The Idea for Digital Currency

The idea for cryptocurrency first emerged in 1983, when American cryptographer David Chaum published a conference paper outlining an early form of anonymous cryptographic electronic money. The concept was for a currency that could be sent untraceably and in a manner that did not require centralized entities (i.e. banks). In 1995, Chaum built on his early ideas and developed a proto-cryptocurrency called Digicash. It required user software to withdraw funds from a bank and required specific encrypted keys before said funds could be sent to a recipient.

Bit Gold, worldwide payment system often deemed a direct precursor to Bitcoin, was designed in 1998 by Nick Szabo. It required a participant to dedicate computer power to solving cryptographic puzzles, and those who solved the puzzle received a reward. Combined with Chaum’s work, it results in something that comes very close to resembling Bitcoin.

But Szabo could not solve the infamous double-spending problem (digital data can be copied and pasted) without the use of a central authority. As such, it was not until a decade later when a mysterious person or group, using the pseudonym Satoshi Nakamoto, set the history of Bitcoin and later cryptocurrencies in motion, by publishing a white paper called “Bitcoin – A Peer to Peer Electronic Cash System.”

Here’s a brief video explaining crypto for beginners:

Now let’s take look at the timeline.

The Beginning (2008-2010)

On October 31, 2008, Satoshi Nakamoto published the Bitcoin white paper, describing the functionality of the Bitcoin blockchain network. Satoshi formally began work on the bitcoin project on August 18th, 2008, when they purchased Bitcoin.org. While it’s not the subject of this article, it’s worth noting that Bitcoin (and all other cryptocurrencies) wouldn’t be possible without blockchain technology, which at its simplest involves using cryptographic protocols and creating unalterable data structures.

The history of Bitcoin was underway. Satoshi Nakamoto mined the first block of the Bitcoin network on January 3, 2009. They embedded a headline from The Times newspaper in this initial block, making a permanent reference to the economic conditions — involving bank bailouts and a centralized financial system — that Bitcoin was partly a reaction against.

This first block — which resulted in 50 bitcoins being mined — is now referred to as the Genesis Block. Bitcoin had virtually no value at this time, as well as for the first few months of its existence. Regardless it was the first truly decentralized digital currency. Six months after bitcoin became tradeable, in April 2010, the value of one BTC was just under 14 cents. By early November, the price ‘surged’ to 36 cents before settling at around 29 cents.

The Market Begins to Form (2010-2014)

While it wasn’t yet worth much, Bitcoin was showing it had real world value. In February 2011 it rose to $1.06 before coming back down to roughly 87 cents. In the spring, in part due to a Forbes story on the new “crypto currency,” the price took off. From early April to the end of May, the value of bitcoin rose from 86 cents to $8.89.

On June 1, after Gawker published a story about the currency’s appeal in the online drug dealing community, the price more than tripled in a week, to about $27. The market value of bitcoins in circulation approached nearly $130 million. However, by September 2011, the value had dropped back down to around $4.77.

In October of that same year, Litecoin appeared, one of many forks (i.e. updated versions) of Bitcoin. Litecoin soon became the second-biggest cryptocurrency by market cap, with the earliest archive of CoinMarketCap (from May 2013) showing PPCoin, Namecoin and 10 others trailing in the distance. Such cryptocurrencies were quickly dubbed ‘altcoins’, with some forked from Bitcoin and others based on new code. They were also referred to as digital or virtual currency.

It was around this time that crypto exchanges started to open their (virtual doors). A cryptocurrency exchange bridges the gap between the cryptocurrency world and the traditional financial system. It’s where users can buy, sell and trade crypto.

In 2012, Bitcoin prices grew steadily, and in September of that year the Bitcoin Foundation was established to promote Bitcoin’s development and uptake. Then known as OpenCoin, Ripple was also launched that year, with the project attracting venture capital the next year.

In 2013, amid federal, criminal, regulatory, and software related issues, bitcoin’s price constantly rose and crashed. On November 19 its price reached $755, only to crash down to $378 the same day. By November 30 it was all the way up to $1,163 again. This was, however, the beginning of another long-term crash that ended with Bitcoin dropping back down to $152 by January 2015.

Scams Dominate Headlines (2014-2016)

Though intentional, anonymity and lack of centralized control make the decentralized digital currency also highly attractive to criminals. In January 2014, Mt.Gox — then the world’s largest bitcoin exchange — collapsed and declared bankruptcy, having lost 850,000 bitcoin. While it’s not known what exactly happened, it’s likely that the missing BTC was stolen gradually over time, beginning in 2011, and resold on various exchanges for cash (including Mt.Gox), until one day Mt.Gox checked their wallets and found they were empty. CEO Mark Karpeles was charged with embezzlement in 2017, but acquitted in 2019, so the destination of the missing BTC remains a mystery.

While the hack was not a singular event, it has served as a cautionary tale, and security on exchanges is much improved. Though smaller exchanges continue to be hacked even today, larger platforms now provide more guarantees on their reserve holdings in case of breaches. This includes the Secure Asset Fund for Users on Binance, for example, which is an emergency insurance fund crypto investors.

Crypto traders are advised to use a hardware or software wallet to safely store their cryptocurrency rather than storing them on an exchange. Wallets such as these were not as accessible during this early period in cryptocurrency’s history.

Bitcoin Ascends to Worldwide Phenomenon (2016-2018)

Bitcoin prices rose steadily year over year, going from $434 in January 2016, to $998 in January 2017. In July 2017, a software upgrade to Bitcoin was approved, with the aim being to support development of the Lightning Network (a layer-two scaling solution) as well as improve security.

A week after the upgrade was activated in August, Bitcoin was trading at around $2,700. By December 17, 2017, Bitcoin reached an astronomical all-time high of just under $20,000.

During this same time, a new blockchain project called Ethereum was making noise in the cryptocurrency sphere, having quickly become the number two cryptocurrency by market cap since launching in July 2015. It brought smart contracts to cryptocurrency, opening a wide array of potential use cases and generating over 200,000 different projects (and counting). In contrast to the Bitcoin protocol, Ethereum enables additional platforms to launch and operate on its own chain, each with their own cryptocurrencies and their own use cases. This was a model widely copied by other new digital currencies, with Cardano, Tezos and Neo (to name only three) launched during this period.

Bust and Recovery, and Bust and Recovery… (2018-Present)

Bitcoin was not able to sustain its all-time high of $19,783. Likewise, Ethereum, which reached its own ATH in January 2018 of around $1,400, was also not able to maintain its newfound level for long. Financial regulations and security concerns (due to semi-regular exchange hacks) contributed to the market-wide decline, and by the end of 2018 bitcoin had dropped down to around $3,700.

However, prices didn’t stay down for too long. Starting from late 2020, bitcoin enjoyed something of a renaissance, beginning with (“business intelligence company”) MicroStrategy’s announcement in August that it had bought bitcoin worth $250 million. This kicked off a bull market that was joined by the rest of the market, with prices boosted further by Tesla’s purchase of $1.5 billion in bitcoin in early 2021. It was in November of that year that bitcoin reached its current record high of $69,000.

The crypto market has fallen once again since this high, dragged down by macroeconomic concerns resulting from high inflation, rising interest rates and the specter of war. That said, with global stock markets also falling in late 2021 and 2022, crypto’s parallel fall shows that the sector is becoming increasingly entwined with traditional financial markets.

And while the volatility of digital assets is both attractive and potentially devastating, the underlying technology behind them all, blockchain, has the power to change many sectors of our society. Whether it’s providing accessible and affordable financial exchange options, securing your own funds so that no one but you can access them, or providing accurate data for your insurance quote, blockchain technology has the potential to be used in almost every area of the economy.

As the market becomes more stable with increased knowledge, and with the introduction of new areas such as stablecoins and decentralized finance (DeFi), it’s easy to get excited about the cryptocurrency market and its potential from an investment and technological perspective. This is regardless of whether it’s Bitcoin or another blockchain project that stokes your interest.

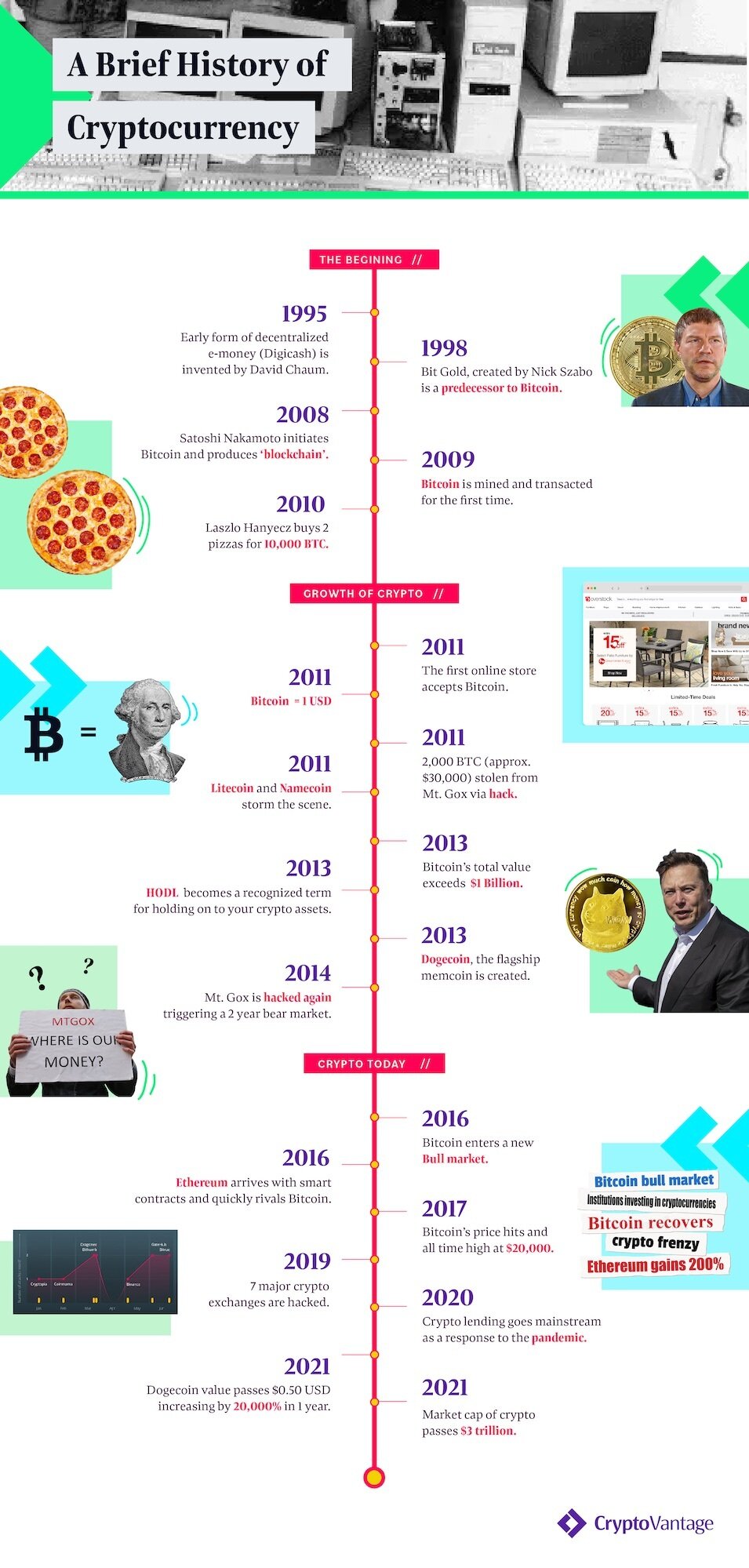

Finally here’s a visual look at the timeline of cryptocurrency:

Top 10 Cryptocurrencies to Know

Bitcoin (BTC) – the original cryptocurrency, conceived in 2008 and launched in January 2009. Operates using a proof-of-work consensus mechanism, meaning that computing power is used to verify transactions and generate new blocks in its blockchain. It has a total maximum supply of 21 million bitcoins, making it potentially deflationary.

Ethereum (ETH) – a proof-of-work cryptocurrency launched in July 2015. Originally conceived as a ‘universal computer’ that could function as infrastructure for a decentralized internet, it is capable of running smart contracts, which execute pre-specificed actions when certain conditions are met. It is currently planning a shift to a proof-of-stake consensus mechanism, in which transactions are verified by staking ethereum on them.

Tether (USDT) – a stablecoin launched in July 2014 as RealCoin. It’s pegged 1:1 to the US dollar and backed up by reserves equivalent to the value of its entire supply. Running on the Ethereum blockchain (and also running on other chains), it generally records the highest 24-hour trading volume of any cryptocurrency in the market. This is because traders tend to exit into Tether during dips, although some commentators have claimed that it isn’t fully backed, a charge given weight by the fact that Tether has never undergone a full audit.

Binance coin (BNB) – the native cryptocurrency of Binance, the world’s largest cryptocurrency by trading volume. Launched in June 2017, holding BNB grants users discounts on the trading fees Binance charges.

Cardano (ADA) – a proof-of-stake cryptocurrency launched in 2015 and opened to trading in 2017. Operating as a general purpose utility blockchain like Ethereum, it has witnessed steady development in the intervening years, launching the ability to run smart contracts in September 2021.

Ripple (XRP) – a cryptocurrency launched in 2012 as OpenCoin. It has generally positioned itself as a remittance network, providing cross-border transfers between counterparties and financial institutions. Ripple’s ledger uses neither a proof-of-work nor a proof-of-stake consensus mechanism, instead using its own consensus algorithm that’s capable of more than 1,000 transactions per second, in contrast to around 7 per second for Bitcoin.

Dogecoin (DOGE) – a so-called meme coin launched in December 2013. Featuring a Shiba Inu dog as its mascot, Dogecoin is a fork of Litecoin, which is a fork of Bitcoin. Despite originating as a joke, it is increasingly popular and commands a large number of loyal fans and supporters, who can often help it rise in price quickly.

Solana (SOL) – A relatively new blockchain platform that launched in 2020 and promised scalability far beyond Bitcoin or Ethereum. SOL is touted for having a small ecologically footprint, fast speeds and extremely low fees. The aforementioned low fees and fast throughput made it a favorite for NFTs, DEX’s and apps. A common criticism of Solana is that it’s heavily influenced by VC funding not as decentralized as its competitors. It’s also experienced several notable outages.

Monero (XMR) – a privacy coin launched in 2014. It helps users to achieve greater anonymity than that offered by Bitcoin and other cryptocurrencies, through a variety of novel features. These include one-time stealth addresses, ring signatures that mix transactions so they can’t be traced, and transactions that hide the amounts transferred. Given its effectiveness, Monero has been delisted by numerous cryptocurrency exchanges, that don’t want to break anti-money laundering regulations.

The Sandbox (SAND) – along with Decentraland (MANA), the Sandbox is one of the biggest gaming- and metaverse-related cryptocurrencies in the market. Launched in August 2020, SAND is the governance and utility token of the Sandbox gaming platform, allowing holders to send money to buy in-game items, vote on upgrades, and for staking, which earns them rewards.

Frequently Asked Questions About the History of Cryptocurrency

The idea of digital money has been around since the beginning of the digital revolution. Companies like PayPal introduced the world to eCommerce in in the late 90s but that was just a matter of keeping a ledger of real-life currencies like USD on the internet.

Cryptocurrency is different because it is entirely digital. It’s not minted by any government. It’s mined, transferred and swapped entirely online.

The first beginnings of a legitimate cryptocurrency also began in the late 90s but it wasn’t until 2008 that Bitcoin launched and created the first viable digital-only currency.

There’s no one person but people like David Chaum, Nick Szabo and Satoshi Nakamoto all played a significant role in making crypto a reality. Satoshi Nakamoto, who has never been identified, is the inventor of Bitcoin.

The very first bitcoins had no value when they were first minted, partially because there was nowhere to trade cryptocurrencies. The very Bitcoin transaction, 10,000 BTC for two pizzas would have valued BTC at roughly a fourth of a cent. Coinbase, one of the most popular crypto exchanges in the world, was launched in 2012 and BTC was valued at $6 at the time.

There are thousands of cryptocurrencies but many of them can be separated into two categories: Store of value protocols and smart contract platforms.

Bitcoin is famously a store-of-value but has limited functionality. Meanwhile Ethereum is a smart contract platform and developers can build advanced products using the code including exchanges, NFTs and more.

There are many different reasons behind the creation of cryptocurrency but Bitcoin was created during the great financial crisis of the late 2000s when numerous banks collapsed.

The idea behind Behind was that it would give people a legitimate peer-to-peer electronic cash system that wouldn’t rely on banks. It’s an independent currency that can be used across borders and theoretically can’t be manipulated by governments.

Bitcoin can be sent to anyone with a Bitcoin address. It’s digital money made for the entire world to use.

Scams targeting crypto investors are especially common in the cryptocurrency industry because you’re dealing with digital money. Unlike traditional money, Bitcoin transactions are not reversible. Therefore they are a common