- >News

- >15% Of All Cryptocurrencies Experience Regular Pump and Dumps

15% Of All Cryptocurrencies Experience Regular Pump and Dumps

Researchers have found that pump-and-dump schemes are extraordinarily common in the crypto market, with 15% of all cryptocurrencies experiencing regular pump and dumps. Posting their study on SSRN, researchers from the University of Technology Sydney identified 355 separate pumps in a seventh-month period between December 2017 and June 2018.

The authors described the level of price manipulation in crypto as “unprecedented in modern markets.” Their findings highlight the care and consideration investors need to take in order not to be swept along by pump-and-dump scams.

However, while other research has also pointed to the regularity of pumps in crypto, the new research also finds that low-cap coins are more likely to be manipulated than large-cap coins such as Bitcoin. This means that investors can reduce their risks by avoiding smaller or newer coins that mysteriously jump for no particular reason.

Pump And Dump Schemes Are Rife In Crypto

The research also found that the 355 pump-and-dump schemes they identified were responsible for around $350 million in trading activity. This netted the organizers of the schemes some $6 million in profits.

To put this in some perspective, the authors say that the scale and frequency of price manipulation significantly dwarfs that of similar manipulation in legacy financial markets.

“If you compare the scale of manipulation to traditional equity markets, it’s exponentially higher,” Anirudh Dhawan, one of the paper’s authors, told Yahoo! Finance.

“Even in the penny stocks, OTC equity markets, you’ve got a few hundred cases in a 10 year period. Here you’ve got more than 300 cases in the space of a few months.”

The authors sampled 1,307 different cryptocurrencies over the seven-month period of their study. 197 of these coins experienced pump-and-dump manipulation during this window, representing 15% of the total sample. Of these 197 coins, there’s an average of 1.80 pumps per coin and 2.67 pumps per “pump-day” (i.e. a day when there’s at least one instance of manipulation).

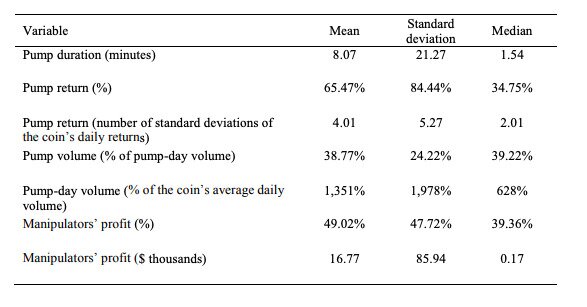

The average pump generates a 65% increase in the targeted coin’s price. Source: Anirudh Dhawan and Tālis J. Putniņš

As the authors write, this means that pump-and-dump schemes are a common and regular feature of the crypto ecosystem.

“There is at least one pump on 133 days out of the 175 days in our sample, indicating that there is almost one pump per day on average. Such a high rate of manipulation is unprecedented in financial markets.”

Other Research

This latest study isn’t the only piece of research to indicate that pump-and-dump schemes are an intrinsic part of the crypto market.

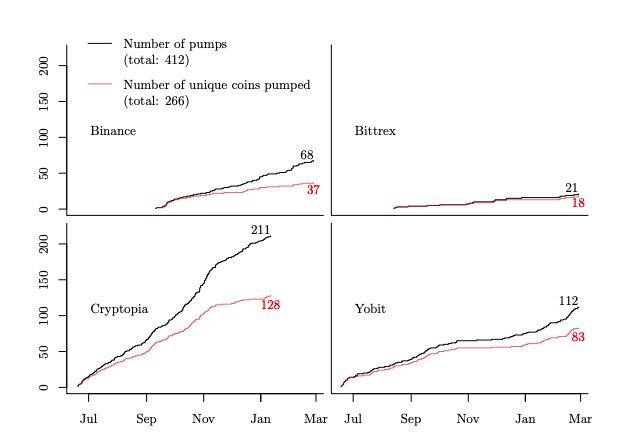

In an August 2019 conference paper, researchers from Imperial College London identified 412 pump-and-dump activities in the eight months between June 17, 2018 and February 26, 2019. They also found that Cryptopia, Yobit, Binance and Bittrex were the most popular exchanges used by pump groups.

Source: Jiahua Xu, Benjamin Livshits

As the authors wrote in the paper’s conclusion:

“The study demonstrates the persisting nature of pump-and-dump activities in the crypto-market that are the driving force behind tens of millions of dollars of phony trading volumes each month.”

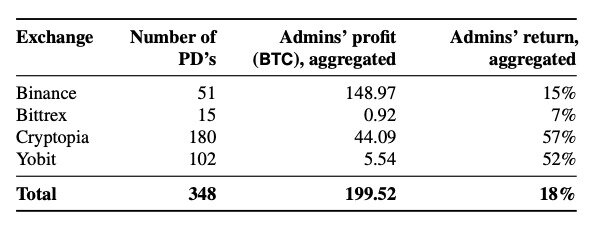

Source: Jiahua Xu, Benjamin Livshits

Another 2019 paper, from researchers at a variety of universities, identified a staggering 4,818 pump-and-dump schemes organized on Telegram and Discord over only six months (between January 2018 and July 2018). It also concluded that ten percent of the pumps on Telegram increased the price (of the targeted crypto) by over 18 percent in only five minutes, while ten percent of the schemes on Discord increased the price by 12 percent.

“These comprehensive data provide the first measure of the scope of pump and dump schemes involving cryptocurrencies and suggest that this phenomenon is widespread,” wrote the authors.

What Traders Can Do To Avoid Getting Burned

One of the interesting findings of the new research is that pump-and-dump schemes are not only widespread in number, but also fairly widespread in terms of the numbers of people participating in them.

The new University of Technology Sydney paper found that the 355 schemes they monitored had 23 million participants in total. This is a high number, and suggests that a large portion of existing crypto traders are actually active in pumps and dumps.

However, the 2019 Imperial College London paper found that most participants in pumps don’t actually profit, unlike the schemes’ admins.

The authors wrote, “It is generally known to pump participants that admins benefit the most from a pump. So why are there still people enthusiastic about partaking a pump, given the risk of being ripped off by the admins? Because people believe that they can sell those coins at an even higher price to other ‘greater fools’.”

Assuming that you don’t want to get involved in pump schemes, and assuming you want to avoid being duped by their effects on the prices of cryptocurrencies, there are two general rules you can adopt to stay safe.

First, avoid small-cap cryptocurrencies. The new paper found that “as market capitalization [of a cryptocurrency] is doubled, the odds of being pumped reduce by 14.79%.”

Likewise, a May 2020 study from Italian researchers looked at 343 pump-and-dump operations and noted that “100 of the coins used for pump and dumps are below 20 million dollars of market capitalization, with 34 of them being below 1 million.”

Another thing traders need to look out for are sudden spikes in trading volume, particularly with smaller cap coins.

“The trading volume on manipulation days is around 13.5 times the usual daily volume,” wrote the authors of the University of Technology Sydney study.

A sudden increase in trading volume or orders for no obvious reason is a strong signal that a pump is probably taking place. According to the 2019 Imperial College London study, the dump often starts a “few minutes (sometimes tens of seconds) after the pump starts,” so traders really have extremely little time to profit from a pump themselves.

However, by remaining highly suspect of lower cap coins and coins that suddenly see big jumps in volume, most traders should avoid getting themselves hurt by pump-and-dump schemes. Of course, the real trick is learning how not to get hurt by the markets for bigger coins, but that’s a lesson for another day…