- >News

- >What Are Staking Tokens and Why Are They Rising So Much in the Crypto Market Right Now?

What Are Staking Tokens and Why Are They Rising So Much in the Crypto Market Right Now?

Every year brings a new trend to the cryptocurrency market, with past years witnessing DeFi, NFTs and the metaverse (among others) succeed in gaining the attention of the millions of traders looking for the next big thing. Well, this year it seems it’s the turn of staking tokens to enjoy above-average returns, with some of the biggest of these — including Lido DAO (LDO) and Frax Share (FXS) — rising by over 100% in the past month or so.

This article will explain just what staking tokens are, putting into context their rise to eminence in the last few months, and unpacking just why investors have taken to them in such a big way. Basically, the whole phenomenon can be boiled down to one primary cause: Ethereum, which in shifting to a proof-of-stake consensus mechanism last September has generated massive demand for staking services.

What Are Staking Tokens? Which Are the Biggest?

By ‘staking token’, this article generally means any token that’s native to a staking service or platform. It doesn’t mean tokens you can actually stake (such as ethereum, cardano, solano, polkadot, etc.), and which are used to secure the corresponding token’s network.

In other words, staking tokens have some kind of utility for the staking platform that issues them, be this utility related to governance or paying transaction and service fees. Accordingly, here are the five biggest staking tokens in the cryptocurrency market right now, sorted according to market cap.

-

Lido DAO (LDO): market cap of $1.78 billion, and a fully diluted valuation (max supply x price) of $2.13 billion. Launched at the beginning of 2021, LDO is the governance token of Lido, so holding it is necessary to vote on protocol updates and also uses of the Lido DAO treasury.

-

Frax Share (FXS): market cap of $752.8 million, and a fully diluted valuation of $1.03 billion. Launched at the end of 2020, FXS is the native utility and governance token of Frax Finance, a decentralized stablecoin and DeFi platform that also offers Ethereum staking.

-

Rocket Pool (RPL): market cap and fully diluted valuation of $728.3 million. Launched back in the middle of 2018, RPL is used within the Rocket Pool platform to secure nodes and to fund one of the two DAOs that operate the staking service.

-

Ankr Network (ANKR): market cap of $213.2 million, and a fully diluted valuation of $262.2 million. Launched in early 2019, ANKR has a variety of uses within the Ankr ecosystem, including as payment for access to the various staking services Ankr runs, as well as for governance and securing nodes.

-

StakeWise (SWISE): market cap of $29.7 million, as well as a fully diluted valuation of $151.3 million. Launched in April 2021, StakeWise is a service for Ethereum staking, with SWISE serving as the governance token for its DAO.

Why Are Staking Tokens Performing So Well in the Crypto Market Right Now?

The tokens above have performed particularly well over the last one or two months, beating the overall market’s returns and beating the returns of many of the biggest cryptocurrencies, including bitcoin, ethereum and cardano.

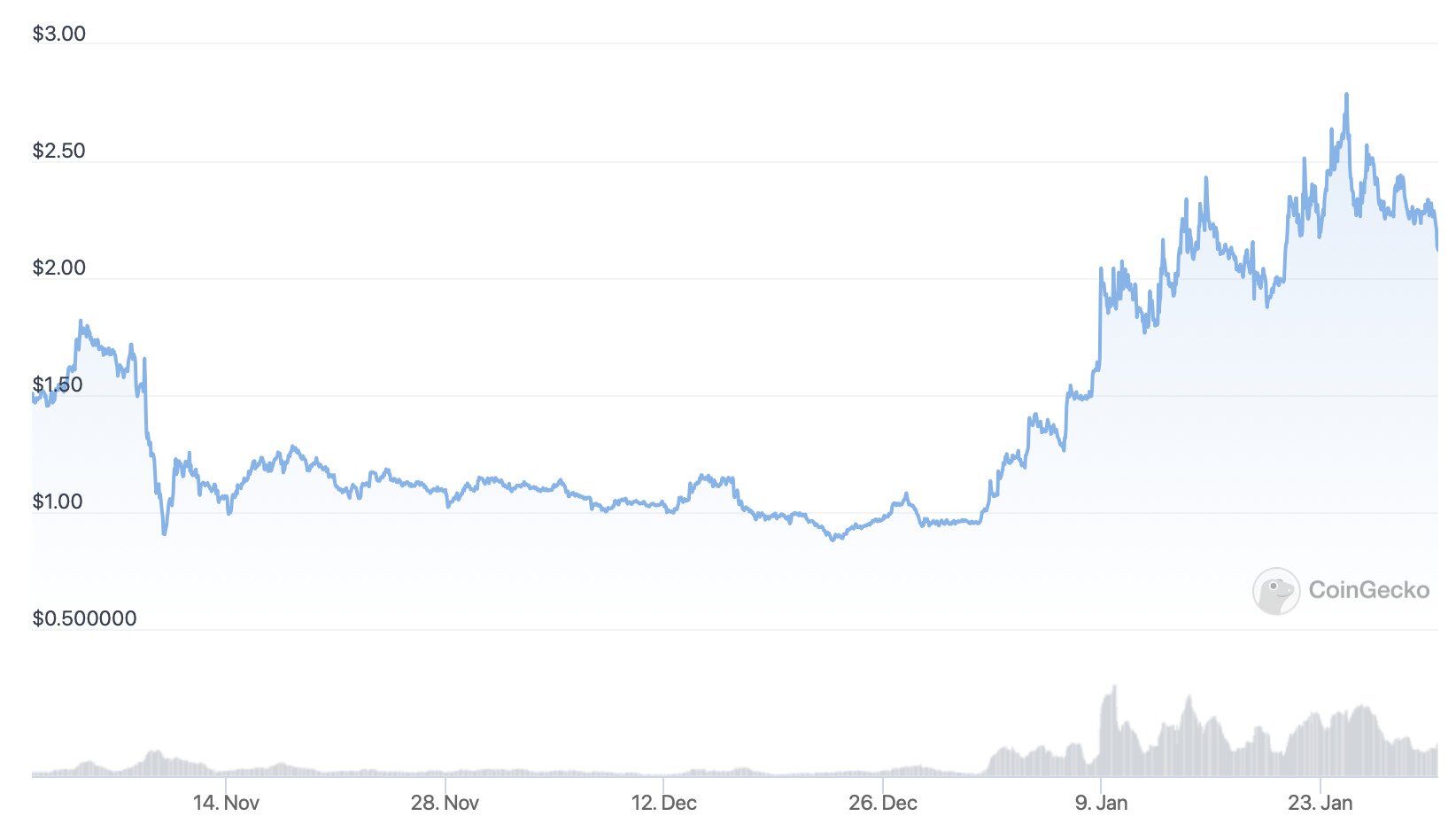

LDO’s price over the past 90 days. Source: CoinGecko

For instance, LDO has risen by 119% in the past month, as against 31% for the market as a whole and 39.5% for bitcoin. It’s a similar story with FXS, RPL, ANKR and SWISE, which have gained by 140%, 92%, 70% and 105%, respectively, over the last 30 days.

Clearly, something is going on here, with staking tokens proving to be the best-performing class of cryptocurrencies in the market during this period. As stated above, the basic explanation for this phenomenon is fairly simple, with the growth of Ethereum staking being the chief culprit.

Put simply, only the very technically savvy — and rich — can manage to run home staking themselves, requiring as it does the ability to run a full Ethereum node 24/7, as well as at least 32 ETH (equal to just over $50,000). As such, most investors interested in staking their ETH have turned to staking pools, with all five of the above tokens being native to such pools.

And yes, the market really has turned to these pools in a big way, with Lido becoming the biggest DeFi application in the entire cryptocurrency ecosystem in terms of total value locked in. Back in July 2022, its TVL was around $5.1 billion, but now it has risen to just over $8 billion, overtaking MakerDAO (which oversees various algorithmic stablecoins) in the process.

This increase has come at a time of declining TVLs for most other DeFi apps, indicating that staking is getting very big. And there are numerous reasons why staking ETH would be very much in demand.

Why ETH Staking Demand Has Grown So Quickly

Firstly, despite a recent mini-rally, the market remains very much in a downturn, given that bitcoin (for instance) is still 66.5% below its all-time high of $69,044. Gains are scarce right now, so those investors who still have tokens and want to do something with them have begun staking ethereum in larger numbers, since this can earn them a variety of rewards. Not only will they receive extra ETH as a yield (at least once the Shanghai update ships in March), but the staking pools they use — including Lido, Frax and Rocket Pool — all provide ETH derivatives in exchange for the actual ETH they stake.

This means that ETH stakers also have the ability to use the derivatives they receive — Frax ether (FRXETH), Lido staked ether (STETH) and Rocket Pool ETH (RETH) — to chase further profits. To a large extent, this involves using these ETH derivatives on other DeFi platforms as liquidity, something which draws its own yields.

Source: Twitter

On top of this, there’s very likely an interest in Ethereum and ETH themselves, since the network’s move to proof-of-stake has created a narrative that it may one day flip Bitcoin. The Merge and other updates have also created a situation where, during busy periods of use, ETH actually becomes deflationary, insofar as its supply actually shrinks (this is due to an on-chain burn of transaction fees and reduced minting of new ETH following move to PoS).

As such, it’s arguable that the narrative and sense of expectation around Ethereum is helping to make staking very popular, especially during an ongoing bear market. In turn, this has created a significant demand for staking tokens, be it the governance and utility tokens staking platforms issues, or the derivative ETH (or SOL, or AVAX, etc.) they issue in exchange for profits.

And with proof-of-staking set to become a bigger rather than smaller fixture within the cryptocurrency ecosystem in the months and years to come, expect staking tokens to mostly rise in value.