- >News

- >‘Buy Crypto’ Searches Are At Their Highest Since 2017 Bull Market

‘Buy Crypto’ Searches Are At Their Highest Since 2017 Bull Market

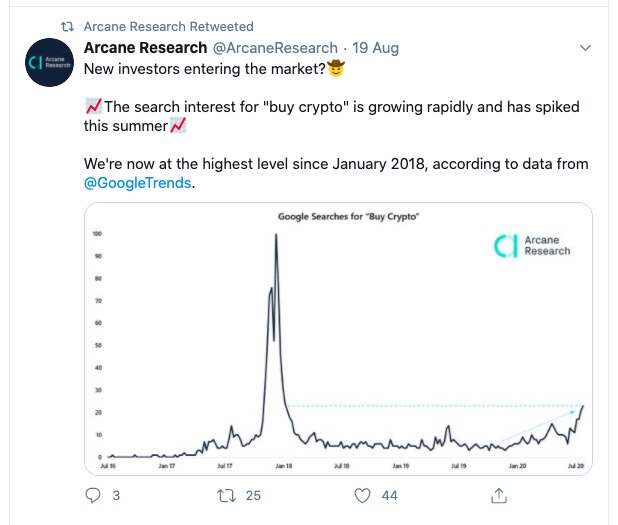

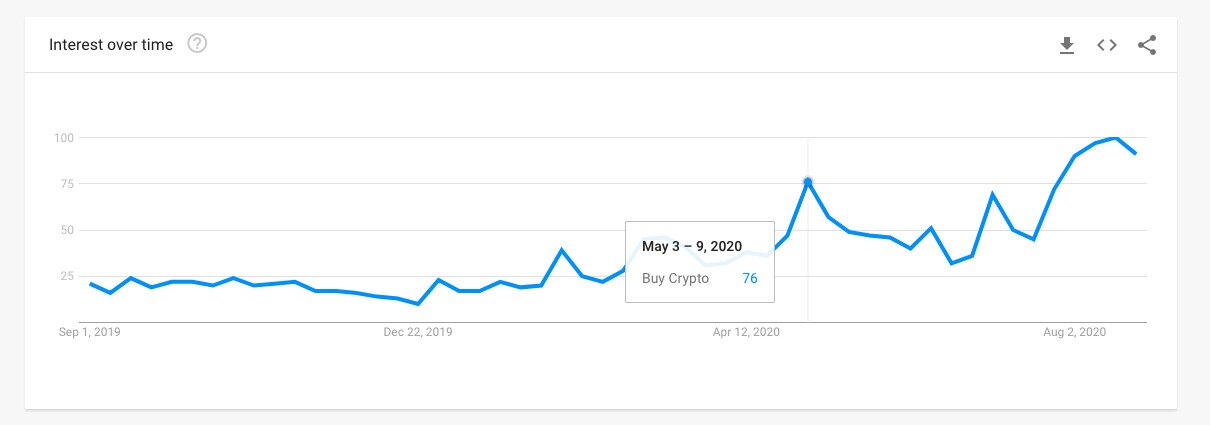

Web searches for “buy crypto” have hit their highest level since January 2018, indicating a growing appetite for cryptocurrency among the general public. Searches for the term hit their highest ever level in December 2017, at the height of the 2017/18 bull market. They trailed off from January 2018, but their resurgence in late July and August this year indicates a steady increase in demand for crypto.

Compared to the FOMO and hype that powered the late-2017 bull market, the gradual increase of interest seems more organic and less media-driven. This is largely because of three factors that have been driving recent demand: 1) the growth in saving that has occurred as a result of the coronavirus pandemic; 2) the perceived weakness of the US dollar; and 3) word-of-mouth, which is spreading the benefits of crypto the more the public buy into it.

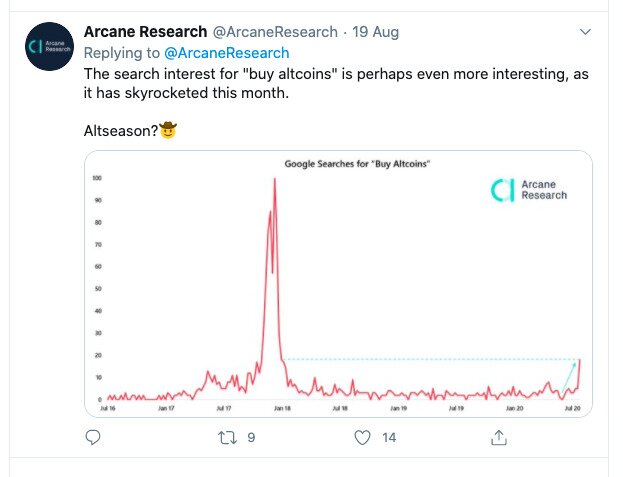

More interestingly, a similar spike hasn’t been observed for “buy bitcoin,” while searches for “buy altcoins” have also hit their highest levels since early 2018. This could indicate that wider interest in crypto is spreading to other coins, and that Bitcoin’s dominance may be weakening.

It’s Time to ‘Buy Crypto’

Google is where ‘ordinary’ people go for information, and the same applies in the case of crypto. Diehard and experienced cryptocurrency traders will likely already know where to buy crypto, so an increase in searches for “buy crypto” indicates an increase in interest among the lay public.

Source: Twitter

To put this in some perspective, Google Trends data indicates that searches for “buy crypto” hit a relative level of 29 in the week between August 16 and 22. 100 indicates the peak in searches for any given term, which in the case of “buy crypto” came between December 31, 2017 and January 6, 2018.

A level higher than 29 was last reached between January 21 and 27, 2018, when it hit 30. Since then, its previous peaks were 18 in June 2019 and 20 in May of this year, around the time of the Bitcoin halving.

Searches for “buy crypto” began steadily increasing again from around the beginning of July, going from 9 to 15 to 21 to 23 to 29.

Price Rises, Savings, US Dollar, Interest Rates, Word Of Mouth

There’s no obvious trigger for this gradual increase, other than the fact that bitcoin (and crypto more generally) rose in price from roughly July 21. From this date, the bitcoin price rose from about $9,300 to a peak of $12,300 on August 18, precisely when searches for “buy crypto” hit their highest level since January 2018.

Price is the short-term cause of the spike in searches. But there are likely underlying factors which made it more probable that ‘normal’ people responded to price rises by showing an interest in buying crypto. This view is supported by bitcoin’s rise beyond $12,000 in July 2019 (Ethereum and other alts also rose around this time), which wasn’t met with the same level of search activity.

So why was a price rise met with more public interest this time? There are various reasons for this, but the most obvious one is that people have more cash to spare at the moment.

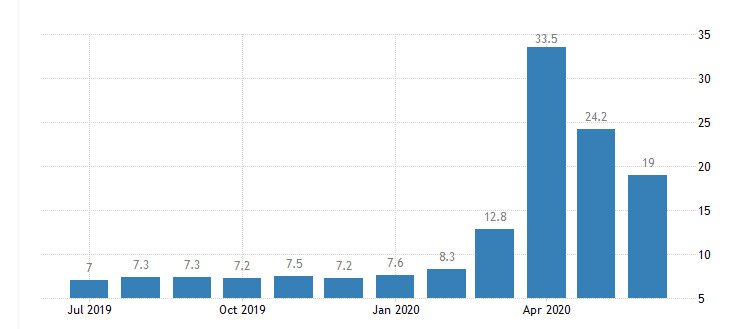

Because of the coronavirus pandemic and the lockdowns, shutdowns and social distancing that have followed it, people are going out less and spending less. Saving has therefore increased, as indicated by the household saving rate for the United States. This rose to a high of 33.5% in April and has remained above average levels ever since.

Source: Trading Economics/US Bureau of Labor Analysis

Basically, a rate of 33.5% means that households saved 33.5% of their disposable income in the corresponding month. With rates remaining high after April, this also means that savings are accumulating on a month-by-month basis. Americans, and people in other nations, have more cash to spare.

They need an outlet for this cash, and it seems that many are turning to crypto. This is made even likelier by the second underlying factor in the rise of “buy crypto” searches: the relative weakness of the US dollar, as well as record low interest rates offered with traditional savings accounts.

In other words, keeping your excess cash in a bank account isn’t particularly advisable, especially when inflation is moving higher than interest rates. The economic situation is effectively forcing people with savings to invest, and crypto is becoming an increasingly attractive investment prospect for people (and institutional investors).

Thirdly, crypto is becoming more attractive because more people are talking about it with each other. Ownership of crypto among consumers has increased over the past year in the US and the UK, for example, which means that there’s a bigger mass of existing users to communicate the benefits of crypto trading. And as studies have shown, word-of-mouth is the most effective form of advertising.

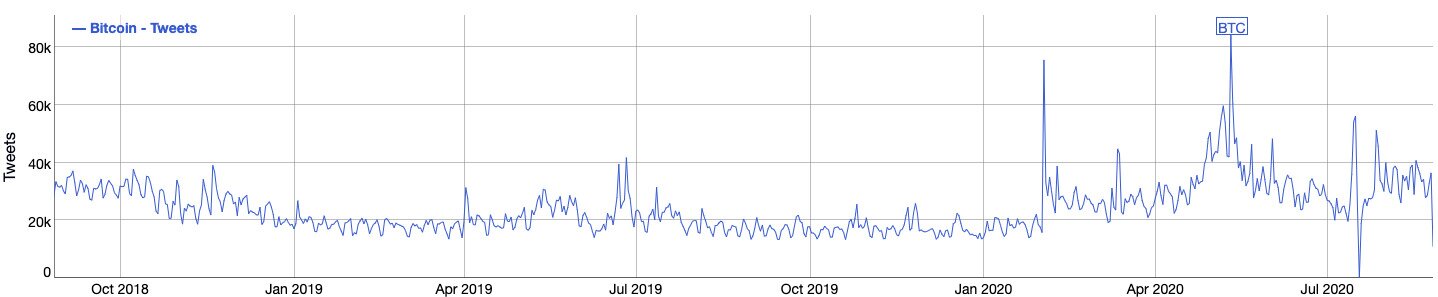

This is backed up by data showing a recent steady increase in tweets about Bitcoin, for example. Twitter mentions of Bitcoin have been relatively low since the beginning of 2019, when they began hovering under 20,000 per day. They’ve consistently topped 30,000 per day since the end of April, indicating a higher level of interest and more communication.

Source: BitInfoCharts

Bitcoin And Bull Markets

In highlighting the Google Trends data, Arcane Research noted that a similar increase isn’t evident for “buy bitcoin”. On the other hand, “buy altcoins” has witnessed an increase in activity.

Source: Twitter

This could indeed mean that “buy crypto” indicates a rising interest only for altcoins, and not for Bitcoin. This is wrong: if you look at the “buy crypto” chart, you’ll notice that it saw a spike to 20 around May 11, the date of the Bitcoin halving.

“Buy crypto” searches for the past 12 months. Source: Google Trends

The “crypto” in “buy crypto” also means “bitcoin”. As such, recent rises in “buy crypto” searches indicate a rising public interest in crypto in general. They may also mean the approach of a new bull market, particularly when other factors such as rising wallet downloads are taken into account.