Crypto Staking Case Study: A Look at ETH, ADA, and SOL

In the following sections we’re going to breakdown the crypto staking rewards for Ethereum (ETH), Cardano (ADA), and Solana (SOL), three of the most popular crypto assets. For each asset, we’ll discuss your expected passive income potential over 1 month, 6 month, and one year if you were to start staking crypto in a $1,000 sum.

This is by no means an exhaustive list of cryptocurrency staking assets, as any asset with a proof of stake consensus mechanism can allow you to earn rewards. This are just three of the most popular platforms for staking and, thus, more accessible.

We’ll also discuss the different ways you can earn staking rewards for each of these assets including staking pools, through a crypto exchange staking platform, and if you were validating transactions yourself.

Ethereum (ETH) Staking Rewards

There are three different ways to earn passive income on your Ethereum staked assets. Staking pools, crypto exchanges staking, and being a validator.

What you can earn for staking Ethereum as a validator is currently 3.9% APR, and this should be the highest return (more when we get to exchange staking). This means you need to have 32 ETH, and set up and run a node at home. This is a fairly high barrier to entry. You essentially can’t stake $1,000 worth of ETH in order to do this (because 32 ETH is over $50k USD), but if you could, you’d earn rewards of $39 for one year, $19.50 for 6 months, and $3.25 for one month. The staking reward could be higher if you compounded your staking yields.

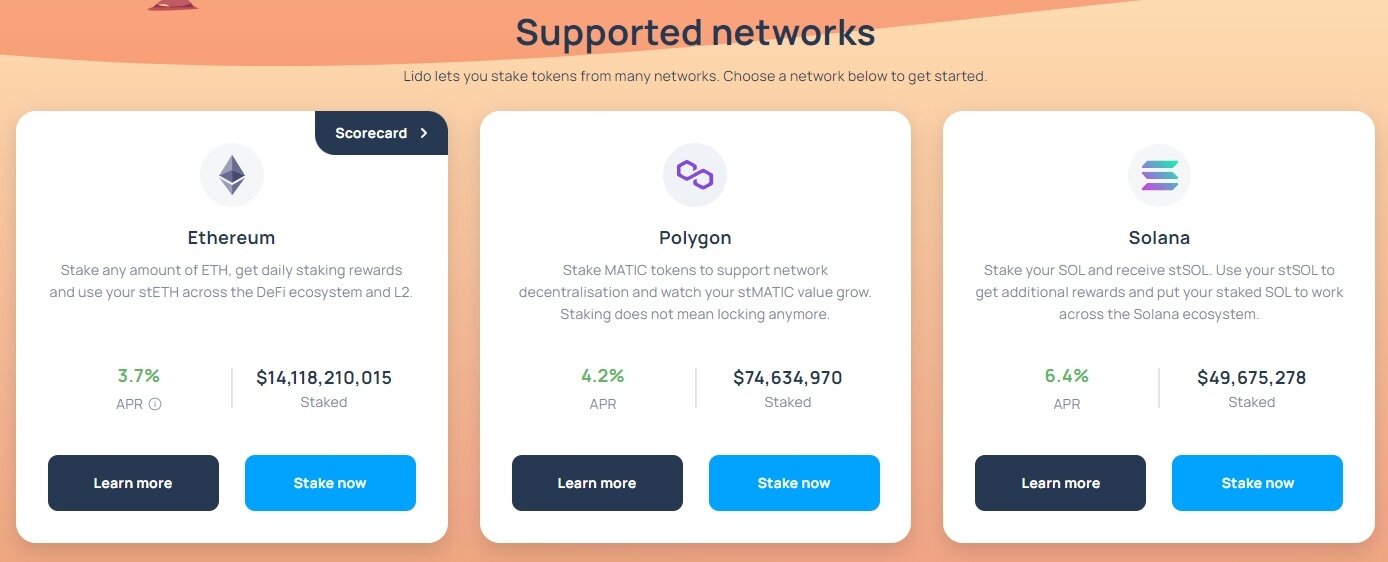

Staking pools such as those offered through Lido Finance, are another way to stake ETH in any amount. You don’t need 32 ETH to join a pool, and you’ll earn about 3.7% APR. This means that if you use the Lido staking platform to stake $1,000 worth of ETH you can earn rewards of $37 for a year, $18.50 for 6 months, and $3.08 for a month. Like with being a validator, this number can be higher if you compound your earnings.

Staking through a centralized exchange generally has lower yields than being a validator or joining a staking pool. After all, you’re going to be paying the staking program commissions in order to participate. However, some platforms such as Kraken, have a yield of 4-7% APR, which means it’s higher than if you were a validator and doesn’t make that much sense. Comparatively, a platform like Coinbase supports staking ETH and offers 3.3% APR. This means if you were to stake $1,000 of ETH with Coinbase, you’d get $2.75 a month, $16.50 for 6 months, and $33 for a year. You can compound this to maximize rewards as well.

Cardano (ADA) Staking Rewards

There are two main ways to stake Cardano (ADA). You can either stake directly to the blockchain as a delegator or validator, or you can stake through a centralized exchange. There are no staking platforms for Cardano because the minimum amount to stake as a delegator is 10 ADA (though no minimum amount once you begin your delegation), whereas you don’t even actually need any to be a validator.

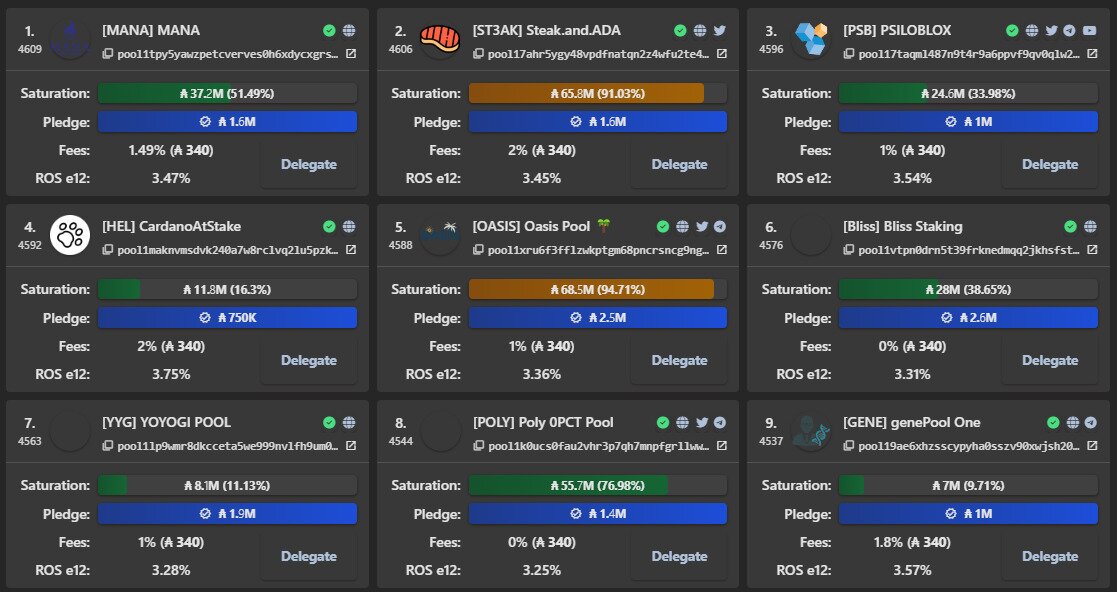

As a delegator, it’s fairly easy to figure out your rewards, as the average return for all pools on Cardano is about 3.5%. This means if you delegate $1,000 in ADA to the staking process you’d earn approximately $35 a year, $17.50 in six months, and $2.92 per month. Cardano’s consensus mechanism automatically compounds your stake so the rewards will be higher than the example. The rewards through a centralized exchange are about the same.

For stake pool operators (validators), there are quite a few factors that would affect the earning rewards. Essentially, the rewards earned by stake pool operators (SPOs) depends on the amount of staked cryptocurrency holdings they’ve pledged, in addition to the delegations they receive from other network participants. We’ll use two ends of the spectrum as examples. If the pool has a total of 10k ADA between the SPO and delegators (lower limit), the SPO can expect about 18 ADA a month. If the pool has a total of 60 million ADA between the SPO and delegators (upper limit), then the SPO can expect about 6,000 ADA a month. You can pretty easily extrapolate those two figures to 6 months and a year.

Solana (SOL) Staking Rewards

Solana is like Ethereum in that there are three main ways for you to stake it. You can delegate your stake to a validator, stake through a cryptocurrency exchange, or use staking platforms like Lido Finance.

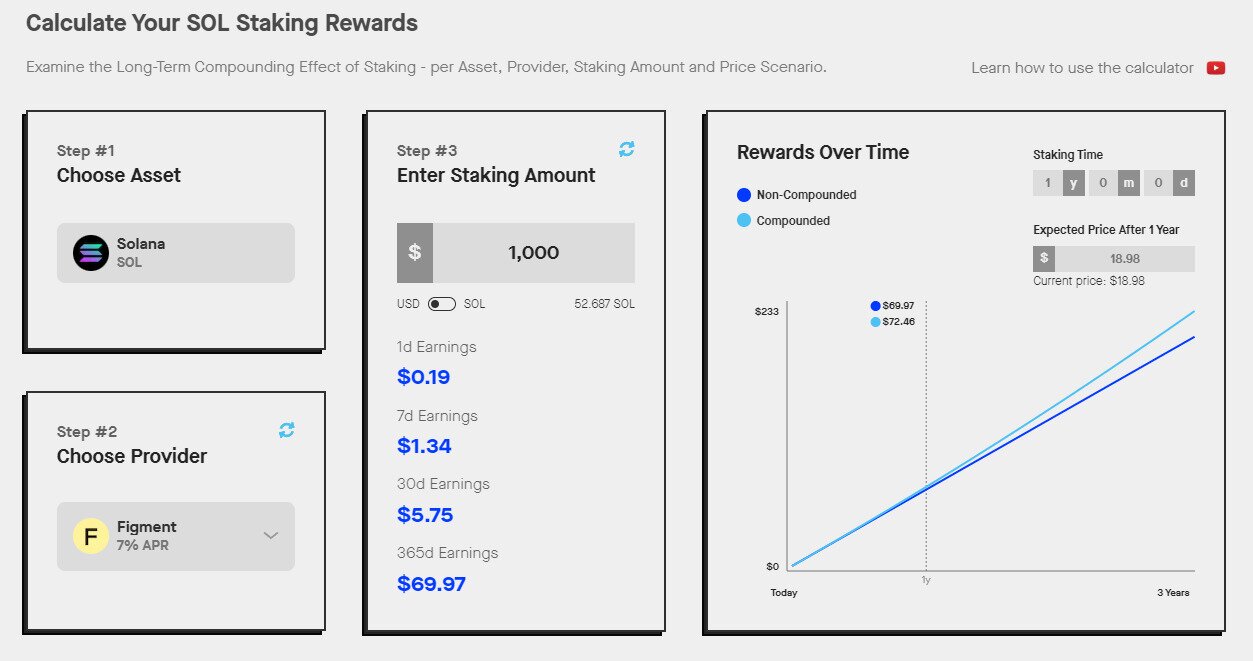

Staking SOL through a validator can earn you anywhere from 5-8% APR depending on the validator and their commissions. We’ll use 7% as our example (as seen in the below image). If you were to stake $1,00 worth of SOL at a 7% APR, you’d get $70 per year, $35 in six months, and $5.83 a month. Like with ADA and ETH, this amount is higher because of compounding.

If you stake SOL through a platform such as Lido Finance, you’ll earn about 6.4% APR, which is in line with staking through a validator as normal. At this rate you’d earn about $64 a year, $32 over six months, and $5.33 a month. The added benefit here is you can actually use the staking tokens you get from Lido for other things if you want.

Staking through a cryptocurrency exchange is actually the least profitable way to stake SOL. Kraken only pays out 2-4% while Coinbase offers 4.35%. You’d be better off staking your SOL through a staking platform or directly to the blockchain network.

Frequently Asked Questions About Staking Profits

Yes! Check out stakingrewards.com and you can find the asset you want and estimate rewards using their calculators.

Not necessarily. There have been plenty of coins over the years (cough, Terra) that offered sky-high staking rates only to have their value implode. In other words you might enjoy 20% APY but have a coin lose 90% of its value. That’s not a good trade off.

That’s why many people stick to reliable coins like Ethereum despite the lower staking rate.

There are no risks of staking crypto when it comes to your principle investment. There is a chance your rewards are slashed if your pool goes offline, but otherwise there’s little risk. Staking rewards through a centralized exchange do have the risk of the exchange failing like FTX did.

Ethereum crypto staking works differently than Solana or Cardano in that you need 32 ETH to earn crypto rewards by yourself (you’d validate transactions). So unless you have 32 ETH and want to validate transactions and participate more directly in the staking process, you’ll need to join a pool.

Validating transactions is more time consuming and requires more technical aspects than simply using staking platforms or direct crypto staking. Depending on the blockchain network, you may need more hardware, and you need to keep your hardware running 24/7 to make crypto staking work.

Crypto staking rewards are only compounded within certain blockchain networks. Cardano and Solana are automatically compounded, while Ethereum is if you’re staking through a crypto exchange, otherwise it likely needs to be done manually. Cosmos (ATOM) is an example of a staking asset you have to manually compound.

You should pick a pool that isn’t already too popular in order to help support staking decentralization. As long as the pool has good history of being online, and has a reasonable commission, it’s worth picking less popular pools in order to help keep the network as decentralized as possible.