- >News

- >Is FTX Finished? And How Could Its Demise Impact the Crypto Market?

Is FTX Finished? And How Could Its Demise Impact the Crypto Market?

2022 has been a dramatic year for crypto, with the respective collapses of Terra, Three Arrows Capital and Voyager Digital (and others) having a big impact on prices. Now, it’s the turn of FTX and its owner Alameda Research to take a big fall, and given that it was the world’s second-biggest exchange at one point, its demise could have even more of a negative effect on the cryptocurrency market than previous exits.

As of writing, it’s not 100% certain FTX is going to collapse, yet the prognosis looks very bleak. Last week brought a leaked document which appeared to reveal that the assets of owner Alameda Research were mostly tied up in illiquid altcoins (including its native FTT token). Soon after, holders began selling FTT and withdrawing their money from the exchange, which was eventually forced to halt withdrawals amid fears that it was insolvent.

Now, Binance CEO Changpeng Zhao has revealed that Binance has offered to buy FTX.com (but not FTX.us), so pending a “DD” (due diligence) check in the next few days, the latter will be absorbed into the former. This is potentially good news for the industry, yet with Binance acquiring one of its biggest rivals, it now arguably becomes too big for crypto’s own good, insofar as its collapse could really imperil the market.

How the FTX Collapse Went Down

Up until about a week ago, FTX was either the second- or third-biggest cryptocurrency exchange in the world (depending on what time you checked the daily trading volume charts). It had famously paid for a high-profile TV advert (starring Larry ‘Seinfeld/Curb Your Enthusiasm’ David) during the halftime of Super Bowl LVI, while its CEO Sam Bankman-Fried was regularly featured in articles celebrating the richest people in crypto, or under 30.

However, this cozy little picture changed on November 2, when an unidentified individual leaked a document revealing Alameda Research’s balance sheet. While the FTX owner’s assets came in at $14.6 billion as against $8 billion in liabilities, a closer reading quickly revealed something very disturbing. Namely, 39% of its assets were in FTT, the native utility token of FTX, while 63% were in cryptocurrencies (including FTT, as well as solana and some altcoins).

This was disturbing insofar as there was no way Alameda could sell such crypto quickly in order to honor its debts. Indeed, it claimed its FTT holdings were worth $5.82 billion, yet the token had a market cap of only $3.35 billion at the time the document was leaked.

Understandably, the market came to suspect that Alameda and FTX were effectively insolvent, with FTT quickly falling in price from about $26 early on November 2 to $22 early on November 8.

FTT’s price over the past seven days. Source: CoinGecko

FTT’s price took a real turn for the worse, however, when Binance — an investor in FTX — revealed that it would be selling its holdings in the coin, amounting to more than $500 million. This caused further losses, which worsened yet again when it became apparent that FTX had halted withdrawals.

Source: Twitter

Needless to say, it was around this point that suspicions of insolvency gained more than a little credibility. It’s also here that Binance stepped in with an offer to acquire FTX.com from Alameda Research, an offer which the latter accepted.

Is FTX Finished?

This is where FTX now stands. FTT remains tradable, with its price currently standing at $4.01, but likely to fall further. What its fall means is that Alameda’s assets have plunged in value, making it even less able to honor its debts.

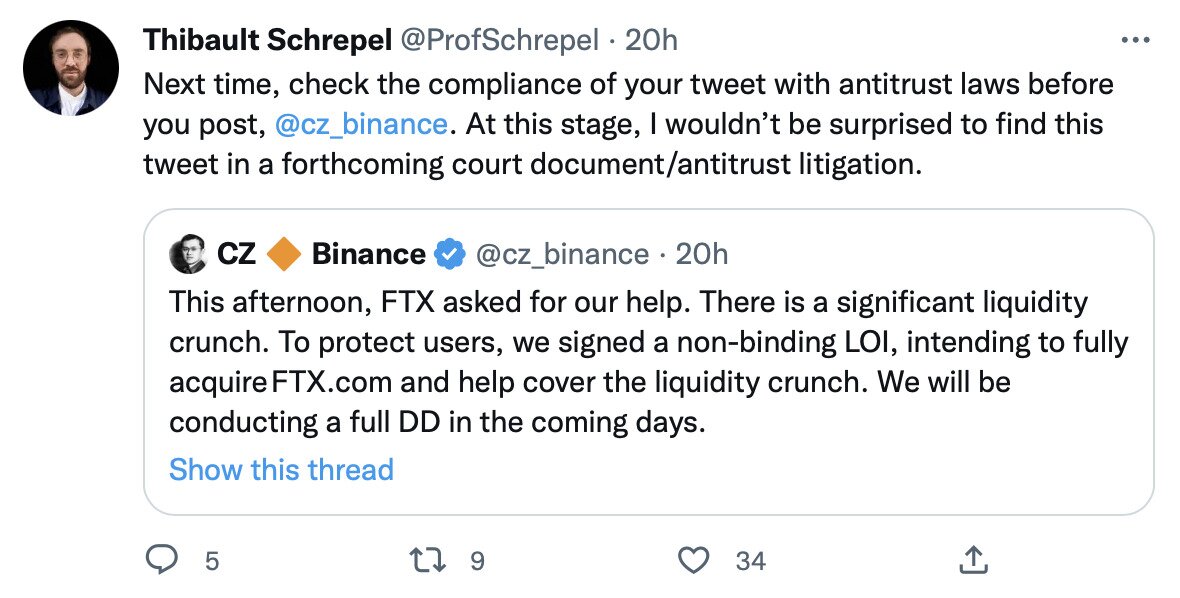

As such, the probability of a complete collapse for FTX remains very high, although the completion of Binance’s proposed acquisition may help preserve it. That said, the potential merger could raise antitrust concerns in the US (or elsewhere in the world), with Amsterdam University’s Thibault Schrepel (an associate professor in antitrust and other legal issues) tweeting in response to Changpeng Zhao that the latter should “check the compliance of [his] tweet with antitrust laws” before he posts.

Source: Twitter

At the same time, even if the acquisition is somehow okayed by regulators, it may result in Binance effectively dissolving FTX.com’s operations and absorbing what’s left into its own website and platform. This is also tantamount to a collapse.

So either way, things look very bad for FTX. It’s also worth highlighting that its troubles have occurred during an ongoing bear market, so it’s unlikely that it can raise the kind of venture capital or debt funding that will enable it to survive on its own account. In fact, it has already benefited from several funding rounds in the past year or so, including a $400 million round in January. So it’s unlikely that any new or existing investors are likely to bail it out now, given its current troubles.

The Wider Implications for Crypto

The thing is, the ramifications of FTX’s demise run deeper than simply flooring the price of FTT and causing another selloff, and for various reasons.

First off, if Binance does end up acquiring FTX, this potentially kicks the can down the round and puts the problem on Binance’s shoulder. That’s because when you buy a company, you generally buy its liabilities and debts. This would therefore mean that Binance would add around $8 billion in liabilities onto its balance sheet, something which may or may not cause it stress, particularly if cryptocurrency prices continue falling.

Encouragingly, Binance CEO Changpeng Zhao has attempted to head off any future concerns regarding its health by taking a number of steps, including adding $1 billion to its insurance fund for user deposits, reaffirming that it has never used BNB as collateral for its own borrowing (something which FTX did with FTT), and announcing that it will begin publishing proof of its own reserves in the near future.

Source: Twitter

This may help relax some fears that Binance could be next on the list of big crypto failures, yet in a recent tweet, Zhao has also explained that FTX’s troubles may make life more difficult for the cryptocurrency industry. In a tweet, he predicted that regulators “will scrutinize exchanges even more” and that licenses around the globe “will be harder to get.”

Indeed, in a year when crypto has already faced a number of significant challenges, FTX’s collapse won’t make things easier. However, it’s arguable that increased regulatory scrutiny and the real-life stress-testing of business models will only make the cryptocurrency industry that emerges out the other end stronger and more sustainable.