The Journey to Cryptocurrency

Why did it take this long for people to understand the need for something like cryptocurrency? Well, our financial system received a massive upgrade in the 1950’s when we digitized the dollar, and began creating ways to send money globally. This introduced the ability for us to send money overseas in a matter of days, instead of weeks in the case of putting physical cash on an airplane or boat.

The problem with this is that we live in a world of many different countries, and currency, each with their own system of checks and balances. When using traditional financial institutions, sending money around the world still to this day can take several business days, sometimes spanning weeks.

Now let’s take a look at the streamlined process of transferring cryptocurrency.

Sending Cryptocurrency

Cryptocurrencies are sent over a peer to peer (P2P) network. This means that the money does not need to be cleared by any third parties in order for it to make it to its destination. This is in stark contrast to how the traditional financial systems work. When you send money through a bank, it is the bank, or its partners that need to approve the transaction. They are able to approve, or deny this transaction at their discretion.

Furthermore, banks get to set limits on how much you can send at once, or in a single day. Finally, banks typically are only operational on business days, which means that if you want to send a wire transfer on the weekend, then you’re out of luck, and need to wait until Monday. If this seems like an overly complicated, restrictive, and clunky system, then you’re not alone.

Cryptocurrency networks outperform banks on almost every dimension in most cases. In general, cryptocurrency networks will allow you to send transactions at any date and time, for next to money, with no limits on the transaction value, to anywhere in the world, without asking any questions. However, cryptocurrency networks are not without their limitations. Earlier cryptocurrency networks such as bitcoin are slow at processing large volumes of transactions, and fees can rise to uncomfortable levels during periods of high traffic.

Dangers of Sending Crypto

If you’re intending on acquiring and sending cryptocurrencies, even if it is to yourself, then it is important that you understand how sending cryptocurrency works. If you make a mistake with sending cryptocurrency, then you may lose the money entirely. There is no 1-800 number that you can call to reverse the transaction or recover your funds.

Cryptocurrency works by sending money to “addresses”, which are long strings of numbers and letters that represent where your money lives.

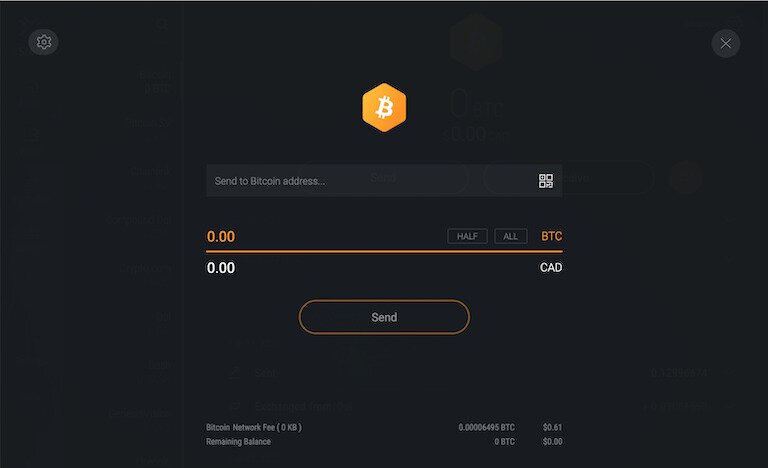

One of the common pitfalls beginners may fall into, is typing out one of these addresses manually. Mistyping the address, even if it is just a single character will result in your cryptocurrency being sent somewhere you did not intend. These addresses are case sensitive, meaning if you type a capital “T”, where you needed to type a lowercase “t”, then you will have sent your cryptocurrency somewhere else. The best way to avoid this pitfall, is to make use of copy and paste or scan a QR code, then double check the address that you just entered into the send field. A typical interface for sending cryptocurrency looks like this. This is a screenshot from the wallet Exodus.

Advantages of Using Crypto

There are several advantages to using cryptocurrency, regardless of if you’re buying something from a merchant, sending money to yourself, or receiving it in exchange for services.

The first benefit is on the receiving end. It does not cost money to receive cryptocurrency. This means that merchants and vendors can save money by accepting cryptocurrency and not be charged by payment providers such as VISA, or their bank.

The second benefit is that transactions are not limited in size by anyone. This means that if you want to send a million dollars anywhere in the world, there is no one to stop you from doing so.

The third benefit is that fees for sending money are consistently low in comparison to the fees charged by banks. This is not necessarily true with respect to e-transfers in some countries. For example, in Canada, it is free to send e-transfers from your personal bank account. However, the bank does impose limits on the amount of money you can send in a single day. Using cryptocurrency, the network will charge you a small amount regardless of whether you’re sending $10 or $10 million dollars.

The fourth benefit is that cryptocurrency networks never sleep. This means that you can send money anywhere in the world, at any point and time in the day, and the network will ensure that your transaction reaches its destination in a timely manner. No more waiting for Monday to make that wire transfer.

Keys

Cryptocurrency received its name because the way that money is sent and received is based on cryptography. What is more interesting, is what this sort of system has done to how we think about ownership. With cryptocurrencies, you own your cryptocurrency directly, rather than how it works with a bank. When you keep your money with a bank, they essentially keep your money on your behalf, and keep track of how much they owe you. They are then free to use a certain percentage of that money for other purposes, such as loaning it to other customers. This doesn’t feel like true ownership.

Most cryptocurrencies use a system that consists of two keys, the public key and the private key. The analogy that we’re going to use to help you understand how these keys work is just that, an analogy. The intention is to boil it down to the basics, so you know how to safely keep, store, and use your cryptocurrency.

Public Key

The public key, or public address is a lot like your public address where you live. Most people, and businesses are okay with posting their public address online, or giving it to a shipping company. People use their public address to get things shipped to them. This is a lot like how your public key works with respect to cryptocurrencies. You can give you your public key to anyone you like. Post it online, in forums, on Facebook, Twitter, or Instagram. Then people are free to send you money, and then money is then stored at that address. If you’d like to access the money at that address, you need something different, you need the private key that corresponds to the public key.

Private Key

The private key is how you access the money stored in a public address. You are only able to access or move the money stored at the public address if you can prove you’re the one that has the private key that corresponds to the public address. The analogy of the home address continues to work in this instance.

Your private key is like the metal keys you have on your keychain. You use those metal keys to get inside of your house, to access all of your belongings. Without that metal key, you would be unable to get inside. If you were to post a picture of your metal key, someone could take that key to a keymaker, and copy your key, and steal your things. This is exactly how your cryptocurrency private key works. You must not ever post your private key anywhere on the internet. If you do, any cryptocurrencies stored inside of your wallet will surely be stolen.

Furthermore, if you lose your private key, and have not made a copy of it anywhere, your funds are also lost forever.

How Do I Back Up My Wallet?

Cryptocurrencies are stored in a wallet, and luckily wallets can be backed up in a number of ways. The simplest of ways you can backup your wallet, is by writing down your “recovery phrase”. Your recovery phrase is a random selection of either 12 or 24 words, depending on the wallet that you use.

In the event that you lose your wallet, for example, you lose you phone, or your laptop breaks, you can use the recovery phrase to import your wallet onto a new device. Your recovery phrase acts a lot like your private key in this sense. If someone gets a hold of your recovery phrase, they are able to steal the money inside of your wallet. You should therefore keep backups of your wallet in a safe location, like with your lawyer, or in a fireproof safe.

Transferring to an Exchange

If you intend on trading with cryptocurrency you may do this from a certain wallet such as Exodus as it has a built in exchange. You will notice that the fees, and waiting time for exchanging assets within Exodus is slow though, so if you’re looking for a cheaper, and faster experience then you will have to make use of an exchange. There are a couple of things you must keep in mind when transferring your money from your wallet to an exchange.

First, exchanges are a lot like banks, wherein they don’t give you direct access to your money. Remember, if you don’t have your private key that corresponds to your public address, you don’t truly own that money.

Second, exchanges will give you a different address for each cryptocurrency. It is important that you don’t try to send Bitcoin to a Bitcoin Cash address, your money will be lost forever if you try this. Make sure you double check the address that you’re sending to. If you’re unsure about whether or not you have it right, send a little amount of money first, before sending the full amount.

If you take the proper precautions then sending cryptocurrency is one of the easiest (and cheapest) ways to transfer value.

Keys

Cryptocurrency received its name because the way that money is sent and received is based on cryptography. What is more interesting, is what this sort of system has done to how we think about ownership. With cryptocurrencies, you own your cryptocurrency directly, rather than how it works with a bank. When you keep your money with a bank, they essentially keep your money on your behalf, and keep track of how much they owe you. They are then free to use a certain percentage of that money for other purposes, such as loaning it to other customers. This doesn’t feel like true ownership.

Most cryptocurrencies use a system that consists of two keys, the public key and the private key. The analogy that we’re going to use to help you understand how these keys work is just that, an analogy. The intention is to boil it down to the basics, so you know how to safely keep, store, and use your cryptocurrency.

Public Key

The public key, or public address is a lot like your public address where you live. Most people, and businesses are okay with posting their public address online, or giving it to a shipping company. People use their public address to get things shipped to them. This is a lot like how your public key works with respect to cryptocurrencies. You can give you your public key to anyone you like. Post it online, in forums, on Facebook, Twitter, or Instagram. Then people are free to send you money, and then money is then stored at that address. If you’d like to access the money at that address, you need something different, you need the private key that corresponds to the public key.

Private Key

The private key is how you access the money stored in a public address. You are only able to access or move the money stored at the public address if you can prove you’re the one that has the private key that corresponds to the public address. The analogy of the home address continues to work in this instance.

Your private key is like the metal keys you have on your keychain. You use those metal keys to get inside of your house, to access all of your belongings. Without that metal key, you would be unable to get inside. If you were to post a picture of your metal key, someone could take that key to a keymaker, and copy your key, and steal your things. This is exactly how your cryptocurrency private key works. You must not ever post your private key anywhere on the internet. If you do, any cryptocurrencies stored inside of your wallet will surely be stolen.

Furthermore, if you lose your private key, and have not made a copy of it anywhere, your funds are also lost forever.

Frequently Asked Questions About Sending Cryptocurrency

If you lose your private key, you lose your money, it’s as simple as that. Make sure you back up your private key onto paper, or copy down your recovery phrase.

Unless you’re worried about someone figuring out that your identity is tied to a particular public address, you may post your public key anywhere on the internet. This way, anyone who discovers your address may send you money.

If you’ve mistyped your public key, and sent money to that address, then your money is lost forever unless someone owns the address you typed. Then it is up to them to send the money back to you if they choose to do so.

Most blockchains are completely transparent in how they deal with transactions. Bitcoin for example, are completely traceable, while a blockchain like Monero hides all of your transaction activity.

All hardware wallets come equipped with the ability to store, receive, and send cryptocurrency. Typically, you must plug your wallet into a computer in order to send the cryptocurrency from your wallet. This is a security feature.

Hackers can steal your money in a variety of ways. Hackers are often very creative in how they get you to send them money. One common way is to hijack your clipboard when you’re sending cryptocurrency so that the address you paste is theirs, instead of the one you were intending on sending to. That’s why it is important for you to double check the address every time you send a transaction.