The Extremely Early Days

A lot of excitement and speculation marked the early days of Bitcoin. The first exchanges to list Bitcoin didn’t even have proper price tickers – they just used the letter B. And when the first exchange, Mt. Gox, did start releasing proper price data, it was often inaccurate or delayed. This made it very difficult for traders to know what the true price of Bitcoin was and caused a lot of volatility.

Despite the challenges, people were drawn to Bitcoin because it offered something that no other currency did: complete decentralization. Bitcoin is not controlled by any government, central bank, or financial institution. This made it very appealing to those who were skeptical of traditional financial institutions and looking for an alternative.

The hype around Bitcoin led to Bitcoin hitting a price of $1,000 in 2013 for the first time. This was followed by a massive crash in 2014, after which the price stabilized around $200-$300 for several years.

Scams and Theft in the Bitcoin Space

Scams and theft were also rampant in the early days. In 2011, Mt. Gox was hacked and lost 850,000 Bitcoins. This was worth over $ 450 million at the time and was the largest Bitcoin hack ever.

Mt. Gox declared bankruptcy and closed down, but this didn’t stop people from using Bitcoin. In fact, usage and adoption continued to grow, albeit at a slower pace.

The Rise of Ethereum and Other Altcoins

In 2015, a new cryptocurrency called Ethereum was created. Ethereum featured smart contracts, which are programs that can automatically execute transactions when certain conditions are met. This was a game-changer in the world of cryptocurrencies and soon led to the development of other altcoins such as Litecoin, Monero, and Zcash.

Ethereum also introduced the concept of Initial Coin Offerings (ICOs), which are a way for projects to raise funds by selling tokens. This quickly became a popular method of fundraising and led to the creation of many new cryptocurrencies.

Even so, Bitcoin remained the top dog, and its price continued to rise. In 2017, Bitcoin reached an all-time high of $19,783. This was followed by a crash in 2018, after which the price stabilized around $3,000-$4,000.

The Introduction of Bitcoin Futures

After many years of preaching against Bitcoin and the entire crypto market, in December 2017 the financial institution Goldman Sachs announced that it was considering offering Bitcoin futures. This was a big deal because it meant that institutional investors were finally starting to take Bitcoin seriously.

In the months that followed, other major financial institutions such as CME Group, CBOE, and Nasdaq also announced their plans to offer Bitcoin futures. This brought about tons of liquidity to the Bitcoin market but also gave rise to concerns about Bitcoin market manipulation.

The launch of Bitcoin Futures also coincided with a huge spike in the price of Bitcoin, taking it from $10,000 to nearly $20,000 in just a matter of weeks.

A Devastating Bear Market

After reaching an all-time high in December 2017, the price of Bitcoin fell sharply throughout 2018. This was largely due to concerns about regulation, as well as the general hype around crypto dying down.

The bear market continued into 2019, with Bitcoin hitting a low of $3,122 in December 2018. As is the case with any asset, when the price of Bitcoin falls, so does the amount of money flowing out of the market. This led to many projects shutting down and workers getting laid off.

The Current State of Bitcoin

Bitcoin’s price has been on the rise again in 2020 and 2021. The popularity of cryptocurrencies with Bitcoin at the lead has given rise to a fully-fledged industry with its ecosystem of exchanges, wallets, and payment processors.

Today, there are thousands of different cryptocurrencies with a wide range of functions and purposes. While some have managed to stay relevant, others have faded into obscurity.

Even so, the crypto industry continues to grow at an alarming rate. In 2020, the total value of all cryptocurrencies increased from $193 billion to $1.3 trillion, and it is predicted to reach $10 trillion by 2025.

This rapid growth has led to increasing interest from institutional investors, as well as concerns about regulation. Nonetheless, the future of Bitcoin and the crypto industry remains bright, with many people believing that we are still in the early days of this technology.

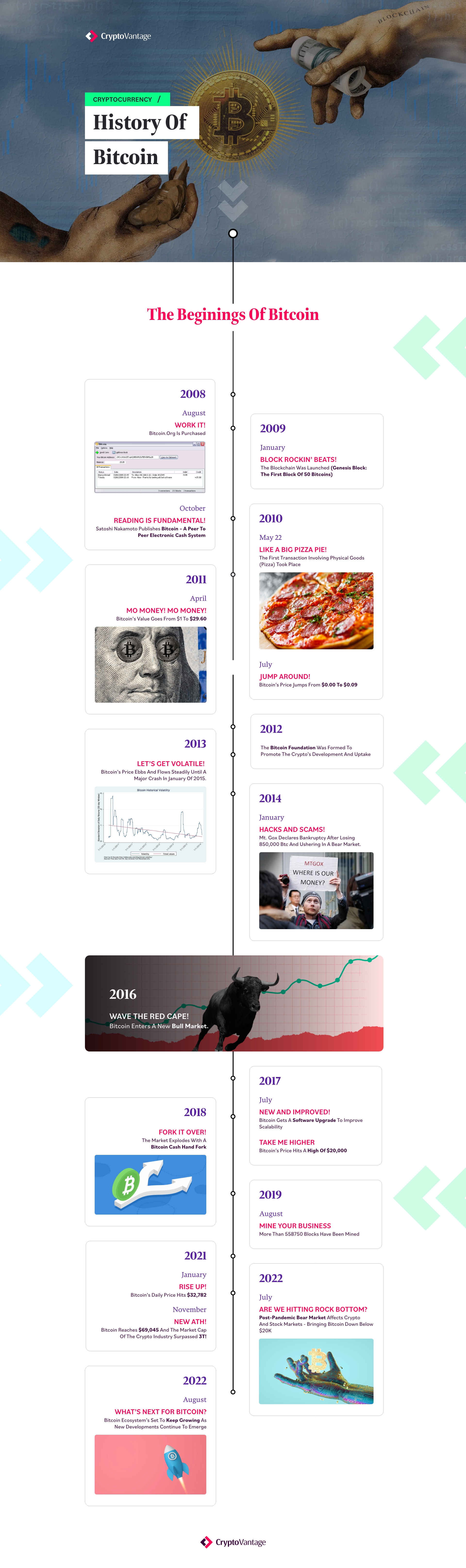

Check out this infographic that tracks the major developments in Bitcoin: