- >News

- >Time to Buy ETH? Ethereum Smart Contracts Hit All-Time High

Time to Buy ETH? Ethereum Smart Contracts Hit All-Time High

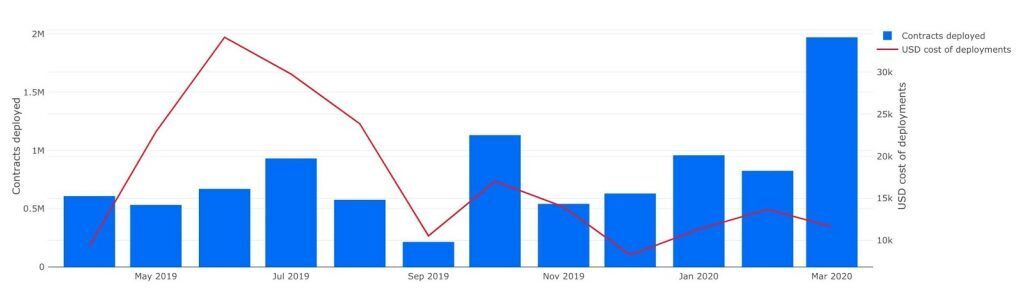

Smart contracts running on the Ethereum blockchain hit an all-time high in March, according to new research from Dune Analytics. The total number of contracts deployed in March numbered almost two million, eclipsing the previous record of 1.1 million set in October 2019.

At a time when the cryptocurrency industry is weathering the uncertainty caused by the coronavirus pandemic, the news of growing demand for Ethereum-based smart contracts is encouraging. If nothing else, it indicates that decentralized finance (DeFi) is finally hitting its stride, and will witness a growing surge of sustained interest once the Covid-19-caused economic downturn ends.

And with the Ethereum 2.0 testnet being launched in April, it looks like the price of ETH will continue seeing better-than-average growth in the short- to medium-term, when compared with most cryptocurrencies.

Rising Smart Contracts = Growing Demand for DeFi

Impressively, Dune Analytics noted in its research that the new record – of 1.97 million contracts – represents growth of more than 75% compared to the previous record of 1.1 million contracts, set in October 2019.

Source: Twitter/Dune Analytics

Picking up on this data, Norway-based Arcane Research suggested that growing demand for DeFi services was largely responsible for the record-breaking smart contract numbers.

Source: Arcane Research

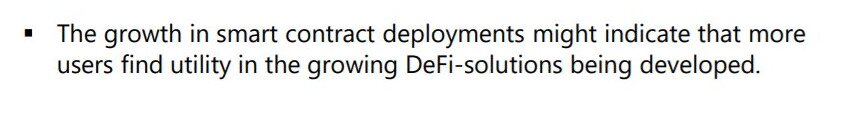

As certain observers pointed out, many of the 1.97 million contracts were GasToken contracts, which allow Ethereum users to tokenize gas, which is used to pay for transactions on the Ethereum network (basically, it enables them to stock up on gas when it’s cheaper). Nonetheless, even with this caveat, March was still a record-breaking month for Ethereum.

Source: Twitter

So even with empty contracts and GasToken contracts removed, there’s a growing demand for genuine Ethereum-based smart contracts. This chimes in with other recent research which has found a growth in the Ethereum DeFi sector.

For example, in March DappRadar revealed that the daily value in USD across the Ethereum DApp ecosystem in February 2020 reached $1.9 billion, which represents a 27% month-on-month increase compared to January.

In fact, between February 2019 and February 2020, the total USD value (including ETH and ERC20 tokens) of all Ethereum-based DApps increased by a staggering 683%.

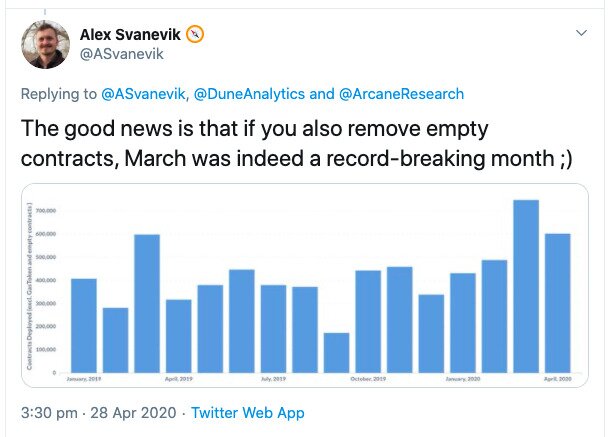

Within this growth, DeFi applications were the biggest growers, witnessing a 294% year-on-year rise. Likewise, DeFi apps generated only 200 daily active unique wallets in February 2019, but rose by 473.5% – to 1,147 – by February 2020.

Source: DappRadar

The data doesn’t stop there. At the beginning of March, DappReview reported that Ethereum-based DeFi grew by 778% in terms of transaction volume compared to Q1 2019.

In other words, decentralized finance applications – such as Compound, dyDx, Fulcrum, and MakerDAO – are responsible for much of the growth we’re witnessing in Ethereum smart contracts, and in Ethereum more generally.

But further good news for Ethereum is that it’s not only DeFi that’s pushing it upwards, but also such categories as games and marketplaces, which were responsible for just over 10,000 daily active unique wallets in February (according to DappRadar).

Growing Demand for DeFi = Growing Demand for ETH

More importantly for traders, growing activity on the Ethereum blockchain seems to have pushed the price of ETH higher than most other cryptocurrencies, at least in recent months.

Since the cryptocurrency market suffered a dramatic fall on March 13, ETH has risen from $100 to roughly $210 (as of writing on April 30), an increase of 110%. By contrast, BTC has risen by ‘only’ 98% across the same period. Meanwhile, XRP, BCH and LTC have risen by 74%, 78% and 74%, respectively, according to CoinMarketCap.

It’s likely that demand for DeFi applications and for smart contracts explains why ETH has increased by a bigger percentage relative to other cryptocurrencies. On the one hand, smart contracts incur transaction fees paid in ETH, which therefore increases demand for the cryptocurrency. On the other, the fact that Ethereum is witnessing growing activity may be leading more traders to invest more in the coin, suspecting that it and its native blockchain have a longer term future.

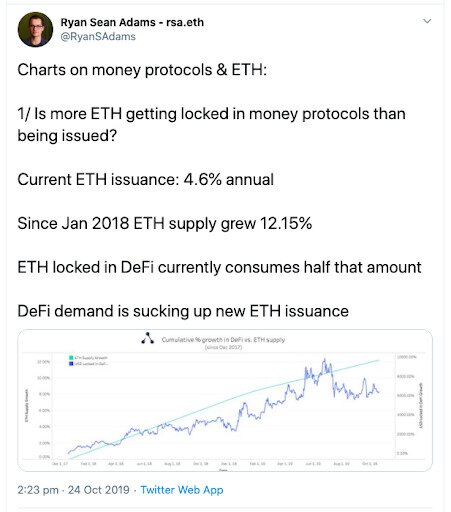

As Mythos Capital founder Ryan Sean Adams wrote in a March article, ETH “serves as the primary reserve asset supplying economic bandwidth for [Ethereum’s] money protocols and financial applications.” Or, as he put it in a tweet from October:

Source: Twitter

Put simply, demand for DeFi results in demand for ETH.

Ethereum 2.0 and The Future of ETH

The demand for DeFi may increase even further in the future, particularly with the launch of Ethereum 2.0. Intended to move Ethereum away from a proof-of-work consensus mechanism to a more scalable proof-of-stake alternative, its latest testnet was launched in April and currently has around 23,000 validators.

Being a proof-of-stake blockchain, Ethereum 2.0 will provide investors with the potential to earn income from staking. Basically, by staking an amount of ETH in the Ethereum blockchain (in order to validate blocks), users could earn a reward of anything between 1.5% and 18%.

Already, analysts are predicting that Ethereum 2.0 could spark an explosion in demand for ETH, in order to participate in staking and DeFi. Writing on Twitter in April, Metacartel Ventures’ Adam Cochran predicted that staking will reduce the circulating supply of ETH, which in turn will drive up its price.

Source: Twitter

Ethereum 2.0 is due to launch finally later in the year. As with most things in crypto, it’s not certain just how much it will impact ETH’s price. Regardless, the economic logic of staking suggests that it will exert upwards pressure. And with the growing number of DeFi applications also raising demand for ETH, the cryptocurrency could experience a very strong end to 2020.