- >News

- >Bitcoin Miners Chug Along Despite Ethereum’s Switch to Proof-of-Stake

Bitcoin Miners Chug Along Despite Ethereum’s Switch to Proof-of-Stake

The Ethereum blockchain transitioned from proof-of-work (PoW) to proof-of-stake (PoS) this September with pomp — in what was heralded as an inflection point for crypto. The network’s new architecture will eventually improve Ethereum’s scalability issues via sharding, which will “reduce network congestion and increase transactions per second.”

But it’s the switch from the energy hogging PoW to the more energy friendly PoS that’s captured people’s imagination and triggered a new round of discussion on what that means for Bitcoin — the only other uber “relevant” cryptocurrency that still uses PoW.

After Ethereum is out of the equation and the spotlight is now solely on Bitcoin, how is the currency’s mining fairing?

PoW and Bitcoin

Bitcoin solves a problem for many, but its PoW validation that uses a ton of energy is where environmentalists and some detractors draw the line. PoW is a concept that’s been in the computing world for decades but was a prerequisite for Bitcoin to exist. The idea was first proposed by computer scientists Cynthia Dwork and Moni Naor in 1993 to combat junk mail.

It was then expanded and named “proof of work” by computer security researchers Markus Jakobsson and Ari Juels in 1999. It wasn’t until American developer Hal Finney adapted the concept to digital money that the concept was used for the next generation of digital currencies. Shortly thereafter, it got a new lease on life when Satoshi based Bitcoin on the concept to foster a decentralized, peer-to-peer money system with no trusted third party.

Bitcoin’s Energy Consumption

Despite PoW’s contribution to the democratization of money, it has one chink in its armor: consuming so much energy — when deployed at scale, at least. Bitcoin is one such application of PoW at scale and that hasn’t won it any favors. Think about it: Bitcoin as an independent currency is already often on a collision course with many regulators. For it to be an energy guzzler too?

The leading crypto has been called “inefficient,” a “waster of energy by design,” etc. The Joe Biden White House is calling on “executive actions” to “limit or eliminate” the use of energy-intensive consensus mechanisms — in the most high-profile threat to Bitcoin mining yet.

When in September, Ethereum rid itself of PoW, bringing down its energy use by 99.9%, all eyes turned to Bitcoin. There was the fear that after Ethereum’s move, Bitcoin mining would become even more unfashionable.

But Bitcoin mining is holding its own quite well. Below, we’ll look more closely at how it’s achieving that.

A New Generation of Miners

For one, we have the newest generation of Bitcoin mining rigs being delivered to miners and going online. Such miners are more powerful than older models of rigs that are more expensive to maintain and less profitable — and sometimes even loss-making.

An example of the new generation of mining rigs includes Bitmain’s Antminer s19 XPs, while Antminer s9 represents the older generation. While the former could muster just up to 14 terahashes per second (TH/s), the new iteration can clock up to 255 TH/s.

As a result of the increased computational power on the network, we’re witnessing an increased hash rate. Indeed, Bitcoin has recently recorded some of its highest hash rates, going on to reach 331EH/s, as reported by Glassnode.

Hash rate is the amount of computational power expended on a blockchain network to discover the next block of transactions. A high hash rate points to more miners joining the network. That means Bitcoin’s mining is going strong.

Miners That Are Already Online Haven’t Shut Off

Similarly, it appears that already online miners aren’t unplugging their machines despite BTC’s price taking a tumble in the prevailing crypto winter. There are several explanations for this phenomenon.

For one, Bitcoin miners have found cheaper sources of electricity, including green energy. For instance, Washington state has become a haven for Bitcoin mining farms thanks to its affordable electricity powered by the state’s cheap and available hydropower. Similar Bitcoin mining farms have come up across Texas — a crypto-friendly state that also boasts massive renewable energy sources.

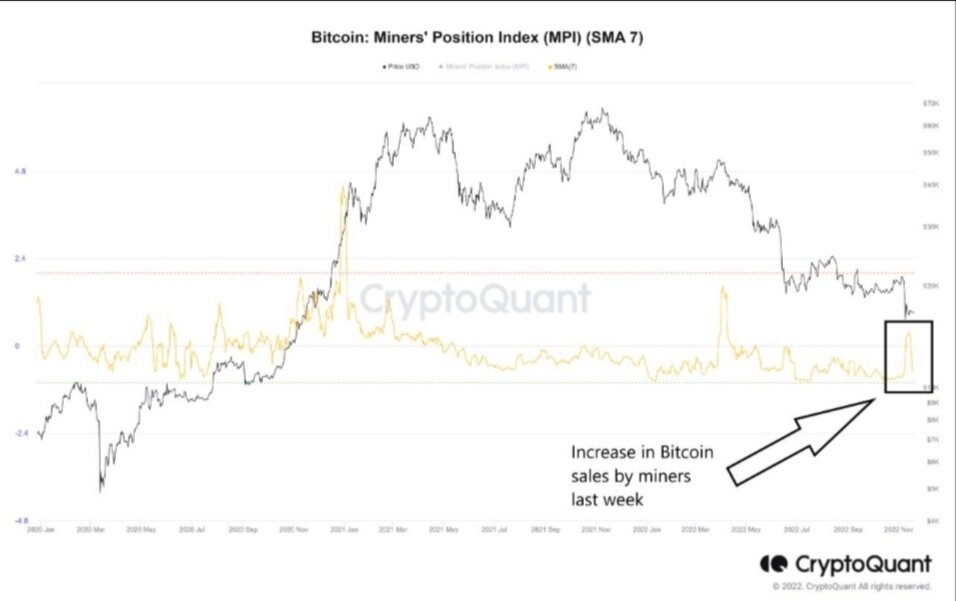

In addition, miners are using their Bitcoin reserves to offset possible losses. On-chain data analysis platform CryptoQuant reports increased outflows from miner wallets to exchanges.

CryptoQuant graph depicting the offloading of BTC reserves by miners

This means miners are selling their BTC to cover high energy costs instead of skipping mining altogether.

Former Ethereum Miners Turn Attention to BTC

After Ethereum mining was switched off, most miners repurposed their resources towards Bitcoin mining. ETH miners unplugging their rigs meant extra storage space, electricity, and internet bandwidth to power BTC mining.

PoW mining company Luxor Technologies CEO Ethan Vera told Bloomberg: “Rack space for Bitcoin miners was limited, freeing up the space paves the way for machines previously unplugged to get plugged in.” Vera also posited that at the time that about 4% of Bitcoin’s processing power flowed from Ethereum’s former miners.

It only makes sense that Bitcoin would be the next most logical cryptocurrency for crypto miners.

Profitability for Mining Any Cryptocurrency

While there are application specific integrated circuits (ASICs) for mining Ethereum, most cryptocurrency miners heavily rely on graphic processing units (GPU) rigs. Unlike ASICs, GPU rigs aren’t customized to mine just Ethereum. That means miners who used GPUs can branch out to other PoW chains such as Ethereum Classic and Ravencoin.

But there’s just one problem: most altcoins might not quite yield the same profits as Bitcoin or Ethereum. That means miners will have to do some math before settling on which cryptocurrency(ies) to mine. My bet is the majority will settle on Bitcoin eventually.

Some Downsides

It’s not all rosy for Bitcoin mining, however.

Last week New York became the first state to ban Bitcoin mining at fossil fuel plants. For now it’s a temporary two-year moratorium with the goal of evaluating the environmental concerns over the industry but it could be extended at a later point. Other states may enact similar legislation.

Perhaps a bigger concern is that the overall hash rate of BTC has been dropping. Hash rate represents the total computational power of the proof-of-work. BTC mining revenue recently hit a two-year low and some miners are turning off their machines, at least for the time being.

The Bottomline: Slow and Steady

Some Bitcoin proponents had legit FUD (Fear, Uncertainty, and Doubt) as to whether it would rattle Bitcoin mining after the second most popular blockchain adopted proof-of-stake.

The stability of the Bitcoin ecosystem is strongly linked to mining. If miners stay on the network, it’s good for the network. And for now, miners are staying.