- >News

- >Is Red-Hot Ethereum Poised to Put a Dent in Bitcoin Dominance?

Is Red-Hot Ethereum Poised to Put a Dent in Bitcoin Dominance?

Aside from death and taxes, there are few things more predictable in life than the unending continuation of the Bitcoin vs. Ethereum debate. It’s been raging ever since Ethereum was launched in July 2015, and it’s only heated up over the last week with ETH hitting new all-time highs.

Not only have rising prices and ATHs intensified the rivalry between the two biggest cryptocurrencies, but so has Ethereum’s in-progress shift to a proof-of-stake consensus mechanism. This shift promises to give Ethereum the scalability it needs to become a ‘universal’ computer capable of hosting “any smart contract or transaction type that can be mathematically defined.” It also promises to make Ethereum more important than Bitcoin.

Or does it? While there’s little doubt that the Ethereum blockchain is already more vital for many other cryptocurrencies and platforms than Bitcoin, it’s also clear that Bitcoin as a cryptocurrency/token is attracting more investors from beyond crypto. So while Ethereum has more potential than Bitcoin as the base layer for a decentralized ecosystem, Bitcoin has more potential as an alternative to gold.

Price Doesn’t Necessarily Mean Potential

Based solely on price action alone, you’d think that Bitcoin has more potential than Ethereum. Not only does it have a higher price per BTC and a higher market cap, but institutions and corporations are predominantly investing in bitcoin, rather than ethereum (ETH).

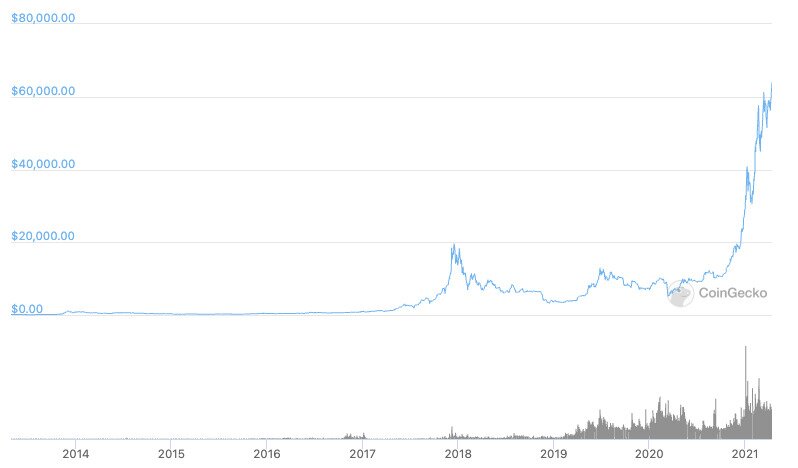

Source: CoinGecko

While bitcoin has risen as high as $64,787 to date, ethereum’s all-time high is currently ‘only’ $2,630.

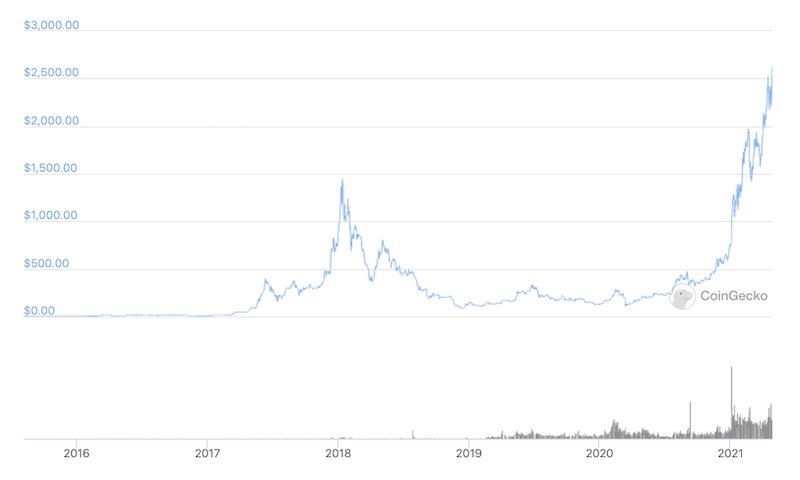

Source: CoinGecko

On top of this, major institutions and corporations — Tesla, MicroStrategy, Square, MassMutual, and others — are buying bitcoin, not ethereum. This alone would indicate that Bitcoin has more potential than Ethereum as far as price is concerned, particularly when Bitcoin has a supply cap and Ethereum doesn’t.

However, when Ethereum supporters argue that it has more potential than Bitcoin, they’re not really talking about price. They’re addressing Ethereum’s potential as the underlying infrastructure for a decentralized financial system.

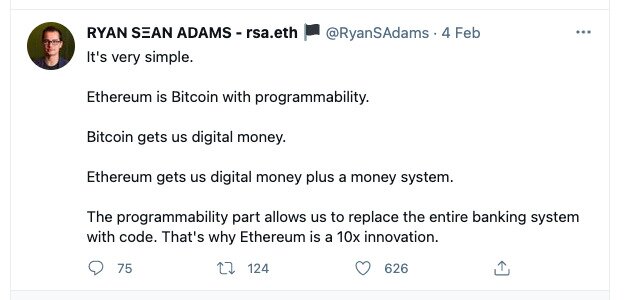

Source: Ethereum

And this is an argument that’s hard to counter, unless you’re inclined to agree with someone like Bitcoin developer/author Jimmy Song, who has basically argued that Ethereum is an interesting experiment that doesn’t have any real long-term viability.

In 2018, Song made a bet with Ethereum co-founder and ConsenSys founder Joe Lubin that Ethereum wouldn’t have at least five dApps with at least 10,000 daily active users and 100,000 monthly active users by May 23, 2023.

According to data from DappRadar, Joe Lubin still hasn’t won this bet, although Ethereum is making some progress. It lists one dApp — Uniswap — with more than 10,000 DAUs and 100,000 MAUs. This is perhaps not especially encouraging for Ethereum, yet there are a number of other metrics which provide an indication of its recent growth, as well as its potential for future growth.

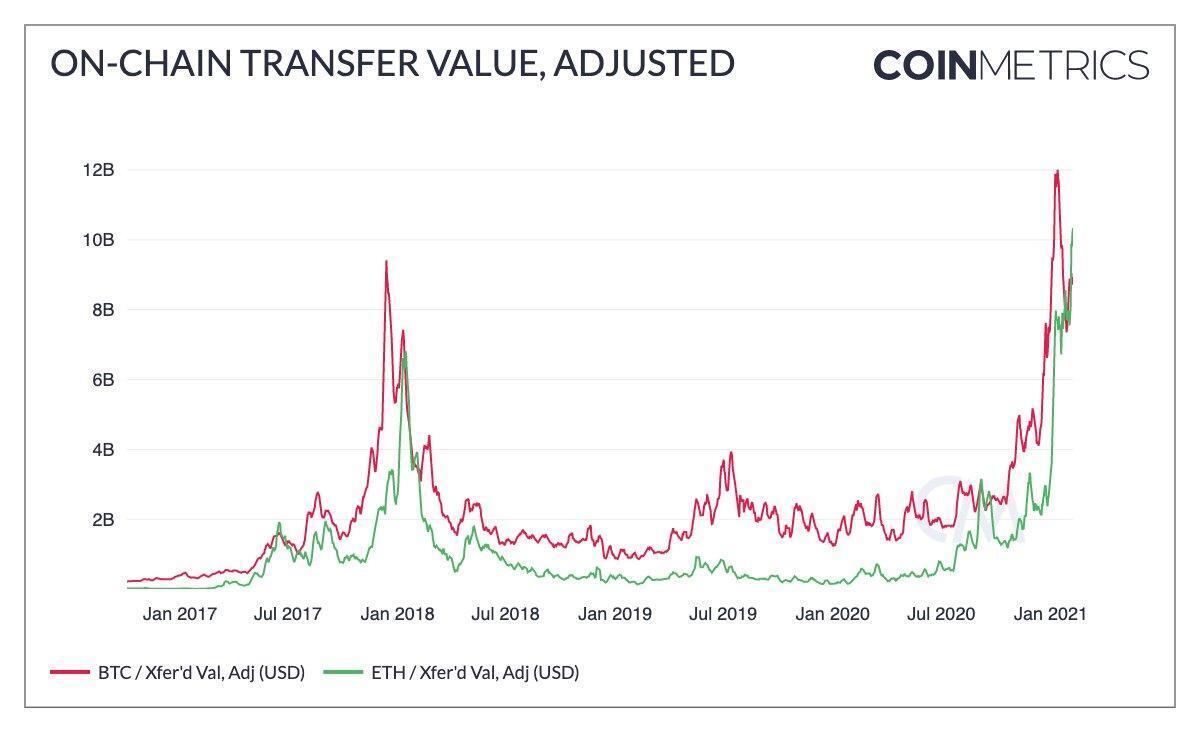

For one, Ethereum has now eclipsed Bitcoin in terms of on-chain transfer value, with Ethereum settling more transactions in dollar terms than Bitcoin. This ‘flippening’ first occurred in February, and is largely the result of the rising popularity of DeFi, which is predominantly Ethereum-based.

Source: CoinMetrics

The recent emergence of non-fungible tokens has boosted this effect even further, with the NFT market now accounting for over $1 billion in volume (DeFi now accounts for $55 billion in total value locked in). Combined with the growth of DeFi, this market teaches us that everything new in crypto is largely stemming from Ethereum.

So despite having a lower price than Bitcoin (and apparently less interest from institutions), Ethereum has more potential for growth in the broadest possible sense.

And what’s so interesting is that Ethereum has enjoyed all of this growth while plagued by fairly high fees, something which has helped Binance Smart Chain (and BNB) become more popular. It’s now pushing through an update which will fix fees, while its transition to Ethereum 2.0 should reduce them substantially. What this implies is that, with the problem of fees removed, Ethereum’s potential for further growth would be multiplied.

Ethereum vs. Bitcoin: Which One is ‘Best’?

With a proof-of-work consensus mechanism and a small block size, it’s unlikely that Bitcoin will end up functioning as the infrastructure for a vast ecosystem of financial apps. And while we’ve suggested that it will enjoy more significant price rises in the future, there’s still a chance that Ethereum’s transition to a proof-of-stake mechanism may help boost its price at a greater rate than Bitcoin’s.

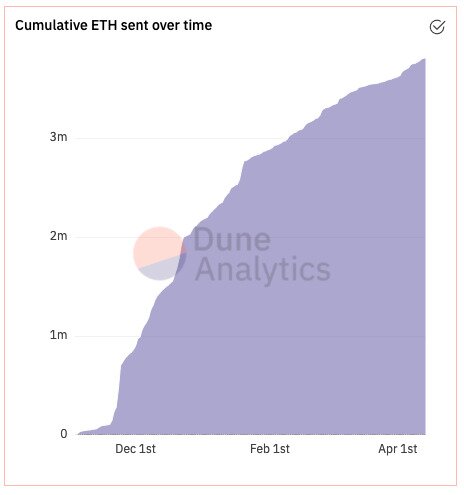

As we’ve written before, PoS entails that Ethereum users lock up a significant portion of ETH in order to validate transactions. Back in January, we noted that the locking up of 2.25 million ETH was a big reason for ethereum rallying by around 25% in a day. That has now risen to nearly 4 million ETH, and Ethereum 2.0 hasn’t even launched yet.

Source: Dune Analytics

According to Adam Cochran, a computer science researcher and partner at Metacartel Ventures, Ethereum 2.0 could end up taking anything between 10-30% of ETH out of circulation. The current 4 million comprises only 3.5% of the total outstanding supply of ETH, so we still have a long way to go, even if ethereum has rallied strongly in recent months. In fact, it has risen by around 1,400% in 12 months, while bitcoin has rallied by 834%.

This implies that, in addition to having greater potential as a platform, Ethereum may have just as good potential for price rises as Bitcoin, if not better. Of course, Bitcoin maximalists and other Ethereum skeptics may counter that Ethereum and the platforms it hosts offer nothing real of value, and they all represent a big bubble.

Source: Twitter

In other words, Ethereum doesn’t have much longer term (price) potential because it’s largely a get-rich-quick scheme that will collapse sooner or later. However, if this is true, it may undermine the argument that Bitcoin has more potential, if only because a collapse in the Ethereum-based ecosystem could seriously damage the reputation of Bitcoin. And if money/investment exits the Ethereum ecosystem, it could just as well as exit Bitcoin.

But assuming that neither collapses, the final judgment should probably be that neither platform really has more potential than the other. That’s because Bitcoin will remain a store of value/speculative asset, while Ethereum will remain as digital infrastructure, making them hard to directly compare in any significant sense.