The Top 5 Best Cryptos to Day Trade

Below we’ve included 5 of the best crypto assets to day trade. These assets are good for crypto day traders because they all have high trading volume, are available on a multitude of crypto exchanges, have high market capitalization, a variety of trading pairs, and sufficient liquidity.

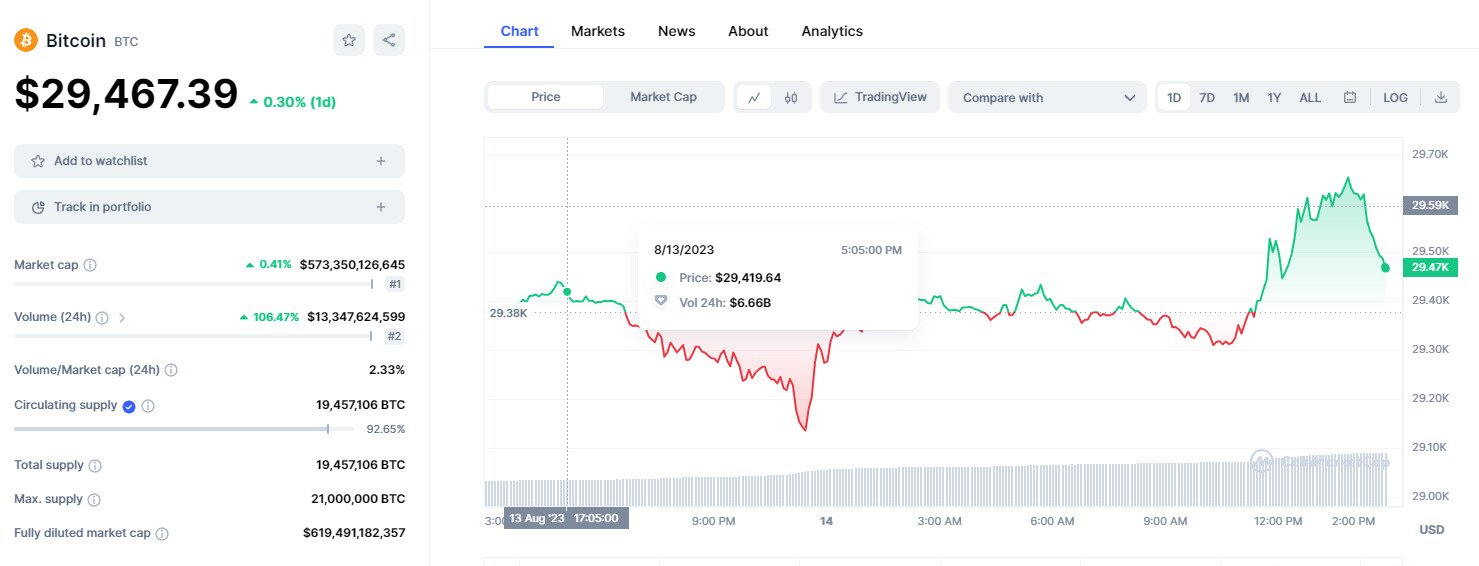

Bitcoin (BTC)

It should perhaps be no surprise that the best crypto to day trade is probably Bitcoin. Bitcoin’s price movements are often quite large, it has the biggest market cap of any asset, is the most available asset on the cryptocurrency market, and tends to have the most trading pairs. Bitcoin is a good crypto to day trade or keep for the long haul.

Binance Coin (BNB)

The native token of Binance exchange, Binance Coin is the 4th largest asset by market capitalization and has high trading volume. Crypto traders looking to day trade Binance Coin are likely best off doing so on Binance exchange, as it has a ton of trading pairs for it. The Binance Smart Chain is also compatible with smart contracts meaning you can trade BNB on decentralized exchanges in addition to on Binance itself.

Cardano (ADA)

Another one of the best crypto to day trade is Cardano. Crypto traders can find it on just about every exchange, and it has high liquidity making it suitable for day trading. It’s the 8th largest asset by market capitalization, and is looking to compete with Ethereum for the smart contracts market.

Ethereum (ETH)

The original smart contracts platform and 2nd largest cryptocurrency by market capitalization, Ethereum is a great crypto to day trade. It has high liquidity, is available on almost all exchanges, and can be traded on decentralized exchanges as well thanks to smart contracts.

Dogecoin (DOGE)

The infamous meme coin is a surprisingly one of the best crypto assets for day trading. What makes it a good crypto to day trade is its availability across major exchanges, and high trading volume. Day traders have been able to take advantage of DOGE’s frequent price movements numerous times, especially when Elon Musk gives it attention in any way.

Factors to Consider When Day Trading Cryptocurrency

Crypto Market Capitalization

The market capitalization of an asset is one of the most important factors for crypto traders to look at when looking to day trade. Crypto assets with a high market cap are more likely to be on multiple crypto exchanges and have more obvious market sentiment than a low cap asset. However, just as important as market cap is trading volume.

Trading Volume

Daily trading volume is an indication of whether an asset has high liquidity or not. High trading volume tends to mean high liquidity and that’s incredibly important to day trading. Crypto traders looking to day trade are paying attention to short term price movements, and are using a trading strategy that means they want to exit trades quickly. If an asset has low liquidity, they’re unlikely to be able to take advantage of short term price fluctuations because their order won’t be filled in time. In contrast, an asset with high liquidity gives day traders the best opportunity to take advantage of short term price movements of the cryptocurrency market.

Cryptocurrency Trading vs Crypto Investing

Crypto day trading isn’t the same thing as crypto investing. Day traders are essentially only concerned with technical indicators, high liquidity, and short term price movements. They look to take advantage of short term crypto trading strategies and market trends rather than invest in the best crypto for the long term. It really doesn’t matter to day traders what the smart contract functionality of crypto assets is, just whether it has high liquidity sufficient to day trade and make quick exit trades.

Crypto trading in general is a short term trading strategy and investment strategy, wherein you look to trade crypto constantly to make a profit as often as possible.

On the other hand, cryptocurrency market investing is a more long term investment strategy. These are likely to be retail and institutional traders who are less concerned with day trading. You are less likely to trade crypto as a crypto investor because you’re thinking long term.

You may do some crypto trading to balance out your portfolio or take profit, but for the most part, you’ve bought what you think is the best crypto to hold for the long term. There is no day trading for more serious crypto investing because of the volatile crypto price swings that can occur and that day traders are looking to take advantage of.

Trading Fees

If you’re going to do crypto day trading, then you’ll need to be aware of trading fees on various crypto exchanges, especially the major exchanges, as they’ll have the highest trading volume. Day traders should be aware of any trading fees charged by the crypto exchange and try to choose an exchange with low fees but high trading volume. This will ensure they day trade with the most capital efficiency.

Frequently Asked Questions About Day Trading

Day trading crypto can be profitable but can also be a losing endeavor. Not all day traders make money when they’re day trading crypto, and crypto trading in general can be an easy way to lose money rather than make it.

You can day trade crypto on just about any crypto exchange, but especially on the major exchanges. This is because a bigger crypto exchange will have high liquidity, low fees, and sometimes even extra features like trading bots and copy trading.

Unless you have a fair amount of disposable income, and time to learn the ins and outs of day trading, then it’s probably not a good idea to jump into it. While day traders can make lots of money, it’s also possible to be on the wrong side of price swings and lose money. If you’re investing for the long-term, then it’s likely best to avoid crypto day trading.

It can be difficult to make trades if there isn’t enough liquidity for a particular crypto on certain exchanges.