

Past data supports this hypothesis. However, many people within the cryptocurrency industry have long championed bitcoin as a store of a value (SoV). And because its price should become more stable the more it establishes itself as a SoV, it’s also highly possible that its recently declining volatility is a sign of it acting more like digital gold.

Bitcoin Becomes A Stablecoin

Bitcoin’s volatility is almost notorious among those within the ‘traditional’ financial sector. Critics of the cryptocurrency like to point to the changeability of its price as a reason why it doesn’t or can’t ever work as a reliable means of payment.

Looking at the past behavior of bitcoin’s price, you realise they may have a point. Bitcoin’s 30-day realized volatility hit a level of 189% in February 2018, just as the bull-run of late 2017 came to a crashing halt.

It has experienced a number of peaks and troughs since then, notably in December 2018, July 2019 and March of this year (after it lost 50% of its value in two days).

Things are different now. Bitcoin’s volatility has been on a gradual decline since the end of May 28, when it hit a one-month high of 73.89%. It sank to 50% on June 9, to 40% on June 26, and to 28% on July 8.

Bitcoin’s historical 30-day volatility over the past year. Source: TradingView

What does this mean? In mathematical terms, it means that daily changes in bitcoin’s price vary on average by 28% over a 30-day period.

As bitcoin’s price chart shows, it has held tightly between $9,000 and $10,000 since June 2. Having recovered from its plunge to $4,000 in mid-March, it’s now apparently locked between the $9,000 support level and the $10,000 resistance level.

Rises And Falls

How long this will last is anyone’s guess. In the past, a steep decline in bitcoin’s volatility has usually prefigured a sharp movement in either direction.

On October 1, 2018, its volatility hit just over 23%. Exactly a month later, it rose to 110%, after the bitcoin price began heading from the $6,500 area to a low of about $3,200 in mid-December.

On March 1, 2019, volatility stood at 25%. At this time, the price of bitcoin was around $3,800, yet it rose to a high of nearly $13,000 by the end of June. Its volatility also climbed to 110% by July 1.

Things could go either way. Based on bitcoin’s history, numerous analysts are now predicting a large price move, without committing to a particular direction. Here’s New York-based crypto fund BKCoinCapital on Twitter:

Source: Twitter

Why is a price movement likely during periods of low volatility? Well, the longer low volatility persists, the less liquid the bitcoin market becomes, since investors withdraw their money in the hunt for volatility (i.e. big price rises) elsewhere. With lower liquidity, the bitcoin market becomes more susceptible to more dramatic price swings.

Bitcoin’s volume has declined relative to previous months. Since June 12, 24-hour trading volume has been under $30 billion, according to CoinMarketCap. A month before that, volume was above $50 billion, while at the end of April volume peaked above $70 billion.

This arguably makes Bitcoin ripe for a strong rally or sell-off. People within the Bitcoin community are now bracing themselves for one or the other.

Source: Twitter

Store Of Value

Bitcoin may witness a strong price move in the not-too distant future. Then again, its recent low volatility may in fact be part of a longer term trend, through which it increasingly acts like a store of value. This is supported by the fact that, while bitcoin’s liquidity has decreased in past weeks and months, it’s still considerably higher than levels seen in 2017 and 2018. In May 2017, when the 2017 rally began, volumes were under $1 billion.

Analysts with Bloomberg recently came to a similar conclusion. In its Bloomberg Crypto Outlook from July, its researchers stated that its decreasing volatility levels are a sign that “the crypto is maturing on a risk-adjusted basis. Volatility on the benchmark crypto should continue to decline.”

Its analysts also wrote that the “lowest volatility ever vs. crude oil confirms our view of Bitcoin’s progression into the mainstream and increasing appeal as a digital equivalent of gold.”

Bloomberg’s analysts are still open to the possibility that, as in the past, a significant movement may be close at hand. As its senior commodity strategist Mike McGlone wrote on Twitter:

Source: Twitter

Still, it’s likely that we’ll increasingly see periods of low volatility, even if bitcoin does rally in the near term. These periods will persist for increasingly long periods of time, drawing more investors towards bitcoin as it proves itself capable of reliably retaining value.

In the long term, this is likely to push bitcoin’s price upwards, although price gains may end up being less dramatic and more gradual in the future. Steady increases may seem less sexy to traders looking for the next big payoff, but it will be much more sustainable, as well as much safer for the average investor.