- >News

- >Bitcoin-Gold Correlation Hits All-Time High: Is BTC Now A ‘Safe Haven’?

Bitcoin-Gold Correlation Hits All-Time High: Is BTC Now A ‘Safe Haven’?

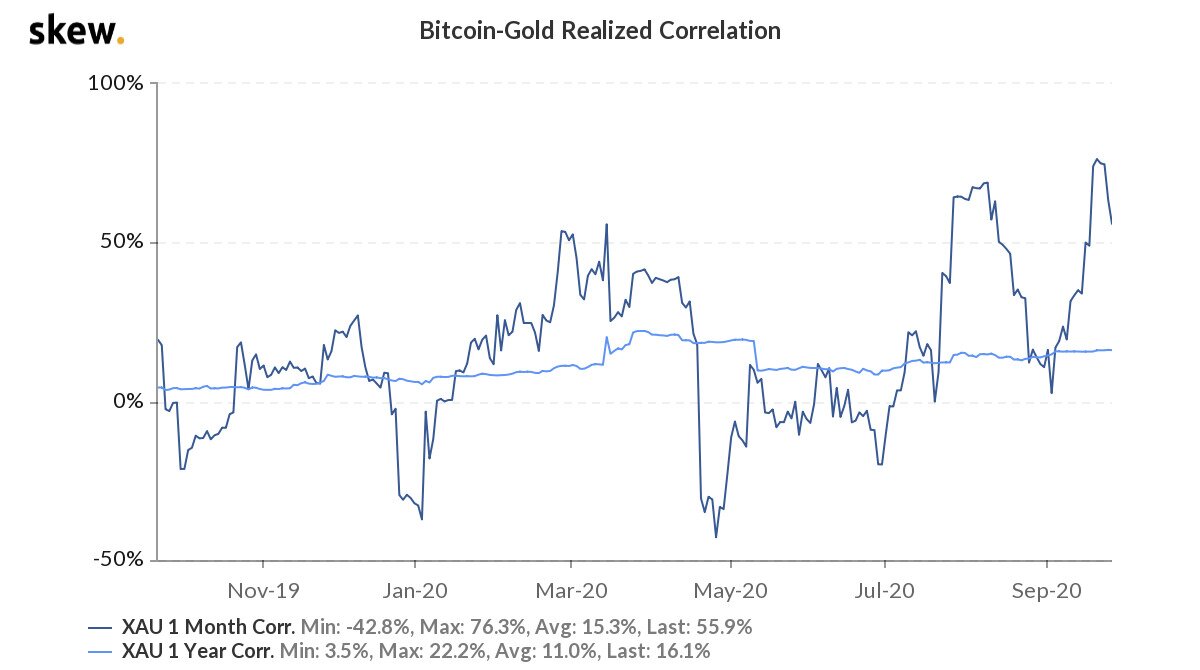

The bitcoin-gold correlation has hit an all-time high, according to data from multiple analysts and research firms. Data from the London-based skew shows the one-month correlation level hitting a whopping 76.3% on September 19, at the end of 30 days when the price of bitcoin and the price of gold had both experienced a fall and then a steady rise.

The correlation between bitcoin and gold has also increased steadily over the longer term, as investors have increasingly sought hedges against inflation during a period of economic instability. And with even the stock market proving shaky in recent days and weeks, it seems even bitcoin has come to be seen more as a safe haven.

However, while investors are undoubtedly viewing bitcoin as a (relatively) safe haven right now, bitcoin’s status as a stable store of value may end as soon as the global economy returns to relative normality.

Bitcoin-Gold Correlation Hits Record Highs

Whichever way you cut it, the bitcoin-gold correlation has peaked this year and, more recently, over the past few days and weeks.

Source: skew

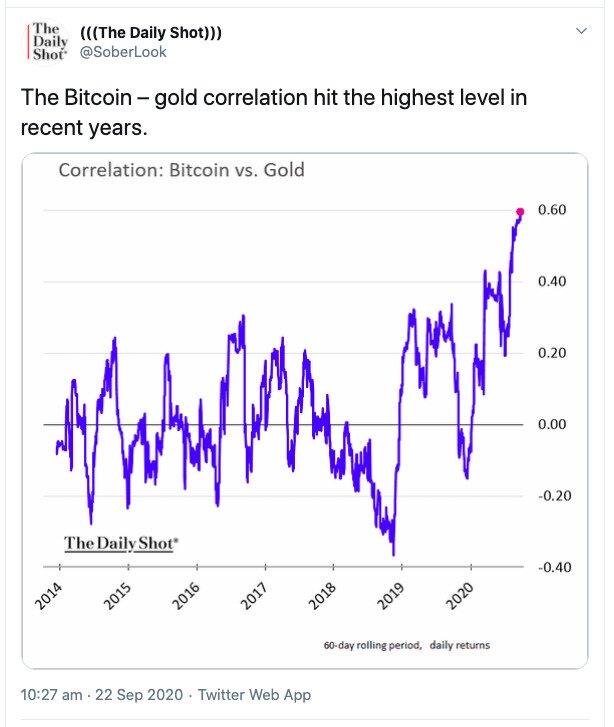

Not only does skew’s data show the one-month correlation hitting an ATH of 76.3%, but data collected by financial newsletter The Daily Shot also reveals that the 60-day correlation hit an all-time high over the past few days.

Source: Twitter

What is happening here? At the most superficial level, bitcoin and gold are rising and falling more or less together, and they’re doing this because of economic circumstances.

Given that we’re in the middle of a downturn that has seen GDP fall by 33% in the United States, 20% in the UK, and 12% in the EU, investors have nowhere to put their money but in financial assets. The general economy is struggling, and while (tech) stocks have offered higher returns, the market has been too fearful to place all of its money with equities, for fear of a probable crash.

As such, the archetypal ‘safe haven’ asset — gold — has risen to record highs during the post-lockdown period. Hitting a 2020 low of $1,478.60 on March 18, it passed $2,000 on August 4, before settling at just above $1,900 almost ever since.

Source: Yahoo!

Something very similar has happened to bitcoin, which also hit a 2020 low (of around $3,500) in the middle of March, before rising by around 240% to pass $12,000 on August 18.

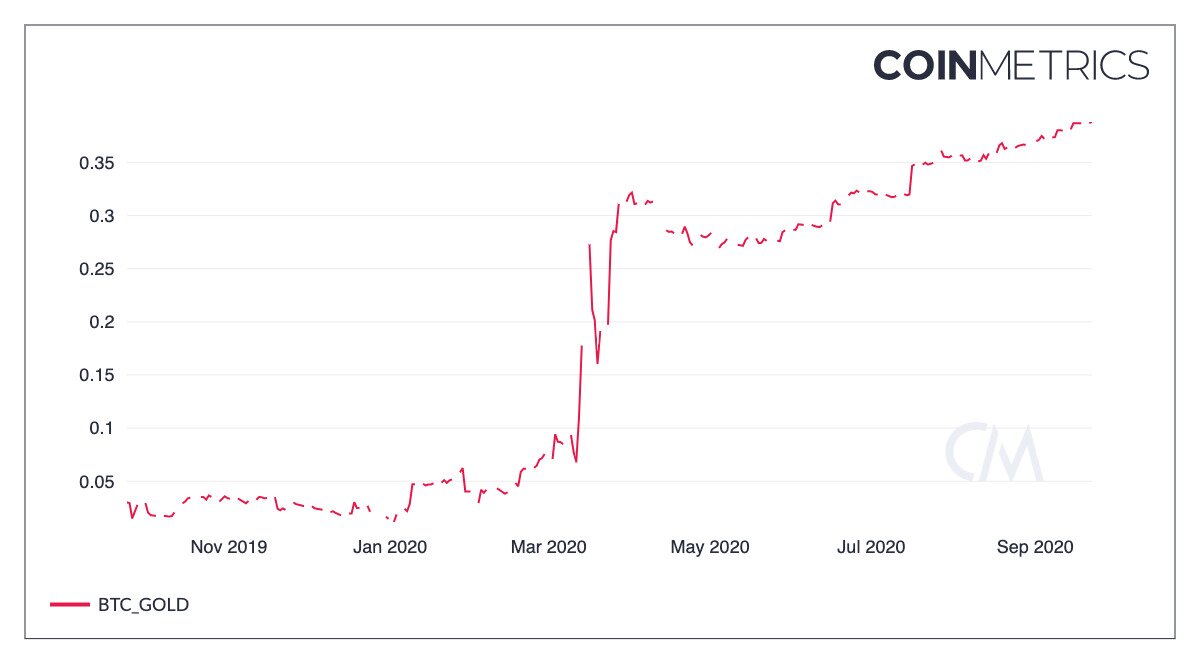

This period has seen the long-term correlation between the two assets also hit all-time highs. Data from Coin Metrics shows the 90-day correlation hitting an ATH of 0.49 on March 16, and staying high pretty much ever since (it’s currently 0.48). This data also shows the 180-day and 360-day levels hitting record highs on September 22, of 0.388 and 0.232.

180-day average correlation. Source: Coin Metrics

Institutional Investors Warming to Bitcoin

Bitcoiners have long championed the cryptocurrency’s status as a deflationary store of value, but what exactly accounts for bitcoin’s increasing correlation with gold, other than economic circumstances?

Aside from the current global recession, the biggest difference compared to recent years is that institutional investors are gradually warming up to bitcoin.

Veteran fund manager Paul Tudor Jones famously admitted in May that around 2% of his assets are kept as bitcoin, which he regarded as a hedge against inflation, particularly when central banks were busy printing money. More recently, MicroStrategy — the largest independent publicly-traded enterprise intelligence company in the world — announced in August that it had adopted bitcoin as its “primary treasury reserve asset.”

MicroStrategy initially purchased 21,454 bitcoins at a cost of around $250 million, yet it announced on September 15 that it had increased its bitcoin holdings to $425 million.

Source: Twitter

Soon after MicroStrategy made its initial announcement in August, Canadian software firm Snappa announced that it had put 40% of its cash reserves into bitcoin.

Such announcements are likely to pave the way for further institutional and corporate investment in bitcoin. Bakkt — a futures market managed by NYSE parent company ICE — recorded its highest ever trading volume for futures contracts on September 15, and then broke this record on September 17. Meanwhile, crypto financial services company Unchained Capital launched a new advanced business account service, allowing companies to hold bitcoin securely.

How Long Will Correlation Continue?

This shift in attitudes towards bitcoin, particularly at a time of potentially high inflation, is perhaps the main reason why the cryptocurrency is beginning to act increasingly like gold.

And given the growing interest in bitcoin from more ‘mainstream’ sources, its likely that the correlation between gold and bitcoin will remain high (and perhaps increase) for months and possibly years to come, just as it has done with the stock market.

The economic fallout from the coronavirus pandemic is likely to be with us for at least a few years, if not longer. As such, we may witness depressed underlying economic output in conjunction with rising asset prices, which will be good news for the price of bitcoin and its correlation with gold (and the stock market).

As far as investors in bitcoin are concerned, this means watching the gold price (and the wider stock market) will become increasingly useful in terms of predicting how bitcoin prices might behave.

However, assuming that the global economy does eventually return to normal, and that inflation is kept under control, we should also expect the bitcoin-gold correlation to weaken in the future. It’s possible that a healthier supplier of investment opportunities in the legacy financial system may push people away from bitcoin.

But with a gradual supply of new institutional and corporate converts to bitcoin, who knows what exactly the future holds for the cryptocurrency.