- >News

- >Ask CryptoVantage: Are Bitcoin Fees on the Rise?

Ask CryptoVantage: Are Bitcoin Fees on the Rise?

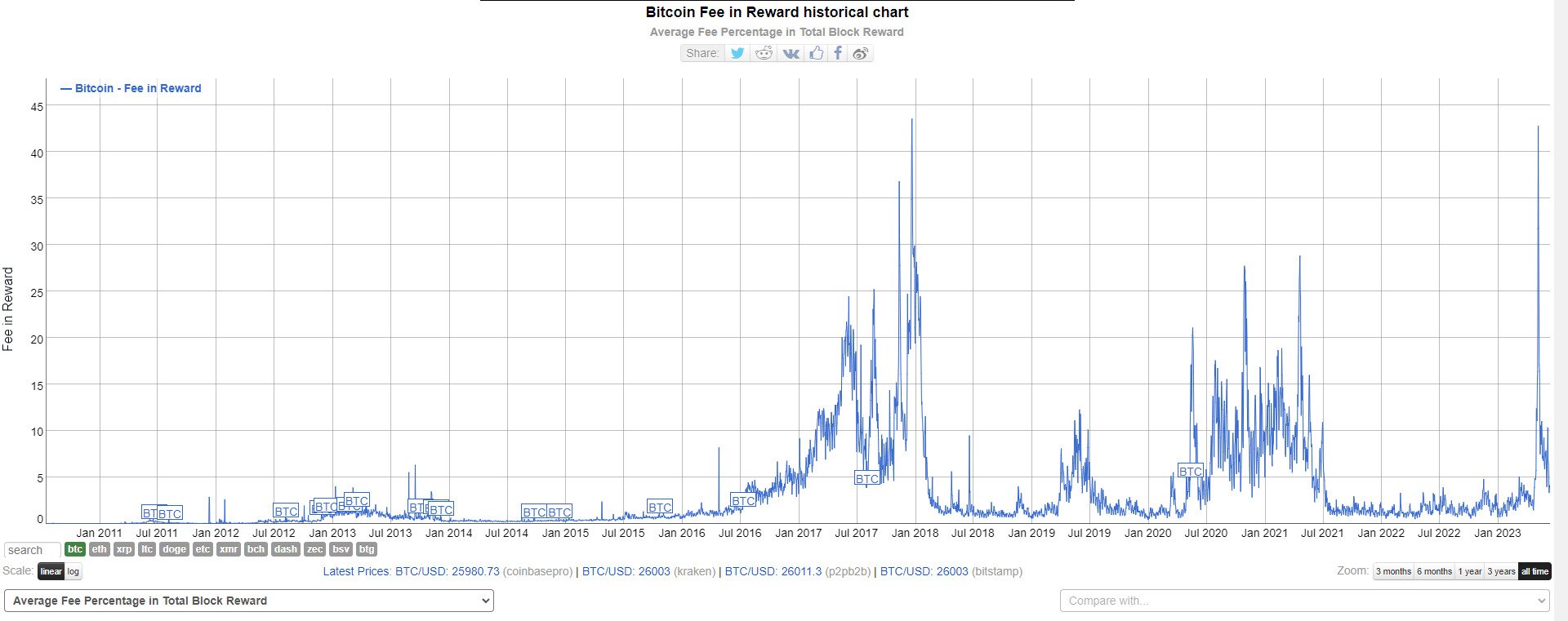

One of the most overlooked and underreported aspects of Bitcoin is the fees used in its transactions. Until recently, coverage of fees was largely pushed to the side due to their stability and their low average cost. If you were not around during the 2017 blocksize wars, then you could be forgiven for thinking that fees had always been this way.

Most of the discussion, until recently, revolved around the overall price in fiat of BTC and the predetermined block reward for successfully mining a block and adding it to the blockchain. Despite these dominating topics, mining fees still provide an essential and evolving role in the Bitcoin ecosystem.

What are Bitcoin Fees?

Simply put, block fees are the fees paid by users to have their transactions included in a block. Users are able to increase their fee amount to increase their chance of being included in the next block.

Similarly, when there is low demand, users can have their transactions included for a lesser fee. These fees fluctuate in their pricing and percentage of total block reward depending on the demand at the time. The more demand for sending Bitcoin transactions, the higher the fees will be. It is no surprise, then, that certain trends have emerged around these fees.

Why Do They Fluctuate?

Basic supply and demand principles determine the block fees. The more users attempting to get their transactions included in blocks, the higher the fees will go. Users who require more urgent processing of their transactions will be willing to pay more to get theirs included, while more trivial transactions get pushed down the priority list.

It is no surprise that these price fluctuations and trends have followed the Bitcoin halving cycles that have typically kick-started each bull run. In previous cycles, as interest in Bitcoin grows, more people become onboarded and begin sending Bitcoin transactions on the Mainnet. This causes a spike in fees which inevitably subsides as the initial interest wanes.

DoS (Denial of Service) Attack?

An interesting aspect of the Bitcoin architecture is that it was hard coded to limit block size to 1MB. It was never explicitly stated that the reason for doing so was as an anti-spam measure to prevent flooding the network. However, one of the early concerns about the Bitcoin blockchain was that due to its smaller block size and slower speed of 7tps, it would be susceptible to a DoS attack.That is, flooding the network with micro-transactions causing it to grind to a halt, making it unusable to the average user.

However, the game theory of a 1MB block size is that by creating a small block size, you create a limited amount of transactions that can be included in each block. When users can pay an increased fee to be included in a block, it makes it too costly to spam transactions on the mainnet. This has allowed for historically reliable trends to develop that follow the overall cycles of Bitcoin.

That is unless a new form of a digital asset comes along, with the same mania and hype as the NFTs craze created during the last bull run, where users are willing to eat the cost of high block fees to push through their trivial transactions. Enter BRC-20 tokens.

Ordinals and BRC-20 Tokens

Love them or hate them, Ordinals have shifted the landscape of the Bitcoin blockchain. After emerging from the blocksize wars and witnessing the explosive growth in the Lightning Network, many believed that Bitcoin’s scalability issue was a thing of the past. In January 2023, the first Ordinal was entered into the blockchain, and Bitcoin’s transaction fees were once again put front and center.

Creator of the first Ordinal, Casey Rodarmor, described them as digital artifacts differing from other NFT collections because they are inscribed into the blockchain rather than minted onto a separate one, like NFTs on other blockchains. Their popularity has been explosive.

From January to May 9th, 2023, the total market capitalization surpassed $1 billion. At the time of writing this article, there are over 10 million ordinals that have been inscribed onto the Bitcoin blockchain mainnet.

This frenzy has caused the block fees to skyrocket outside normal trends. After the initial spike in block fees during the last bull run, Bitcoin block fees began settling down to historical norms of between 1-4% of the total block reward.

After the release of Ordinals, those fees ballooned to an average of over 40% of the block reward, peaking in early May. They have since started retreating back down but pose an interesting new dynamic to the Bitcoin Blockchain.

As BRC-20 tokens evolve beyond meme coins and monkey JPEGs, their use cases will expand and cause additional strain on the blockchain.

It's a Feature, Not a Bug

Scalability has always been an issue for Bitcoin. If hyperbitcoinization is ever to become a reality and billions of users adopt it as their preferred form of money, then scalability is something that will need to be resolved. In its current form, billions of people’s transactions on the Mainnet would cause chaos and an endless backlog of transactions. Layer 2 protocols like the Lightning Network are ways to solve this issue, but they remain in their infancy.

When it comes to those pesky Ordinals, fortunately, necessity is the mother of innovation, and the Bitcoin community has some of the most brilliant innovators in the industry. One such project that is tackling the BRC-20 scalability issue is a Defi project called ALEX. It operates as one of the few Defi projects on the Bitcoin network, and since the rise of BRC-20 tokens, has rolled out a Layer 2 DEX. By creating a Layer 2 solution, ALEX is able to process transactions on a separate layer and bundle them together on the mainnet. This alleviates congestion and strain on the Bitcoin network.

With the evolution of these new Layer 2 solutions, it will be interesting to see how the ecosystem evolves further. The trend is that block fees should go down as more Layer 2 solutions are created. With the next halving event occurring in less than a year, we could start to see more tension arise between miners and users if block fees continue to be minimized via these layer 2 solutions.