- >News

- >Bitcoin-Altcoin Correlation Shows that Crypto is Still in a Bear Market, Despite Recent Rises

Bitcoin-Altcoin Correlation Shows that Crypto is Still in a Bear Market, Despite Recent Rises

The cryptocurrency continues to experience its ups and downs. During a bear market, this seems to be the predominant pattern, with prices going through a series of phony ‘breakouts,’ prior to settling back down to levels most cryptocurrencies can’t seem to shake off right now.

As of writing (March 22), the market is witnessing one such breakout: bitcoin has risen to just under $43,000, having stood at $40,500 as recently as March 18. Most other cryptocurrencies have risen by similar magnitudes, with the likes of ethereum, XRP and cardano enjoying rises of 3.5% or above in the past 24 hours. These increases have led some commentators and traders to declare that the “bull market is back,” yet data suggests we’re still very much in a crypto bear market.

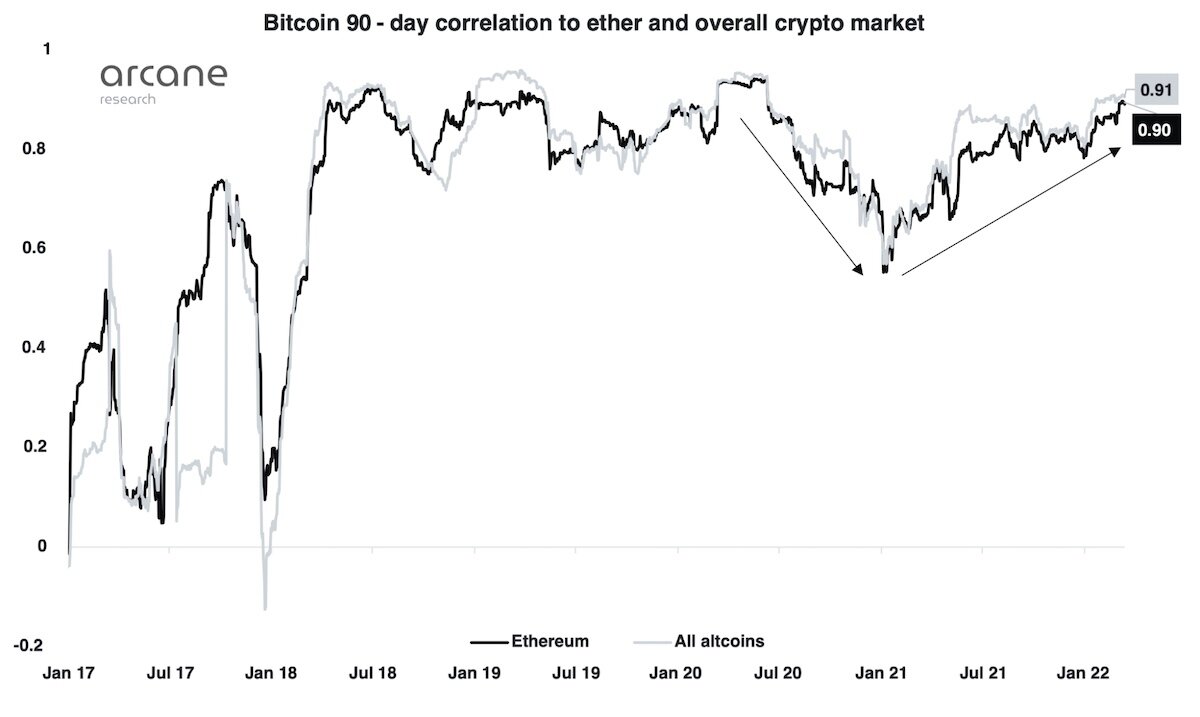

What data? Well, price information compiled by Arcane Research shows that the correlation between bitcoin, on the one hand, and ethereum and other cryptocurrencies, on the other, has reached its highest level since May 2020.

What this shows is that the market remains highly cautious, with altcoins simply tracking bitcoin, and that investors are better off simply sticking with BTC until conditions improve.

Rising Bitcoin-Altcoin Correlation Shows We’re Still in a Crypto Bear Market

Writing in his report on increasing correlation levels, Arcane’s Vetle Lunde noted that bitcoin’s correlation with the rest of the market (and vice versa) is approaching all-time high levels.

Source: Arcane Research

“The 90-day correlations in the crypto market are approaching the highs from the bear market of 2018 and 2019. This paints a picture of an overall risk-averse sentiment in the market,” he said.

Lunde also highlights the contrast with bear markets, when the correlation declines due to more investors being willing to speculate on smaller altcoins.

“In the summer of 2020, the correlation was headed downwards, caused by bitcoin strength compared to alts. The correlation bottomed on Jan 9th 2021, before it grew as altcoins began moving more in line with bitcoin,” he adds.

However, eagle-eyed observers will have already noticed a clear long-term trend illustrated by the above chart: the bitcoin-altcoin correlation has remained above 0.5 (and usually much higher than 0.5) since the first quarter of 2018. Not only that, but previous sudden jumps and falls have given way to gradual climbs downwards and (mostly) upwards.

“Interestingly, previous high correlation periods were caused by sudden sharp sell-offs, whereas the recent trend has seen a steadier growth. This suggests that the market overall has tended to move in the same direction throughout the last year, with altcoins in general seeing higher beta,” explains Lunde.

In other words, the long-term trend is that the overall crypto market has become more, rather than less, correlated with bitcoin. Given how frequently Bitcoin is criticized for being ‘outdated technology’ you’d think the opposite would be the case, but it really does seem as though bitcoin continues to lead the wider market.

Why Correlations Show That Bitcoin Is Always the ‘Safest’ Bet in Crypto

For Arcane Research, the main message to draw from the rising correlation level is that, despite recent ups (and downs), the market remains bearish.

“So far this year, the correlation between BTC and ETH has grown from 0.78 to 0.9, in general suggesting a prevailing risk-averse sentiment in the crypto market and a low desire to rotate into altcoins,” concludes Lunde.

However, a more important message can arguably be taken from this. Because aside from highlighting that conditions remain bearish, the correlation chart above also provides further evidence that, if you’re going to invest in only one cryptocurrency, it should almost certainly be bitcoin.

Why? The reason is simple: to say that the cryptocurrency market is highly correlated with bitcoin is to say that it doesn’t move up (or down) without BTC moving up (or down) as well. This is what correlation means: when one correlated variable moves, the other correlated variable moves with it.

To put this in practical terms, traders and investors can save themselves a lot of time (and most likely money) by investing in bitcoin, rather than one of the thousands of altcoins in the market. Instead of spending hours researching which small altcoin might emerge from the crowd to post above-average gains, it would be simpler to stick with bitcoin. Indeed, predicting which particular altcoin is going to become, say, the next Shiba Inu is an almost random task, not least when there often seems to be little driving up altcoin prices other than clever marketing and community pumping.

It’s worth pointing out that, even in traditional stocks and assets, most day traders lose money. Basically the same principle applies to investing in altcoins, if only because many altcoins have shorter lived rallies (e.g. Dogecoin and Shiba Inu), which as a result nudge their holders towards taking a more short-termist perspective. This is almost never a good recipe for making sustainable profits.

By contrast, bitcoin has been the dominant cryptocurrency for over 13 years, and shows no signs of losing its powerful network effects. And as the correlation data shows, the cryptocurrency market isn’t doing anything without BTC doing it first. This has always been the case, in fact, with the ‘altcoin seasons’ of early 2018 and January 2021 being enabled by earlier bitcoin rallies. And now, over the past couple of years, the stark oscillations between bitcoin and altcoin seasons have given way to a higher and sustained correlation.

To put this differently, any retail trader struggling to decide which small altcoin to buy is arguably better off simply sticking with bitcoin. It may now have a diminished chance of posting ridiculous gains (in contrast to recently launched altcoins), but if the wider cryptocurrency market is going up, it’s all-but guaranteed to go up as well.

That’s what the correlation data tells us. And this basic message applies all the more during a bear market, since more investors will be drawn towards the comparatively ‘safe’ bitcoin, as opposed to riskier altcoins. This is why HODLing — and in particular, HODLing BTC — remains by far the best strategy in cryptocurrency investing.