- >News

- >A Step-by-Step Guide to Staking Without Using an Exchange

A Step-by-Step Guide to Staking Without Using an Exchange

Staking your cryptocurrency assets is a great way to earn passive income on your holdings. While crypto exchanges such as Coinbase offer staking services through their platform, it’s not necessary to use an exchange in order to stake your digital assets. Proof of stake assets such as Ethereum (ETH), Cardano (ADA), Polygon (MATIC), Solana (SOL), and Polkadot (DOT) can all be staked directly to their respective blockchain networks in order to earn rewards.

However, some of these assets, namely Ethereum and Polkadot, have higher barriers to entries for staking than the others mentioned. This means that you need a high amount of the asset in order to stake on your own, which shuts out smaller holders from being able to earn. As such is the case, staking these assets through Lido Finance is one of the easiest ways to stake without using an exchange and earn rewards. Find out how in this guide.

What is Lido?

Lido Finance is a staking platform that was originally launched when Ethereum first began offering staking back in 2020. Lido offered Ethereum staking pools for users who had less than the general requirement of 32 ETH required to stake. They remain one of the most popular ways to stake cryptocurrencies such as Ethereum (ETH), Solana (SOL), Polygon (MATIC), and Polkadot (DOT). The Lido Finance platform allows you to delegate and stake these crypto assets without requiring you to perform any of the technical requirements necessary to earn staking rewards. This means rather than needing to be a validator to earn rewards, you can delegate your holdings to Lido, a validator, who then gives you the proportionate reward to your stake.

Lido only offers their services for proof of stake assets such as Ethereum, meaning assets such as Bitcoin (BTC) and Litecoin (LTC) will not be able to be staked using Lido. In exchange for providing their staking services, Lido takes a percentage of the rewards, much like a commission when staking through a centralized exchange. Lido is a decentralized autonomous organization (DAO). This means the community votes on and approves changes to the platform with voting weight being determined by LDO (Lido’s governance token) holdings. Follow the step by step guide below to begin staking with Lido.

Step by Step Guide to Stake Crypto with Lido

For this guide, we’ll be using Ethereum and MetaMask as the staking asset and crypto wallet, respectively. Lido Finance allows you to stake Ethereum along with Solana (SOL), Polygon (MATIC), Polkadot (DOT), and Kusama (KSM). The process for staking all of these assets with Lido is pretty well the same, but simply requires you to use their respective crypto wallets such as Phantom for Solana.

Polygon can be used with MetaMask, so its process is identical to Ethereum’s. Also, if you’re using a multi-asset wallet, such as a Ledger Nano S or X hardware wallet, or a browser wallet like Trust Wallet, it’ll be the same process for each asset. Below are the steps required to stake crypto with Lido Finance.

Step 1: Navigate to Lido’s Staking Page

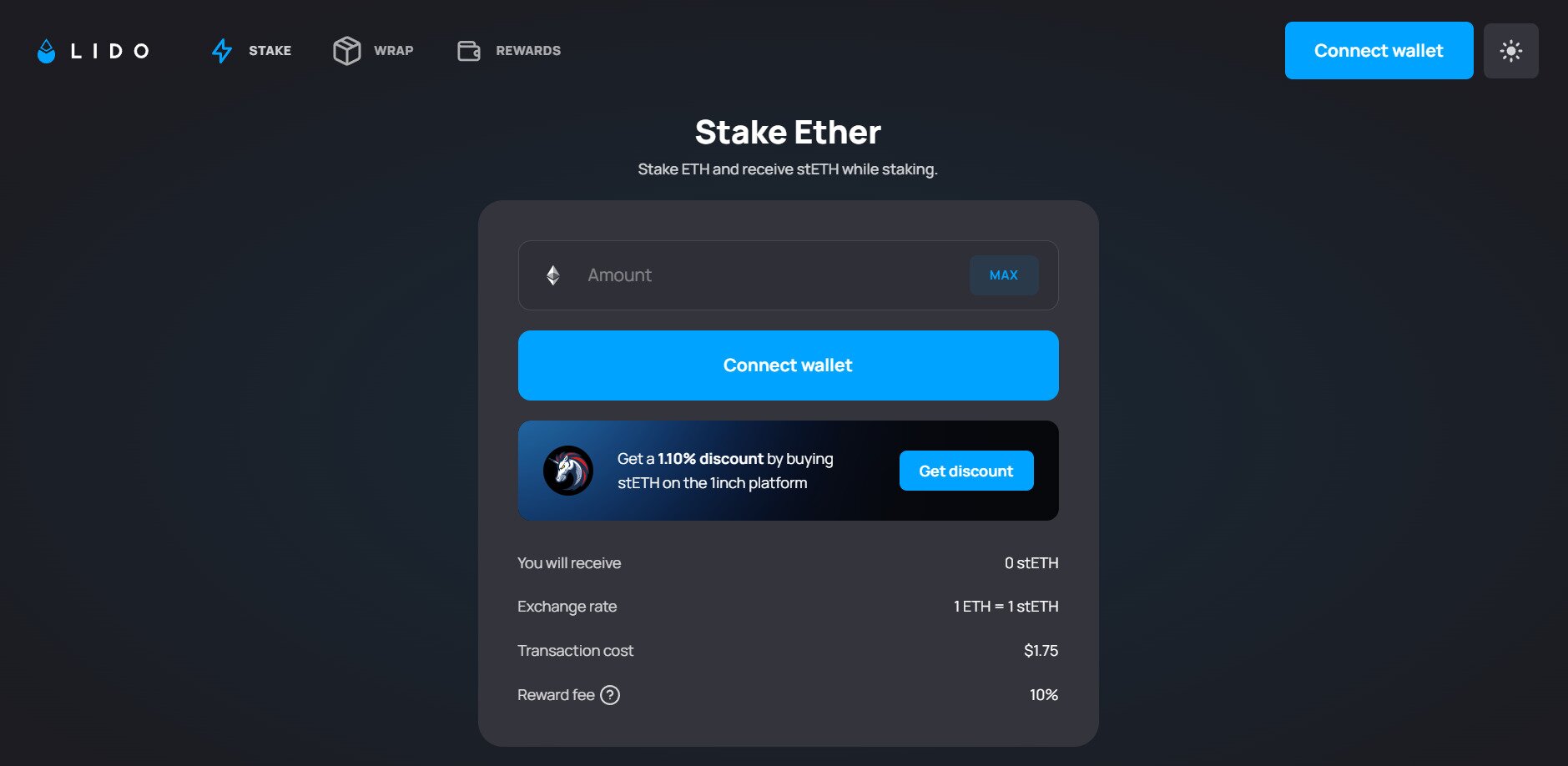

The first step to staking is to go to the Lido staking page: https://stake.lido.fi/:

Step 2: Connect Your Wallet

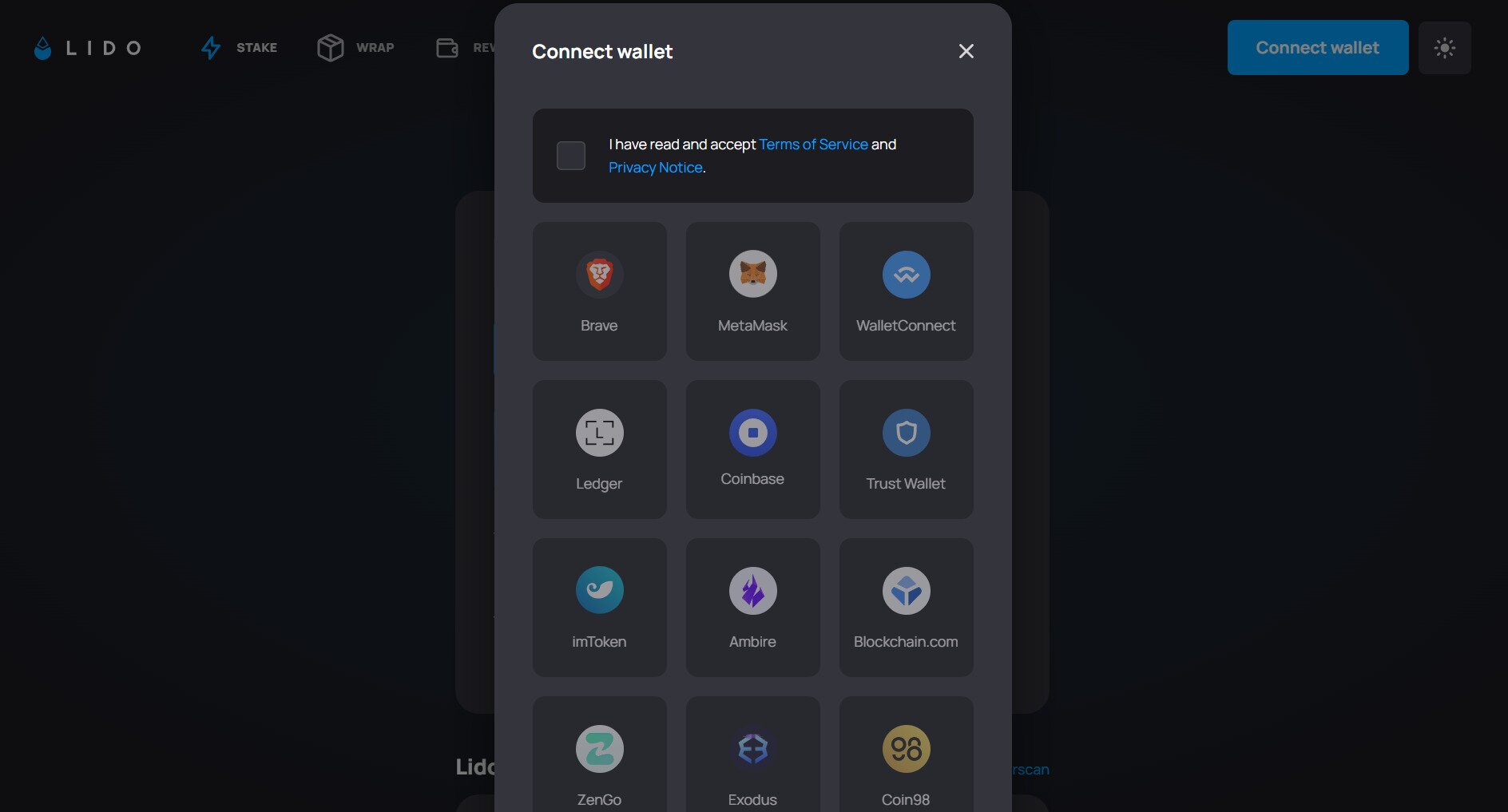

Next, click “Connect Wallet”, which is located in the middle of the page or in the upper right corner. You’ll then be shown a list of compatible crypto wallets. Tick the box to accept the terms and conditions, then choose the wallet you wish to connect.

Lido has support for Brave, MetaMask, WalletConnect, Ledger, Coinbase, Trust Wallet, imToken, Ambire, Blockchain.com, Zengo, Exodus, Coin98, MathWallet, Tally, Gamestop, and XDEFI wallets.

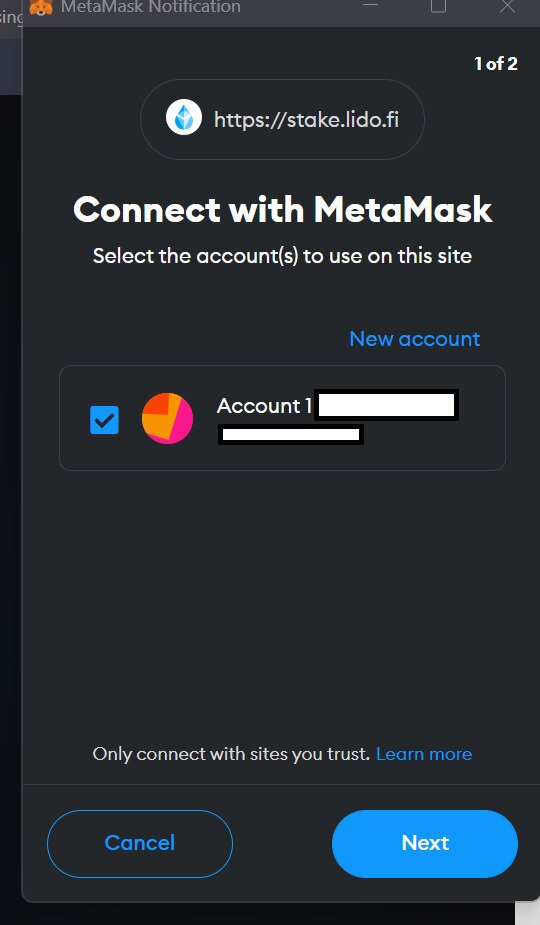

Step 3: Confirm the Connection with Your Wallet

After selecting the wallet you wish to connect, that wallet will pop-up asking you to confirm the connection to Lido. Click “Next”, then “Approve”. Then your wallet will be connected to Lido.

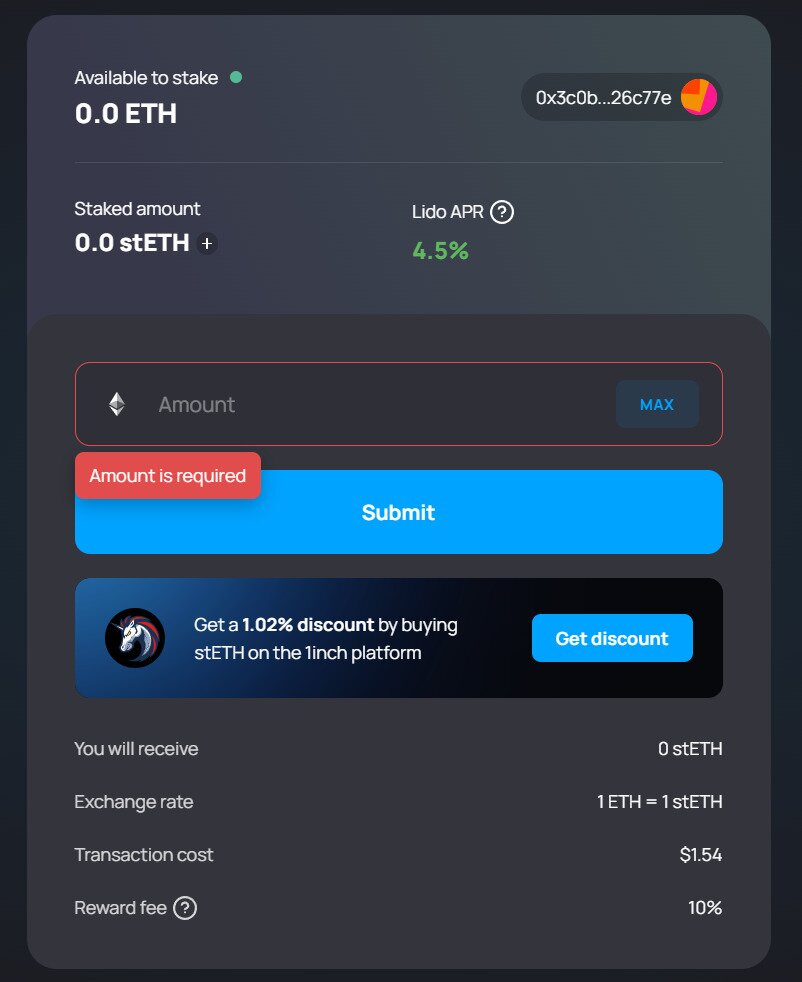

Step 4: Enter the Amount of ETH You Want to Stake

Once you’ve connected your wallet, you can enter the amount of ETH you want to stake into the field on the page. Then, click “Submit”.

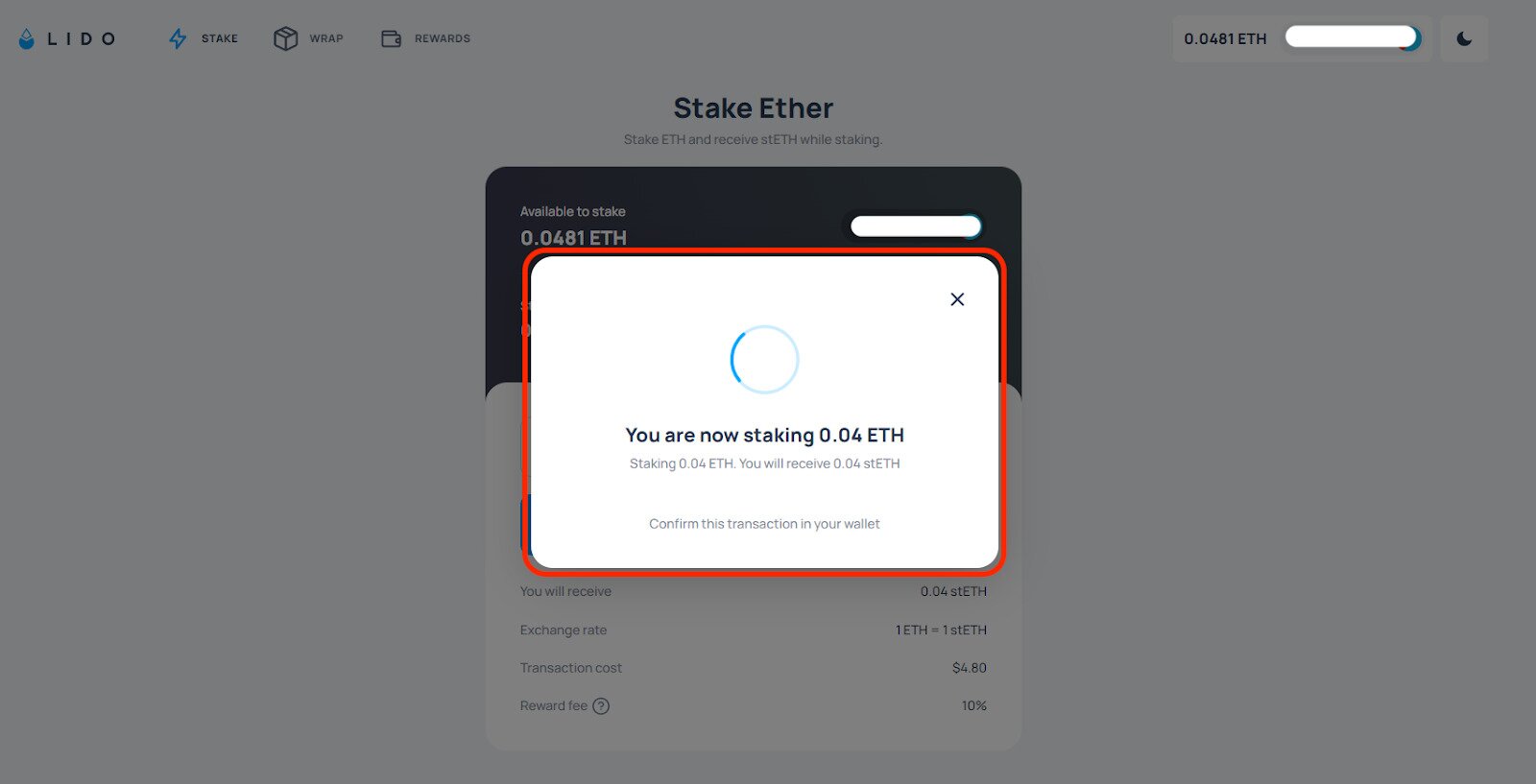

Step 5: Confirm the Staking Transaction in Your Wallet

You’ll then get another pop-up on the page saying to approve the transaction with your wallet. Your wallet will then pop-up for you to confirm your transaction. Click “Confirm” to approve the staking transaction (Note there will be a Gas fee here).

Step 6: Done!

You’re now staking ETH with Lido. You can confirm that you’re staked by looking at the page you just staked on, as your staked balance will update. For staking any of the other assets mentioned here, follow the same process but with that asset replacing ETH.

Is Staking with Lido Safe?

Yes, staking with Lido is a safe process. When staking with Lido you receive a token such as stETH (Staked Ethereum). This stETH entitles you to the redemption of your ETH rewards and your staked ETH, but is also a tradable token that you can also buy or sell. Keep in mind you need stETH in order to redeem staked ETH, so if you sell or trade all your stETH you can’t redeem the ETH you staked with Lidom. You can withdraw an amount of ETH equivalent to the stETH you hold, meaning that buying other stETH would entitle you to a greater redemption of ETH.

What Other Ways Can I Stake?

Lido is a great way to stake without an exchange, but there are other ways to do so. You can stake directly to various proof of stake blockchain protocols without using Lido. This is true for Cardano (ADA), Solana (SOL), Cosmos (ATOM), Avalanche (AVAX), and any other proof of stake crypto asset. All you need to do so is a crypto wallet for the relevant blockchain.

The steps are similar regardless of whether you’re using Lido to stake, the only difference is that you can choose a validator with a lower commission than Lido, or one that doesn’t charge a commission at all.