- >News

- >Which Cryptocurrencies Perform Best During a Bear Market?

Which Cryptocurrencies Perform Best During a Bear Market?

Crypto has been in a bear market since the beginning of May, when the total cap of all cryptocurrencies sank to $1.785 trillion, representing a fall of just over 20% from a four-month high of $2.273 trillion, set on April 5. And compared to this already depressed level, the market has continued to sink further, dropping another 23% by May 12 and remaining more or less in the same position ever since.

So yes, crypto is well and truly in a bear market at the moment. However, market-wide declines hide a number of nuances and exceptions, with some cryptocurrencies holding up or performing better than most. In this article, we provide a rundown of these, examining which cryptocurrencies perform best during a bear market. And while some entries in this list will be expected, some may surprise you.

Bitcoin

You may have heard of the correlation between bitcoin/cryptocurrencies and the stock market (or, in the past, gold), but arguably the most important correlation in all of crypto is that between bear markets and rising bitcoin dominance.

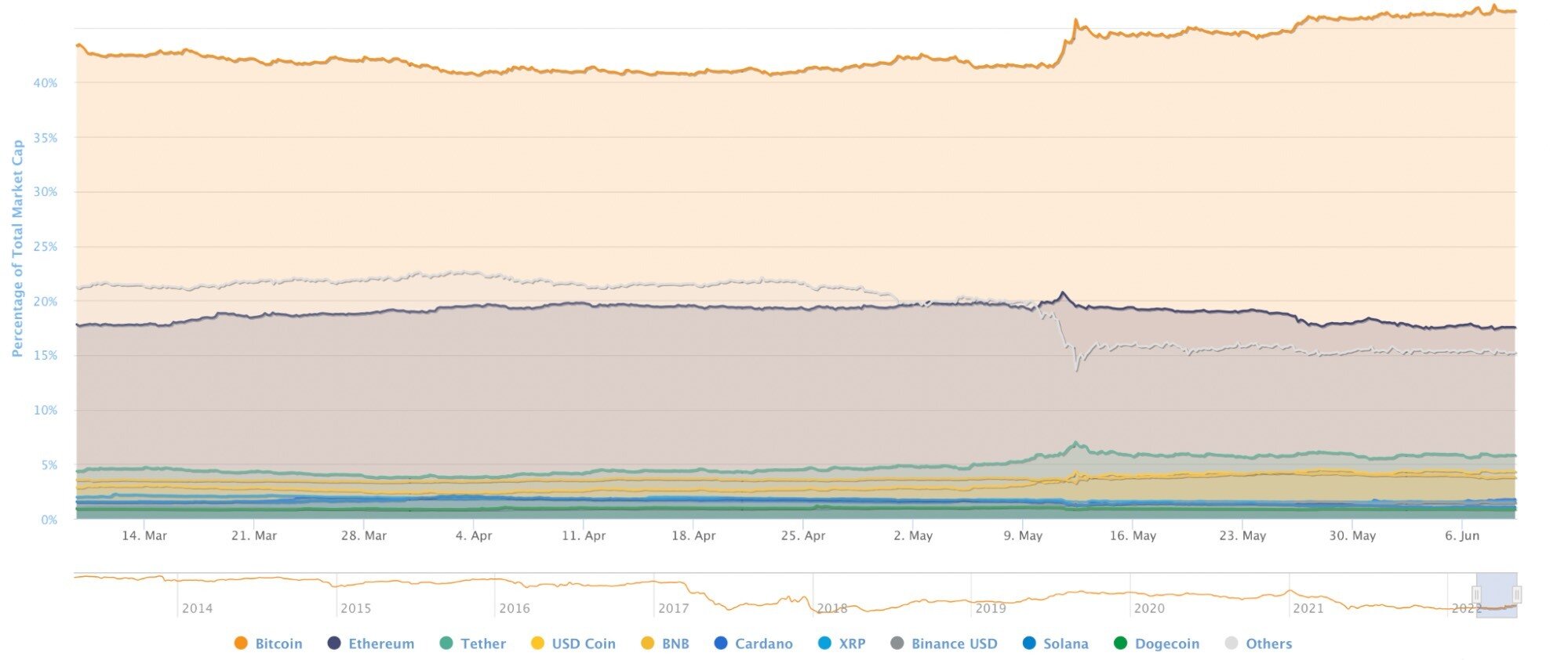

By ‘dominance,’ we mean bitcoin’s market cap as a percentage of the cap of the entire cryptocurrency market. Way back in 2013, this was a massive 95%, which wasn’t especially surprising, given that there were only a handful of other cryptocurrencies.

However, this dominance dropped significantly with the advent of Ethereum and other altcoins, falling as low as 34% with the bull market of late-2017/early-2018. It then rose again with the arrival of the 2018-19-20 ‘crypto winter,’ reaching 71% in early 2021, as BTC led a new bull market. Of course, it sank down to 40% as ‘alt season’ followed in mid-2021 and early 2022.

Now, another bear market is here, and BTC’s dominance is creeping up again. From 40% in April, it has now risen to 46.4%, according to CoinMarketCap.

Source: CoinMarketCap

Assuming that this bear market is only just getting started, it’s safe to bet that BTC’s dominance will only increase. What this means as far as investors are concerned is that bitcoin will do a better job of holding its value than most other cryptocurrencies, and may even see gains as traders exit from more highly speculative alts.

Indeed, bitcoin’s price is basically unchanged in the past month, and has lost 55% since reaching an all-time high of $69,044 in November 2021. By contrast, here are the corresponding movements for a selection of other major coins:

-

Ethereum – down by 20% in the past month, and by 62% since its November ATH

-

Cardano – up by 5% in the past month, but down by 79% since September ATH

-

Solana – down by 35% in the past month, and by 84% since November ATH

-

Dogecoin – down by 23% in the past month, and by 89% since ATH in May 2021

Sure, losing 55% since November isn’t great, but bitcoin has kind of stabilised in the past few weeks, while other major coins are still shedding value. This means that, if you have to keep your money in crypto, BTC is still the ‘safest’ option.

And most importantly, as with the bull runs of 2017 and 2020-21, a new bull market won’t happen without BTC surging first. So it really is the best option right now.

Ethereum and Undervalued Coins

While we’ve only just compared it negatively to Bitcoin, it’s worth recommending Ethereum as a cryptocurrency to buy during a bear market (although this article is not financial advice). That’s because the downturn has resulted in it being dramatically undervalued relative to its potential.

First of all, Ethereum remains the biggest blockchain platform in terms of usage, with its total value locked in — currently $69.58 billion — making up 64.65% of the total DeFi sector. As with BTC and its dominance, this has risen from 54% in April, meaning that users have returned to Ethereum as conditions have become more uncertain.

Secondly, Ethereum has something very big on the horizon: its shift to a proof-of-stake consensus mechanism. It has just successfully completed a testnet merge, which paves the way for the real merge to take place at some point later in the summer. This will make Ethereum more scalable and energy-efficient, and will likely increase demand for ETH by extension.

A similar principle applies to other altcoins with strong fundamentals. This includes Cardano, XRP, Avalanche, Polygon, Internet Computer, Polkadot, and others, which are undergoing steady growth yet are falling dramatically, due to overriding market and macroeconomic conditions. This makes them significantly undervalued, and prepares the ground for a potentially large rise once the bear market turns into a bull market again.

Binance Coin and Exchange Tokens

Maintaining the focus on relativity, Binance coin (BNB) is another token that has fallen markedly less than other major cryptocurrencies. It’s down by 3% in the past month, and by ‘only’ 57% since an all-time high of $686, set back in May 2021.

What supports BNB’s price is the fact that, as a utility token granting Binance user’s discounts on trades, it remains in use even during a bear market. In other words, there remains a certain basic level of demand for it, while its attachment to the world’s largest exchange also means that investors may have more faith in it than other general cryptocurrencies.

BNB (in blue) has fallen by less than many other coins. Source: Yahoo! Finance

Binance is admittedly the subject of an investigation by the SEC right now, but a similar story applies to a number of other exchange tokens (e.g. LEO Token, FTX, KuCoin).

Stablecoins

It may seem odd to highlight ‘stablecoins’ as among the cryptocurrency that perform best during a bear market, but there’s little doubt that most stablecoins have, on average, retained their value more than non-stablecoin cryptocurrencies.

Stablecoins such as USD Coin (USDC), Dai (DAI), Binance USD (BUSD), Tether (USDT), and the Pax Dollar (USDP) remain pegged 1:1 to the US dollar, meaning that they have officially lost 0% during the current bear market. Obviously most traders would prefer investments that rise in value (rather than just staying the same), but with pretty much everything falling, stablecoins are basically the best of a vulnerable bunch.

That said, not all stablecoins are equal, and with TerraUSD (UST) collapsing completely in May, investors should do their homework before trusting any particular stablecoin with their wealth.