- >News

- >Analyst Conflict Shows You Can’t Always Trust On-Chain Bitcoin Data

Analyst Conflict Shows You Can’t Always Trust On-Chain Bitcoin Data

Data is king, or so some people say. However, data isn’t king if you misinterpret it, particularly when the stakes are high. This is something a whale alert from South Korean analytics firm CryptoQuant proved quite starkly this week, after it suggested that the movement of nearly 19,000 bitcoins to a wallet on the US-based Gemini exchange was the result of big traders preparing to sell.

This alert happened just before the price of bitcoin fell from around $60,500 to a slightly less impressive $54,000, causing many analysts to blame the alert for creating panic among traders. Led by Swiss analytics company glassnode, these analysts claimed that the alert was false, in that the movement of the 19,000 BTC was internal to Gemini, and didn’t come from a whale (or whales) ready to dump their bitcoin.

Not only does this episode show the difficulty of interpreting (on-chain cryptocurrency) data and the need for greater quality control among analysts, but it also shows the dangers even to investors who research their trades and try to act rationally. Because when the rest of the market believes misleading information, believing accurate information isn’t going to save you from a price dip, or a crash.

CryptoQuant vs. glassnode

On Monday March 15, CryptoQuant posted an alert on Telegram indicating that 18,961 BTC — which was then worth around $1.15 billion — had been deposited to the Gemini exchange. The firm’s CEO, Ki Young Ju, backed up the alert, tweeting that it was “legit,” and warning traders not to “overleverage if you’re in a long position.”

Source: Twitter

Nearly 30,000 subscribers saw CryptoQuant’s alert, potentially enough (depending on who these subscribers are) to set a chain reaction of sells which caused the price of bitcoin to fall fairly steeply.

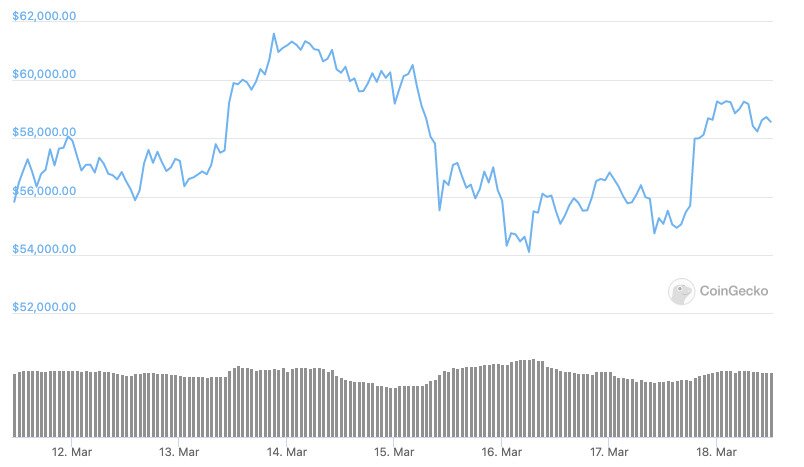

Bitcoin’s price over the past seven days. Source: CoinGecko

From the chart above, it’s fairly obvious where CryptoQuant’s alert falls: just around the time bitcoin drops from $60,500 to about $55,000. It then fell to $54,000 by the next day, cementing a drop which, technically speaking, put bitcoin in ‘correction’ territory.

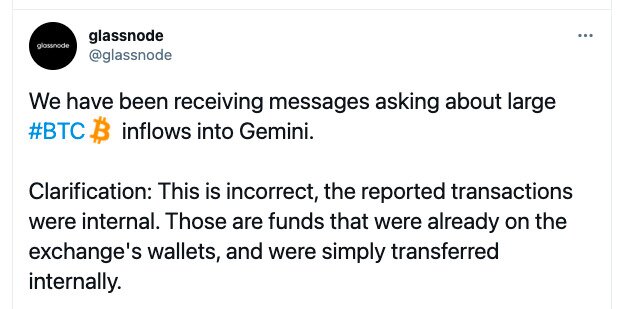

If a whale (or group of whales) had actually sold around 19,000 BTC, this would all be perfectly fine. But various analysts took issue with CryptoQuant’s alert, with glassnode in particular tweeting that the 19,000 BTC movement was entirely internal to Gemini.

Source: Twitter

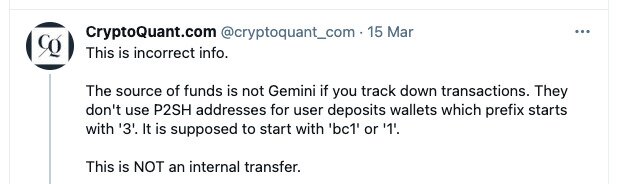

Most other individual analysts seemed to agree with glassnode’s take on the debate, yet CryptoQuant wasn’t prepared to give ground. It initially denied that the transaction was internal, arguing that different kinds of bitcoin wallets were used from those that Gemini uses for internal transfers.

Source: Twitter

A day later, a CoinMetrics engineer informed CryptoQuant that the transfer appeared to come to Gemini from BlockFi, an exchange for which Gemini provides custody services. Because Gemini and BlockFi have a partnership, this caused CryptoQuant to offer a self-correction of sorts, while still holding that glassnode was wrong in labeling the transfer as “internal.”

Source: Twitter

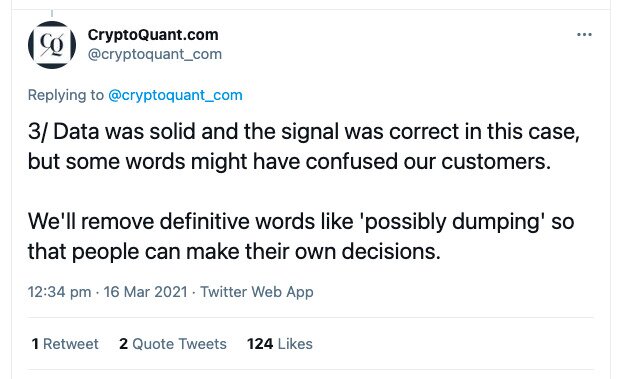

In other words, CryptoQuant admitted it was wrong to claim the 19,000 BTC deposit was a whale preparing to ‘dump’ bitcoin, but it also argued that it was correct to label the deposit as an external transfer into Gemini.

This is important, because while glassnode was right not to agree that the transfer was a whale, it was technically wrong to say that the transfer was internal. This underlines the complexity of blockchain data, and of how even two of the most prominent and respected analytics firms — glassnode and CryptoQuant — can be incorrect in various (and different) ways, and of how they can fail to reach agreement on what the data is ‘saying.’

Investors who like to study on-chain data before making trading decisions should probably be disturbed by such conflict and confusion. Such data is supposed to give advanced warning of the future direction of the bitcoin and cryptocurrency markets, but if this data can’t entirely be trusted, what is a trader supposed to do?

Conversely, if analysts are going to shy away from interpreting data (as CryptoQuant has vowed to do) and simply present it without “definitive words,” what is such data supposed to mean? What is its significance? What is the point of it?

Mysteries and Irrational Markets

There are also deeper problems here. For one, it’s hard to say with certainty whether CryptoQuant’s alert actually caused the price dip from $60,500 to $55,500. Its Telegram alerts had 28,600 subscribers, but given the possibility that only a portion of these subscribers actually acted on the info they received, were they really enough to send bitcoin downwards?

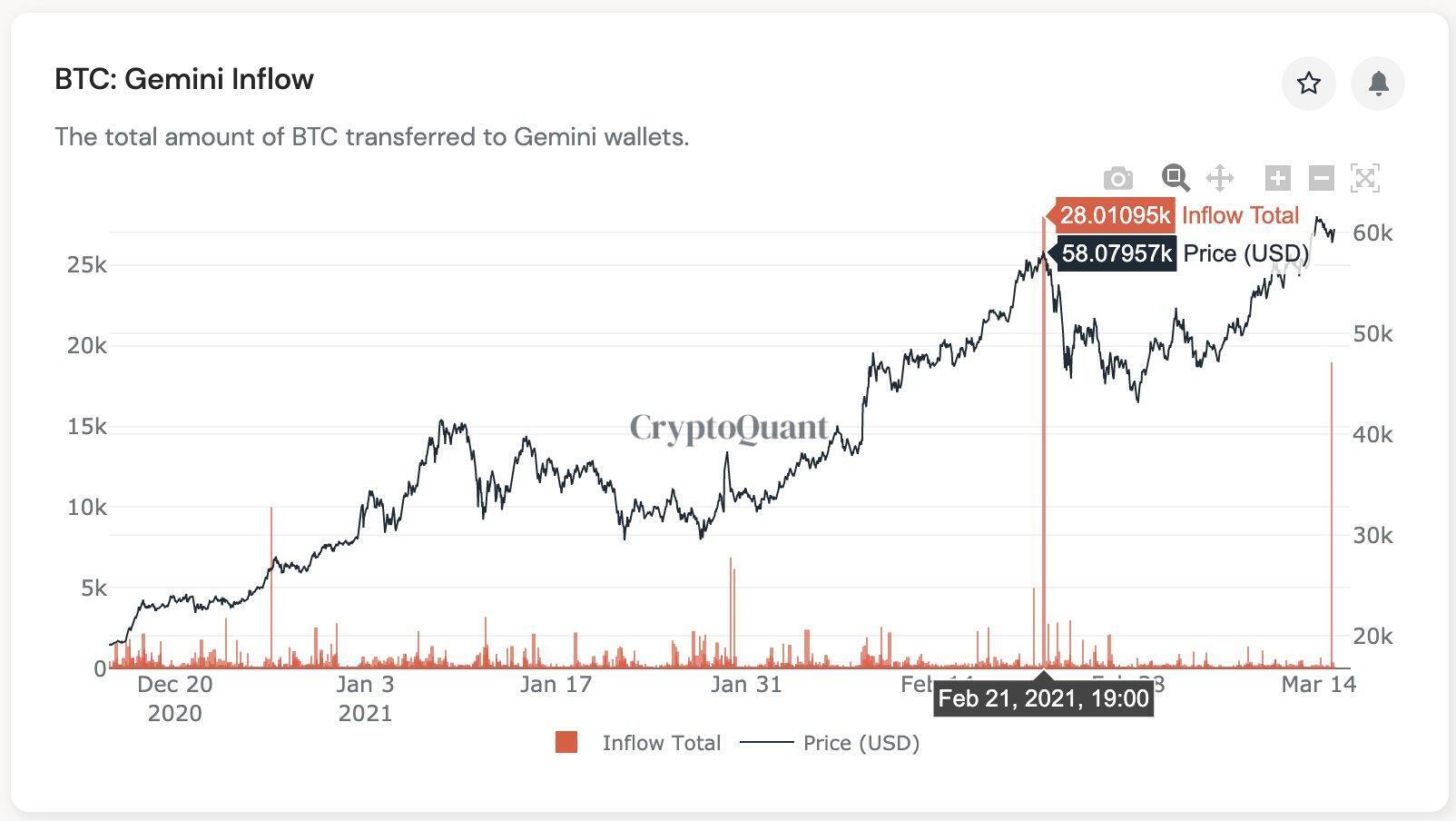

A chart shared by CrypoQuant CEO Ki Young Ju shows that previous large deposits into Gemini preceded similar bitcoin price falls.

Source: Twitter/CryptoQuant

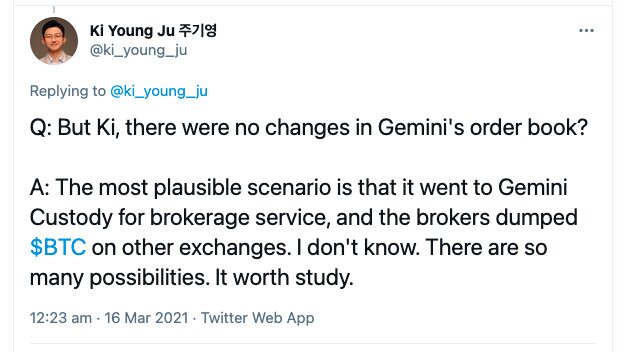

Did whale alerts cause drops in each of the cases illustrated above? Or was it actually whales themselves, selling bitcoin? Well, sometimes it may be alerts causing panic, and sometimes it may be actual whales. As Young Ju notes in a follow-up tweet, it’s possible that BlockFi deposited the bitcoin with Gemini’s custodial service, and from there it was moved to over-the-counter brokerage services or other exchanges and sold.

Source: Twitter

So CryptoQuant could, more or less, be right. At the same time, there “are so many possibilities” largely because, even though on-chain data is fairly transparent, what’s happening on a human, practical level is actually very opaque.

This is why we’re likely to encounter many similar instances of traders or analysts misinterpreting data, which appears self-evident but may have some underlying context that’s invisible to us.

What’s particularly dangerous is that, even if certain interpretations are ultimately false, they often need only be sensationalist, alarming or dramatic for people to act on them. And if people do act on them, they effectively become self-fulfilling prophecies, forcing even those who know better to sell, for fear of losing money.

This situation may change as the cryptocurrency industry matures and data becomes more standardized, as well as better understood. However, for now, it may be best to stick to a long-term strategy, and try not to be swayed in the short-term by isolated pieces of data.