- >News

- >Ethereum Rally Set to Continue as Data Reveals Shrinking ETH Supply

Ethereum Rally Set to Continue as Data Reveals Shrinking ETH Supply

Ethereum has been stealing Bitcoin’s thunder over the past few weeks, and this trend looks set to continue. Not only did the price of ethereum hit an all-time high of $4,136 on Monday, but data from glassnode reveals that the circulating supply of ETH is continuing to decline, leading to expectations of further rises.

As we’ve written before, the transition to Ethereum 2.0 and a proof-of-stake consensus mechanism has long been expected to squeeze the supply of ethereum. Yet even before Ethereum 2.0 has been fully launched, this supply is already shrinking substantially, with the amount of ETH on exchanges falling in parallel with a rise in ETH locked into smart contracts.

And with Ethereum Improvement Proposal 1559 set to reduce circulating supply even further when it’s implemented in July, ethereum’s impressive performance over the past few weeks could continue for a while yet.

Declining Supply + DeFi/NFT Smart Contracts + Ethereum 2.0 = Price Rises

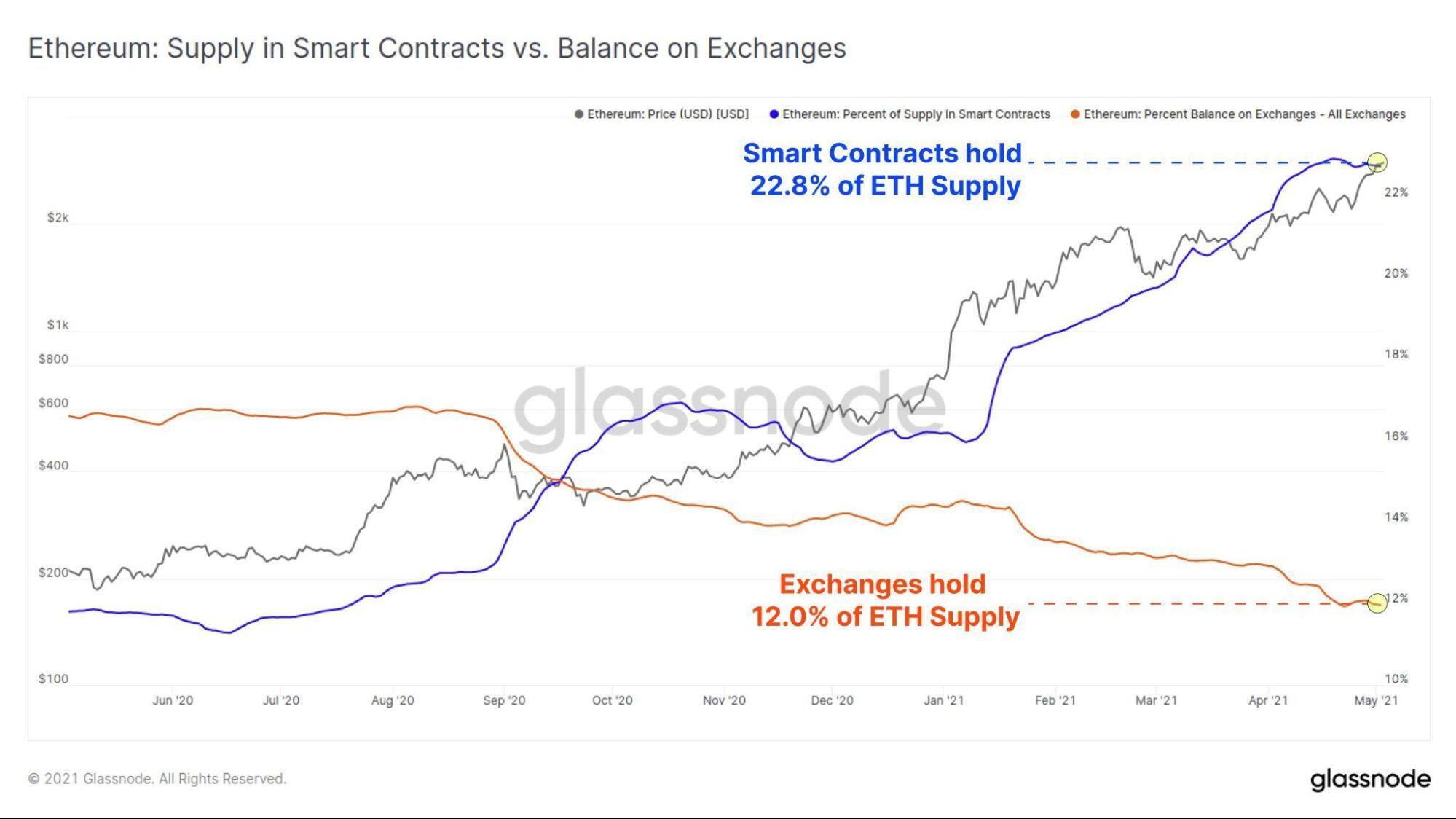

The latest data from glassnode makes for some interesting reading. As the chart below illustrates, smart contracts now hold a substantial 22.8% of the total ethereum supply. A year ago, they held only 12%.

Source: glassnode

The chart above also indicates that the total percentage of ethereum’s supply on exchanges has sunk from just over 16% to 12%, indicating that fewer people are interested in offloading their ETH.

Needless to say, this is pretty bullish for ethereum. It becomes even more bullish when you notice the evident correlation between the price of ETH and its declining supply: the more ETH has been locked into smart contracts and/or taken out of exchanges, the more it has risen in value.

There are two major reasons for this decline in supply. The first is the rise of DeFi, which heightens the demand for ETH (usually via the need to pay gas fees). With the total value locked into various DeFi platforms rising from 2.77 million ETH a year ago to 10.24 million today (a rise of 269.7%), it’s pretty clear that DeFi is the single biggest cause of ethereum’s skyrocketing price.

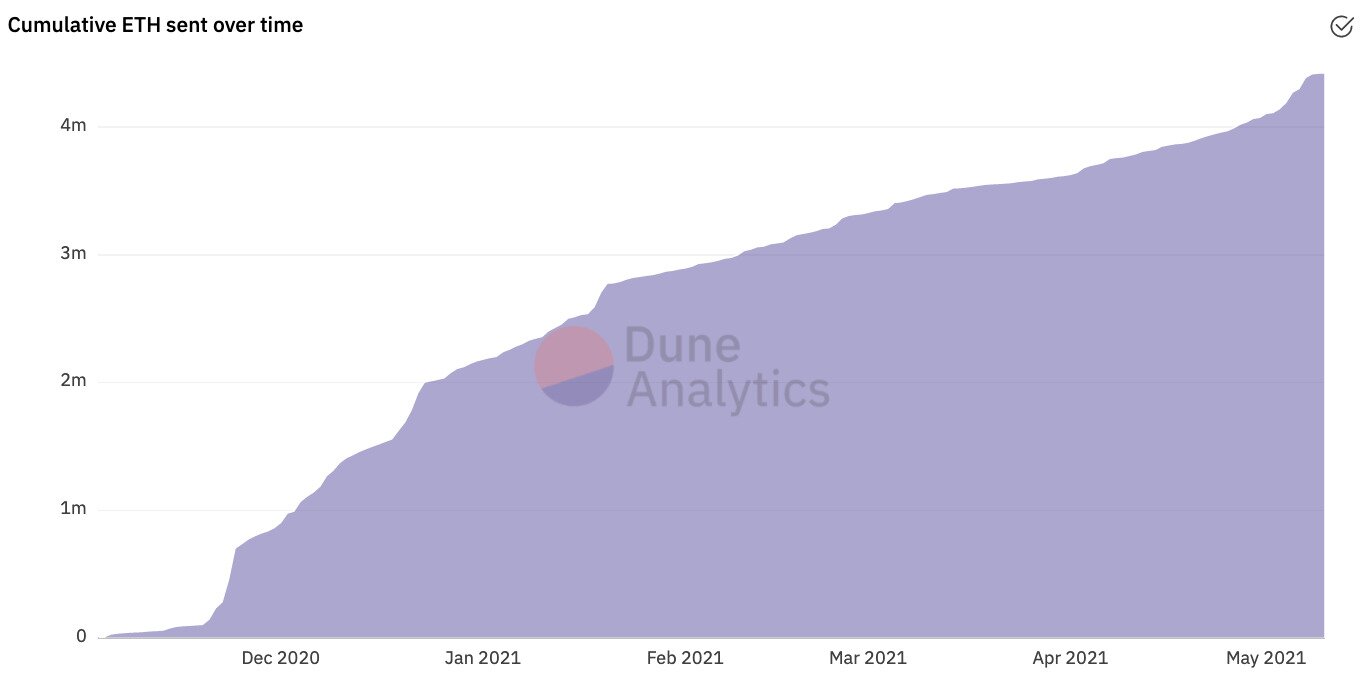

But it’s not the only cause. Another big factor is the arrival of Ethereum 2.0, which hasn’t fully launched but is in the process of rolling out, and also in the process of accepting ETH into its smart contract. Having had only 11,621 ETH on November 4, it’s now responsible for sucking up 4.4 million ETH.

Source: Dune Analytics

Not only is DeFi continuing to grow in popularity (aided in part by the rise of NFTs), but more ethereum is likely to be sent to the Ethereum 2.0 smart contract. In fact, it’s possible that as much as 30% of ethereum’s supply could end up being diverted to the smart contract, which will be used as part of Ethereum 2.0’s staking process.

When combined with the ongoing decline in ETH on exchanges, the increase in the popularity of DeFi and NFTs, we could possibly see more than 50% of ethereum’s circulating supply being taken out of action.

In other words, prices in excess of $4,000 may only be the beginning of the current ethereum rally.

Other Factors

The fun doesn’t stop there, however, since there’s something else on the horizon that will also increase the squeeze on ethereum’s circulating supply.

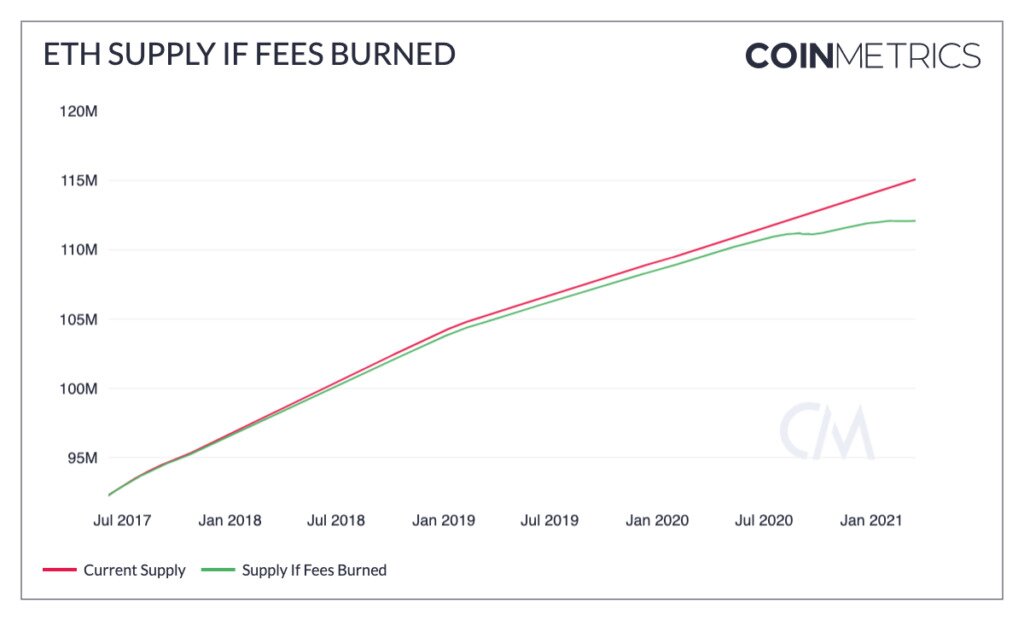

This is the forthcoming Ethereum Improvement Proposal 1559, which will result in the burning (i.e. destruction) of the ETH used to pay for transaction fees. As Coin Metrics wrote in a recent report on Ethereum’s gas fees, this could result in a reduction of about 3 million ETH over three years, and “will effectively decrease ETH’s supply inflation.”

Source: Coin Metrics

The effect won’t be instantaneous by any means, but there will be a long-term squeeze on the supply of ethereum’s supply, giving it a quasi-deflationary edge that will boost its price (all other things being equal).

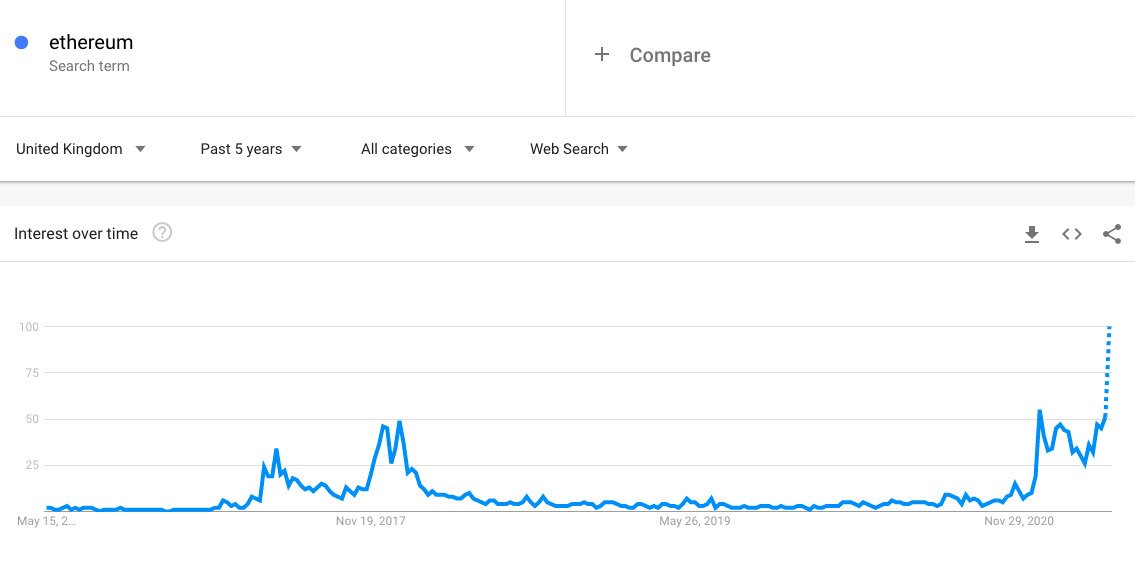

EIP 1559 is due to be implemented in July, by which time pre-existing supply constraints may have pushed ethereum’s price even higher. The likelihood of continuing increases in the next few weeks and/or months is also suggested by social data, with searches for “ethereum” hitting an all-time high for the week between May 2 and 8. This includes the late-2017/early-2018 bull market, which could only muster a score of 49, by comparison to last week’s maximum of 100.

Source: Google Trends

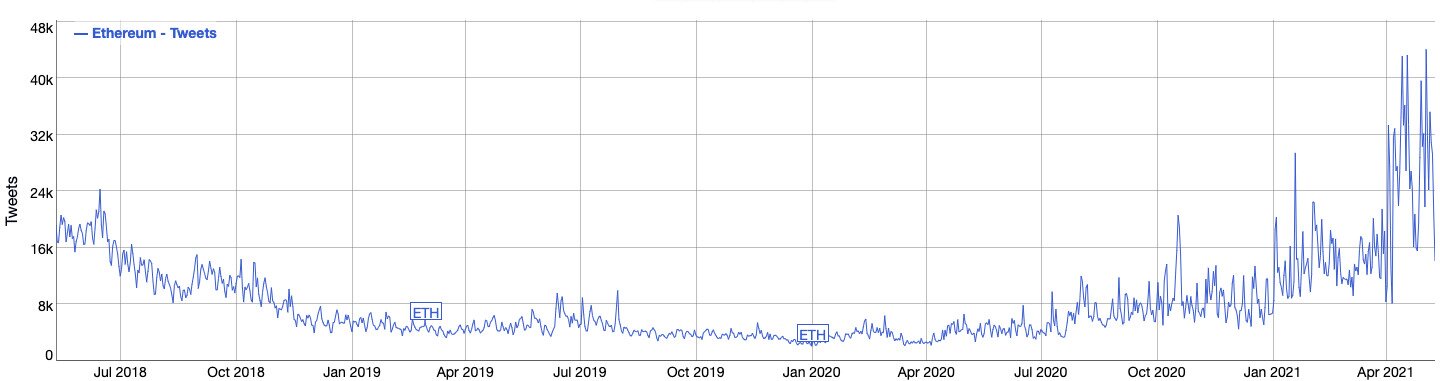

Likewise, tweets mentioning Ethereum have also hit their highest levels in three years, surging to 44,000 on May 3, the second highest total ever (after the 50,000 of October 15, 2017).

Source: BitInfoCharts

Given the plethora of such bullish data, it’s unsurprising that many within the Ethereum community have begun saying some equally bullish things. For example, Ethereum educator Anthony Sassano has recently suggested that it won’t be long before 1 ETH will be worth 1BTC.

Source: Twitter

A number of Ethereum supporters (and more neutral commentators) are also raising the possibility of a ‘flippening,’ whereby ethereum’s market cap takes over bitcoin’s (or ETH even passes BTC in price).

Source: Twitter

As it happens, one ETH-BTC flippening has occurred: ethereum options volumes have overtaken volumes for bitcoin options over recent days, according to data from various sources. For instance, ETH futures volume hit $70 billion on May 4, compared to $67 billion for BTC. If nothing else, this indicates growing investor interest in the cryptocurrency.

But regardless of whether ethereum overtakes bitcoin in terms of market cap or price, it seems highly probable that its rally still has plenty of space left to continue. With supply dwindling and demand continuing to tick upwards, basic economics indicate that its price can move in only one direction for the time being. Up.