- >News

- >Central Banks Are Planning Digital Currencies, But They Will Struggle To Beat Bitcoin

Central Banks Are Planning Digital Currencies, But They Will Struggle To Beat Bitcoin

Central banks are coming for crypto. Or at least, central banks would like to think they’re coming for crypto, judging by the number of central bank digital currency (CBDC) pilots being announced in recent months. It seems that many of them are intent on launching CBDCs partly as a means of stealing Bitcoin’s thunder, by providing faster and cheaper payments than those currently provided by the legacy financial system.

But while CBDCs are perhaps the biggest emerging trend in national finance, it’s highly unlikely that they will ever be a real threat or rival to Bitcoin and other decentralized cryptocurrencies. Not only has the recent digital yuan trial in China shown that consumers don’t seem very interested in CBDCs, but it’s clear that CBDCs won’t offer what are currently the main benefits of crypto: protection against inflation, self-custody, and privacy.

CBDCs: Banks Love Them, People Don’t Really Care

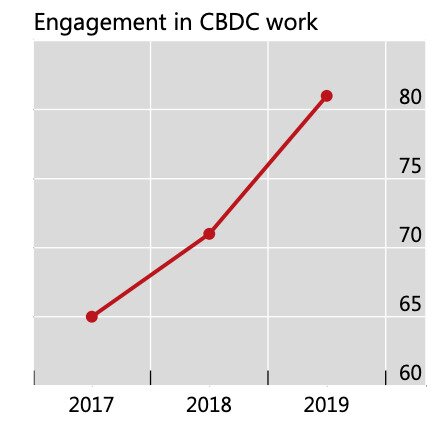

Around 80% of the world’s central banks are exploring CBDCs in some capacity, according to the Bank for International Settlements. However, few are as far advanced in their research as the People’s Bank of China, which conducted a trial this month in Shenzhen, China. It distributed some $1.5 million of digital yuan to 50,000 participants, who received the digital cash via a smartphone app.

Engagement in CBDC work among central banks. Source: Bank for International Settlements

The trial was successful in purely technical terms, but reports on the ground suggest that its participants weren’t particularly impressed by the digital yuan. Many said they preferred existing digital payment apps such as Alipay and WeChat Pay, while others saw no obvious benefit in using the digital currency (other than that it was distributed to them for free).

“Alipay and WeChat Pay have been out for a long time. The new digital currency is similar to those so it’s quite late to just start the trial,” said one participant speaking to Reuters.

Another said, “I’m not planning on using it again. Unless there is another red envelope, of course.”

It may be instructive to note that it’s China — a single-party authoritarian state that can impose new laws and customs on its residents at will — that’s leading the charge in trialing CBDCs. In other words, people themselves don’t see much need for a central bank digital currency, but the Chinese government is one of only a few worldwide that can pretty much force people to use it.

Benefits For Banks And Governments, Not Individuals

And if you look at the other CBDCs that have been planned or even tested elsewhere, you’ll see that most of the benefits will go to the central banks, governments and businesses introducing it.

For example, Sociète Generale famously made a payment in May for €40 million in bonds, using digital euros issued by the Banque de France to settle the transaction. Such digital euros will, according to Sociète Generale, “pave the way for the automation and shortening of payment processes, with simplified market infrastructures and strengthened security.”

This simplification of processes will benefit only central and private banks, while doing very little to help the public, unless savings are passed on to consumers (which is doubtful). As the European Central Bank outlined in an October report on CBDCs, the drive towards CBDCs is more about digitalization, efficiency, and undermining “unregulated” payment solutions than anything else.

Source: European Central Bank

Likewise, the Swedish central bank — the Riksbank — has acknowledged that “offering an e-krona which is available to everyone will also reduce the risk of the krona’s position being weakened by competing private currency alternatives.”

Another big draw of CBDCs for central banks is transparency and traceability. As the World Economic Forum noted in August, “Increasing transparency and traceability can protect against money laundering and other forms of financial crime. For central banks, the most important benefit is the ability to improve regulatory compliance and the effectiveness of monetary policy.”

A central bank digital currency will allow national governments to monitor the flow of money in more minute detail than ever before. Insofar as this restricts actual criminal activity it will be a plus, but it may very well come at the cost of personal liberty, with China reportedly arresting Uighur muslims who send money abroad via bank transfers, for instance.

Bitcoin and Crypto Are Better

This brings us to crypto and Bitcoin, which in being decentralized and pseudonymous provides individuals — particularly those in repressive regimes — with a degree of financial autonomy they would never receive from a CBDC.

While crypto is still immature, its benefits lie with the user. It doesn’t grant additional power to governments or central banks, which would explain why various authoritarian regimes have tried to curtail its use in recent years.

Also, while the detachment of Bitcoin from monetary policy is a negative for governments who want to control such economic indicators as interest rates and inflation, it’s usually a positive for those who hold it and other cryptocurrencies. Bitcoin has now mutated into a relatively non-volatile store of value, with a growing number of institutions and corporations buying it up as a hedge against inflation.

Unlike a CBDC, bitcoin has nothing to do with a nation’s fiat currency, meaning that it can hold (or increase) its value while that currency (and any CBDC based on it) suffers inflation. It also allows for self-custody, while CBDCs are likely to be held in apps or accounts controlled by central or private banks.

This is exactly what the participants in Shenzhen’s digital yuan trial missed: a benefit you don’t normally receive from existing currencies and payment services. In bucking inflation and affording a greater degree of financial autonomy, Bitcoin provides exactly that. This is why CBDCs will do little or nothing to undermine its growing status.