- >News

- >Research Finds Spike In The Numbers of People Buying Cryptocurrency

Research Finds Spike In The Numbers of People Buying Cryptocurrency

Retail investors are increasingly flocking to cryptocurrency, a growing body of new research from around the world suggests. The general public is showing more interest in Bitcoin and other cryptocurrencies, and data indicates that more of us are taking the plunge to buy crypto.

This trend was indicated most recently from the UK’s Financial Conduct Authority, which found an annual increase of 1.1 million in the number of Brits who have owned crypto at some point. Other recent data from other countries indicates a similar tendency, which has only grown stronger in the wake of the Covid-19 pandemic.

Stronger retail interest is undoubtedly a positive development for Bitcoin and cryptocurrency. Via the magic of network effects and word-of-mouth, it will only invite further adoption in the future, and so on. And with it, longer term price rises should follow.

Retail Investors Coming To Crypto

Published at the end of June, the Financial Conduct Authority’s (FCA) research found that an estimated 2.6 million people in the UK have bought cryptocurrencies at some point. Not only is this almost 4% of the total UK population, but it represents a 1.1 million increase compared to the same study from last year. In other words, an increase of roughly 73%.

“This FCA report reveals the increasing popularity of cryptoassets among the UK consumer population,” said the FCA’s Interim Executive Director of Strategy and Competition, Sheldon Mills.

Encouragingly, 1.9 million – or 73% – of the 2.6 million still hold cryptocurrency of some kind, with over half owning crypto worth more than £250 (about $310).

Such research is echoed in other parts of the world. In the United States, there have been sizable increases in cryptocurrency ownership ever since the bull market of late 2017.

For example, a Finder.com survey revealed that the number of Americans who own crypto of some kind almost doubled in 2019, as compared to 2018. The percentage rose from 7.95% to 14.4%. This is a rise of 81%, and suggests that as many as 47.2 million Americans have owned crypto at some point.

More recently, data and observations suggest that the American public’s interest in crypto has surged even further. With Covid-19 sending the U.S. into a money-printing frenzy, the allure of decentralized cryptocurrencies has grown among Americans. Meanwhile, reports suggest that many of the $1,200 stimulus checks sent out by the U.S. government in April were spent on crypto.

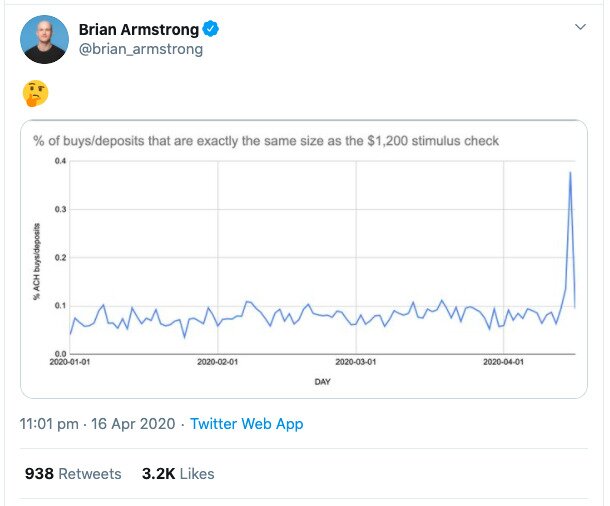

Indeed, Coinbase CEO Brian Armstrong tweeted that the number of deposits or buys worth exactly $1,200 spiked at Coinbase around the time the checks were distributed.

Source: Twitter

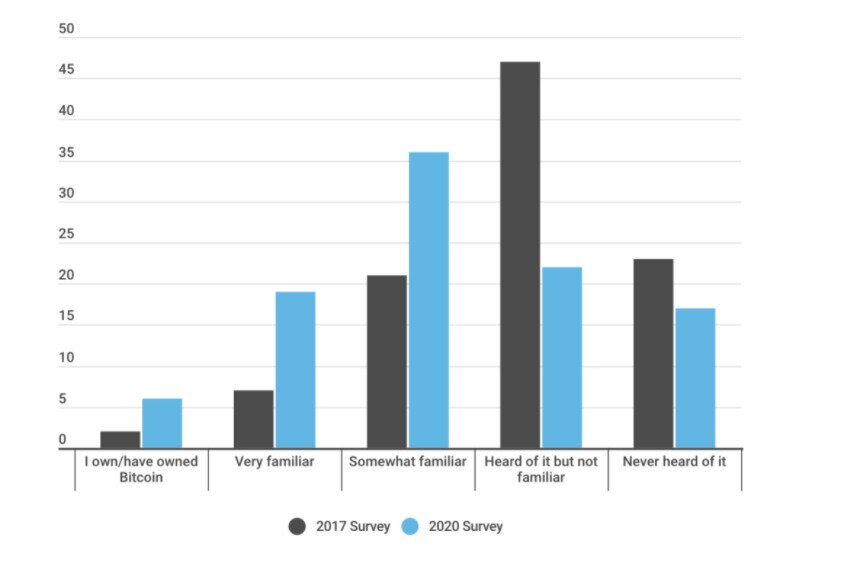

At the same time, research from The Tokenist indicates that the public’s knowledge of and attitude towards cryptocurrency has improved considerably since 2017.

Most significantly, it found that, across 17 nations (including America), ownership of bitcoin has increased. It was 2% in 2017, while in April 2020 it was 6%. More impressively, ownership of bitcoin among millennials has risen from 4% to 14% over this same period, while ownership among over-65s increased from 0% to 7%.

Source: The Tokenist

Such increases appear together with more favorable views on cryptocurrency. For instance, 45% of respondents would prefer bitcoin over stocks, real estate or gold. 60% believe that Bitcoin is a positive technological innovation, compared to only 33% who believed the same in 2017. 47% trust Bitcoin over big banks, an increase of 29% over three years. And so on.

Retail Eats Up Bitcoin

Basically, the narrative surrounding Bitcoin and cryptocurrency is changing. Slowly but surely, the longer crypto sticks around and grows, the more people are coming to accept it as a valid part of the financial landscape. In fact, some aren’t simply accepting it, but are singing its praises and investing in it.

At the end of April, crypto-exchange bitFlyer published a survey on the attitudes of 10,000 people in ten European countries towards cryptocurrency. As with The Tokenist’s survey, it also found an increased positivity towards crypto. In particular, 66% of Europeans believe cryptocurrencies will still exist in ten years’ time, up from 63% a year before.

Such increases may be modest, but further research indicates that they will be inexorable and that, eventually, retail investors will dominate the cryptocurrency market.

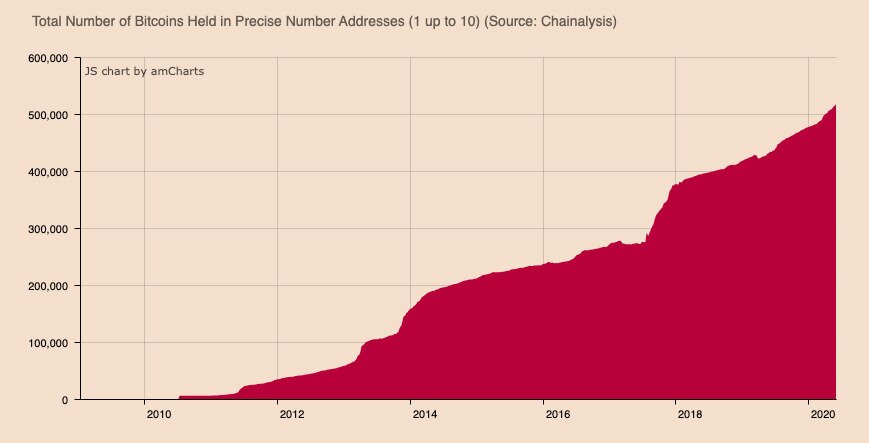

At the end of June, crypto-exchange Zubr published data showing that retail investors will hold around 50% of bitcoin’s supply by 2024. Basically, the steady growth of wallet addresses holding exactly one, two, three and up to ten bitcoins has averaged between 1% and 1.5% since 2014. As Zubr’s research points out, if this continues, “retail could potentially account for eating up over 50% of the physical supply” of bitcoin by 2024.

Source: Zubr

Put simply, retail investors are coming for bitcoin and crypto. A wealth data from various sources reinforces this view, indicating that crypto is gradually winning people over, particularly as governments and central banks respond to the Covid-19 crisis by printing enough money to cause major inflation somewhere down the line.

As far as the price of bitcoin and other cryptocurrencies go, this gradual adoption indicates a steadily rising price over the long run. More converts bring even more converts, and combined with Bitcoin’s supply cap, economic logic dictates a rising price.

But assuming you’re one of the people who wants to get into crypto for the first time, what do you do? Well, there are now a wide range of crypto exchanges operating throughout the world, with many offering easy ways of buying crypto. By finding the one that looks right for you, and by reading one of the many buying guides on the web, you should be able to take that first step as safely as possible.