Set Up A Crypto Exchange Account With The Following Partners

Getting started with cryptocurrency begins with choosing a reliable exchange platform to buy, sell, and manage your digital assets. To help you on your journey, we’ve partnered with two of the most trusted names in the crypto industry: Coinbase and Binance. Whether you’re a beginner looking for an easy-to-navigate interface or a seasoned trader in need of advanced tools, these platforms offer a secure and seamless way to set up your crypto exchange account. Here’s everything you need to know to get started with our recommended partners.

- Great for crypto beginners

- Solid crypto/general trading platform

- Reliable company with solid trust in the community

- Fully supports credit cards for deposits and withdrawals

- Earn $200 in free crypto after completing sign-up process. Terms apply.

- Variety of products including exchange, staking, wallet

- Advanced Trading options for experienced traders

Basic Steps for Setting Up an Exchange Account

While not every cryptocurrency exchange set up is exactly the same, there is a general registration process that tends to be rather similar at each crypto trading platform. Coinbase is a fantastic exchange for beginners who are looking to start buying cryptocurrency. Alternatively a site like eToro or Public.com gives users access to crypto as well as stocks and other assets. You can read through our comprehensive reviews of alternative exchanges to Coinbase on our best cryptocurrency exchanges listings page.

The sign-up process usually goes something like this:

First, you will need to provide a small bit of personal information, which could be nothing more than a name and an email address. The exchange will then send you an email to confirm that you are in control of the associated address.

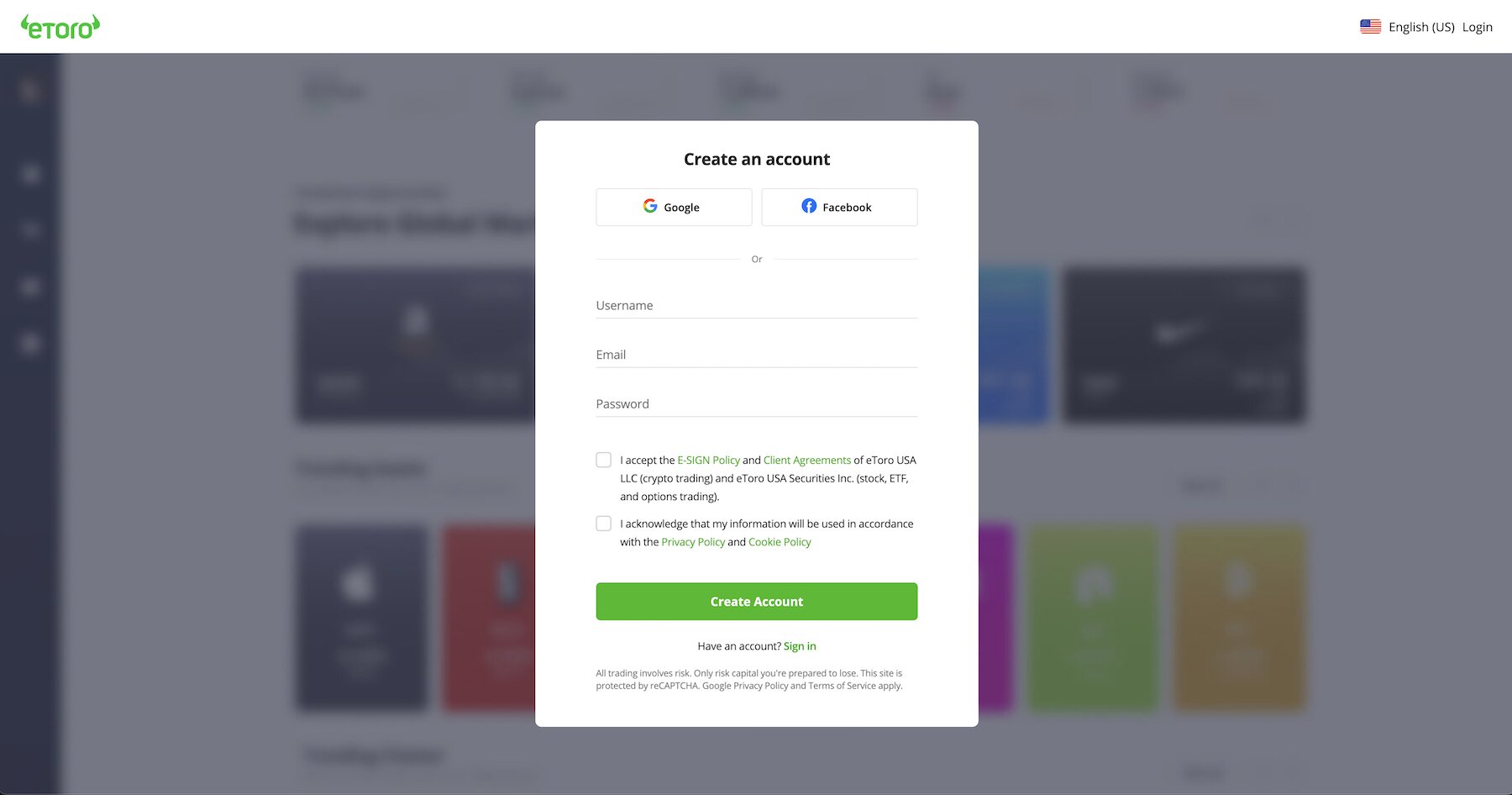

Here’s an example using eToro:

You will then need to add a payment method that can be used as a mechanism for deposits and withdrawals.

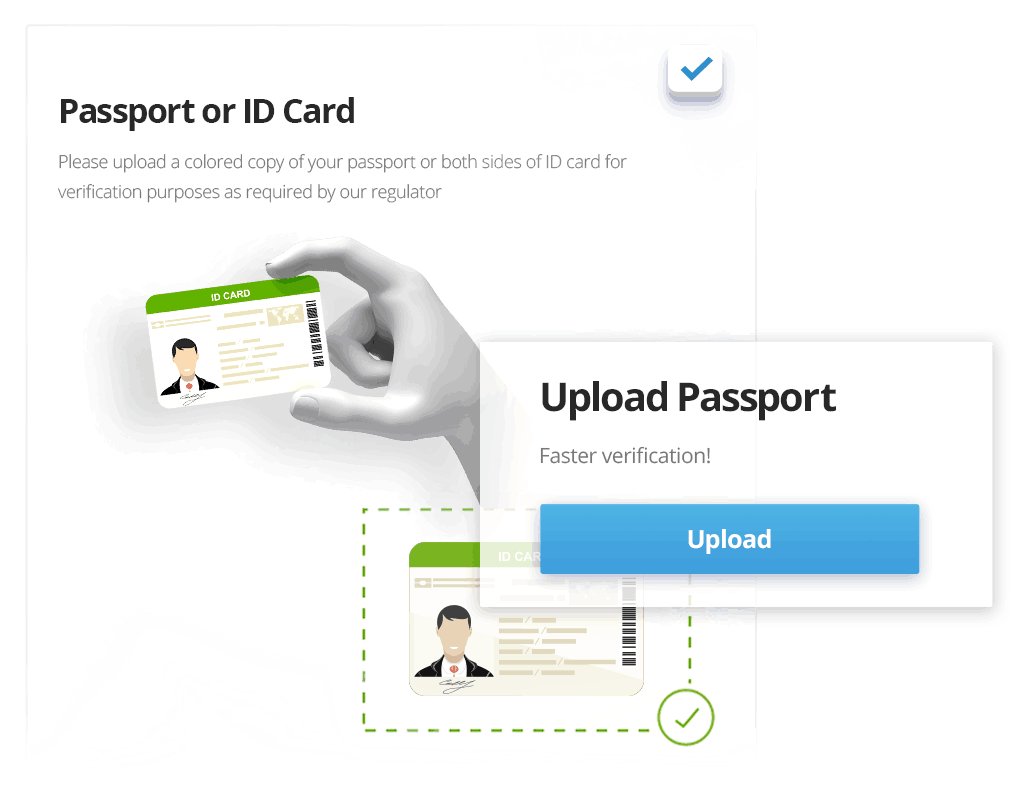

For some users, the above three steps will be enough to get the job done. However, depending on the exchange, and the level of your engagement, you will need to go through a more extensive “Know your Client” (KYC) process, which is really just identity verification.

If you’re interested in making larger trades, then you’ll need to verify more information about yourself. Different trading tiers are available to users based on the amount of information the exchange has collected about the customer. Additional verification could come in the form of an address, phone number, government-issued identification, and even a selfie of you holding that form of ID.

What You Need to Get Started

In addition to digital currency exchanges offering different tiers of trading to their customers, the laws regarding user verification can also vary between jurisdictions. This is why instant sign-up is possible on some exchanges while others may take some time to get you verified for trading.

For the crypto trading platforms that have more stringent requirements for knowing about their customers, the following information may be required:

- Full, legal name

- Date of birth

- Email addresses

- Phone number

- Address

- A copy of a utility bill sent to that address

- Social security number

- Driver’s license, passport, or other government-issued ID

- A selfie of you holding that government ID

- Some exchanges may even ask you about the nature of your interest in cryptocurrency

In general, starting an account on a cryptocurrency exchange isn’t that hard. It generally just takes a little patience and follow through. The great thing is that once you’ve got your account up and running you’ll generally be set for as long as you continue doing business with the company.

For in-depth comparisons of the best crypto exchanges, check out:

Do I Need a Crypto Wallet?

You don’t need a crypto wallet but it is generally recommended.

If you don’t want to bother with a crypto wallet then you’re actually storing your crypto on the exchange’s wallet. That’s fine if the you trust the exchange 100% and they always act in your best interest but many crypto experts prefer to secure their crypto on a personal wallet.

There are a few different forms of crypto wallets but they usually break down to the following:

- Software wallets (such as Exodus, MetaMask, Zengo)

- Hardware wallets (Ledger, Trezor and Tangem)

Hardware wallets (also known as cold wallets) offer better security but cost money. Meanwhile software wallets are 100% free and have excellent UIs. But because they are online they are often referred to as “hot wallets”.

You can sometimes combine a software wallet with a hardware wallet to get the best of both worlds.

Common Questions About Cryptocurrency Exchanges

The short answer is yes but the reliability of a crypto exchange can vary. In addition to obvious concerns regarding the security of your funds, it’s also important to make sure your exchange can be trusted with your personal data. To ensure the safety of your personal information, stick with exchanges that have been around for a long time and are in jurisdictions where there are strong consumer data protections.

The amount of time it takes to register for an exchange account will depend on the jurisdiction of the exchange and how much cryptocurrency you want to trade. Some exchanges are able to offer instant sign-up options, while others will take at least a few days to get you ready to trade. The general rule of thumb is that the exchanges with heavier requirements regarding Know Your Customer and anti-money laundering regulations will take longer to get you registered.

If you get denied at one exchange, it may mean that you need to look at options in a different jurisdiction. Exchanges in your home country will be your best bet. If you’re unable to get registered at an online exchange, then you could always look into peer-to-peer options like LocalBitcoins or Bisq.

No. The exchange will hold onto your coins until you are ready to transfer them over to your own crypto wallet software.

The availability of altcoins like Ethereum and Bitcoin Cash will depend on the exchange. Some exchanges still stick with Bitcoin and nothing else, but the vast majority of digital currency exchanges will allow you to trade a wide variety of cryptocurrencies.

It should be noted that some exchanges do not interact with the traditional banking system at all and only allow their users to trade between various cryptocurrencies. These types of exchanges tend to have lower requirements when it comes to the information they’ll want to collect from you before you can start trading. However, the relatively lower level of regulatory clarity around these types of exchanges also makes them more susceptible to issues around exchanges hacks and could be considered riskier.

The difference between trading cryptocurrencies and purchasing them really has to do with the activity level of the user. If you’re someone who is trying to play the market on a daily basis and are both buying and selling cryptocurrencies on a regular basis, then you’re a trader. If you’re just buying cryptocurrencies less frequently as a long-term investment, then that’d be considered purchasing.

Different exchanges are targeted to different types of users, so it makes sense to stick with an exchange that best fits your specific needs. Having said that, the exchanges targeted towards more advanced traders who tend to buy and sell more frequently usually have lower fees associated with their platforms.

Centralized online exchanges are not the only way to acquire Bitcoin, and the more die-hard fans of cryptocurrency tend to look down upon this particular method of accessing the world of cryptocurrencies. You should remember that cryptocurrencies are just money, so you can acquire them in the same way you would acquire U.S. dollars, euros, or any other traditional fiat currency.

For example, you could see if your employer or customers would be willing to pay you in your cryptocurrency of choice. You can also exchange cryptocurrencies in a more peer-to-peer manner by simply finding someone in your local area who has some cryptocurrency to sell and meeting up with them in person to buy that crypto with physical cash. Having said that, caution should be used when meeting up with individuals for in-person deals, especially if you’re going to be trading with large sums of cash.