- >News

- >How Bad is the Genesis Bankruptcy for DCG and the Crypto Market?

How Bad is the Genesis Bankruptcy for DCG and the Crypto Market?

Another one has bitten the dust. This time, it’s the turn of Genesis Global Capital, the lending unit of the Digital Currency Group-owned Genesis, as well as two other lending-related subsidiaries of Genesis. It filed for Chapter 11 bankruptcy protection last week, becoming the latest in a growing list of companies unable to survive the ardors of the 2022 crypto bear market.

Genesis Global Capital froze customer withdrawals as far back as November 16, some five days after major exchange FTX collapsed. In other words, the writing had been on the wall for some time, with Genesis Global unable to raise the roughly $1 billion it needed to stave off bankruptcy, an injection that was necessary after it transpired that it had $175 million locked in its FTX trading account.

But with Genesis Global owing tens of millions to a variety of creditors, and with owner Digital Currency Group potentially open to litigation from the latter, its demise could in turn have knock-on effects on the rest of the cryptocurrency ecosystem, and so on. However, it’s worth noting that the cryptocurrency market itself moved little in response to this latest bankruptcy, implying the ongoing contagion from the Terra-Three Arrows-FTX saga may already be largely priced in.

Genesis Declares Bankruptcy, Throws Owners Digital Currency Group in Hot Water

There was an air of inevitability about Genesis Global Capital’s eventual bankruptcy, suggesting that, amid a continued bear market, any industry entity that finds itself in trouble may similarly struggle to raise sufficient funds to save itself.

Not only was Genesis exposed to FTX’s bankruptcy, but it was also reportedly owed $1.2 billion by Three Arrows Capital, the cryptocurrency hedge fund which itself was taken down by Terra’s collapse in May. If nothing else, what this chain of downfalls highlights is just how inextricably linked much of the cryptocurrency ecosystem is, with multiple firms lending and owing money to many others.

Source: Twitter

Of course, companies lending and owing money to each other is common in many other industries and sectors, but what makes crypto different is that its underlying market is much more volatile than others, rendering the pyramid of credit-debt much more vulnerable to collapse.

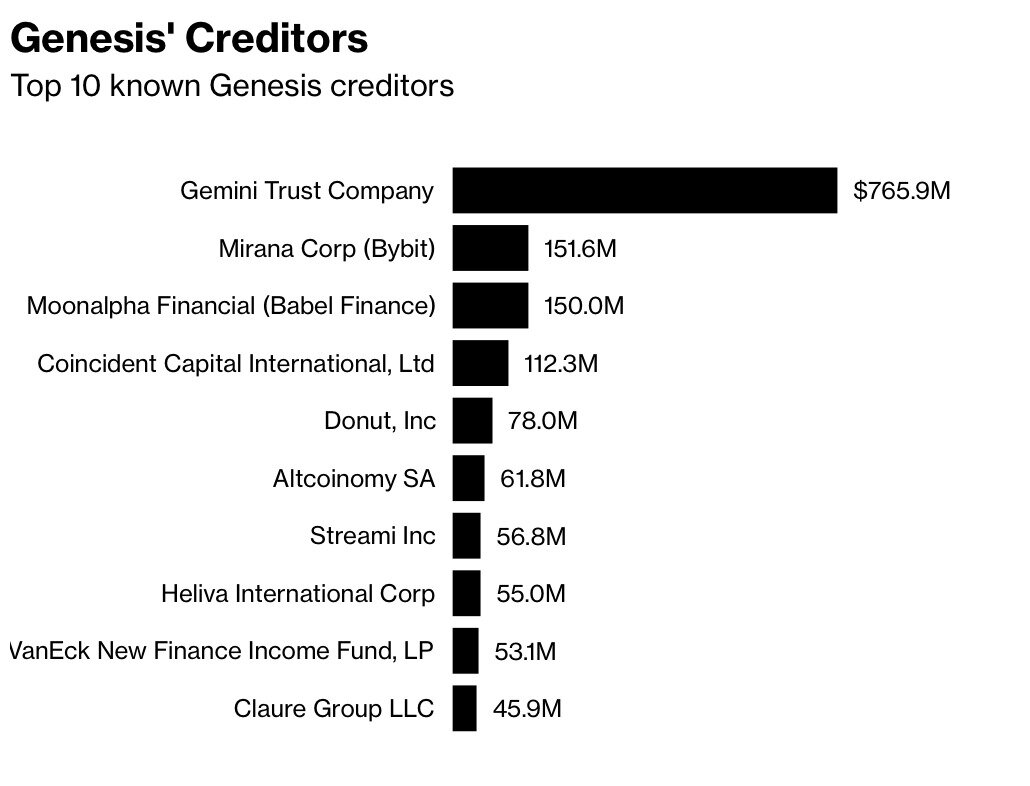

And once again, further pieces of this pyramid may fall in the coming weeks, with Genesis owing around $3.4 billion to its top 50 creditors. What’s significant about this figure is that it exceeds the $3.1 billion FTX owes its own creditors, implying that the repercussions on the wider industry and market may end up being bigger with Genesis than it has been and will be with FTX.

Source: Bloomberg/Genesis Chapter 11 filing

At the top of the creditors list is Gemini Trust Company, the owners of US-based Gemini exchange, which entered into a partnership with Genesis in recent months to launch Earn, a cryptocurrency lending product. Gemini now claims that Genesis actually owes a total of $900 million to it, as a result of Genesis halting customer withdrawals for Earn in November.

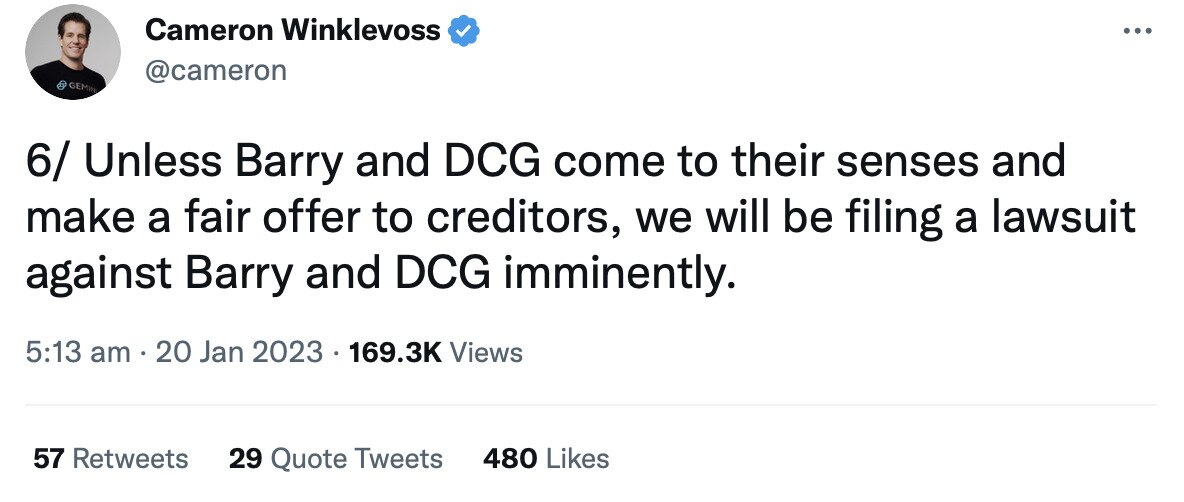

And with Genesis now going under, Gemini’s owners — the Winklevoss twins — are threatening to sue both it and owner Digital Currency Group, something which could have repercussions on DCG.

“Barry” refers to DCG founder and CEO Barry Silbert. Source: Twitter

In fact, the bad news doesn’t end just there for DCG, because it may be liable in more ways than one as a result of Genesis’ bankruptcy. Most notably, the Financial Times reported in December that, if Genesis were to go bankrupt, DCG would immediately have to repay $350 million of a $600 million loan it received from Todd Boehly and other investors back in November 2021.

This is potentially serious, because while it isn’t clear just how financially stable or unstable DCG is, an immediate $350 million liability isn’t something that most companies would be happy about having. Especially companies that have just seen a major subsidiary of theirs declare bankruptcy, and especially companies operating in an environment where it would be hard to raise extra funding.

Put differently, there’s more than a non-negligible possibility that DCG could end up in dire financial straits as a result of the Genesis collapse. It had already borrowed around $1.675 billion from Genesis prior to the latter’s collapse, indicating that it hasn’t always been swimming in cash. On top of this, it also owns media outlet CoinDesk, which has now hired investment bank Lazard to explore its own sale from DCG to a new, presumably less troubled benefactor.

Then there are the 50 or so creditors to which Genesis owes money. Assuming that, say, Gemini doesn’t get anything out of Genesis’ bankruptcy, it too could be at severe risk of collapse, and then so too could its own creditors. And so on, in one vicious circle.

Cryptocurrency Market Shrugs At Yet Another Collapse

There are many good reasons to assume that further collapses and bankruptcies are due this year, yet what’s interesting is that the cryptocurrency market seems largely untroubled by this possibility. At least that’s the message to be taken from how prices reacted to Genesis’ failure.

News of the bankruptcy came out on January 20, at which point the overall market rose from a total cap of roughly $1.012 trillion to $1.077 trillion the next day. And it’s now (as of writing) at $1.084 trillion, representing a small gain since Genesis’ bankruptcy.

This is certainly odd market behavior if you assume that half of the industry is going to collapse in the next few months. However, it could be argued that the falls of the previous few months had already priced in collapses resulting from the FTX bankruptcy, and that now the market is beginning to recover. At the same time, major exchanges such as OKX and Binance have been publishing proof of their respective reserves since November, reassuring investors that other big dominoes aren’t likely to fall anytime soon.

Recent gains have also followed from the publication of positive inflation and GDP figures in various major economies, something which stock markets and crypto have taken as a sign that the global economy is now through the worst of 2022’s downturn. Ultimately, this little upsurge may have come at just the right time in recent history, potentially saving at least a few cryptocurrency firms — although not Genesis (and maybe not its owner) — from their own troubles.