- >News

- >After Ethereum’s Merge, Which Are the Biggest Proof-of-Work Coins?

After Ethereum’s Merge, Which Are the Biggest Proof-of-Work Coins?

Based purely on media coverage, you’d be forgiven for thinking that proof-of-work’s days are numbered. The consensus mechanism had been no stranger to controversy in the years leading up to Ethereum’s Merge, and now that the latter has switched to a proof-of-stake consensus mechanism, calls are growing for the more energy-intensive PoW to be phased out.

Not only are governments in the United States and the EU looking to curtail or even ban PoW, but industry insiders such as Vitalik Buterin have called on the remaining proof-of-work coins to make their own respective moves. This would therefore suggest that PoW may one day become a thing of the past…

However, there still remain a healthy number of major coins sticking with PoW, with proponents arguing that the latter provides more stability and security than PoS. This article collects the biggest proof-of-work coins in terms of market cap, while examining their recent developments and future prospects.

Bitcoin (BTC)

The first entry on this list will come as a surprise to no one: bitcoin (BTC) is the world’s original cryptocurrency, which also makes it the original proof-of-work cryptocurrency. As outlined in the now-famous Bitcoin whitepaper from Satoshi Nakamoto, it operates using “an ongoing chain of hash-based proof-of-work” consensus mechanism, which forms a record that “cannot be changed without redoing the proof-of-work.”

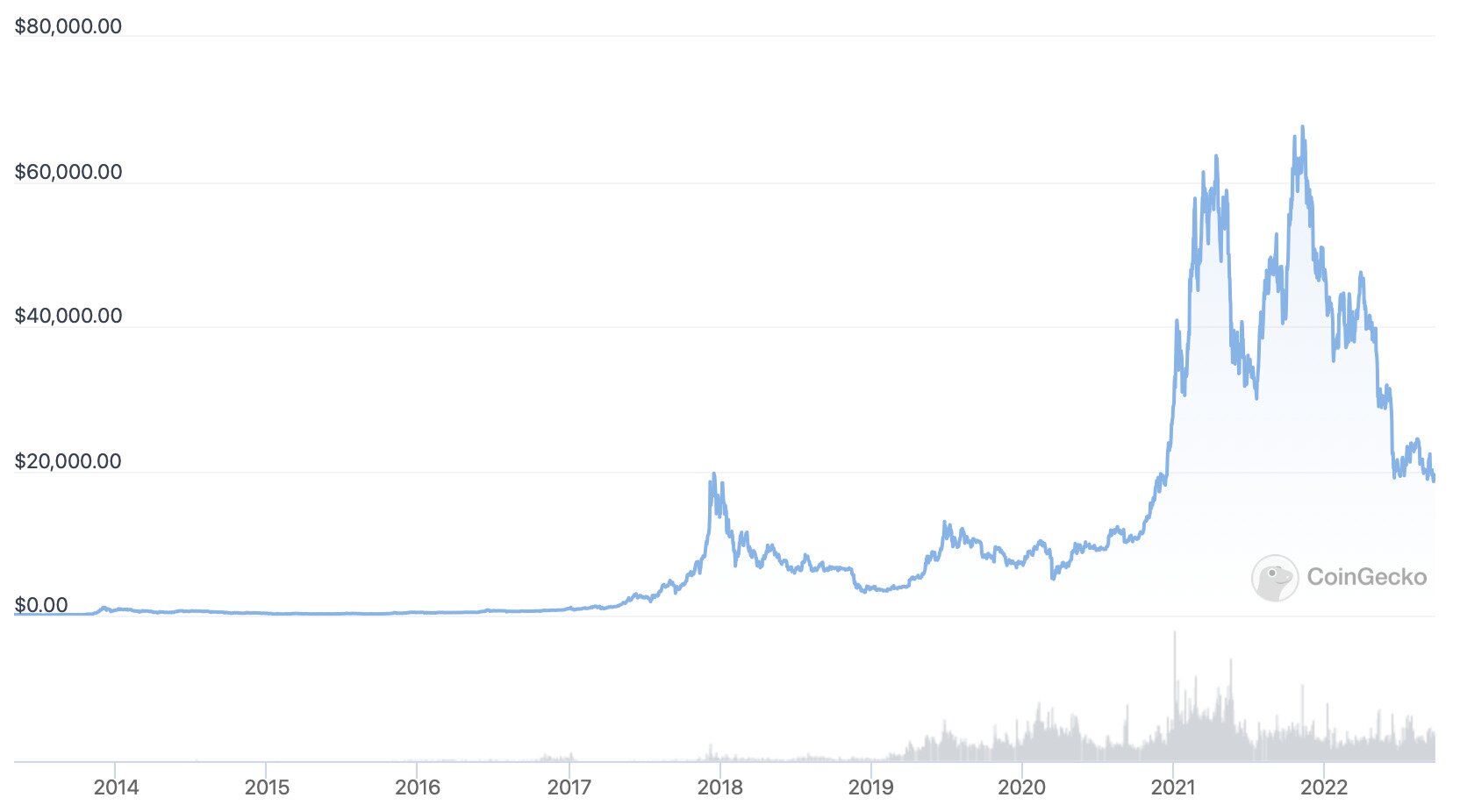

Source: CoinGecko

In terms of its recent price action, BTC has followed — or rather, has led — the market downwards. From an all-time high of $69,044 in November 2021, it has descended to its current level of $19,108, making for a 72% decline. Such a climbdown is largely the result of depressed macroeconomic conditions, including high inflation and rising interest rates, which have served to spook investors.

Still, news suggests that the foundations of a future bitcoin rally and bull market are currently being laid. Financial institutions — including Société Générale and Nasdaq (to name a couple of the most recent examples) — are increasingly rolling out bitcoin-related services, while trillion-dollar asset manager BlackRock launched its own bitcoin fund last month, in addition to partnering with Coinbase.

This all suggests that, despite the negative press surrounding PoW, major interest remains in investing in the biggest — and most secure — cryptocurrency in the market.

Dogecoin (DOGE)

A distant fork from Bitcoin, DOGE is the second-biggest proof-of-work coin in terms of market cap. It was launched as a joke back in late 2013, but since then it has reached a total valuation of over $8 billion, as of writing.

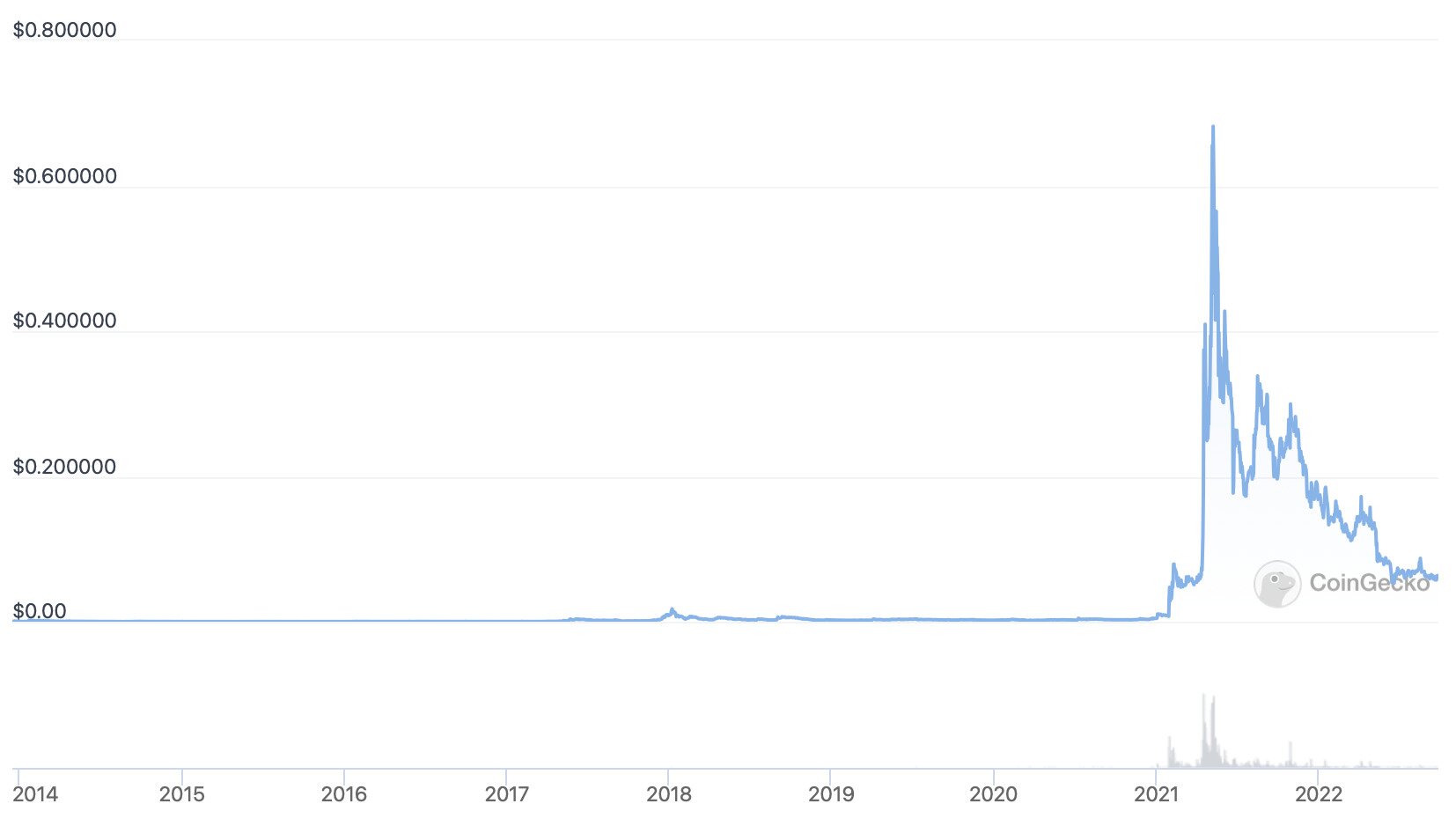

Source: CoinGecko

Its ATH of $0.731578 was set back in May 2021, on the back of hype surrounding Dogecoin’s championing by Tesla CEO Elon Musk. It has since fallen by just over 91%, yet it continues to witness modest development in various areas.

For instance, it witnessed some important software updates in 2021, after its price rises enabled funding for developers. While it has also seen some adoption as a method of payment, with the likes of Tesla and Newegg now accepting it. However, its 2022 has been relatively quiet.

Ethereum Classic (ETC)

Forked from Ethereum in 2016 after the infamous DAO hack (and the ensuing debates over reversibility), Ethereum Classic remains a proof-of-work consensus mechanism, even though Ethereum itself has now moved to PoS.

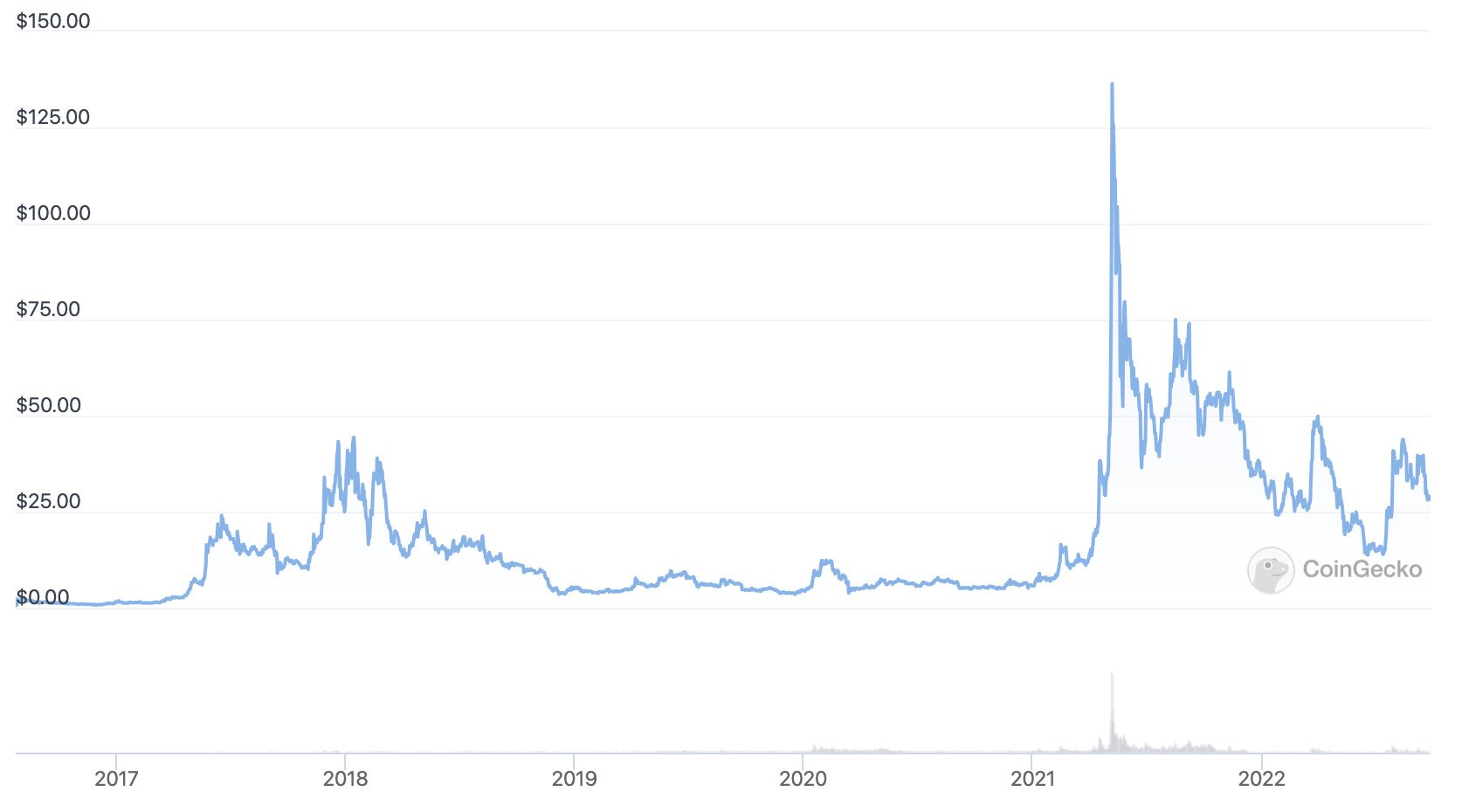

Source: CoinGecko

It has always lived in the shadow of Ethereum, with ETC’s price currently only 2% of ETH’s. It enjoyed an ATH of $167.09 in May 2021, while it also saw a rally in the runup to the Merge, with investors excited by the prospect of Ethereum’s former miners moving to Ethereum Classic.

Based on its hashrate data, Ethereum Classic has indeed seen an influx of miners in recent weeks, with its rate rising by just over 1,000% between mid-July and mid-September. This increases the strength and security of its network (more hashpower makes a 51% attack more expensive), and may help it attract organic adoption for its smart contract and utility platform.

Litecoin (LTC)

Another fork of Bitcoin, Litecoin began life in October 2011 as a ‘more scalable’ version of its source, in that it allowed for block sizes that were four times larger than Bitcoin’s. This tweak meant that it quadrupled its total max supply, leading some to dub Litecoin as the ‘silver to Bitcoin’s gold).

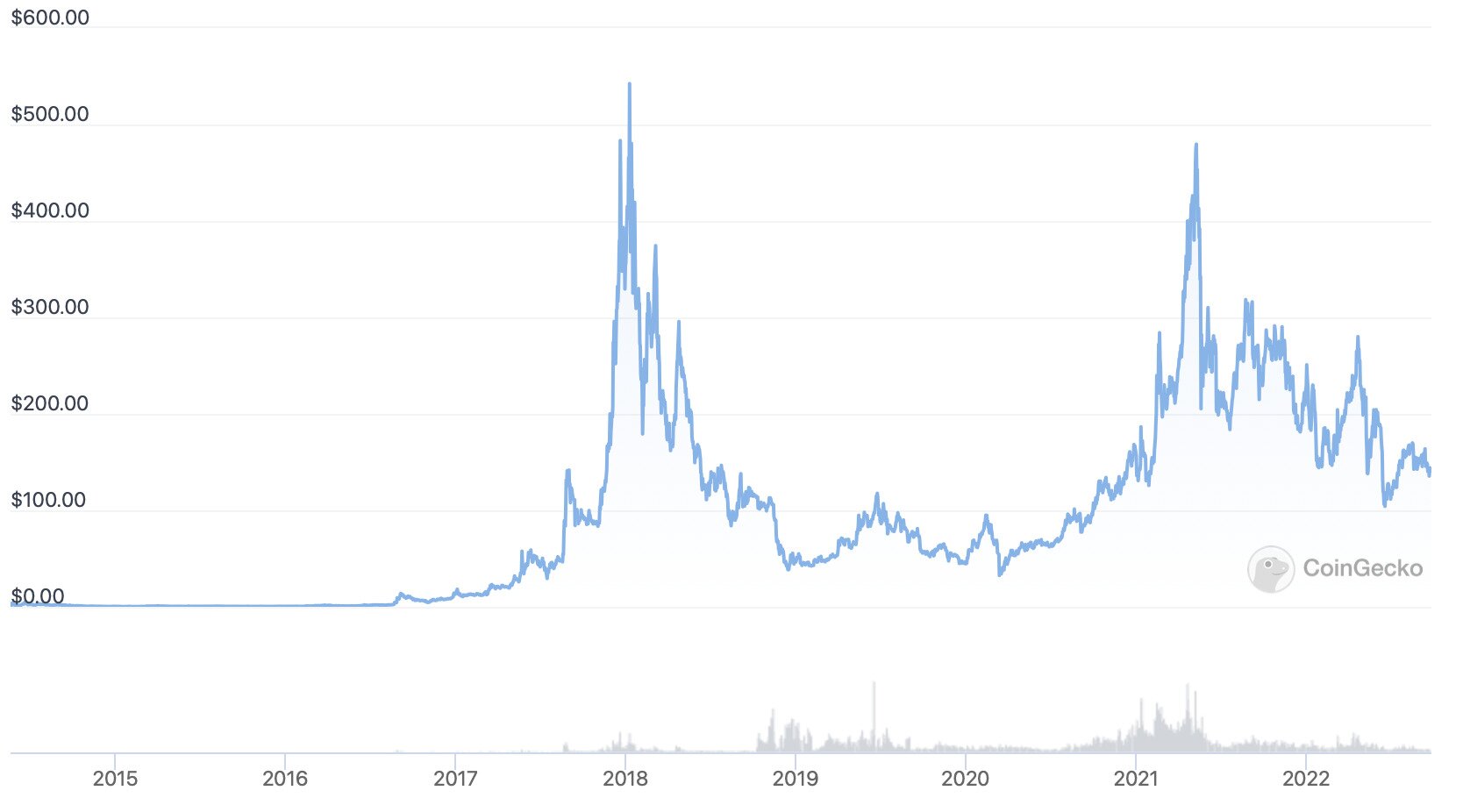

Source: CoinGecko

Pricewise, Litecoin has witnessed peaks in 2017/2018 and 2021, like much of the rest of the market. Its current all-time high is $410.26, set in May 2021. What’s interesting about this is that it’s only 13.75% higher than the then-record of $360.66 it set on December 18, 2017, whereas BTC’s current ATH surpassed its 2017 record by 249%.

This implies that Litecoin may not be growing in line with market averages. And with the protocol seeing noticeably less development activity on GitHub than what we see with Bitcoin (compare contributor numbers, for instance), there’s a sense that Litecoin isn’t evolving as much as other proof-of-work coins.

Monero (XMR)

Launched back in April 2014, Monero now uses a proof-of-work algorithm called RandomX to validate its transactions, with RandomX designed to be resistant to ASIC chips, which infamously have turned Bitcoin mining into an energy-intensive arms race.

More importantly, Monero is a privacy coin, with its transactions being both anonymous and untraceable. This is achieved via the use of three core technologies: Stealth Addresses, Ring Signatures, and RingCT.

Source: CoinGecko

Since launching, XMR set an all-time high of $542.33 in January 2018, with its 2021 peak only making it as far as $479.61. This is largely because governments and regulators have pushed back against privacy coins such as Monero, with major exchanges such as Kraken, Bittrex, Bithumb and Huobi delisting the cryptocurrency in recent memory, while Coinbase has refused to list it altogether.

Still, with privacy-enhancing mixing services such as Tornado Cash being banned in the United States, it’s likely that Monero will see growing usage in the coming months and years. Because while the ethical and political merits of hiding all transactions can be debated, it does indeed seem that Monero works as advertised, and that it meets a genuine demand.