Compare The Best Apps to Buy Stocks in 2025

Platform

Why We Recommend

Feature

Safe and insured by multiple financial regulators

Low account minimums and high investment rewards

How To Sign Up For a Crypto and Stock Trading App

Here’s the good news:

The steps for signing up for a crypto and stock trading app are quite similar for most of the options on this toplist. The processes are secure and fairly intuitive, all-around.

That being said, there are some subtle differences to look out for, as minor (yet important) processes do differ from one platform to the next. Just be aware that some steps might be a little bit different from the description here.Let’s get into the general sign up process and how it all works.

Step 1: Visit the site and download its app

The first step in signing up for a crypto and stock trading app is to visit its site and download its app from your device’s app store. The exact procedure depends on the individual stock trading app and whether you are downloading it on an Android or iOS device.

Step 2: Fill out personal information and verify your identity

When signing up for a crypto and stock trading app, you will have to provide your personal information to verify your identity. This typically includes your address, full name, date of birth, email, and phone number. In some cases, they may even request your occupation and source of funding. Additionally, you may have to provide pictures of an identity document, such as your driver’s license, passport, or national ID card.

Step 3: Wait for your identity verification to be completed

Once you have correctly filled in all your personal information and uploaded the required documents, you will have to wait for the platform to verify your identity, before you can start trading or investing in crypto and/or stocks.

This can take a few minutes, hours, or days, depending on the platform and the accuracy of the information and documents you provided. We found that identity verification often takes between two and four hours, provided that all the information has been filled in correctly.

Step 4: Funding your account

Once your identity has been verified by the crypto and stock trading platform, you can deposit funds. This can typically be done through an “Add Funds’’ or “Deposit’’ button. With some apps, you may need to link a bank account or card during this step.

Depending on the crypto and stock trading app you’re using, the funds may be instantly available, or the transfer may need to settle first. For example, with Wealthsimple, you can deposit up to $1,500 instantly. Once the funds are available in your account, you can make your first crypto stock trade or investment.

Step 5: Make a trade

Once the funds are available in your account, you can make your first trade. This can be done as a market or limit order, depending on the app chosen. In some cases, your account will need to be verified first.

Personal tip: Make sure to double-check that you are completely satisfied with the amount you are buying and the associated fees, then submit your order. The app will execute the trade automatically when the set conditions are met, and the asset will be in your account when the trade has been completed.

My Overview

“In my opinion, dual-trading apps have come a long way in the last few years. Today, the best stock apps offer seamless integration for both stocks and crypto, with user-friendly interfaces and advanced features. This makes them not only the best apps for buying stocks, but also the best option for cross-traders looking to expand their portfolios.”

What Are The Best Apps For Trading Stocks

There are plenty of top trading apps to pick from these days. This is why we have carefully examined the features and functionalities of the leading brands to present you with a comprehensive list of excellent all-rounder platforms. Don’t worry, we have also ensured they offer dual-functionality with your crypto assets.

The best stock apps provide you with top-of-the-range features, are easy to navigate, secure and offer various crypto and stock options. Not to mention, they should not break the bank. We are here to make money, after all. Take a closer look at the apps that tick all the boxes.

Robinhood

Robinhood is a crypto and stock trading app that rose to popularity due to its no-commission fee structure. It added a crypto section to its platform during the crypto asset bubble of 2017. Note that Robinhood is currently only available to US citizens.

As arguably the best stock trading apps, Robinhood boasts zero commissions on both stock and crypto trades. It makes money by incorporating a price spread on its markets instead. Available investment options at Robinhood include cash management on uninvested cash, stocks, ETFs, gold, and crypto.

As of writing, Robinhood offers over 35 coins and tokens for trading and investing. Almost all of these can be deposited and withdrawn from the platform using its built-in cryptocurrency wallet features. Additionally, Robinhood offers staking opportunities, allowing users to earn up to 15% APY on their idle crypto holdings. Robinhood even allows users to invest in cryptocurrency exchanges, for instance, by buying Coinbase stock.

Why choose Robinhood?

My experience with Robinhood: I recommend Robinhood as one of the best overall apps for trading crypto and stocks because it offers great value for your hard-earned money. Especially, when it comes to instantly buying and selling cryptocurrencies and stocks. The frequent bonus promotions and staking opportunities make Robinhood truly stand out from the competition.

Robinhood user experience

Robinhood makes it straightforward to sign up, deposit, and trade, all within the same day. Added to this, they store the majority of the crypto holdings in cold storage, adding an extra layer of security for those valuable assets.

Available platforms

- iOS

- Android

- Web-based (for PC and laptop users)

- A great one-stop shop for anyone looking to invest in cryptocurrency or stocks

- Easy onboarding procedure requires very little from user

- Fully regulated financial institution in the United States

- Support for BTC, ETH, LTC, BCH, DOGE, ETC, and BSV

Pros

Offers commission-free trades

Buy and sell stocks and crypto from a single app

Easy sign-up process and beginner-friendly trading platform

Cons

Only available to US citizens

Limited crypto selection compared to the other best apps for trading crypto and stocks

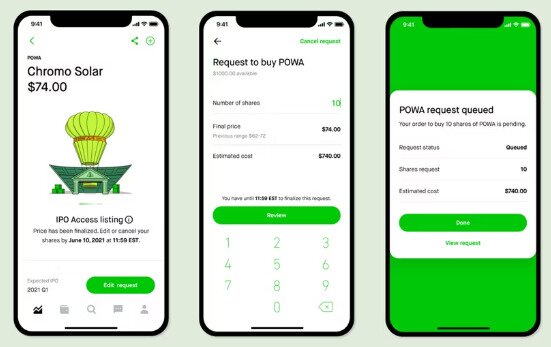

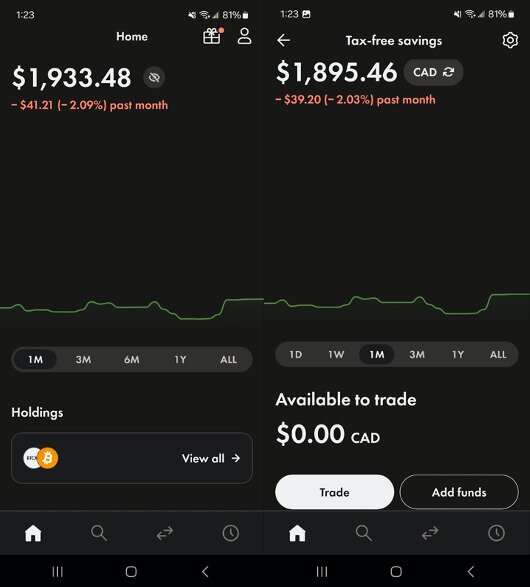

Wealthsimple

Wealthsimple was launched in 2014, and the financial technology company is primarily focused on providing ways for its users to easily access and manage crypto and stock investments via automated savings systems. Users can buy and sell stocks, as well as crypto, across multiple exchanges in a personal or tax-free savings account (TFSA), making it one of the best crypto and stock trading apps around.

Now that Wealthsimple has added cryptocurrencies to its offerings, traders and investors can even buy and sell supported digital assets on the platform. Wealthsimple is a dual-investing app that offers both crypto and traditional investments through a single trading platform. This kind of flexibility is why Wealthsimple has become one of the best trading apps for stocks and crypto.

The Wealthsimple trading app provides investment options in Canadian stock markets, such as the Toronto Stock Exchange (TSX), while simultaneously offering users access to US markets like the NASDAQ, ETFs, and more. Cryptocurrency-wise, Wealthsimple currently offers access to 66 digital assets for buying and selling.

Why choose Wealthsimple?

My experience with Wealthsimple: I recommend selecting Wealthsimple because it offers a great way to automatically invest in both stocks and crypto. Another key reason to use Wealthsimple is its significantly lower management fees (that are up to 4 percent lower than the average Canadian mutual fund). A great alternative is Voyager.

Wealthsimple user experience

Wealthsimple’s Instant Deposit is a stand-out that is incredibly convenient when looking to buy a dip on your favorite stocks and cryptos. Another great plus to take note of is the excellent support system. If you need it, you can speak to a professional financial advisor seven days a week. This ensures that you always have someone to ask when you are unsure of an investment.

Available Platforms

- iOS

- Android

- Web-based (for PC and laptop users)

- All-in-one app that features banking, stocks and cryptocurrency options

- Wealthsimple Crypto is available to Canadians only

- Wealthsimple is very safe and insured by several regulators

- One of the fastest growing online financial institutions in the world

Pros

Offers no-commission trading

Easy deposits and withdrawals

Canadian users have access to both Canadian and American stock markets

Cons

Currently not available to US citizens

Relatively high spread fees compared to cryptocurrency exchanges

eToro

eToro originally launched in 2007 for trading stocks, CFDs, and other traditional financial assets. These days, it is a top contender for the best app for buying stocks and just top trading apps in general. It accepts credit cards, debit cards, and wire transfers as payment methods and doesn’t charge any deposit fees.

The eToro trading app is available for US, UK, and many European users, but Canadians are unfortunately excluded from the list. The eToro app provides access to stocks, ETFs, and cryptocurrencies, and also provides a social trading aspect, allowing users to copy each other’s trading strategies for free.

As of writing, eToro offers 130 crypto coins and tokens on its platform, with staking options for Ethereum, Cardano, and Tron. It is also possible to use eToro Money in some countries and geographical locations. This feature allows you to use your eToro account as a cryptocurrency hot wallet.

Why choose eToro?

My experience using eToro: I recommend picking eToro as a stock and crypto trading app if you are looking for a large selection of trading and investment options. With more than 15 years in the business, eToro must be doing something very right. Another reason why I would recommend signing up at eToro is the fact that its user interface is incredibly beginner-friendly, allowing you to easily buy your first crypto or stocks with just a few clicks.

eToro user experience

The eToro app is extremely convenient. When compared to some other trading apps on the market, eToro makes it very straightforward to move assets. The eToro app can be downloaded on both iOS and Android devices and has a sleek, modern design.

Available Platforms

- iOS

- Android

- Web-based (for PC and laptop users)

- Great for crypto beginners

- Solid crypto/general trading platform

- Reliable company with solid trust in the community

- Fully supports credit cards for deposits and withdrawals

Pros

Large selection of both crypto and stocks

Staking options available

Relatively low trading and non-trading fees

Cons

Not available in Canada

eToro Money Wallet feature not available to all users

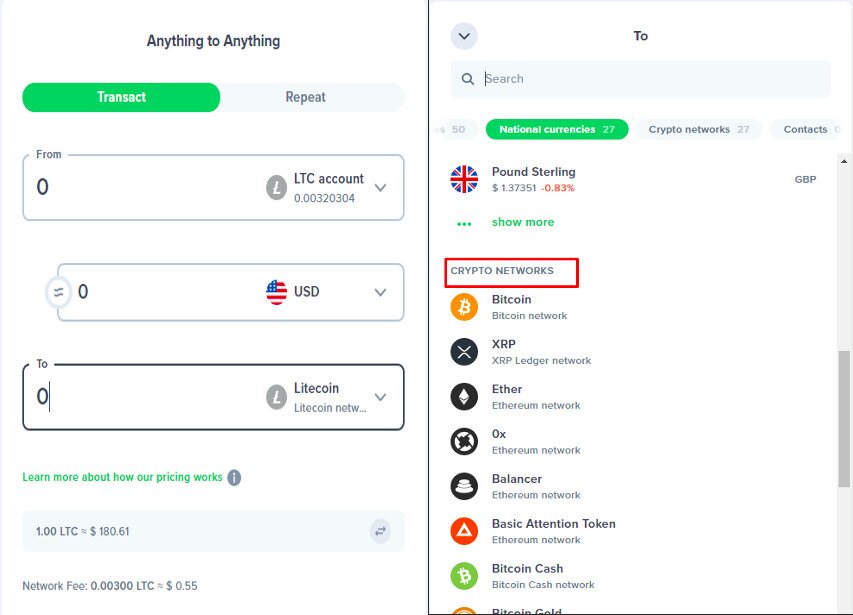

Uphold

The Uphold Exchange is one of the best stock trading apps on the list, as it allows users to convert their (digital) assets to any other supported asset from the same trading page. For example, it is possible to convert Bitcoin (BTC) to US stocks like Apple (AAPL) from within the same account.

This asset-swapping feature is quite unique, and it allows users to decide what they want to trade and receive instantly. Most of the other apps for trading crypto and stocks mentioned in this guide would require you to first swap Bitcoin for cash, then cash for stock(s). Uphold Exchange’s system is much smoother and may end up saving you tons of time in the long haul.

Why choose Uphold?

My experience using Uphold: I would recommend choosing Uphold because of its incredibly handy features and design. Another advantage of using Uphold is that you can order a MasterCard-brand debit card that allows you to spend your crypto by swiping a card wherever the payment method is accepted.

Uphold user experience

Being able to convert any supported asset, into another, through a simple interface is definitely a notable benefit. This general ease of use extends beyond the one-stop asset swapping. Almost every aspect of the Uphold platform is extremely convenient, fast, and fine-tuned for both traders and investors who like quick solutions.

Available Platforms

- iOS

- Android

- Web-based (for PC and laptop users)

- The ultimate anything-to-anything exchange with support for foreign currencies, crypto, precious metals and more

- Easy sign-up process with streamlined UI

- Remarkably secure with proof of assets feature

- Available to people in over 150 different countries

Pros

Uphold reports its reserves regularly

Extremely easy to convert stock to crypto and vice versa

Easy-to-use trading interface

Cons

Fees are charged as spreads

Relatively high withdrawal fees

Pros

Low fees, clocking in at 1%

Convenient, easy to use and beginner-friendly

Intuitive user interface that allows for easy trading and investing

Cons

Crypto and stock trading is now split into two different apps

Only 8 cryptocurrencies available

Tips on Investing for Crypto and Stock Using a App

There are several important factors to consider when looking to invest in crypto or stocks using dual-trading apps. However, safety and security should always be near the top of the list. It’s also crucial to choose reliable investment options. If you’re unsure about which cryptocurrencies are the safest to invest in, check out our guide on the safest crypto to invest in for informed decisions and secure digital asset management.

How will the app store my assets?

For cryptocurrencies, most apps mentioned in this guide will keep 95% or more of their customers’ funds in cold storage (offline), in case of a security breach. This option is more secure, but can be tedious when you want to trade quickly. On the other hand, some platforms will act as custodian for your crypto holdings, but keep your tokens in an online “hot’’ wallet. This method is much more convenient, but also more vulnerable to attacks. Some platforms, like Robinhood and eToro, use a mix of both hot and cold storage. It is important to examine your needs, and to do your research, before you start investing.

How will my account be secured?

It is crucial to check if the app chosen requires you to use two-factor authentication (2FA) or similar methods when signing in, making withdrawals, or placing trades. Ideally, you want there to be an extra layer of security in case someone gains unauthorized access to your account.

How will my data be secured in the event of a security breach?

As long as the platform you’re using is properly regulated, you can rest assured that your user data is secured. Every app on my list meets the high standards noted above, as they all offer 2FA or similar account security features, while also keeping most user funds offline.

Frequently Asked Questions

While most platforms mentioned in this guide advertise zero commissions on trades, there is often a caveat to those statements. The Securities and Exchange Commission (SEC) assesses transaction fees on exchanges it regulates. Additionally, FINRA charges a trading activity fee to those exchanges.

These platforms pass these fees on to their users, but they are typically not incurred unless you pass certain thresholds for trading (a transaction for over $500, for example). One should note that SEC-regulated exchanges that advertise zero fees may have some fine print to read through.

The apps mentioned in this guide offer the best of both worlds, with crypto and stock trading functionalities. Stock trading apps, like Binance, even come with a few advantages over the best crypto exchanges.

In most cases, their user interface is much simpler. Additionally, you aren’t interacting directly with your crypto and don’t have to worry about crypto addresses or high gas fees. However, if you are only interested in crypto trading, it will be best to focus your approach with cryptocurrency exchanges, like Coinbase or Kraken and their respective mobile apps.

Although both of these assets are tied to supply and demand, they actually differ in a few key aspects.

Cryptocurrencies, as the name suggests, are currencies that leverage blockchain technology. They can be exchanged, used to store wealth, or even used as a token. They are highly volatile and still largely unregulated. Stocks, however, represent equity in a specific company and are highly regulated. Stocks can be leveraged for voting rights and dividends, but their value is ultimately determined by the performance of the company and other market forces.

Robinhood and Webull are great options for those interested in stock-only trading. The main reason is that both apps have a great selection of US, Canadian, and international stocks available for investing or trading. Plus, they have incredible features that make trading a breeze.

If you’re looking to buy and hold stocks for a while before selling them, Webull is the most optimal app out of the platforms mentioned in this guide, because of its low maintenance fees. Another key reason why Webull is the optimal app for stock investing is the fact that its user interface is beginner-friendly and intuitively designed.

eToro is the most suitable for new traders, as it has the most understandable user interface and extensive educational material available. Additionally, it offers a demo account for beginner traders and investors who want to try it out, before committing.

In general, dividend stocks are the most suitable for new investors. These stocks are generally backed by businesses that can pay out yearly dividends to their investors.