- >News

- >Bitcoin Held on Exchanges Hits 2-Year Low as BTC Holders Aren’t Selling

Bitcoin Held on Exchanges Hits 2-Year Low as BTC Holders Aren’t Selling

The bitcoin market has regained its confidence. After falling to as ‘low’ a price as $43,382 following Tether’s settlement with the NYAG, bitcoin rebounded to $57,000 on March 10, and it now sits at around $55,500 (as of writing).

This news is already good enough for bitcoin holders as it stands, but there are a number of other indicators which suggest that the resuscitated rally may continue moving upwards for some time. Most notably, exchange balances — the quantity of bitcoin in wallets held by crypto-exchanges — are continuing to fall, and have in fact hit a two-year low.

Taking bitcoin off the platforms where it can be sold is a strong indication that the market believes its price is set to rise further. And in combination with rising open interest, rising futures funding rates, and rising on-chain bitcoin users, it suggests that we may see bitcoin reach new price levels before long.

Exchange Balances Show Expectation of Bitcoin Price Rises

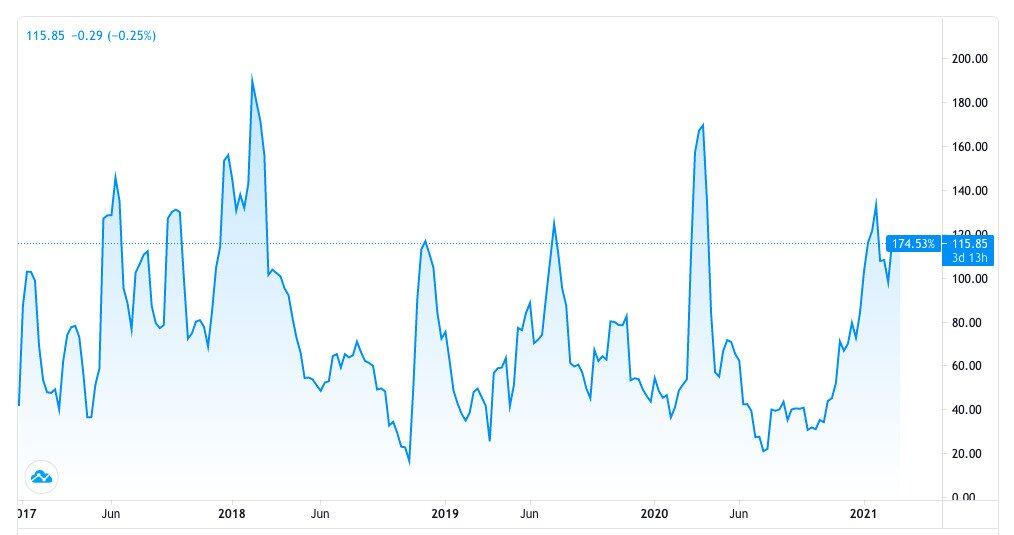

Bitcoin has had an interesting few weeks. Its plunge to nearly $43,000 and its rebound to $57,000 have pushed its volatility to levels not seen since its infamous plunge in March 2020, when it lost around half of its value and dipped below $4,000. As the chart from TradingView shows below, its current volatility of 115% was last seen on April 6, 2020.

Source: TradingView

Basically, the price of bitcoin is fluctuating more right now than at any time since roughly a year ago. It may therefore seem hard to predict where bitcoin may go right now, not least when even Elon Musk himself suggested that bitcoin is overpriced.

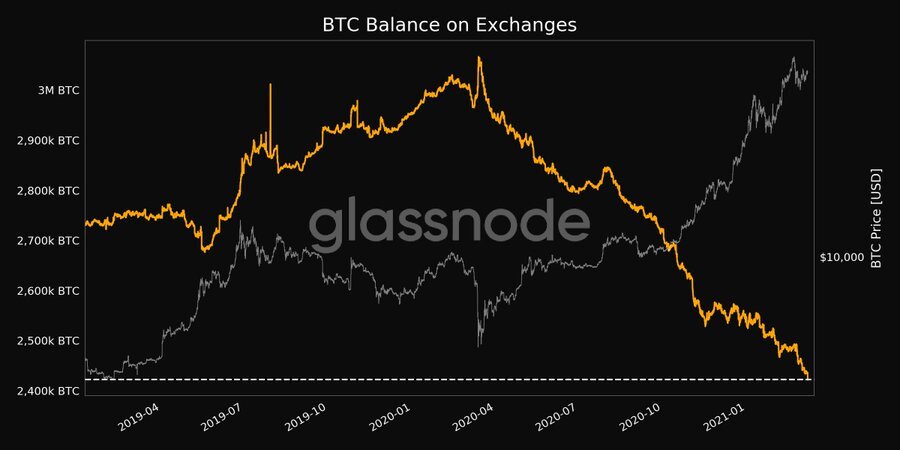

However, data from exchanges provides a reassuring picture to anyone worried about the potential of downwards as well as upwards travel. Glassnode’s metric of “balance on exchanges” shows that the quantity of bitcoin in exchange wallets has fallen to just under 2.4 million BTC, its lowest in two years.

Source: glassnode

The amount of BTC on exchanges has fallen by over 500,000 BTC in just under a year. More recently, the exchange balance actually increased by nearly 40,000 BTC on February 21, just prior to bitcoin declining steeply from its ATH of $58,000. However, it resumed declining again from February 23 onwards, indicating the change of mood.

In other words, the dip of several weeks ago has done nothing to alter the long-term belief that the price of bitcoin is heading in only one direction: up. The market is increasingly convinced they won’t need to sell their bitcoin anytime soon, so they’re taking their funds off of exchanges.

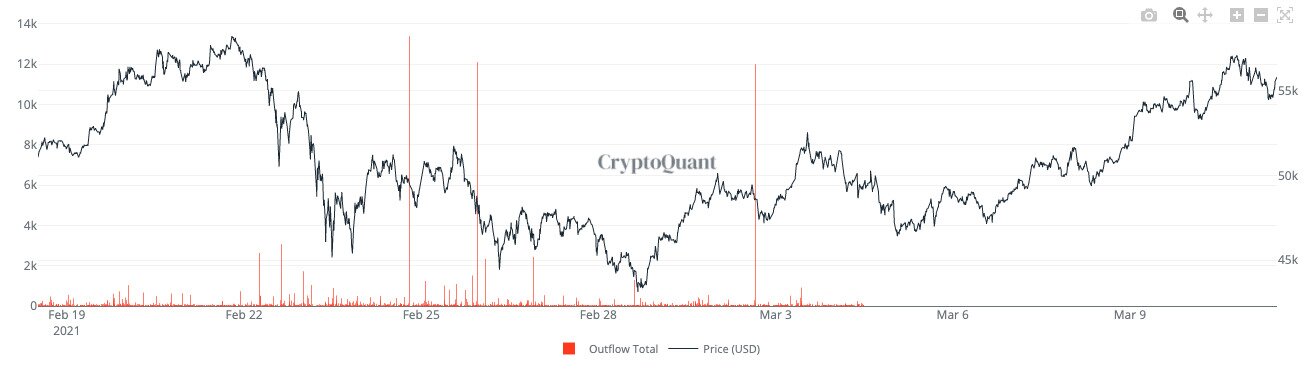

Other exchange data reinforces this confidence-inducing picture. For example, analytical firm CryptoQuant has analyzed Coinbase Pro outflows to show that, in recent weeks, large institutional investors have withdrawn bitcoin from the exchange during dips. This indicates that such investors have bought the dip, and then withdrawn their BTC, apparently confident that the price will only rise over the longer term.

Source: CryptoQuant

According to CryptoQuant, the spikes in outflows we see during bottoms suggests that institutions are providing a resistance against bitcoin falling much lower than $48,000 or $47,000.

With institutions and other investors taking bitcoin off exchanges, the circulating supply of BTC will inevitably decline. And at a time when more companies — such as Meitu and Aker — are entering the market for the first time, the increase in demand and decline in supply can mean only one thing: rising prices.

Bull Market Continues

Exchange withdrawals aren’t the only factor indicating market confidence, with other metrics suggesting we’re still very much in the middle of a bull market.

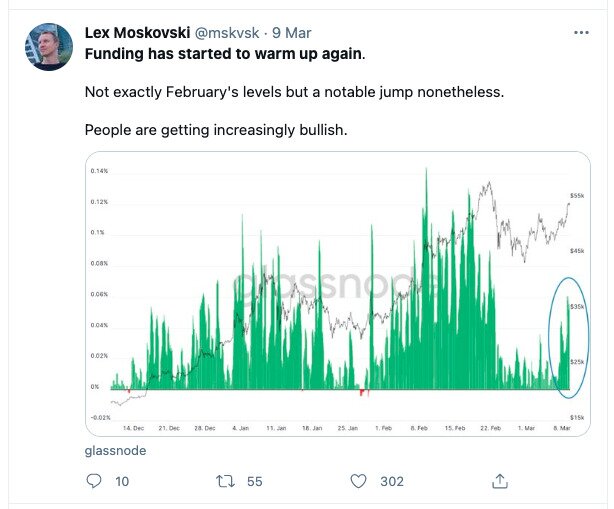

For one, rising futures funding rates are also equally bullish. This means that more people are becoming increasingly prepared to pay higher rates to fund long positions on bitcoin, presumably in the expectation that the extra expense will be worth it, since BTC is going to rise.

Source: Twitter

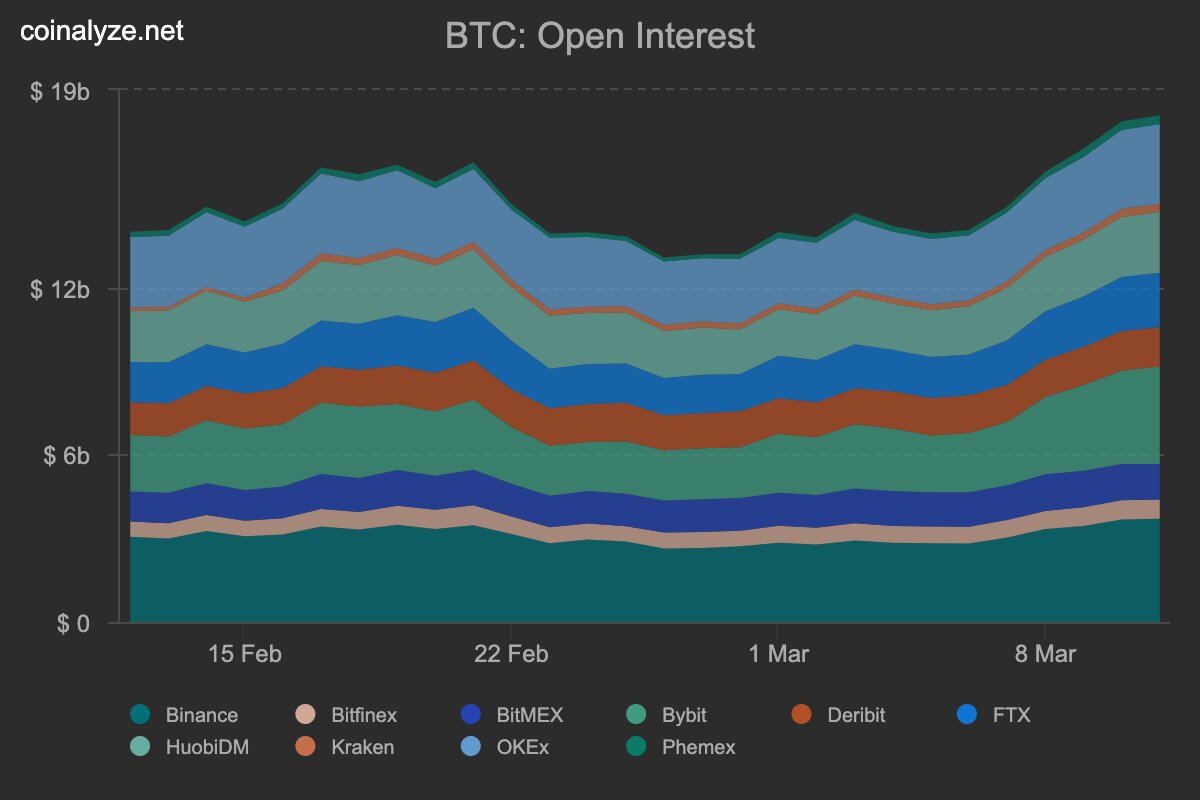

In keeping with rising funding rates, open interest in bitcoin has now exceeded the high levels witnessed before bitcoin’s brief correction from $58,000.

Source: Coinalyze

What the above means is that the number of open futures contracts related to bitcoin have reached a record high in terms of the dollar value of these contracts. This, again, is bullish, and other data suggests that such futures contracts are overwhelmingly long, with roughly 93% long and 7% short.

You’d expect such interest in bitcoin to be reflected by a growth in the number of Bitcoin users, and we do indeed find a continued surge in on-chain users of the cryptocurrency.

Source: Twitter

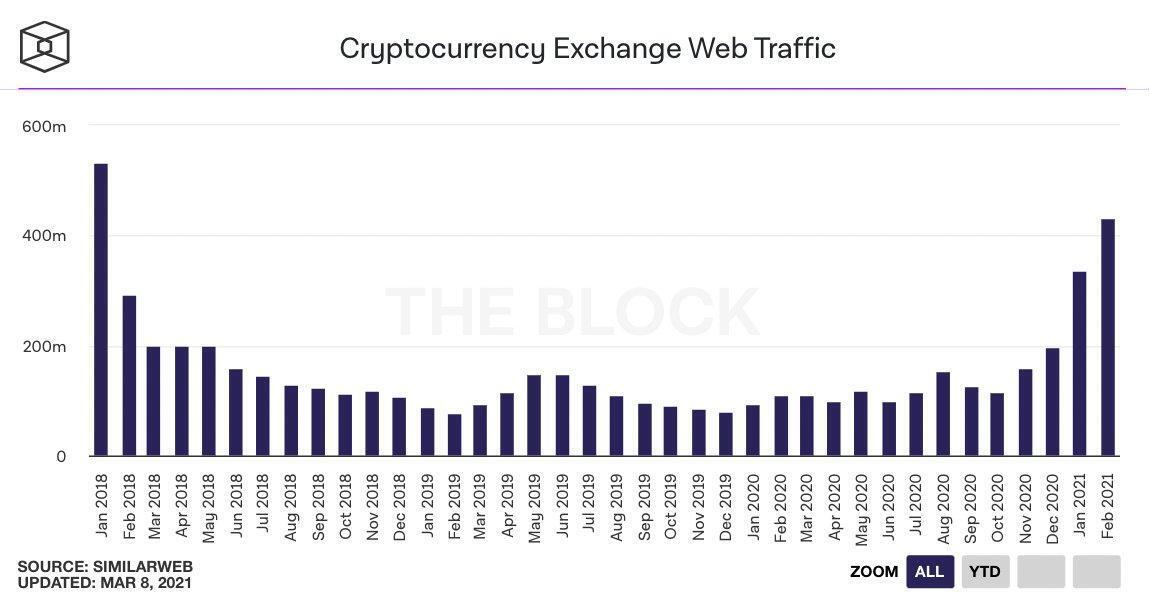

You could in fact argue that the rally is only just beginning, since even if the adoption curve is rising, the arrival of retail investors hasn’t fully taken place. As data from SimilarWeb shows, crypto-exchange web traffic hasn’t actually reached the levels seen in January 2018.

Source: SimilarWeb

Uncertain Financial Landscape

This would imply that the rally is only just beginning. At the very least, it reveals that there is still plenty of room for it to continue still further, pushing bitcoin up to $60,000 and potentially beyond.

Of course, the wider economic and financial landscape remains uncertain, with stock markets proving shaky over the last few weeks and with US Treasury yields disconcertingly climbing upwards. This points to a market that may be losing its appetite for risk, something which could potentially hurt bitcoin.

Still, that doesn’t seem to be the case right now, with bitcoin ascending above $55,000 and with the market preparing for more gains.