- >News

- >Increase in Ethereum Staking Indicates ETH is Due for a Big Rally

Increase in Ethereum Staking Indicates ETH is Due for a Big Rally

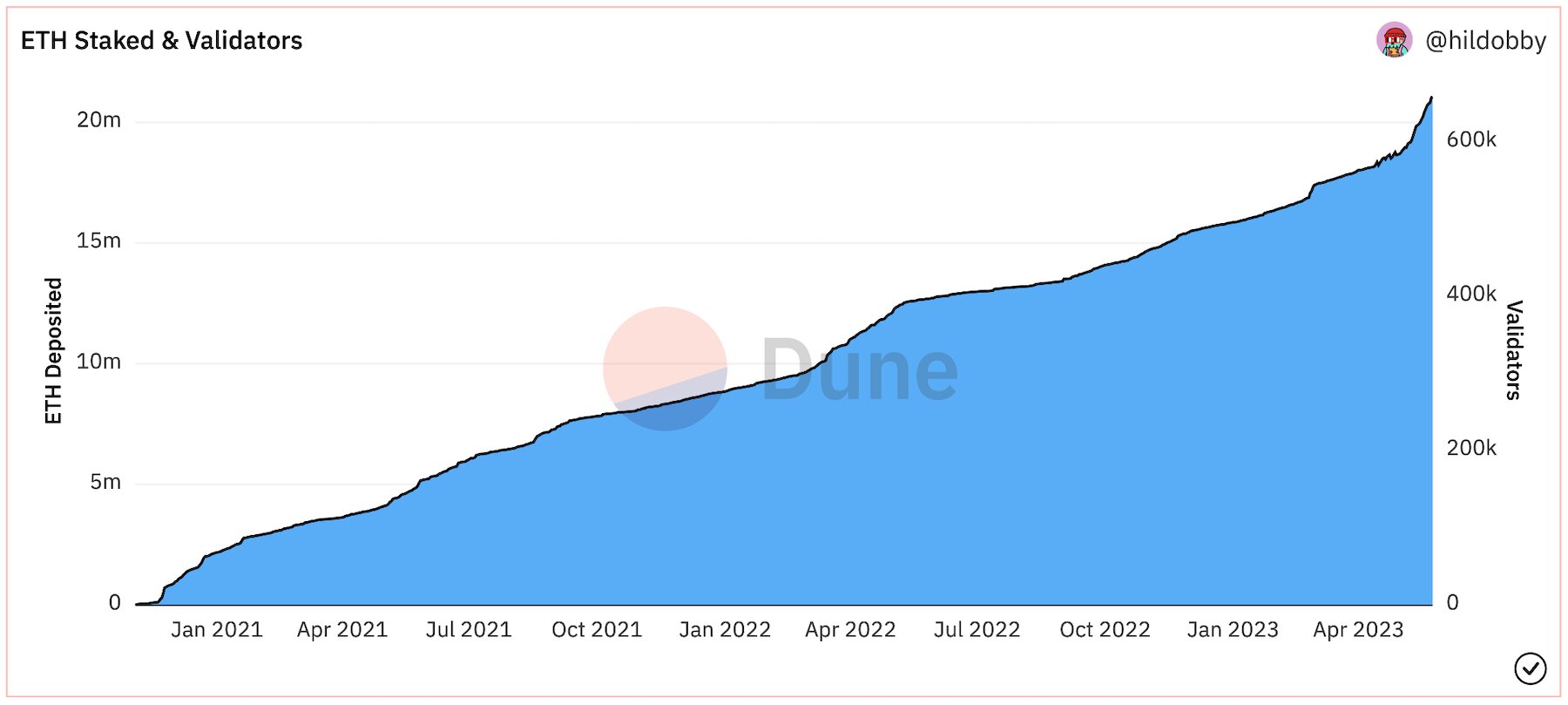

Ethereum has witnessed a big increase in staking since enabling withdrawals on April 12, with the amount of staked ETH rising from 18.3 million to 21 million, according to data on Dune Analytics. This is an increase of 14.75% in just over a month, with the rise confounding the pessimists who suggested that the opening of withdrawals would “obliterate” the market.

With staked ETH now passing 21 million, some 17.66% of the altcoin’s total circulating supply is locked up, while the much higher staking ratios of other proof-of-stake cryptocurrencies — between 40% and 60% — suggests it still has plenty of rising left to do. What this means is that ethereum’s circulating supply could decline drastically in the coming months. And combined with its tendency to become deflationary during periods of peak traffic, the altcoin is increasingly moving into a position where it’s due a big rally.

Yet what’s significant is that, despite the arrival of staking and the unlocking of withdrawals, the stagnant market and global economy means that ETH has remained grossly undervalued in recent months. But an improving macroeconomic picture could soon change this, resulting in further increase in Ethereum adoption and potentially making ETH the best-performing major cryptocurrency of the next bull market.

Withdrawals Result in… More Staking

Depending on which sources you use, Ethereum’s increase in staking is even more impressive than what we’ve reported above. Because while the Dune data reveals an increase in staked ETH of nearly three million, data from glassnodes — which tracks all ETH locked up in smart contracts — suggests that the figure has increased by four million, to a total of 22 million. By contrast, data from BeaconScan (an offshoot of Etherscan), puts the increase at a more modest one million.

Source: Dune

Regardless, it’s clear that the ability to withdraw staked ETH has effectively ‘de-risked’ staking for users, in that they now know they can reclaim their ethereum at any time. So rather than users rushing for the exit and looking to sell their ETH, we have actually witnessed an increase in staking.

This shouldn’t really be surprising, for various reasons. Firstly, the prices continue to remain depressed at the moment, with data having suggested that most stakers have been sitting on a loss. As such, they’re unlikely to want to sell now, given that they will effectively be throwing money away.

Secondly, and relatedly, there’s likely to be a heightened demand for staking at a time when prices are subdued, seeing as how staking ETH currently earns you a passive yield of around 7.7% per year.

As Bitfinex analysts wrote in a note this week, “The surge in demand for staking probably originates from large Ether holders, who prefer not to liquidate their holdings and instead seek to generate passive income.”

Steadily accumulating tokens over time is precisely what sensible investors do, particularly during bear markets, and staking Ethereum enables you to do just that. Hence the increase in staking, rather than a decline and a big selloff.

And as mentioned above, Ethereum still has plenty of catching up to do if, for example, it wants to match Cardano’s staking ratio, at 61%. Assuming that it does reach this percentage, that would take a total of 73.3 million ETH out of circulation, which would only have a positive effect on the cryptocurrency’s price.

Staking Rewards, Burning and Adoption

But what’s most significant about this news is just how bullish it is for Ethereum in the longer term, especially when considered in tandem with other recent developments.

For instance, the combination of proof-of-stake with fee burning (brought in with the EIP-1559 update of August 2021) means that Ethereum can become a deflationary cryptocurrency, depending on how much traffic it’s processing. That is, because there’s no longer a block reward for miners, daily issuance has declined substantially with the move to PoS, while Ethereum will burn more ETH the more transactions it handles.

And overall, Etherscan data shows that Ethereum’s total supply has actually declined since September, when the Merge happened. From about 120.53 million on October 3, there are now 120.26 million ETH in circulation. While this is hardly a dramatic drop, it highlights the direction of travel, while further increases in Ethereum adoption could accelerate the process.

Coupled with increased staking, burning and lower issuance means that ETH will become scarcer, relatively speaking. By extension, this should mean it rises in price too.

As Bitfinex’s analysts wrote in the aforementioned bulletin, “This trend is anticipated to persist, particularly considering that deflationary forces are expected to propel the price of Ether significantly.”

Also propelling the price of ETH will be adoption, with Ethereum enjoying more positive adoption stories than pretty much every other layer-one blockchain in the ecosystem. To cite only a few recent examples, Societe Generale’s digital asset unit launched a euro-denominated stablecoin on Ethereum in April, while in February Visa announced it was trialing Ethereum-based USDC payments. Also in February, Russia’s Sberbank revealed it would be launching its own DeFi platform on Ethereum, while major exchange Coinbase revealed its development of a layer-two platform for the second-biggest cryptocurrency.

Such adoption and usage adds up, and with Ethereum already accounting for around 57% of the entire sector’s total value locked in, it’s arguable that the platform’s dominance of the smart contract ecosystem is only going to increase. This means more demand for ETH, and by extension, a higher price for the cryptocurrency.

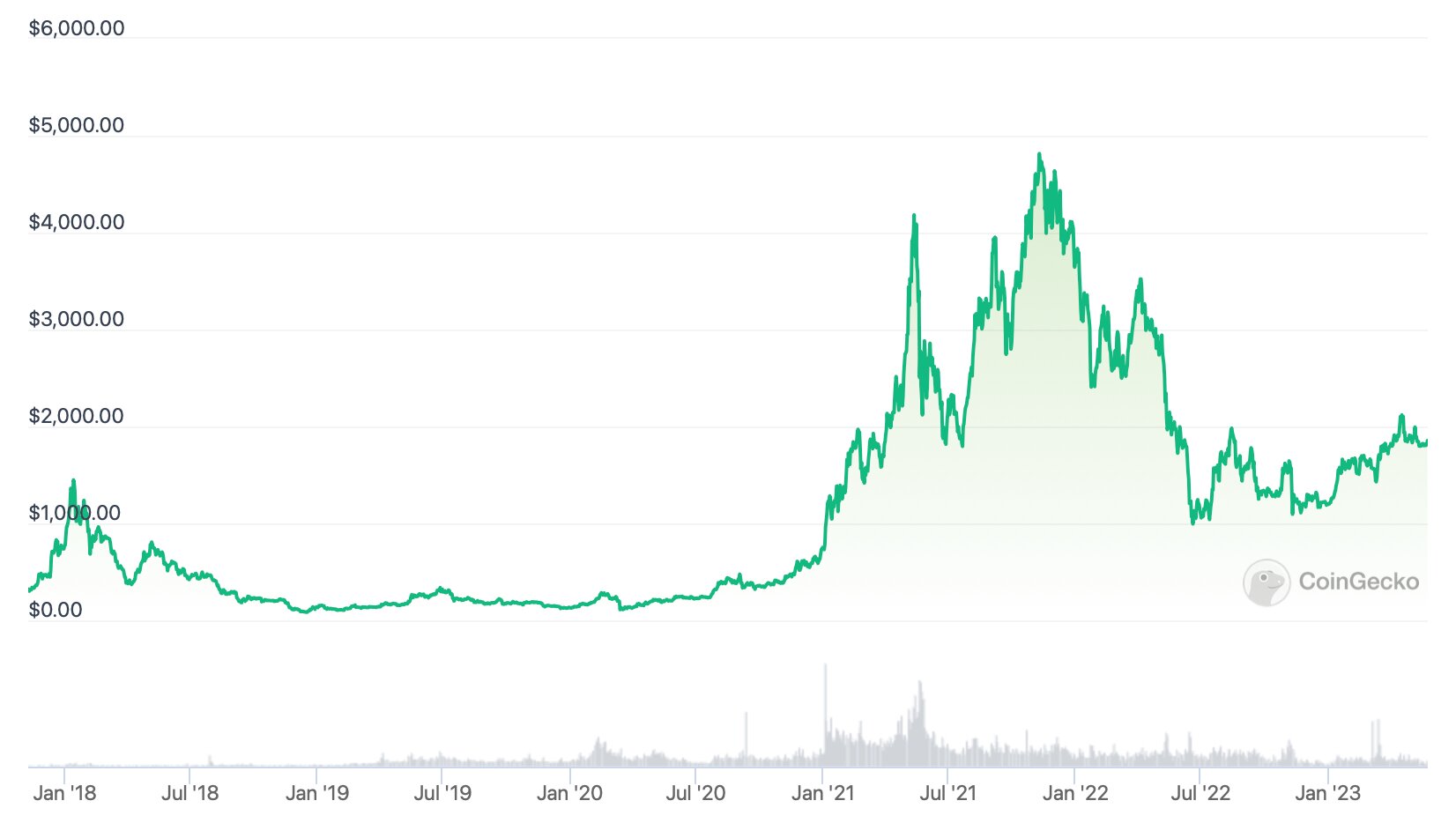

Ethereum’s price since December 2017. Source: CoinGecko

Basically, the main point here is that a number of developments are pointing towards a substantially improving price for ETH, yet what’s interesting is that much of the market still hasn’t realized this yet. ETH remains at around $1,800, as of writing, and is still down by 63% compared to its all-time high of $4,878 (set in November 2021). In the long run, the recent staking news suggests it should end up breaking this record high, particularly when you add the deflationary tokenomics and Ethereum’s status as the most likely platform to attract major adoption.

Indeed, Ethereum’s development as a scalable smart contract platform remains completely on track, as evidenced by the successful implementation of September’s Merge and April Shanghai update. Assuming you believe that blockchain is going to play a major role in the future global economy and financial system, then it’s only a matter of time before ETH reaps the benefits of this development.