Best Exchanges for Staking Polygon

- Earn $200 in free crypto after completing sign-up process. Terms apply.

- Variety of products including exchange, staking, wallet

- Advanced Trading options for experienced traders

- Exceptionally secure exchange with proof of reserves

- Supports many different funding options

- Accepts users from across the globe including USA and Canada

- Very high trading volume

What is Polygon (MATIC)?

Polygon (MATIC), formerly known as Matic Network, is a layer 2 blockchain network built on top of the Ethereum network. This means MATIC tokens are ERC-20 tokens and that the Polygon network has the same security as the Ethereum blockchain, which is strong. Polygon aims to be the Internet of Blockchains on the Ethereum network, much like Cosmos (ATOM) with their Inter-Blockchain Communication (IBC) protocol, or Polkadot (DOT) with parachains. MATIC is the native token of the Polygon network but also works on the Ethereum layer. Transaction fees on the Polygon network are much lower than on Ethereum, and it is a scaling solution for the ecosystem.

Polygon is a proof of stake digital asset, which means that you can stake MATIC on the Polygon network in order to earn staking rewards. Polygon validators run their own node, stake MATIC, and verify transactions, while delegators can have tokens staked with a validator in order to earn passive income. The latter is referred to as a staking pool.

Step by Step Guide for MATIC Staking

Staking Polygon is a fairly simply process that you can easily do by following the steps below. While these steps are for using MetaMask wallet for MATIC staking, you can stake MATIC with just about any noncustodial wallet using these same steps, the only difference will be the interface. Before you can begin staking MATIC, you’ll need to have one of these wallets and some MATIC tokens in it. If you haven’t done that yet, you’ll need to do so before participating in Polygon staking.

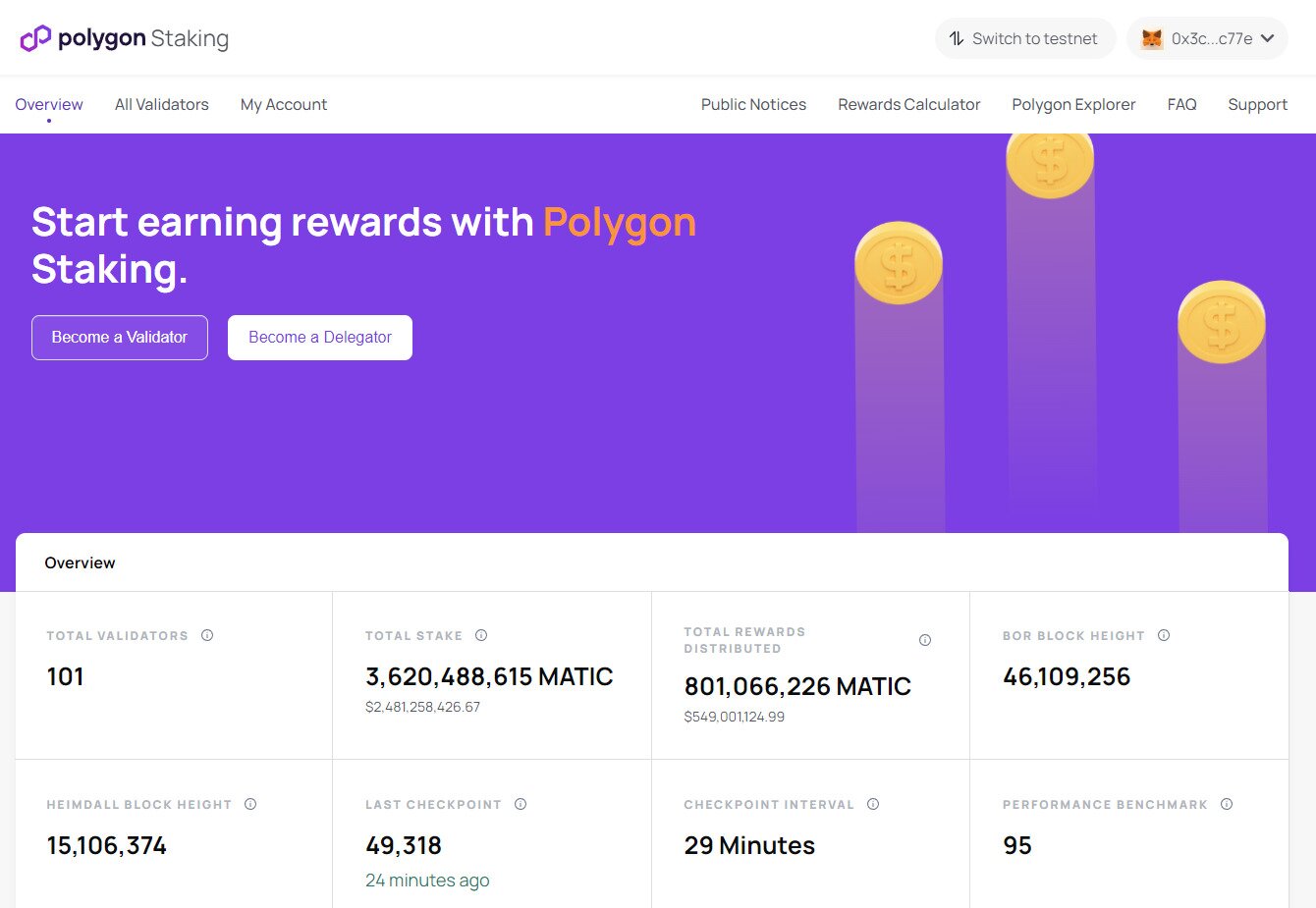

Step 1: Go to Polygon’s Website

The first step to staking Polygon is to go to their official staking platform and connect your MetaMask. Once connected you’ll see the below landing page.

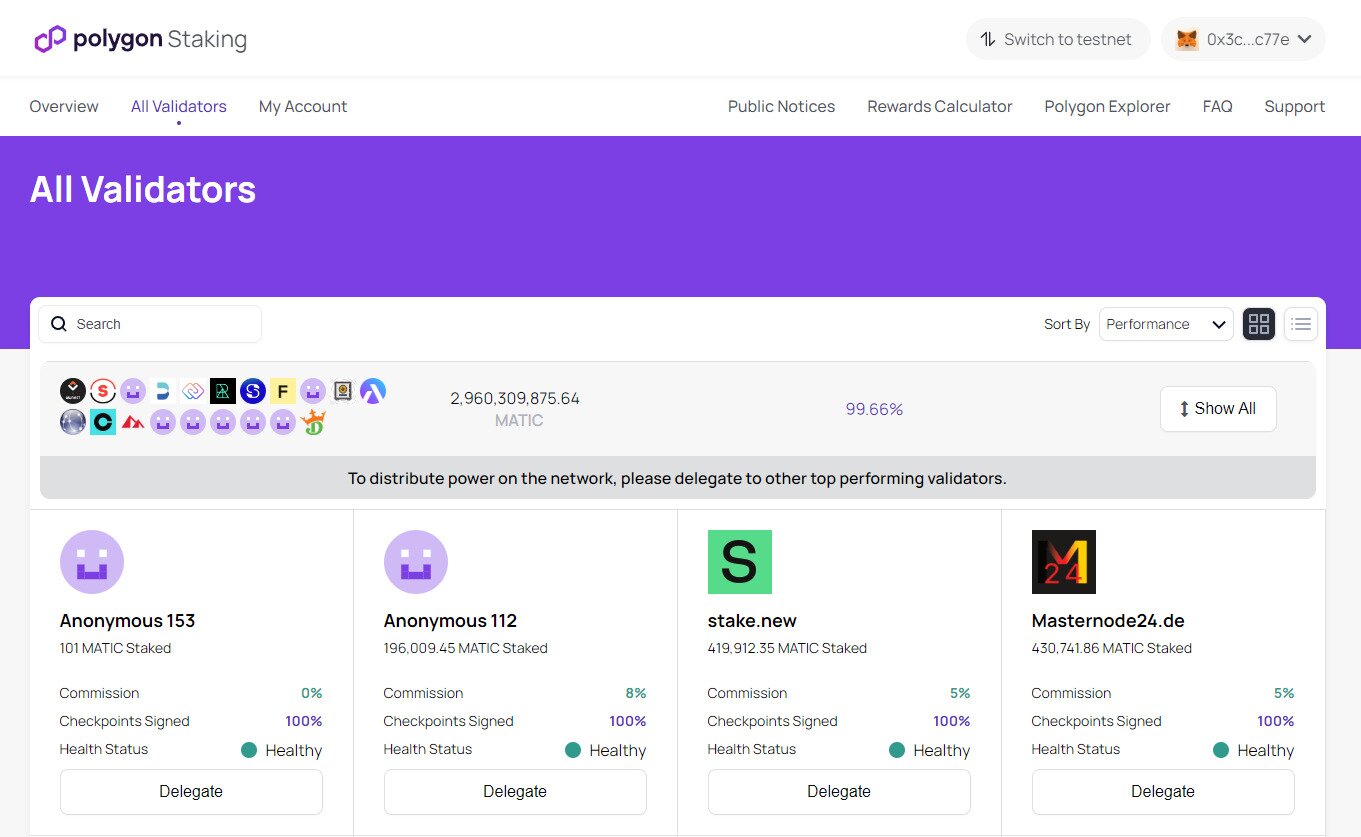

Step 2: Choose a Validator

There are currently no validator slots available for the Polygon network, so you have to become a delegator by picking a validator for staking MATIC with. Once you click the “Become a Delegator” link seen in the above image, you’ll see the below where you can pick a validator for staking Polygon. You can see if the validator is healthy, their commission, their checkpoints signed, and the amount of MATIC staked with them. When you find a validator you like, click “Delegate”.

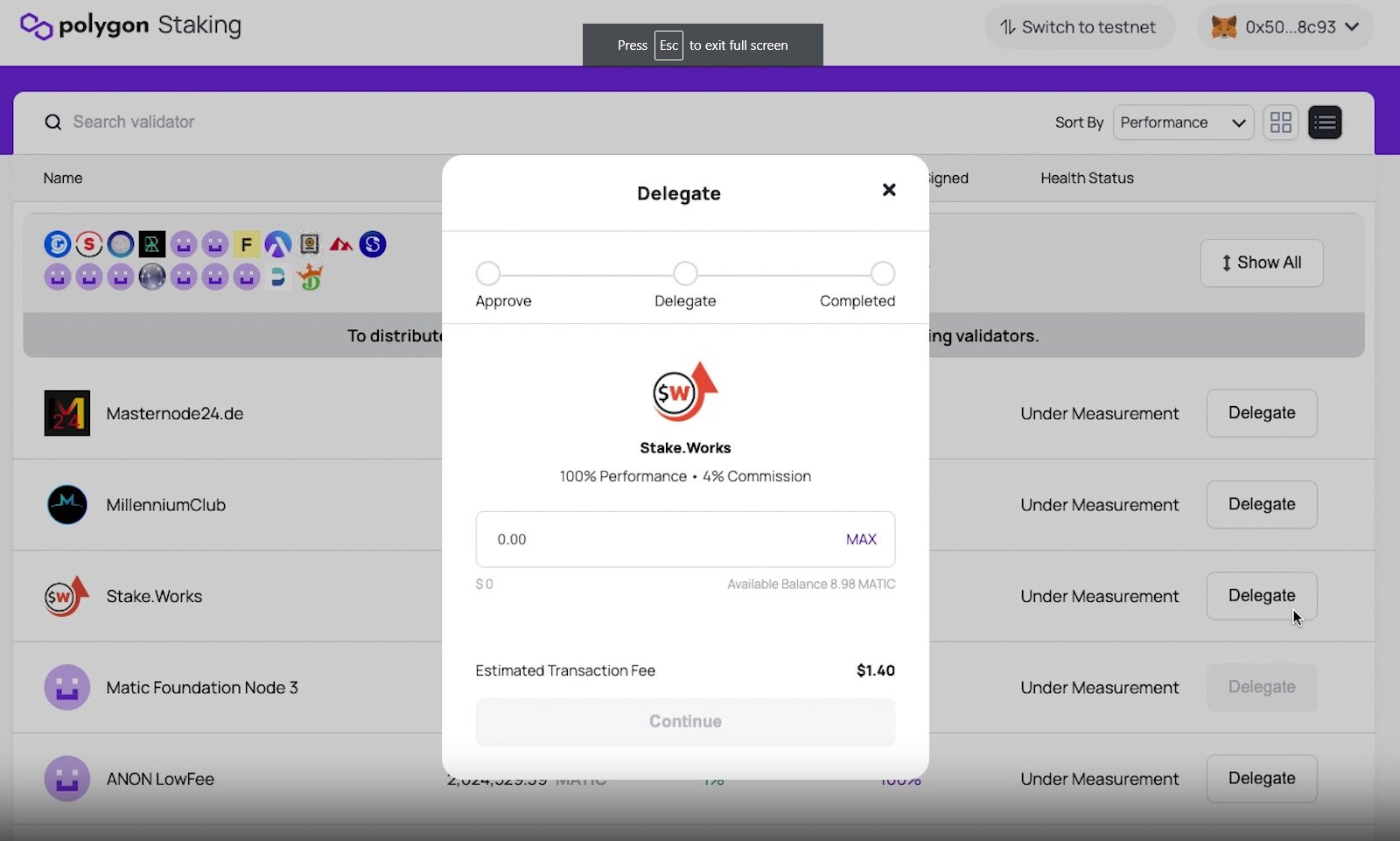

Step 3: Choose Your Delegation Amount

Once you click “Delegate” you’ll see the below popup. You can enter the amount you want to delegate or click “MAX” to stake it all. Then click “Continue” when you’re happy with the staking amount.

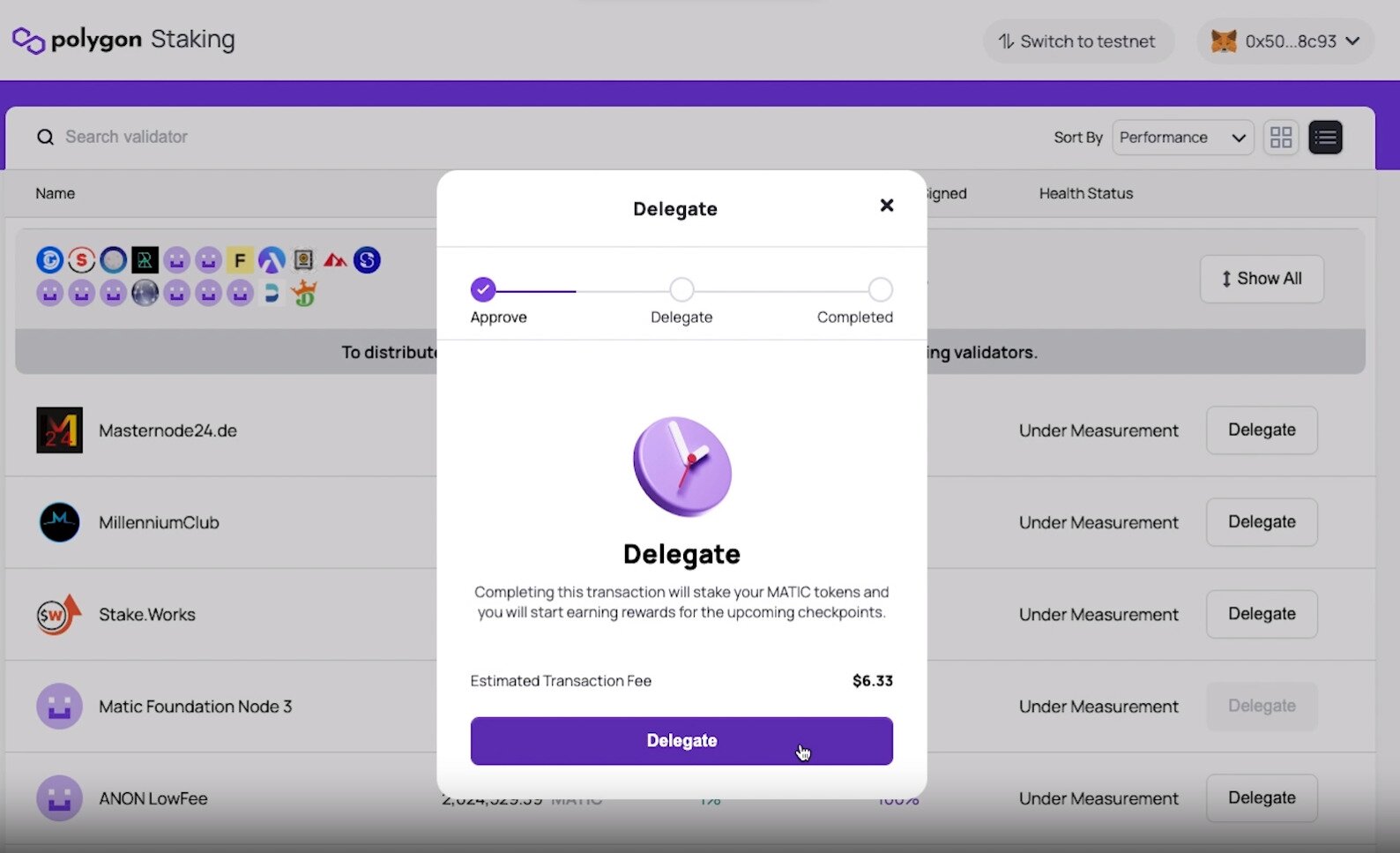

Step 4: Confirm Your Delegation

Once you click “Continue” you’ll see the below. You can see the amount of MATIC you’re going to be staking, and the estimated transaction fees. If it all looks good, click “Delegate”. You then have to confirm the transaction using your MetaMask wallet, which will pop up (second image below). Click “Confirm”.

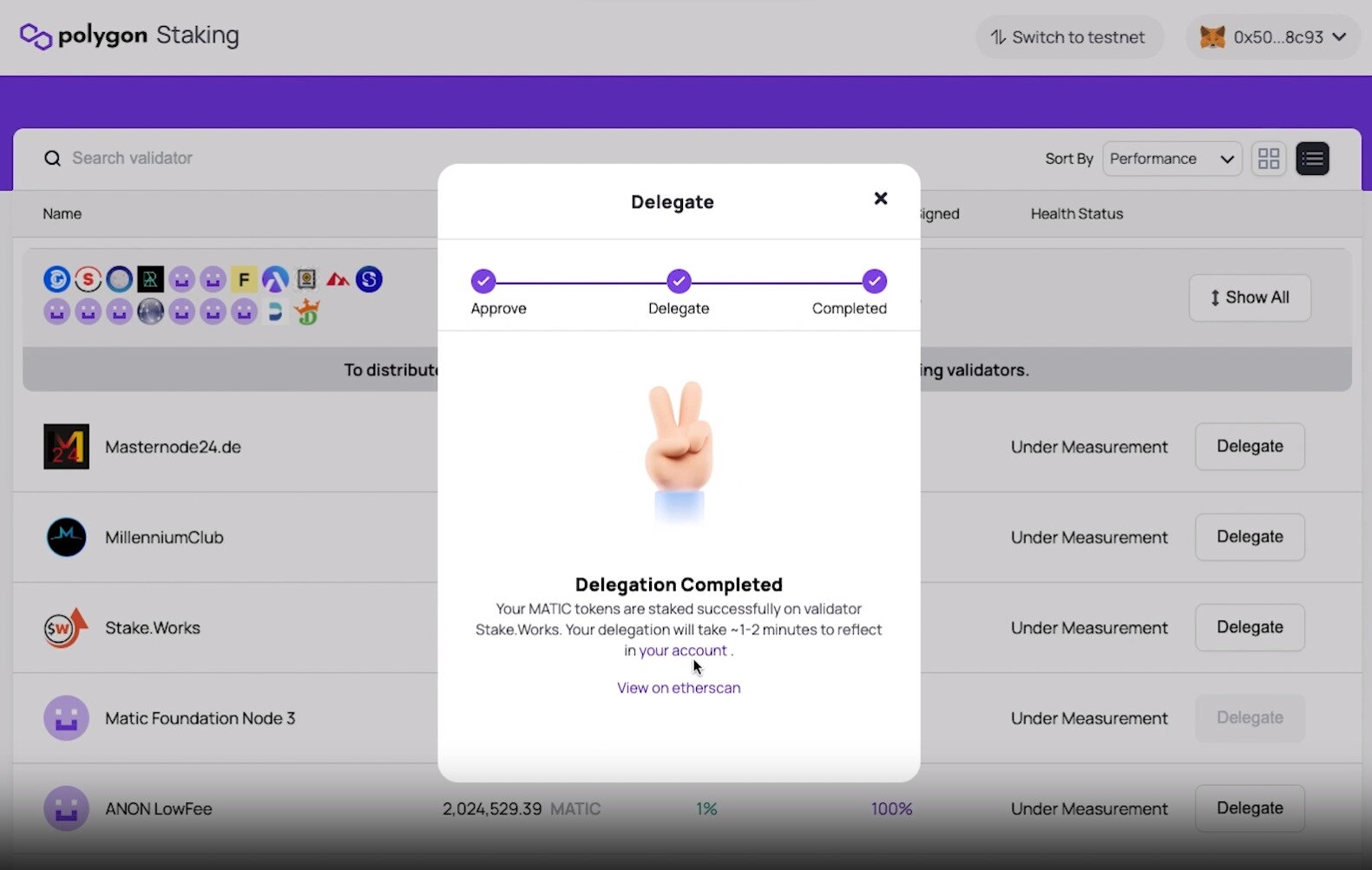

Step 5: Done!

Once you’ve confirmed the transaction with your MetaMask wallet, you will see the below to confirm that you have successfully delegated your MATIC for staking rewards.

What Rewards Sould I Expect for Staking Polygon?

Polygon staking rewards are just under 5% per year, less the commission charged by the validator node for MATIC staking. If you stake Polygon through an exchange it should be more or less the same reward.

Staking Polygon is a good way to earn passive income on your MATIC token. Of course with all crypto staking the real hope is that the token appreciates considerably in value and therefore your APY becomes much more valuable.

Is Staking Polygon Risky?

Staked assets are not at risk if you stake MATIC tokens using your Polygon wallet. However, using staking platforms like a centralized exchange or decentralized platform like Lido does pose some risk.

On the technical side there is always the chance of a smart contract bug affecting the staking pool. When you stake MATIC on Lido you receive stMATIC in return (which generates a passive yield). You have custody over the stMATIC tokens while your MATIC is locked in a staking pool. You can theoretically swap back at any time.

Lido has been remarkably stable over the years but it is important to note that it is an extra step compared to just holding Polygon. Otherwise, there is no real risk to stake Polygon (MATIC) to earn staking rewards.

Frequently Asked Questions About Staking Polygon

Yes, there are staking fees for Polygon (MATIC). Polygon validators charge a commission for their services. You have multiple validator staking options to choose from, so you can pick which one will earn rewards and stake your MATIC tokens with them.

The minimum MATIC that can be staked is 1, but may vary with centralized staking options like Coinbase or Kraken.

No, you cannot sell your staked MATIC tokens as staking MATIC involves locking it to the Polygon chain. If you want access to your staked tokens to sell them you need to unbond them from Polygon staking, which takes 3-4 days. You can then sell your

Polygon (MATIC) tokens can be staked through some crypto exchanges along with other crypto assets. Coinbase, Binance, and Kraken are all examples of staking platforms where staking MATIC is possible. Staking providers like them tend to offer flexible staking plans.

Polygon staking rewards are earned every at checkpoints signed, which is about every 34 minutes. When you earn rewards you have to manually compound them using your MATIC wallet to increase your passive income potential. If you stake Polygon (MATIC) through an exchange the payout may be less frequent than every checkpoint.