Where to Spend Crypto

This article aims to provide you with a better understanding of how and where you can spend Bitcoin (as well as other cryptocurrencies). We will provide an overview of some of the major companies that accept Bitcoin as a payment option; we will also discuss the limitations and fees involved so that you don’t end up caught off guard.

Don’t worry if you’re not interested in using your Bitcoin to purchase items from these major companies, we also cover different use cases ranging from trading Bitcoin for other assets or donating it to charities.

Major Companies That Accept Bitcoin

There are many companies that accept Bitcoin for online purchases, including some of the world’s largest companies. Most of these large companies don’t accept Bitcoin directly but accept the payment through a processor such as BitPay or Coinbase. Payment processors charge a small fee, usually around 1%, and convert the Bitcoin to the merchant’s preferred currency. Some merchants may pass these fees on to the customer, although it would likely go unnoticed since the fees are less than they would be with traditional payment methods such as credit cards.

Overstock

With over a billion dollars in annual revenue, Overstock is one of the world’s largest online retailers. In 2014, Overstock became the first major retailer to accept Bitcoin as a payment option, using Coinbase as their payment processor. Much of what Overstock offers is home furniture and décor, but they also sell everything from electronics to clothing to outdoor sporting goods. Bitcoin payments are currently available on the Overstock.com desktop website but are not accepted on the mobile website or Overstock.ca at the time this article was written.

Newegg

Another of the world’s largest online retailers, Newegg, has accepted Bitcoin via BitPay on their online store since 2014. Newegg sells a wide range of items but are mostly known for their selection of computers and computer components. Whether you are looking for a computer for work or gaming, or if you want to build your own from scratch, Newegg offers a wide array of options that can be purchased with Bitcoin. However, items available for sale on Newegg’s marketplace cannot be purchased using Bitcoin – this option is only available for items sold directly by Newegg.

AT&T

AT&T, the world’s largest telecommunications company, started using the payment processor BitPay in May 2019 to accept Bitcoin payments for online bills. This allows AT&T customers to pay their cellphone, internet, and TV bills using Bitcoin.

Flexa

Although unconfirmed, Forbes reported in May 2019 that a payments startup called Flexa was beta-testing an app that would allow many partner companies to accept Bitcoin as a payment option. Some of these companies include Starbucks, Nordstrom, and Whole Foods. Spedn, Flexa’s first app, generates a QR code on the customer’s phone, which is then scanned by the merchant to debit the customer’s Spedn account. As with other Bitcoin payment processors, merchants using Spedn don’t receive actual Bitcoin – the Bitcoin is converted to the local currency for a small fee and given to the merchant.

Companies That Previously Accepted Bitcoin

Following the massive attention Bitcoin received at the beginning of 2018, Microsoft started allowing users to deposit funds into their Microsoft accounts using Bitcoin. Since then, it seems that Microsoft removed this option, possibly due to the drop in mainstream attention as well as Bitcoin’s high price volatility.

Another major company that previously accepted Bitcoin was Expedia, the online travel shopping giant. Expedia stopped accepting Bitcoin in mid-2018, possibly for the same reasons suggested above for Microsoft.

These examples show that some of the biggest companies in the world have the knowledge and capacity to accept Bitcoin when the consumer demand is there, meaning they could start accepting it again in the future.

Microsoft and Expedia dropping their Bitcoin payments shows us that other companies that currently accept Bitcoin may not always accept it. Keep this in mind when shopping at the businesses described in this article, as they could stop accepting Bitcoin at any time.

Tesla is a somewhat unusual company in this category. The company purchased $1.5 billion Bitcoin in early 2021 and announced it would start accepting BTC as payment for its vehicles. Than later that year Tesla CEO Elon Musk announced the company would stop accepting Bitcoin over concerns of the “rapidly increasing use of fossil fuels to mine Bitcoin”. That, of course, caused the price of Bitcoin to plunge, which in turn hurt Tesla’s BTC holdings. The company later divested itself of the majority of its BTC holdings at a significant loss.

Musk has said the company will likely start accepting BTC again when, and if, miners can prove they are using mostly renewable energy.

Other Uses for Spending Bitcoin

It’s great that major companies are starting to accept Bitcoin payments, but what other ways can we spend Bitcoin? As Bitcoin significantly reduces the barriers to entry for e-commerce and online payments, there are many small businesses and charities that accept Bitcoin.

Buying Gift Cards

There are services all around the world that offer local gift cards in exchange for Bitcoin. These gift cards include restaurants, gas stations, grocery stores, and much more. You can even use your Bitcoin to buy Amazon gift cards, where you can purchase almost anything! CoinCards.com and BitRefill.com are two of the most popular options for buying gift cards with Bitcoin. Both companies also sell top-ups for prepaid mobile phone plans.

Trading for Other Cryptocurrencies

Arguably, the most common use case for spending Bitcoin is trading it for other cryptocurrencies. There are thousands of cryptocurrencies listed on online cryptocurrency exchanges, and most of them can be bought or sold for Bitcoin. Two of the most popular cryptocurrency exchanges are Coinbase and Binance. Remember, when you store your Bitcoin on an exchange you no longer have possession of the coins and are at risk if the exchange were to be hacked. Most crypto experts recommend a personal digital crypto wallet.

Gold and silver are also commonly purchased with Bitcoin. An example of a company that accepts Bitcoin for gold and silver is goldsilver.com, which sells precious metals as bars and coins. Goldsilver.com even offers a 3% discount for users that purchase with Bitcoin, since it is one of the most affordable payment options.

Services

Bitcoin is a digital money native to the internet, so it makes sense that it would be used to pay for internet-native services such as domain name registration. Namecheap.com is a company that accepts Bitcoin as payment for registering domain names. Namecheap was one of the earliest online service providers to accept Bitcoin, accepting it as far back as 2013.

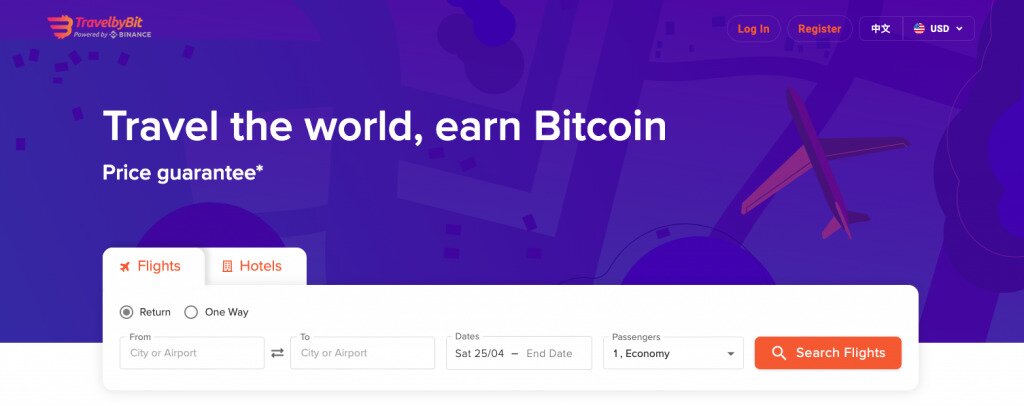

TravelByBit.com is an online service that allows users to book hotels and flights using Bitcoin. Similar to travel shopping sites like Expedia, TravelByBit provides a search engine for finding hotels and flights and lets you book through their website.

Charities

Many charities accept Bitcoin because it is easy to post a Bitcoin address to a website and have donations sent to it without further costs or work done by the charity. Pseudonymous donations can be easily made, meaning the recipient wouldn’t know who you are, and they would see the donation coming from a Bitcoin address rather than your identity.

The Wikimedia Foundation (the organization that hosts Wikipedia) and the Internet Archive (who maintain an archive of digitized materials including hundreds of billions of webpages) are two examples of very well-known non-profit organizations that accept Bitcoin donations.

The Big Secret for Spending Crypto

We’ve gone through this entire article without mentioning arguably the easiest way to spend crypto that exists: Credit cards.

Crypto-based cards (they come in credit or debit varieties) are by far the easiest way to “spend” Bitcoin and other cryptocurrencies at nearly every vendor on earth (or at least anyone that accepts Visa or Mastercard). In fact some crypto cards will even reward you with cashback in Bitcoin or Ethereum so you’re not only spending crypto but you’re actually earning it the same time.

Of course crypto-based cards have a big caveat: Technically you’re not spending crypto. You’re actually converting it at the point of sale into the fiat currency of your choice.

Some people will argue that it’s just a matter of semantics because you could have a huge balance of crypto and just convert it to fiat when needed but it’s true that you’re still relying on the traditional finance infrastructure to transact, which somewhat undermines the true purpose of crypto.

But until crypto becomes mainstream as a payment method it’s worth at least checking some of the notable crypto-based cards. Crypto.com has long offered one of the most popular cards (with significant perks like free Netflix and Spotify) while Coinbase has an exceptionally streamlined debit cards that lets users earn up to 4% in crypto back.

In addition there are a variety of different ways to earn and spend crypto that you can find in our best crypto tools section.

- Visa card backed by one of the most reliable companies in cryptocurrency

- Links to your Coinbase account

- Spend your crypto anywhere Visa is accepted

- Switch between cryptocurrencies on the fly

- Up to 8% crypto cashback on all purchases

- Huge amount of available perks, including free Netflix, Spotify and Airport Lounge access

- Unique CRO staking model offers five different tiers of cards

- High-quality premium metal cards

- Get up to 3% back in cryptocurrency with no annual fee

- Available in all 50 US states

- Most crypto cards are debit based but Gemini Mastercard is an actual credit card

- Backed by the most regulatory-compliant bitcoin exchange in the world