- >News

- >Bitcoin Price Passes $18,000. When Will It Stop?

Bitcoin Price Passes $18,000. When Will It Stop?

The price of bitcoin has passed $18,000, pushing its market cap to a new all-time high of $333.95 billion (as of writing). There seems to be no immediate short-term cause of the latest rally, but with May’s halving, the launch of PayPal’s cryptocurrency service, and an increase in institutional-corporate investment, it seemed almost inevitable that demand increases and supply squeezes would result in the bitcoin price rising.

$18,000 represents the highest bitcoin price since January 6, 2018, when the famous bull market of late 2017 began running out of steam. But with bitcoin surging by 118% over the past year and by a whopping 215% since it fell to around $5,700 on March 12, the question is: when and where this latest bull run is going to end?

$18,000, $20,000, and Then… The Moon?

For some analysts and industry figures, the longer term rally isn’t going to an end for a while. This week, a Citigroup analyst set bitcoin an upper limit of $318,000 by the end of 2021, while such cryptocurrency investors as Galaxy Digital’s Mike Novogratz are suggesting a near-term high of $65,000 (or higher).

Who’s right, and where will the current bitcoin price rally end? As far as our own analysis goes, we’re expecting a significant pullback at the $20,000 mark, which represents something of a historical resistance level, given that this is the current all-time high.

However, the bitcoin market has grown considerably in volume since 2017, so while there will likely be a fall when the price of bitcoin hits $20,000, it won’t be as large as it was in 2017. As such, bitcoin will likely recover soon after falling, and will resume its longer term march upwards, past $20,000 and beyond.

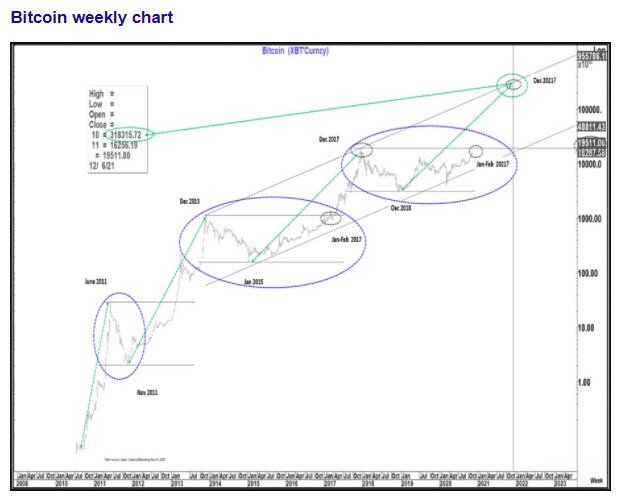

It’s not clear how much further beyond it can go, however. When producing a figure of $318,000, the Citigroup analyst mentioned above — Tom Fitzpatrick — referred to previous rallies and bull markets in Bitcoin’s history, arguing that the cryptocurrency’s development over time has become “much more symmetric as Bitcoin as an asset became more visible and increasingly more mainstream.”

Importantly, he notes that the bitcoin price multiplied by “an incredible 555 times” between 2011 and 2013. It then fell by 86% over the next 13 months, then multiplied by 121 times between 2015 and late 2017, fell by 84% up until December 2018, and is now set up to multiply (by a high number) yet again between 2019 and the subsequent two or three years.

“Such an argument would suggest that this move could potentially peak in December 2021, at the high of the channel, suggesting a move as high as $318k,” he adds

Fitzpatrick admits that $318,000 is probably the maximum limit, and that a lower figure would be more realistic. Still, he concludes that “the backdrop and the price action we are looking at clearly suggest the potential for a major move higher nonetheless in the next 12-24 months.”

Source: Citigroup/Twitter

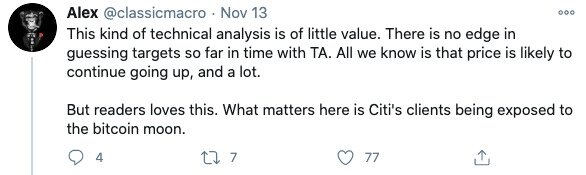

Historical trends are encouraging, but they ultimately guarantee nothing about future market behavior. Yes, there’s likely to be an increase in bitcoin’s price during this period, but we can’t say it will be multiplied by “100 times” just because this is what happened in the past.

The circumstances surrounding the bitcoin market have changed significantly over the past few years, and will also change over the next few months. Extrapolating from the past is therefore of little value, as argued by Twitter-based crypto commentator/analyst “@globalmacro,” who posted Fitzpatrick’s analysis.

Source: Twitter

Bitcoin Price Realism

A lower target may be more realistic. As noted above, Galaxy Digital CEO Mike Novogratz gave a $65,000 figure on November 17, although his only argument supporting this prediction was that the “network effect has taken over.”

This is hardly scientific, but more credible — and less financially interested — analysts have recently produced similar, albeit less exuberant, estimates. In late October, analysts at JPMorgan predicted that the bitcoin price could double or triple over the next one or two years.

Their reasoning centered around Bitcoin becoming popular as a form of digital gold, particularly among millennial investors, who are increasingly forming a more important part of the financial ecosystem with every passing year. If correct, this would suggest a bitcoin price of about $26,000 or even $39,000, based on the fact that bitcoin was roughly $13,000 around the time they produced their forecast.

Analysts at Bloomberg reached an even more optimistic conclusion in October, extending their time frame until the end of 2025, when they expect the price of bitcoin to be sitting at the $100,000 mark. Again, they largely based their reasoning on historical market trends.

It would be foolish to put too much faith in such estimates, especially if they rest on historical movements. As the bitcoin market welcomes a greater volume of mainstream retail and institutional investment, it will begin to behave more like a traditional financial market. In other words, its past growth will become no guide to its future growth.

Indeed, if bitcoin really is becoming “digital gold,” it will start to behave more like gold over the coming months and years. And in case you were wondering, the price of gold has stalled recently, hitting $2,000 in early August but declining slightly to $1,875 today.

Source: Yahoo! Finance

These precautions aside, it seems that bitcoin is currently attracting new investment, and that it will continue rising steadily in the short-to-medium term.

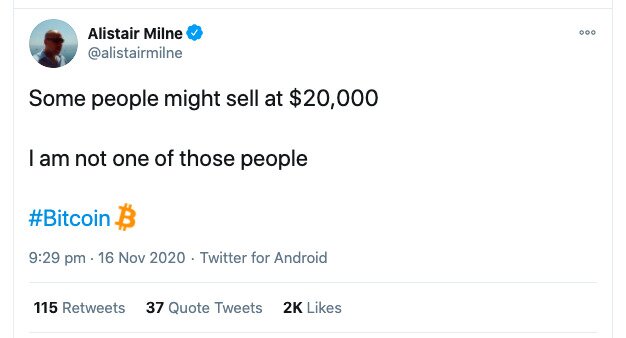

As we warned above, it may potentially suffer a fall once it reaches $20,000, its previous all-time high. This is hinted at by the number of prominent traders online declaring that they won’t sell at $20,000, suggesting that many others — particularly those who’ve recently entered the market — will.

Source: Twitter

Fortunately, the bitcoin market has expanded massively in volume since 2017, rising from an average of only two, three or four billion dollars per day in late 2017, to consistently over $20 billion (or higher) today. It can therefore soak up a larger number of sales once it hits $20,000, and continue rising afterwards. Just don’t ask us how high it will go.