- >Buying Crypto

- >Terra (LUNA) Overview

How to Buy Terra (LUNA) | Coin Overview and Buying Guide

Terra Pros & Cons

Pros

Can stake LUNA for around 6-7% interest a year

Fast transactions with low fees

Terra Station user interface is very slick and easy to use with mobile apps also available

Interoperable with other blockchains

Growing ecosystem with strong dApp development

Cons

Future regulation risks associated with cryptocurrencies

Sister coin UST collapsed in spectacular fashion in 2022

Still somewhat hard to find on crypto exchanges

Our Favorite Exchange for Buying Terra (LUNA)

- One-stop shop for crypto with built-in exchange, app, lending platform, debit card and more

- Native CRO token gives users a huge variety of perks and can be staked for over 10% APY

- Potential for earning high amount of interest when storing digital assets on Crypto.com

- A long-term goal of building cryptocurrency adoption on whole

Terra Ratings

Supply

- Total: 1,000,000,000 LUNA

Network Speed

- Rating: High

- Reason: Uses Cosmos Tendermint which allows for 10,000 transactions per second with a transaction time of around 2 seconds. It has been stated by the founder Do Kwon that the network currently handles up to a thousand transactions per second with an average block time of about 6 seconds.

Disbursement

- Rating: Low

- Reason: Around 41% of circulating supply is currently staked, with no stake pool holding more than 5% of the supply.

Developer Engagement

- Rating: Low

- Reason: Network is consistently being upgraded. Users vote on proposals based on voting power of stake. Many dApps both use and are powered by Terra. Github repositories are updated frequently. Terraform Labs constantly trying to innovate, and Terra is interoperable with a few blockchains already with more on the way.

Liquidity

- Rating: Low

- Reason: Top 100 crypto asset by market cap, available on the biggest exchanges.

History of Terra

Terraform Labs was started in January 2018 by Do Kwon and Daniel Shin. They received backing from firms such as Polychain Capital and Coinbase Venture and soon launched LUNA and the Terra Network with the goal of a decentralized payment system. Terra was built on the Tendermint SDK, which makes it compatible with Cosmos and the Inter-Blockchain Communication protocol (IBC).

Terra made it possible to create stablecoins pegged to a broad range of fiat currencies with 17 pegs currently available including South Korean Won, Euro and USD. For a period of time Terra was partnered with South Korean payments product Chai, which is used by 5% of the population.

Over the years Terra has innovated in a number of different ways including the including the creation of the Luna Foundation Guard, which has purchased billions of dollars worth of BTC to help secure its ecosystem. It’s also purchased over $100,000 million in Avalanche (AVAX) tokens.

The Luna Foundation Guard proved to woefully inadequate, however, as UST collapsed in early 2022 and nearly took Luna with it. The price of Luna went from nearly $80 to sub 1 cent. The collapse was so bad that a new 2.0 version of the coin was launched under the old LUNA name.

Despite the rebrand, LUNA, remains a shell of its former self and many crypto pundits view the entire ecosystem as a failed project.

Where You Can Buy Terra (LUNA)

You can buy Terra (LUNA) coins from most major exchanges including but not limited to:

If you are planning on holding your crypto and not trading, we recommend storing your Terra (LUNA), or any other digital asset, in a wallet which you control the keys to, such as MetaMask, or a Ledger hardware wallet if possible, rather than keeping them on the exchange which is potentially subject to a hack.

There’s also the native Terra Station wallet, which offers one of the best UIs for a crypto wallet and can even be secured with a hardware wallet such as Ledger.

You’ll need to open an account on most major exchanges to actually purchase LUNA with USD but if you already have Bitcoin there are some exchange where you can avoid going through a KYC process and simply swap your BTC (or other crypto) for LUNA.

Steps for Buying LUNA

Buying Terra LUNA or any other crypto is basically the same process on any of the major cryptocurrency exchanges. It usually includes the following steps.

- Open an account (you’ll have to provide an email address)

- Verify your identity with a selection of documents (Driver’s license, passport, etc.)

- Fund your account by using credit card, debit card, wire transfer, bank transfer (ACH, SEPA, etc.)

- Use your account balance to buy Terra LUNA.

- Optional: Withdraw your LUNA to a personal wallet like Terra Station.

The entire process is relatively easy and should only take a matter of minutes of work to set up your account although (depending on your payment method) it can take a few days to get your account funded.

Advantages of Terra

There are quite a few advantages to Terra, both the ecosystem and the asset (LUNA). Being a proof of stake protocol is one of the biggest advantages, as users can stake their LUNA for a yearly return of about 6%, much higher than most traditional financial systems. Transactions are extremely fast with blocks being confirmed in about 6 seconds and with very low fees (we haven’t paid more than 5 cents USD yet).

Overall, the Terra ecosystem has many features. Terra Station, the official application from Terraform Labs, has an extremely user-friendly interface that is easy to navigate and features staking, swapping, voting, and interactions with contracts. Coupled with the fast transactions and low fees, it is quite an enjoyable piece of software to use. You can even get it for Android and iOS.

Disadvantages of Terra

Terra is an example of the risks that are still involved with crypto.

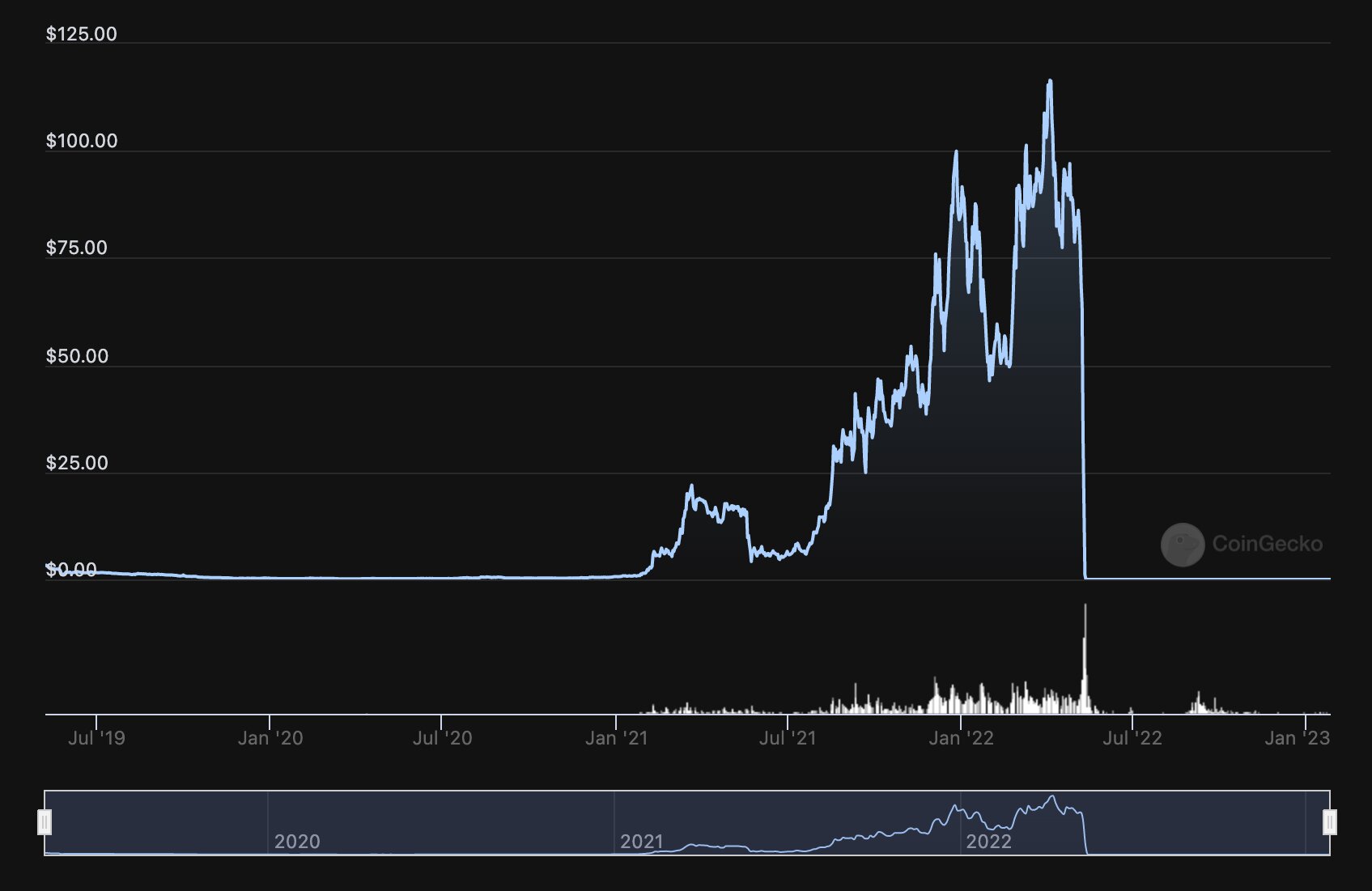

Many crypto experts criticized LUNA for its reliance on the UST stablecoin. The major criticism was that if a Black Swan event occured where everyone tried to sell their UST at once then it would destroy the value of LUNA as well. That’s exactly what happened in the spring of 2022 when UST lost its peg and immediately created a panic that saw LUNA go from being valued $82 a unit to $.0001 in little over a week.

The Terra collapse serves as a reminder that crypto is very risky and you should invest what you’re willing to lose. It remains one of the most startling collapses in crypto and arguably one of the most devastating charts in history

Credit: CoinGecko

Terra Luna Frequently Asked Questions

You can store Terra (LUNA) using a hardware wallet, their Google Chrome extension, their desktop application for Mac, Windows, and Linux, or their mobile application for Android and iOS.

Terraswap is the Terra version of Uniswap. It is an automated market maker (AMM) just like Uniswap, PancakeSwap and SushiSwap, where users can exchange one Terra ecosystem asset for another in a decentralized manner.

Yes. You can store your Terra (LUNA) safely on your Ledger hardware wallet, whether the Ledger Nano S, or Ledger Nano X. Simply install the Terra application to your Ledger wallet using the Manager feature in Ledger Live and you can then send your LUNA to your Ledger. You can also use your ledger to secure the Terra Station Wallet.

Redelegating Terra (LUNA) is quite easy, especially if using the Terra Station application. Simply go to the “Staking” tab, select the validator that your want to redelegate to, click “Redelegate”, select which source your delegation is coming from (can come from any other delegations you have), and then complete/sign the transaction changing your delegation.

It is possible to lose money when staking Terra (LUNA), but only if the validator you have chosen does some sort of bad action, in which case they can have their funds slashed and/or jailed. This is very unlikely. This affects delegators’ returns and can cause you to lose money as your delegation can be slashed meaning you lose tokens. This can be fairly easily avoided by ensuring your delegate to a trustworthy validator. The major slashing conditions are:

- double signing: a validator signed two different blocks with the same chain ID at the same height

- downtime: a validator was non-responsive / couldn’t be reached for more than an amount of time

- too many missed oracle votes: a validator failed to report a threshold amount of votes that lie within the weighted median in the exchange rate oracle

Yes. Astroport, Terra Swap and Mars Protocol are some of the most popular AMMs and DEXs in the ecosystem. Furthermore Terra is IBC compatible so you can use Cosmos-based DEXes like Osmosis and Junoswap.

Yes. Terra is Inter-Blockchain Communication (IBC) compatible so it’s very easy to swap with all coins that are IBC-enabled.