- >News

- >What Are the Best Crypto Coins for Staking?

What Are the Best Crypto Coins for Staking?

Staking is now a multi-billion dollar business, and in more ways than one. Not only has the combined market capitalization of all proof-of-stake cryptocurrencies reached $270 billion in recent weeks (accounting for 24% of the entire market), but the total value of all tokens actually staked has topped $100 billion. These are massive sums we’re talking about here, and they’re also rounded out by the billions of dollars being held on dedicated staking platforms, indicating the growing appetite among investors for staking.

But what is staking? For the uninitiated, this might not be obvious, even if the answer is relatively straightforward. This article will dispel any confusion by not only providing an introduction to the concept of staking, but also running through the best coins for staking. This means taking a look at cryptocurrencies that use a proof-of-stake consensus mechanism, and that can therefore be staked in order to secure its network and also earn a passive income.

What is Staking?

To understand staking, it’s best to start by contrasting proof-of-stake with proof-of-work consensus. In the case of Bitcoin, its transactions are validated using proof-of-work, which involves computing the correct hash (basically a code) for the next block in its chain.

However, with proof-of-stake, transactions are authenticated by validators staking cryptocurrency on the next correct block. The idea behind this is that, because validators will lose their stake if they vote for an invalid block, the network is incentivized to continue validating the correct blocks with the correct transactions.

As a concept, staking first emerged in 2012, when Sunny King and Scott Nadal (both apparently pseudonyms) published a research paper outlining Peercoin (PPC), a cryptocurrency that would be secured via proof-of-stake. Basically, they claimed that using staking would improve on proof-of-work by eliminating “dependency on energy consumption, thereby achieving lower inflation/lower transaction fees at comparable network security levels.”

While relatively brief, this research paper — and Peercoin itself — formed the basis of the proof-of-stake coins that followed, including such early (but now forgotten) examples as NXT and Blackcoin. Then came a wave of proof-of-stake cryptocurrencies that have proved a little more enduring, including Cardano, Algorand, Cosmos, Tezos and Neo.

As PoS blockchains, these platforms enable all holders to stake their cryptocurrencies and earn a reward/yield for doing so. Rewards tend to be paid out via the minting of new coins, which can mean inflation over time, but if a platform experiences adoption and sustained growth, such inflationary effects can be counteracted.

While proof-of-stake remained fairly marginal for several years following its conception, more recent years have seen a massive growth in PoS coins. Not only did the market witness another wave of successful PoS blockchains (e.g. BNB, Avalanche and Solana), but in September 2022 Ethereum — the second-biggest crypto by market — transitioned from proof-of-work to PoS.

This shift has arguably made proof-of-stake the ‘default’ option for any new cryptocurrency, while also making proof-of-work something of a controversial mechanism, given its energy consumption levels.

The Best Coins for Staking

There are now a wide variety of proof-of-stake cryptocurrencies in the market, with some more valuable and useful than others. The following is a rundown of the best coins for staking, evaluating PoS cryptocurrencies in terms of their market cap, price histories, utility, and also in terms of the yields they tend to offer to holders who stake them.

Before we delve into each individual coin here’s a quick cheat sheet on the approximate rates (APY) that are currently offered by the by each cryptocurrency (this is a rough estimation based on Staking Rewards data):

Ethereum (ETH)

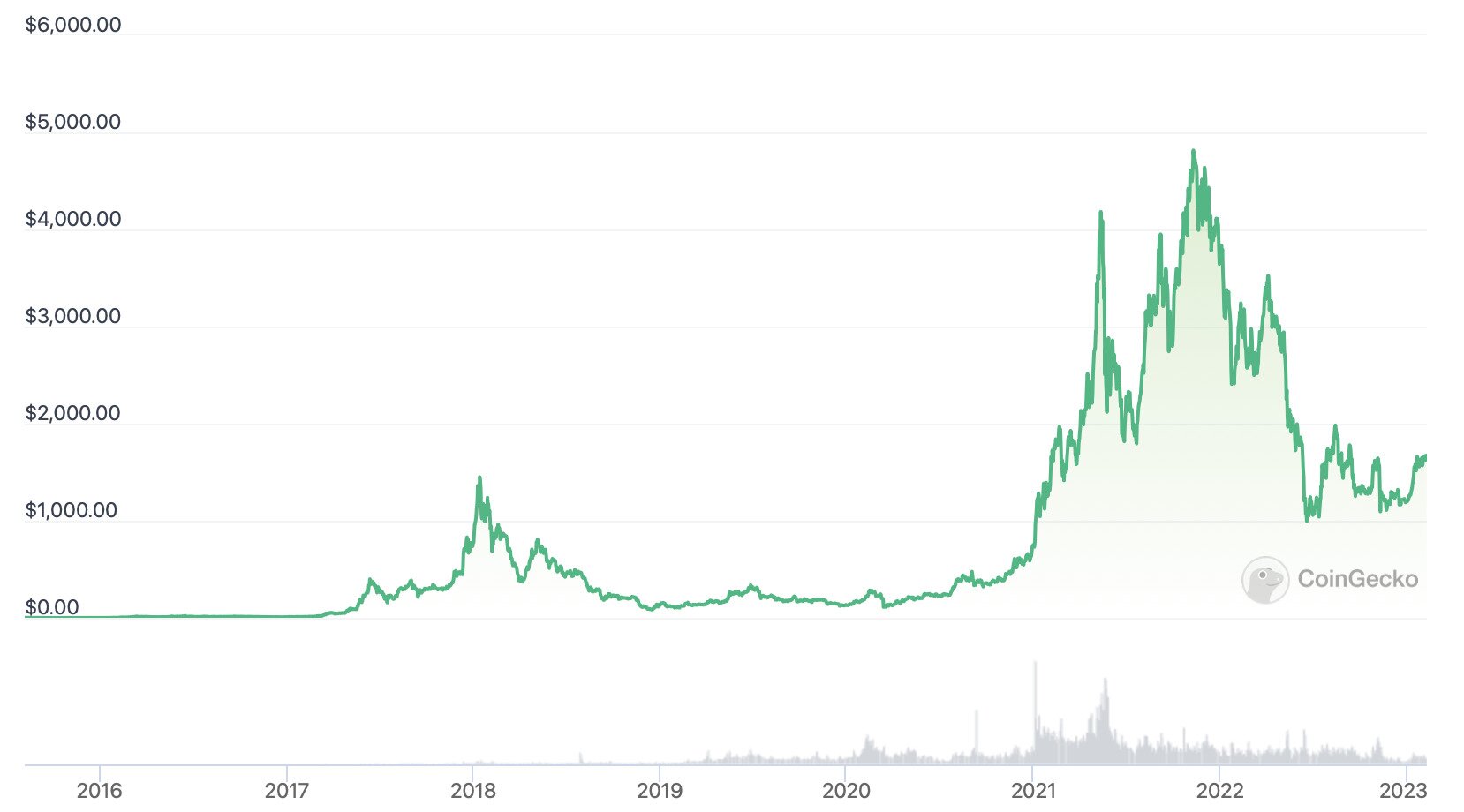

First launched in 2015 and moving to PoS in 2022, Ethereum (ETH) is the biggest staking coin in terms of market cap. As of writing, it’s worth $197.8 billion and has appreciated by 380,501.8% compared to its recorded all-time low of $0.432979 (set in 2015).

Ethereum’s price history since launching in 2015. Source: CoinGecko

It’s likely that Ethereum will remain the most valuable PoS coin for some time to come. This is largely because its native platform is the most widely used layer-one smart contract blockchain in the crypto ecosystem, with a total value locked in of $29.17 billion (this means that apps running on its blockchain store cryptocurrency worth this amount).

In terms of staking, Staking Rewards currently puts the average yield for staking ETH at 3.84% per year, while Staked.us puts ‘nominal yield’ (so not accounting for inflation) at 5.6%.

As for inflation, this is currently 0.5% per year. However, an upgrade — EIP 1559 — implemented in 2022 means that Ethereum burns a portion of its transaction fees. So some of its supporters argue that it can be deflationary during periods of peak activity.

BNB Chain (BNB)

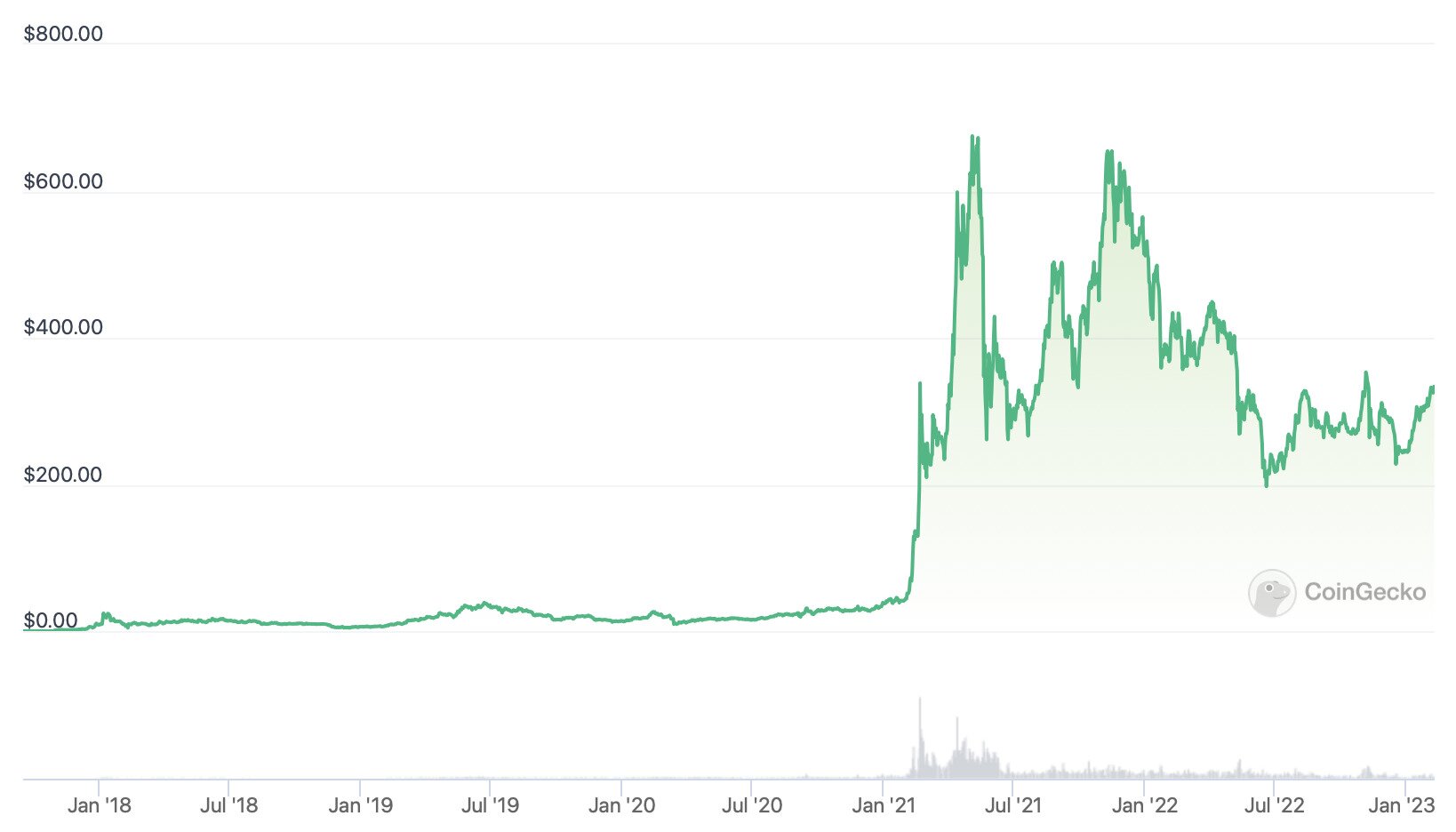

Formerly known as Binance Smart Chain, BNB Chain is a proof-of-stake smart contract platform launched by crypto-exchange Binance in 2020 (native token BNB ran on Ethereum from 2017-2020).

It’s the second biggest PoS coin in terms of market cap, with a valuation of $51.4 billion. It has also gained by a whopping 817,749.6% compared to its record low of $0.03981770, from 2017.

BNB’s price history since launching in 2017. Source: CoinGecko

BNB Chain also happens to be the second-biggest network in terms of total value locked in ($5 billion), with the platform generally offering lower transaction fees than Ethereum, something which has enabled it to attract adoption and usage.

Yields for staking BNB currently stands at 2.5% per year. However, Binance has committed to burning a total of 100 million BNB, which is half of its total maximum supply. This means that adjusted yields are likely to be higher when accounting for this deflation, with Staking Rewards putting such yields at 7.7%.

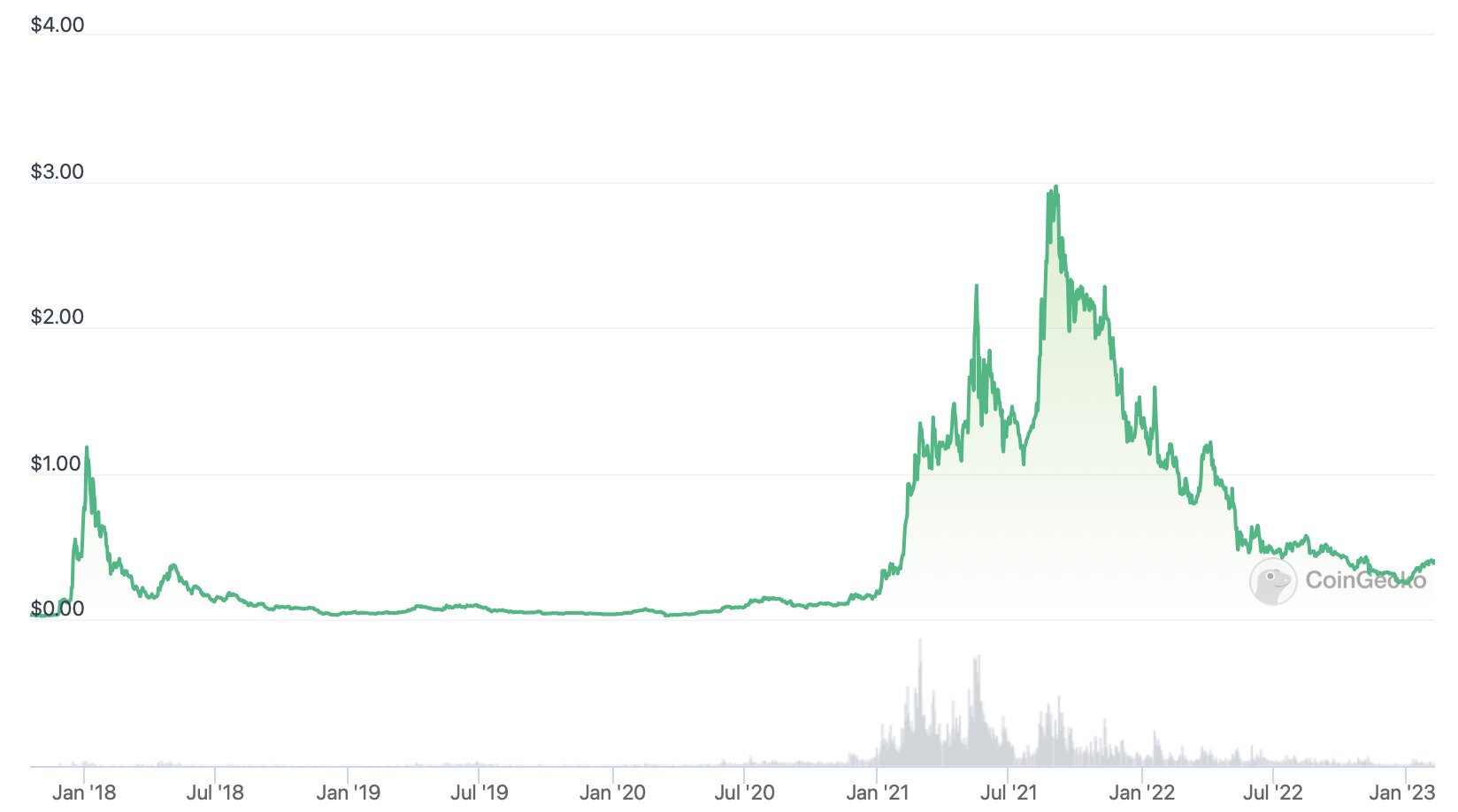

Cardano (ADA)

Founded by Ethereum co-founder Charles Hoskinson, Cardano launched its mainnet in 2017. Its native token, ADA, is the third-biggest staking coin by market cap, with a total value of $13.7 billion. ADA has gained by 1,939% compared to an all-time low of $0.01925275, recorded in March 2020.

ADA’s price history since launching in 2017. Source: CoinGecko

While Cardano has spent years in development without gaining much in the way of actual use or adoption, this has begun to change in recent months. In particular, the launch of the Cardano-based stablecoin Djed has seen its total value locked in more than double since January.

Currently, Staked.us has its nominal staking yield at 3.8% and its real yield (accounting for inflation) at 1.7%, while Staking Rewards has it at 3.3% and only 0.o5%. Its inflation rate is currently 2.1% per year, according to Staked.us.

Polygon (MATIC)

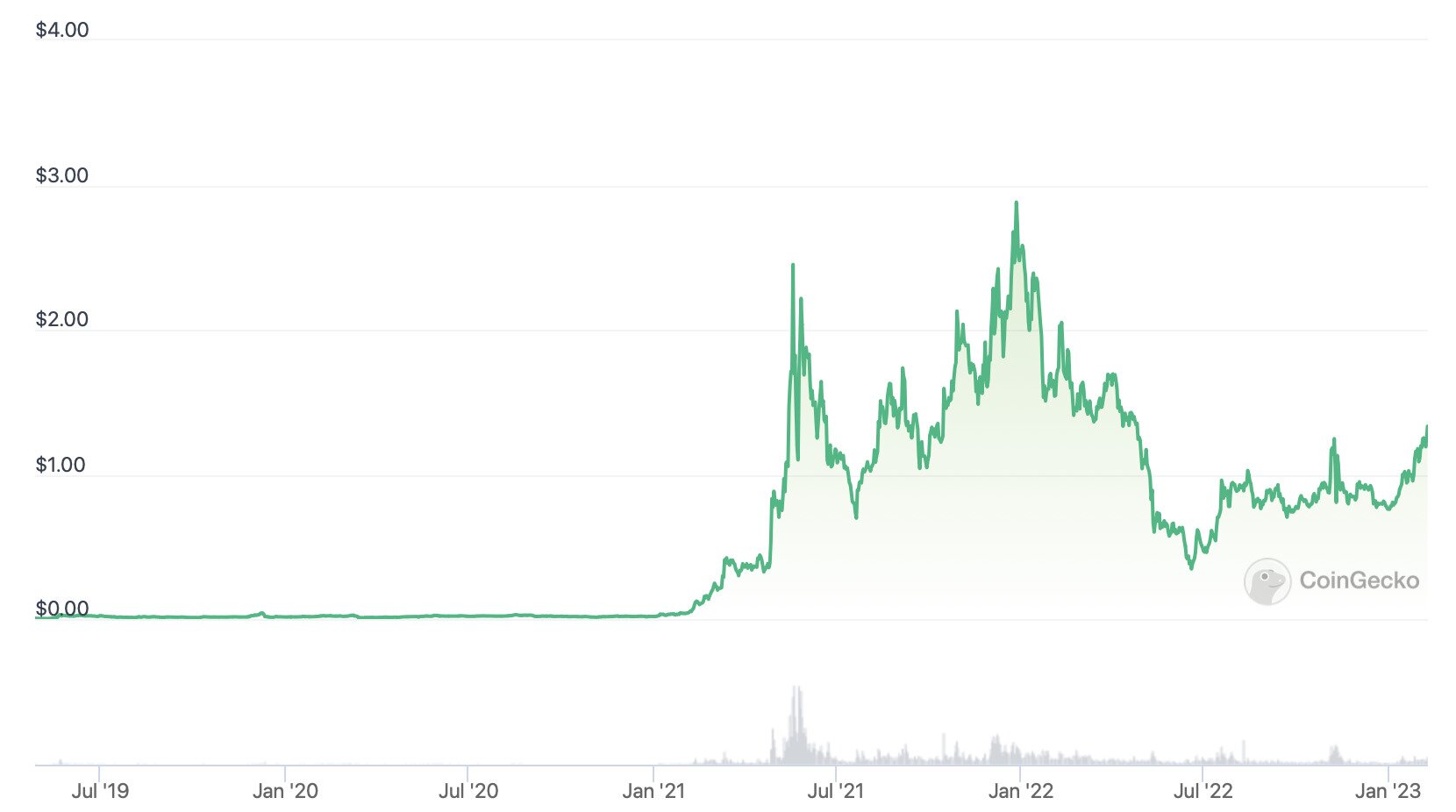

While a layer-two scaling solution for Ethereum, Polygon is itself a proof-of-stake platform, meaning that native token MATIC can also be staked. It first launched in 2019 and has a market cap of $12 billion, with MATIC rising by 41,483.6% since May 2019, when it was priced at only $0.00314376 (it’s now $1.34).

MATIC’s price history since launching in May 2019. Source: CoinGecko

Even though it is a layer-two scaling network, Polygon is still one of the biggest platforms in crypto, with a TVL of $1.23 billion. This puts it ahead of Avalanche, Solana and Cardano, to name a few layer-one blockchains.

Annual staking rewards currently stand at 4.7% in nominal terms and 2.5% in inflation-adjusted terms, according to both Staking Rewards and Staked.us. MATIC’s inflation is 1.8% per year.

Solana (SOL)

Launched in 2020, Solana spent much of that year and its successor becoming one of the hottest new properties in crypto. It boasted theoretical max transaction speeds of around 60,000 transactions per second, putting Ethereum and many other networks to shame. This has helped it gain a market cap of $8.7 billion, with native token SOL gaining by just over 4,500% since launch.

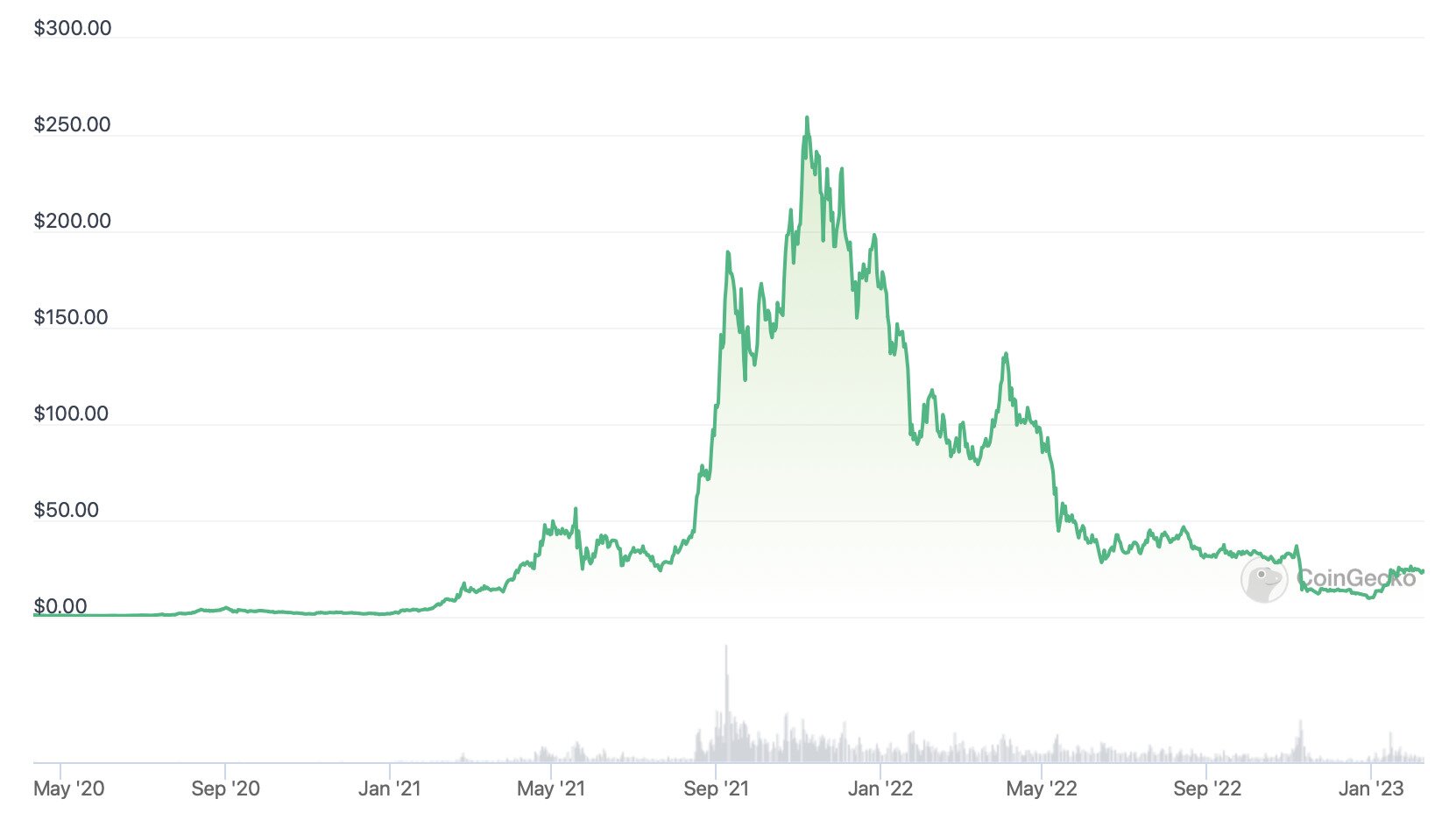

SOL’s price history since launching in 2020. Source: CoinGecko

However, Solana suffered a series of outages in 2022, undermining its growth. Worse still, the collapse of FTX — a major supporter of Solana — in November of that same year caused the value of SOL to plummet. As such, Solana’s TVL has dropped from a record high of $10 billion in November 2021 to $260 million, as of writing. That said, it has been able to recover a little in recent weeks, helped a little by the launch of Solana-based meme token Bonk (BONK) and ongoing development.

Staking SOL can presently earn holders a return of 7.1% in nominal terms and of 2% in real terms, with SOL’s inflation standing at 4.9% per year.

Honorable Mentions: Staking Coins with High Yields

While introducing every single staking coin in the market is beyond the scope of this article, it will end with a very quick list of some proof-of-stake cryptocurrencies with high nominal and real staking yields. These yields are taken from Staked.us.

-

Secret (SCRT): nominal yield – 24.4%; real yield – 8.1%.

-

Audius (AUDIO): nominal yield – 22.1%; real yield – 15.6%.

-

Mina (MINA): nominal yield – 22%; real yield – 2%.

-

Cosmos (ATOMS): nominal yield – 21.4%; real yield – 5.6%.

-

Kusama (KSM): nominal yield – 18.7%; real yield – 9.2%.

-

Livepeer (LPT): nominal yield – 17.4%; real yield – 8.6%.

-

Polkadot (DOT): nominal yield – 15.4%; real yield – 7.7%.

-

Near (NEAR): nominal yield – 10%; real yield – 4.8%.

-

Flow (FLOW): nominal yield – 9.9%; real yield – 4.8%.

-

Elrond (EGLD): nominal yield – 8.4%; real yield – 3.1%.