- >Best Crypto Exchanges

- >Comparing Kraken and Binance: Which Platform Reigns Supreme?

In-Depth Analysis: Kraken vs Binance – Uncovering the Best Exchange

- Exceptionally secure exchange with proof of reserves

- Supports many different funding options

- Accepts users from across the globe including USA and Canada

- Very high trading volume

Kraken vs Binance: Comparing the Best Features

Kraken Quick Overview

This seemingly bulletproof exchange has maintained a positive reputation among traders since its founding in San Francisco in 2011.

The exchange operates in all US states except New York, Maine, and Washington and in 170 countries worldwide. It has a weaker portfolio of crypto pairings than Binance, with 240+ to choose from.

Want to know more? Read our full Kraken review for more information.

Kraken Pros & Cons

Pros

Well-tested security, incl. fully-disconnected (“air-gapped”) cold storage.

Deep liquidity.

Low fees.

Cons

Recent decline in trading volume and US support.

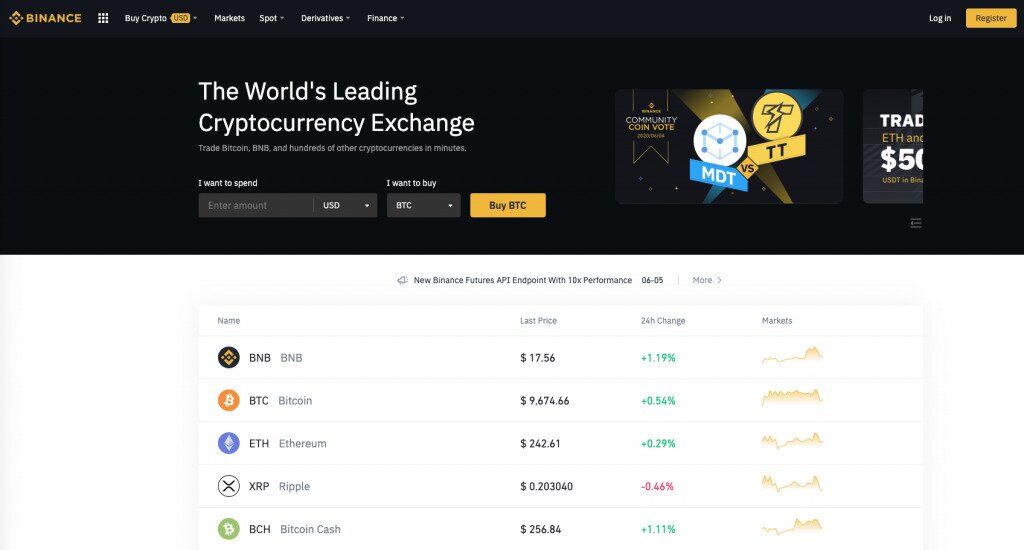

Binance Quick Overview

Binance Exchange continues to be one of the top cryptocurrency exchanges in the world. They offer users the most cryptocurrency trading pairs, from top-quality, trusted exchanges, and they have the highest trading volume of any crypto exchange.

This exchange quickly found a massive user base, thanks to its low fees and innovative products. These days, Binance offers almost every crypto product you could think of. Their product offering includes an exchange, staking, derivatives, loans, payments, credit cards, NFTs and more.

They offer mobile and desktop applications, in addition to the online website. If you’re interested in the desktop application, it’s available for MacOS and Windows, while the mobile app is available for iOS and Android.

If you’re keen to know more about them, check out our comprehensive Binance review.

Binance Pros & Cons

Pros

Discount on trading fees with BNB token.

Provide top security for your crypto assets by storing them.

Extensive range of coins.

Cons

The verification process is quite complex

US portal is limited in functionality.

Which Platform has the Best Trading Features?

Binance supports staking and OTC trading in the US and margin, options, and futures trading in other locations. Kraken provides OTC trading, staking, spot trading, and limited margin trading. Just note, futures trading is only available outside the US.

Kraken and Binance are highly liquid exchanges. With such a high volume of daily trading, Binance is arguably the most liquid platform in cryptocurrency.

Let's Unpack Beginner Friendliness

Kraken and Binance are leading cryptocurrency exchanges, and they are wise enough to know to cater to both beginners and experts. Each company has designated platforms, designed to match the needs of different user levels.

Kraken is celebrated for its simplicity and educational tools, making it particularly beginner-friendly, while Binance offers a broader ecosystem. For some, their platform can feel complex to navigate. But all in all, both exchanges have options for beginners and advanced options for seasoned traders.

Kraken

For Beginners:

- Standard Kraken Platform:

- This platform is intuitive, and very user-friendly.

- Features include simple buy/sell options for a seamless trading experience.

- Newbies can benefit from their educational resources, such as guides and FAQs.

For the Seasoned Experts:

- Kraken Pro:

- This platform provides advanced trading tools, like customizable charts, detailed order types and more.

- You’ll get lower trading fees for higher-volume trades.

- Experienced users can enjoy margin trading and staking.

Binance

For Beginners:

Binance Lite (Note: This platform is only available in Select Regions)

-

- This platform is more simplified and only focuses on essential buy/sell functions.

- Newbies can enjoy reduced complexity for cryptocurrency trading.

- You’ll have limited, advanced features to avoid overwhelming newcomers.

For the Seasoned Experts:

- Binance Pro (Standard Platform):

- Enjoy advanced tools, such as futures trading, margin trading, and staking.

- You’ll have access to over 350 cryptocurrencies and diverse trading pairs.

- You’ll get access to high-liquidity markets and detailed charts for more complex trading strategies.

- The platform also offers a wide array of additional features, like decentralized finance (DeFi) products and launchpads.

Trust & Security

Both Kraken and Binance have made significant strides in earning user trust through robust security measures and regulatory compliance.

Kraken stands out with an impeccable track record, maintaining a spotless reputation by avoiding any major hacks for over a decade. While it has faced occasional Distributed Denial of Service (DDoS) attacks, such incidents are common risks for any online platform and are managed effectively. Kraken further strengthens user trust by holding a US bank license regulated by the Wyoming Division of Banking and adhering to the UK’s Financial Conduct Authority standards.

Binance has also prioritized security, achieving “regulatory maturity” in 2024 when it officially established its headquarters in George Town, Malta, after previously operating in regions like China and Japan. This move reflected its commitment to transparency and adherence to global regulations. The platform continually invests in advanced security features and has reassured users by addressing concerns about operational clarity.

In short, both exchanges showcase their dedication to protecting users and building confidence in the crypto trading ecosystem.

Fees

Kraken and Binance use the maker/taker model. This fee structure grants lower fees to those who provide liquidity (makers) and higher fees to those who take it away (takers). Maker fees at Kraken range from 0.25% for a 30-day volume of US$0-10,000 to 0.00% for a volume of US$10m+. Taker fees start at 0.40%, climbing to 0.10% over the same price structure.

Binance grades its users by VIP level and how much BNB they have. A balance of 0BNB (or less than $US1m) grants maker/taker fees of 0.1%/0.1%. The minimum is 0.0110%/0.0230% at 5,500BNB or more than US$4bn. A discount is available when operating exclusively in BNB, potentially bringing fees down to 0.0083%/0.0173%.

Kraken vs Binance, Binance is better for low-volume users, while Kraken has more to offer for those willing to provide the extra liquidity.

Sign-up Process

Binance users can sign up via desktop or the app. You’ll need to complete KYC checks. Binance.us requires a social security number. Functionality varies by degree of verification. For instance, to get higher withdrawal limits and OTC trading, you’ll need an official ID, such as a passport, and complete facial verification via Binance’s system.

Getting started on Kraken begins in the traditional way, i.e., with a username, password, and confirmation email. Verify your identity with your mailing address, job, social security number, and at least one document from a passport, driver’s license, or ID card.

Available Cryptocurrencies

Among the 240+ cryptocurrencies available on Kraken, for exchange and trading purposes, are Bitcoin, Bitcoin Cash, Cardano, Dash, Ethereum, Litecoin, Tether, Polkadot, and Ripple. Binance casts a much larger net than Kraken, which is to the benefit of the user. It supports the same big, “celebrity” coins as Kraken and 500+ others.

Of course, plenty of meme and gaming tokens occupy Kraken and Binance lists, including Dogecoin, Decentraland, Axie Infinity, and various football/soccer-related coins. We’ve found that Kraken and Binance are vigilant to industry changes and remove problematic cryptocurrencies from their exchanges.

Standout Features

One of Binance‘s major drawbacks vs. Kraken was a lack of support for fiat currencies, but that’s all in the past. It’s now possible to buy hundreds of cryptocurrencies (USD, CAD, GBP, etc.) with a traditional bank card. So, if you want to buy the Jupiter coin with Zambian Kwacha, that’s easy to do. Binance’s versatility when it comes to trading pairs is unmatched.

Kraken offers its users a fortress against intrusion. It has an extensive guide to securing every part of digital life in its help section. With friendly fees, Kraken is a potential ally for high-volume traders.

The Wrap Up: Which Exchange Is Best For You

We’ll be honest here, this is a tough one. Bot Kraken and Binance offer distinct strengths, making them suitable for different types of cryptocurrency traders.

Kraken’s emphasis on security, regulatory compliance, and a carefully curated selection of coins makes it ideal for those prioritizing trust and a streamlined experience. On the other hand, Binance’s expansive ecosystem, vast selection of altcoins, and advanced trading options cater to users seeking variety and innovation.

Choosing between them ultimately depends on whether you value Kraken’s reliability and simplicity or Binance’s diversity and cutting-edge features.

Yes. Binance has its own US portal at Binance.us.

Yes. The KYC or Know Your Customer check is required for Binance and Kraken. Exceptions may be made for corporate clients.

Arguably, Binance, due to its huge range of supported currencies. Kraken may be better suited to higher-volume traders.

Fees range from 0.00% — 0.40% at Kraken to 0.1% at Binance. Discounts may apply at Binance.