- >News

- >How Will Bitcoin Miners Survive the Next Halving?

How Will Bitcoin Miners Survive the Next Halving?

To the uninitiated, Bitcoin mining may seem like nothing more than a speculative investment opportunity to capitalize on the most lucrative of digital assets.

In reality, Bitcoin mining and the Proof of Work (PoW) consensus mechanism provide the foundation for the hardest money ever created.

How Does Bitcoin Mining Work?

The protocol works by creating a competition between miners to successfully “mine” the next block by completing complex mathematical formulas and producing a 64-randomized character output known as a hash. The more miners compete to solve the problem and mine the next block, the harder the problem is to solve. Miners contribute their hash power to solving the problem and, if successful, are rewarded by a predetermined amount of bitcoin as a reward.

The Bitcoin Halving

The issue is that over time, the rewards for completing the problem are reduced while the competition becomes tougher to beat. Roughly every four years, the reward is halved while more miners enter and try to compete for the block rewards. What started out as a 50 BTC reward has already been halved down to 6.25 BTC and will be reduced further around April 2024 to 3.125 BTC.

With fewer rewards available for miners and fiercer competition, how many will survive the next halving?

Mining Rewards

It may seem odd at first as to why the rewards were designed to decrease over time as opposed to staying constant until all of the bitcoin has been mined. This is not a defect. It is by design. Bitcoin has absolute scarcity built into its architecture. By designing the vesting schedule in this manner, Bitcoin controls the deflationary pressure, incentivizes miners to keep mining, and limits the inflationary impact on the current supply. Higher block rewards at the beginning rewarded early adopters while also ensuring that enough supply was widely distributed to avoid a concentration and centralization of Bitcoin.

Another reason for this kind of vesting schedule is that over time, as adoption grows, so will demand for bitcoin. This increased adoption fuels the demand for fewer and fewer available Bitcoin. The result is that each Bitcoin becomes more valuable in terms of fiat to accumulate. This higher price for fewer rewards is designed to offset the decreased rewards for miners. They can sell fewer of their mined bitcoin for a higher fee. This creates a positive feedback loop by incentivizing more miners to enter the competition and further decentralize the protocol, making it more secure and valuable over time.

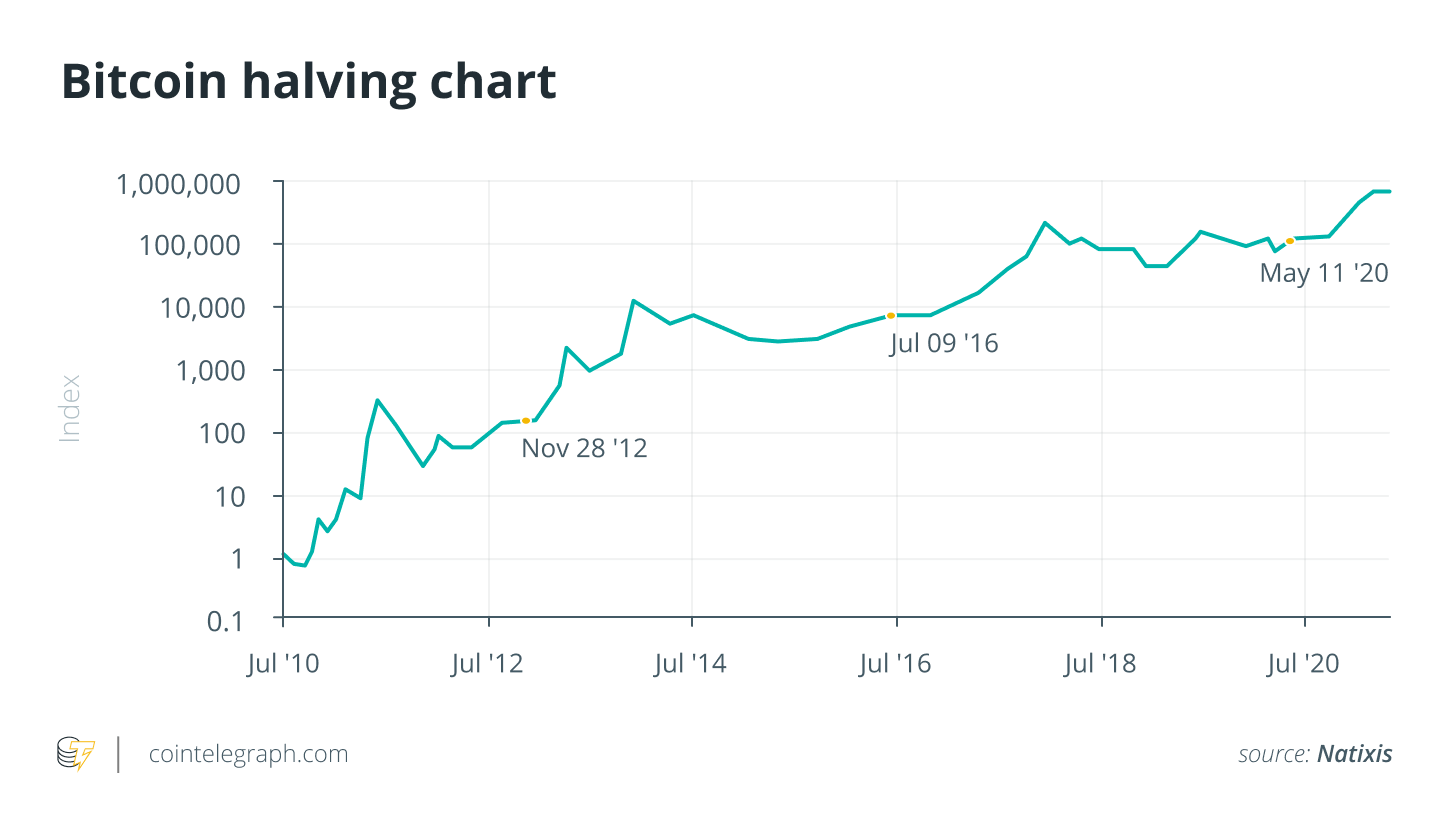

Block rewards over time vs price in fiat

Historical trends

To date, Bitcoin’s valuation in fiat has followed a pattern of boom and bust cycles that mirror the halving events. Every four years, when the rewards are halved, there has been a surge in interest and demand.

The media spur on these events, and investors and speculators are caught up in a purchasing frenzy. As the price of bitcoin increases, more miners rush in to try and capture some of these gains.

This puts more pressure on the existing miners as it creates further competition for less rewards. This pressure can drive out the less profitable and less efficient miners as a result or force them to adopt their approach.

Bitcoin Halving Chart reflecting the price in fiat increase over time

Market Dynamics

While the theory of what should happen to mining is that it should maximize decentralization over time, the reality is slightly different. Technological innovations and more efficient miners have shifted the demographics of how and where mining is concentrated.

To operate a Bitcoin miner, there are a few economic dynamics at play. There are the upfront costs of purchasing the hardware to mine. Individuals used to be able to leverage their desktop CPUs to mine Bitcoin. However, as Bitcoin’s value increased with competition, technology advanced and ASICs were developed to maximize hash rate. Small hobby miners were forced into purchasing new expensive miners or being cost out. As rewards increased, institutional investors began entering the space with deeper and deeper pockets.

The second economic factor at play is the financial cost of running Bitcoin miners. Miners, as often reported in the mainstream media, consume an immense amount of energy. A recent KPMG report claimed that Bitcoin consumes 0.55% of the total energy consumption. Over the past couple of years, miners have migrated to both crypto-friendly jurisdictions but also to regions that have an abundance of cheap energy.

Future of Bitcoin Mining

While the halving events in Bitcoin mining can be a double-edged sword, higher rewards can drive increased competition for those rewards. There is an unexpected benefit to this increased competition. More exposure is attracting non-traditional miners who might not have thought previously to enter the space.

The days of mining Bitcoin from your computer have given way to ASIC hardware and mining farms. As a result, we are seeing innovative solutions to capture previously lost energy. Mining becomes profitable even in periods of increased competition when the energy costs associated with mining can be offset. Oil and gas companies have been capturing lost flared energy and turning it into hash rate, while companies like Sazmining and Iris Energy are giving a second life to abandoned renewable energy projects.

Furthermore, small miners are able to exist through leveraging lost energy. Tom Campbell is an Irish farmer who produces energy from captured methane gas at his dairy farm. He is unable to sell the entirety of that energy back to the grid, so he utilizes Bitcoin mining to consume the excess energy at a profit. Similarly, a Bitcoin mining startup named Nodal recently raised $13 million in funding to start capturing stranded energy from methane released at garbage landfills.

All these new use cases are providing evidence that Bitcoin mining will continue after the next halving. Whether the current batch of miners will make it is yet to be seen, but if the recent trends are anything to go on, mining will find a way.