- >News

- >Report: Russia, Ukraine, Venezuela Lead World in Cryptocurrency Adoption

Report: Russia, Ukraine, Venezuela Lead World in Cryptocurrency Adoption

Russia, Ukraine and Venezuela are the top three countries for cryptocurrency adoption, according to a new report published by Chainalysis. The 2020 Global Adoption Index found that these countries have the highest level of cryptocurrency use relative to their internet user numbers and average incomes.

While interesting in its own right, Chainalysis’ report is important because of what it reveals about cryptocurrency adoption more generally. Russia, Ukraine and Venezuela all figure highly when it comes to a lack of public trust in governmental and financial institutions. They also have weak national fiat currencies, which have declined in value over recent years relative to the US dollar.

This indicates that we should expect bitcoin and wider cryptocurrency adoption to increase worldwide the more the global population loses faith in banks and governments, and the more fiat currencies decline in value. Given that such trends have been accelerating in 2020, it’s very likely that wider global crypto adoption will accelerate this year.

Cryptocurrency Adoption Leaderboard

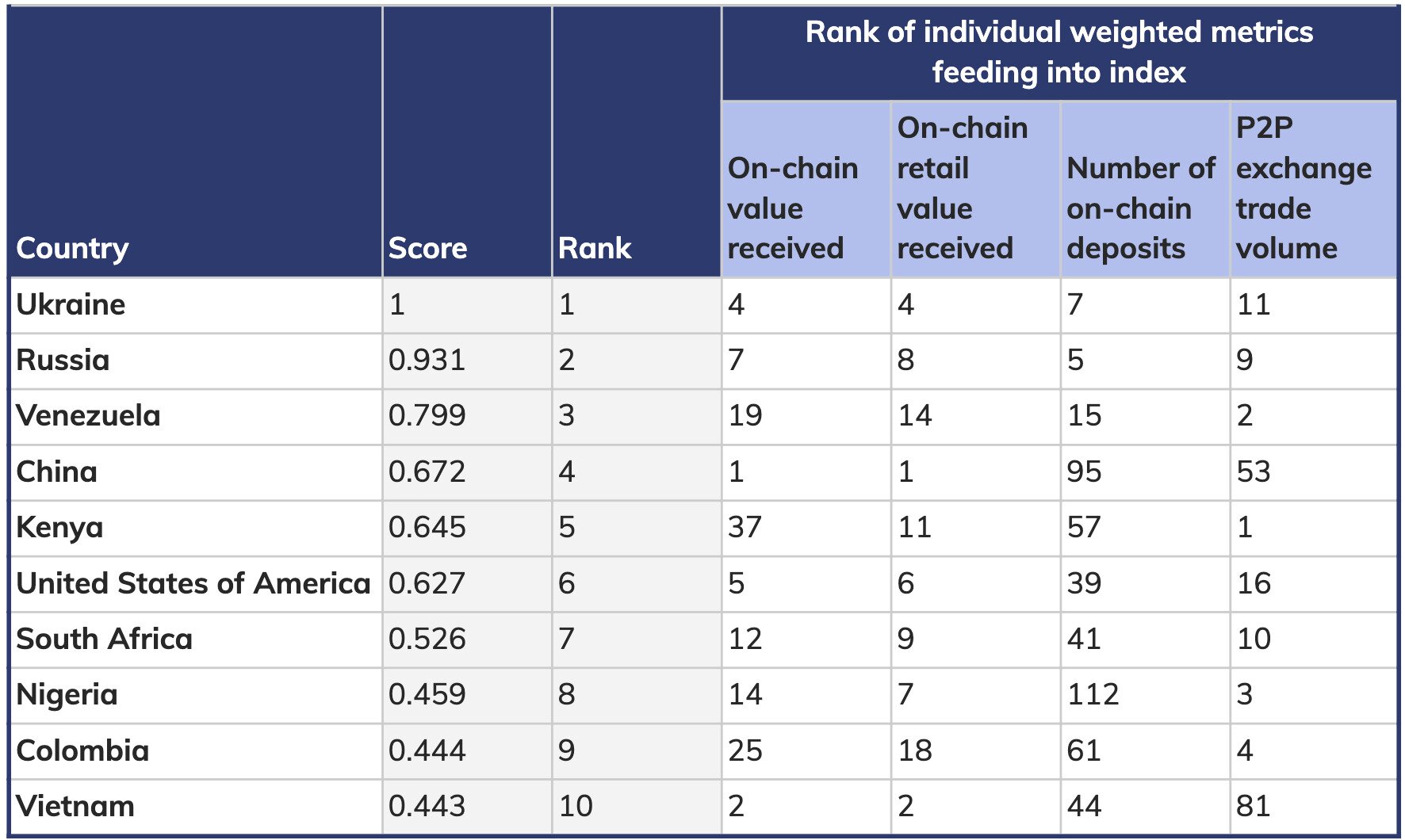

Chainalysis’ Global Adoption Index ranked the world’s 154 countries according to four criteria of adoption:

-

On-chain cryptocurrency value received, weighted by purchasing power parity (PPP) per capita. This metric takes the total amount of crypto sent to a country, and effectively divides it by the wealth of the average person in that country. So countries with lower average wealth per person will rank more highly, since more of the population’s wealth is being used to buy crypto.

-

On-chain retail value transferred, weighted by PPP per capita. This is almost the same as the above metric, although it counts the value of crypto sent as well as received by people.

-

Number of on-chain cryptocurrency deposits, weighted by number of internet users. Basically, if a country has more crypto deposits and fewer internet users, it will rank more highly.

-

Peer-to-peer (P2P) exchange trade volume, weighted by PPP per capita and number of internet users. Here, Chainalysis takes volume data from LocalBitcoins and Paxful, and weights it according to average wealth and the number of people with internet access.

Assessing the world’s nations according to the above criteria, Chainalysis produced the following top ten:

Source: Chainalysis

The fact that China and the United States appear in this table is hardly a shock, given that so much of the Bitcoin and crypto industry is based in and around these two countries.

The rest of the top ten may come as a surprise to most people with an interest in crypto, given that the other eight spots are occupied by relatively ‘minor’ nations (with the exception of Russia).

However, it makes perfect sense when taking a closer look at the countries concerned, and how their economic and political circumstances makes it likelier that their populations would turn to crypto.

What Makes Russia, Ukraine and Venezuela So Special

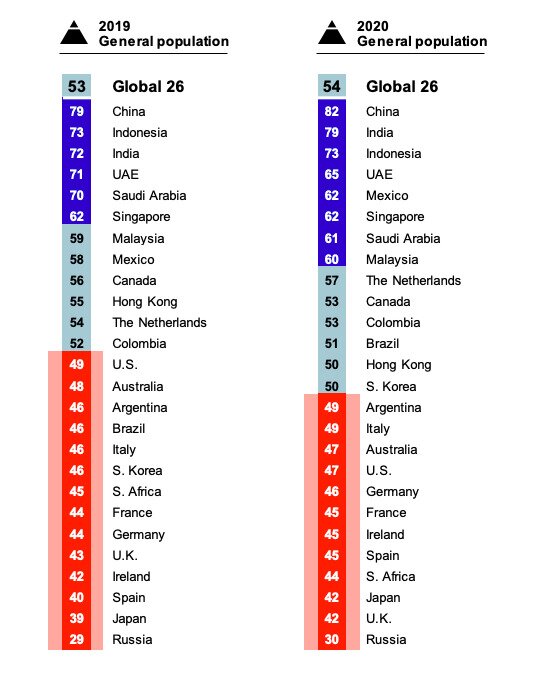

As Chainalysis notes in a follow-up blog, public trust likely plays a big role in driving Russians and Ukranians towards crypto (and the same goes for Venezuela). Russia scores last for trust in government, business, the media and NGOs, according to Edelman’s 2020 Global Trust Barometer report, and has done for several years.

Source: Edelman

Trust specifically in banks is particularly low in Russia, with a research article published this February finding that “the level of trust in the banking system is lower than in most countries of the world, and it has been falling in recent years due to the financial crisis and a number of other factors.”

Likewise, corruption is rife in Russia, Ukraine and Venezuela, while the citizens of these nations have a relatively high fear of having their assets seized by authorities (something which happened in Russia in 2014, when the government seized $8 billion in pension contributions).

Then you add the fact that the national currencies of these three nations aren’t in the best possible shape (something which can also be said for the currencies of Kenya, South Africa, Nigeria, Colombia and Vietnam).

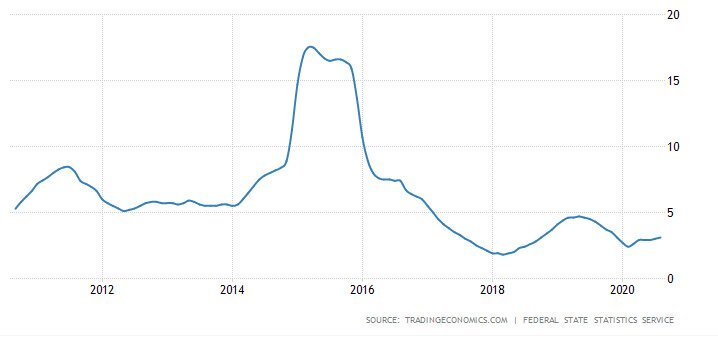

Looking at Russia’s consumer inflation rate over the past ten years, you see that it has been above 5% for most of the decade, and even hit a high of 17.5% in 2015.

Source: TradingEconomics

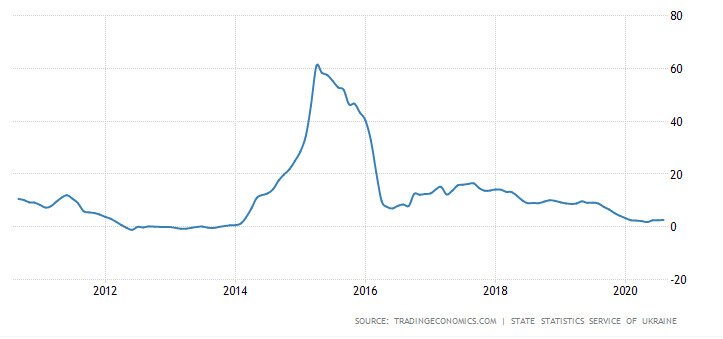

Much the same goes for Ukraine, which even witnessed an inflation rate of roughly 60% in 2015.

Source: TradingEconomics

Venezuela’s recent problems with hyperinflation are also well-documented, as is the fact that Venezuelan’s have flocked to cryptocurrencies as a result.

With low public trust and high inflation both serious problems in Russia, Ukraine and Venezuela, the residents of these nations have understandably adopted cryptocurrency in greater numbers. Cryptocurrencies such as Bitcoin are famously censorship resistant, aren’t controlled by a central/governmental body, and are limited in supply.

In other words, they’re almost perfect if you happen to have a strong distrust of government and banks, and don’t want inflation to erode your wealth.

Around the World

Chainalysis’ report may be interesting if you happen to live in Russia, Ukraine or Venezuela. It’s also interesting if you live elsewhere, since it illuminates the path the world may have to take if cryptocurrency adoption is to become more widespread.

Much of the world may already be on this path. The United States has expanded its broad money supply by trillions of dollars in the wake of the coronavirus pandemic, while the Federal Reserve has recently committed to relaxing its approach to inflation. And with America’s CPI measure of inflation rising from 0.1% in May to 1.3% in August, it seems that higher inflation is already fast approaching.

At the same time, trust would appear to be declining even further in many developed nations. Americans increasingly distrust their government, while the coronavirus pandemic has damaged trust in countries such as the United Kingdom and France.

Such trends are likely to continue for the foreseeable future. And if Chainalysis’ report is to be believed, if they get particularly worse, then we should expect to witness a significant increase in cryptocurrency adoption worldwide.