- >News

- >Best Ways to Earn Passive Income with Crypto in 2022

Best Ways to Earn Passive Income with Crypto in 2022

While the early days of bitcoin and cryptocurrency were dominated by traders looking to buy low and sell high, the crypto ecosystem has recently seen increased financialization and different ways in which users are able to earn passive income on their crypto holdings.

With developments such as staking and lending, crypto holders are now able to earn additional returns on top of the potential increase in price of their underlying crypto holdings. Much like the traditional financial system, there are varying degrees of risk that come with different methods of earning passive income on bitcoin, ether, and a large number of other crypto assets.

Before seeking additional yields on your crypto assets, it’s important to understand the risks associated with various areas of decentralized finance (DeFi) and centralized finance (CeFi). Let’s take a closer look at three of the most popular ways crypto users are earning additional returns on their assets today.

Staking with an Exchange

The simplest way to get started with passive income in crypto is to look at the various options for staking cryptocurrencies on exchanges. Centralized exchanges are able to remove all of the complexities that come with staking crypto assets on decentralized financial protocols, which makes them the perfect option for anyone who is still somewhat new to the wild world of crypto.

As a reminder, staking is a key aspect of cryptocurrencies that operate on proof-of-stake (PoS) rather than proof-of-work (PoW). In PoS, crypto users stake the underlying crypto token associated with the blockchain network to mine new tokens rather than using the specialized, energy-intensive hardware that is used in PoW systems like Bitcoin. When users stake their crypto holdings as part of the consensus process, they earn a return denominated in the same crypto they have staked on the network. These tokens could be newly generated, collected as transaction fees, or both.

While PoS cryptosystems can be somewhat difficult to fully grasp, many exchanges and crypto financial institutions offer to stake coins on behalf of their users. While the centralized institutions charge an additional fee for their added convenience, it is more than worth it in many situations due to the simplification of the entire process. Of course, it should be noted that staking through a centralized custodian throws out the key principle of decentralization that underlies the entire value proposition of crypto. Three of the most popular options for staking assistance are Kraken, Coinbase, and Binance.

Kraken

Kraken currently offers twelve different crypto assets for staking on their platform. That said, it should be noted that non-PoS-based assets, such as bitcoin and U.S. dollars, are mixed in with PoS coins such as Cosmos and Tezos. Kava is the crypto asset that pays the highest yearly Pos reward on Kraken at 20%. Here is the full list of assets that can be staked on Kraken:

- Polkadot

- Kusama

- Cardano

- Flow

- Ethereum (ETH 2.0)

- Solana

- Cosmos

- Tezos

- Kava

- Euro

- U.S. dollar

- Bitcoin

Kraken offers both on-chain and off-chain staking on its platform. The returns earned from staking euros, U.S. dollars, and bitcoin come from internal programs at Kraken rather than on-chain protocol staking.

- Exceptionally secure exchange with proof of reserves

- Supports many different funding options

- Accepts users from across the globe including USA and Canada

- Very high trading volume

Coinbase

Coinbase is the most well-known crypto brand in the United States, but their staking options are still somewhat limited at this time. In addition to having a low number of different crypto assets available for staking, the returns offered by Coinbase are lower than what can be found with other centralized exchanges on the market. For example, staking ETH nets you a 5-7% return on Kraken; however, the rate is only 4.5% on Coinbase. Here is the full list of PoS coins offered for staking on Coinbase:

- Algorand

- Cosmos

- Ethereum

- Tezos

Coinbase also offers rewards on non-PoS-based crypto assets such as Dai and USD Coin. The highest rate of return available for staking on Coinbase is 5%, which is available for Cosmos.

- Earn $200 in free crypto after completing sign-up process. Terms apply.

- Variety of products including exchange, staking, wallet

- Advanced Trading options for experienced traders

Staking with a Wallet

While staking with an exchange is a solid option for someone who is new to crypto finance, staking with a wallet will generally lead to higher returns and more control over one’s crypto assets.

When you stake with a wallet rather than an exchange, you will be interacting directly with a PoS blockchain network rather than going through a middleman who will charge additional fees. If you’re a bit more technically inclined than the average person, then staking your crypto assets through your own non-custodial wallet is going to be your best bet. Of course, it’s important to understand the high amount of responsibility you are putting into your own hands when you decide to take full custody of the private keys associated with your crypto holdings.

Let’s take a closer look at three of the best wallets for those who are looking to take full control over their crypto staking activities.

Exodus

Exodus is a multi-chain crypto wallet that supports the staking of seven different crypto assets. All of the staking available in this app is completed in the Rewards section, which is a single interface for tracking all of the different ways you are earning passive income on your crypto holdings. Having one screen for tracking all of your staking rewards makes Exodus an attractive option for those who are looking to take a deep dive into this method of earning yield on crypto assets. Here are the coins that can be staked in the Exodus cryptocurrency wallet:

- Algorand

- Cardano

- Cosmos

- ONT/ONG

- Solana

- Tezos

- VeChain

One glaring omission from Exodus in terms of staking options is Ethereum. Although Ethereum 2.0 has yet to officially launch, it is already possible to stake ETH on the Ethereum 2.0 network. In addition to staking with PoS chains, Exodus has also integrated with Compound Finance’s borrowing and lending platform.

- Free to download for desktop & mobile

- Supports multiple hardware wallets

- Supports over 100 cryptocurrencies

- Great customer support

Ledger Live

Ledger Live is the official crypto wallet that pairs with various types of hardware wallets created by the Ledger team. There are currently five different crypto assets that can be staked via the Ledger Live wallet, but Ethereum is not one of the available options. It should be noted that many other third-party wallets will also allow their users to take advantage of a hardware wallet, so it’s also possible to use Ledger’s hardware with other software options for staking. Here are the coins that can be staked via the Ledger Live crypto wallet:

- Algorand

- Cosmos

- Polkadot

- Tezos

- Tron

Although Ethereum staking is not directly available in the Ledger Live wallet, ETH can be staked by accessing the Lido dapp (decentralized application) through the Ledger Live software. By using Lido, Ethereum users are able to stake ETH without needing 32 ETH to be their own network validator.

Note: You will need to buy a Ledger hardware wallet to use Ledger Live.

- Flagship Ledger wallet with industrial-grade security with bluetooth

- Supports over 1300 crypto assets and tokens

- Supports all major desktop and mobile operating systems

- Connect to Ledger Live for staking, DeFi, NFTs and more

Trust Wallet

Trust Wallet includes the most extensive support for staking coins of the three wallets covered in this article. There are eleven different coins that can be staked via Trust Wallet; however, Ethereum is, yet again, not a natively-supported option in this wallet. Here are all of the different crypto assets that can be staked in the Trust Wallet:

- Binance Coin

- Tezos

- Terra

- Callisto

- TomoChain

- Algorand

- Tron

- Cosmos

- VeChain

- Kava

- IoTeX

In addition to the coins that are currently supported for staking, Trust Wallet has plans to add even more PoS coins in the near future. Trust Wallet also includes a dapp browser in its interface, which means a variety of other ways of earning yield on crypto-assets can be accessed via the wallet.

- Highly respected multi-crypto wallet that launched as an open-source project

- Stake coins like Binance Coin, Kava and Cosmos to earn interest

- Options to buy cryptocurrency directly in wallet

- Supports NFTs and in-browser dApps

Crypto Earn (Also Known as Lend)

While staking is a new way of earning passive income that was created for securing various blockchain protocols, there are also more traditional ways of earning a return on crypto holdings, such as allowing others to borrow your crypto assets for a certain period of time.

In general, the ability to earn yield via lending is more widely available in a larger part of the crypto ecosystem, as there is no need for a coin to be attached to a PoS consensus protocol in order to earn a return. Therefore it’s possible to earn yield on Bitcoin (which is not based on PoS).

Borrowing and lending in the crypto industry works in a manner similar to how it works in the traditional financial world; however, the returns available on these sorts of “interest accounts” tend to be much higher than what is available in legacy banks. Of course the risk is generally regarded as higher than traditional banks and these services are very centralized, which runs antithetical to much of the original crypto ethos.

Here are three of the most popular options available for lending out your crypto assets to other users.

Celsius Network

Celsius Network is another one of the largest crypto lenders in the market, and many market commentators say this is largely due to the platforms native token, known as CEL. Some of the highest rates of interest in the industry are offered by Celsius Network; however, users must be willing to receive payouts denominated in CEL tokens to achieve the highest interest rates. Users of Celsius Network can earn up to 17% APY on their crypto tokens. There are dozens of coins that can be lent out via Celsius Network, and here are some of the more popular assets on this platform:

- TUSD

- GUSD

- PAX

- USDC

- USDT

- SNX

- MATIC

- DOT

- CEL

- AAVE

- LUNA

- ETH

- LTC

- BTC

- WBTC

- BCH

- ETC

- XRP

Notably, the first 0.25 BTC deposited to Celsius Network can earn users an interest rate of 6.2% per year. Currently, SNX is the crypto asset that pays the highest rate of interest on this platform at 13.99% APY.

- Easy to use app, instant loans

- Some of the highest interest rates in crypto lending

- Users can lend and borrow 38+ different cryptos including BTC, USDC, BNB and CEL

- Free Bitcoin with sign-up codes

Conclusion: The Time to Earn is Now

While generating a yield from crypto will always carry some inherent risk it’s never been easier to gain passive income from staking or lending your crypto.

There’s simply something for just about everyone with centralized exchanges and lending organizations offering simple yield-generating solutions to more decentralized opportunities like wallet staking or even staking directly with cryptocurrency networks.

If you’re interested in putting your coins to work you should be able to find at least one reliable method of getting some side income.

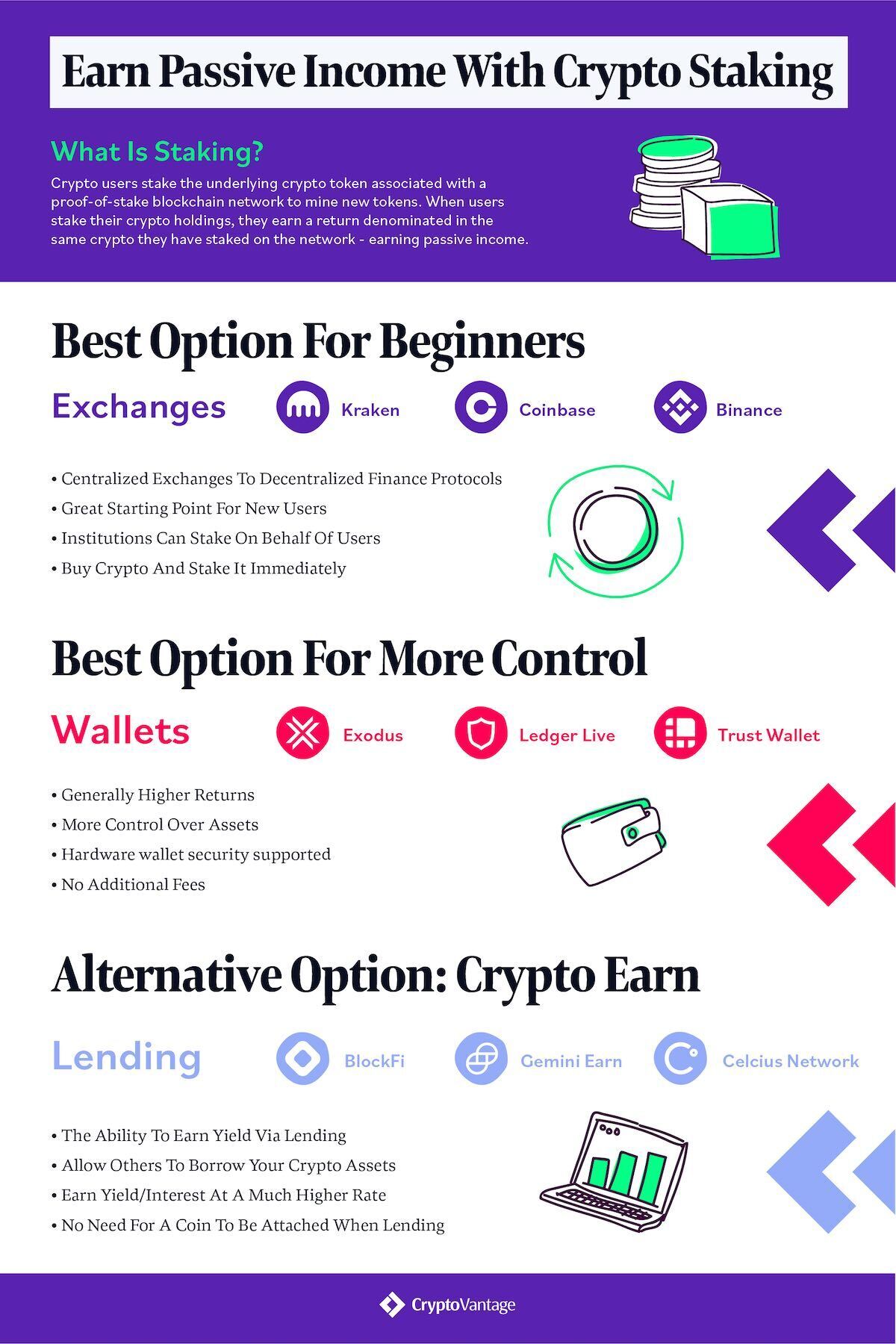

Here’s a graphic summary of what we’ve learned today: